Tag Archive: newsletter

OLAF SCHOLZ WILL UNS SCHÄDIGEN!

Klicke hier, um Dich gemeinsam mit Oli unabhängig zu machen:

? http://bit.ly/oli-ausbildung

Meine Webseite: https://tradingcoacholi.com/

Inhaltsverzeichnis:

►Mein Telegram Kanal: http://t.me/tradingcoacholi

►Folge Oliver auf Facebook: http://bit.ly/TOFBpage

►Folge Oliver auf Instagram: http://bit.ly/TOInst

►Oli macht auch TikToks: https://www.tiktok.com/@tradingcoacholi

►Abonniere Oliver auf YouTube: http://bit.ly/Oli-Kanal

►Folge Oliver auf...

Read More »

Read More »

Inflation: Damit rechnet keiner!

► Meinen Podcast findest Du hier: https://lars-erichsen.de/podcasts.html

David Rosenberg hat in einer aktuelle Studie gerade dargelegt, wieso die Inflation im Jahr 2023 komplett verschwinden könnte. Es könnte zu einer absoluten Mega-Rallye kommen und ich stelle euch gleich 5 Aktien vor, die von diesem Szenario profitieren würden.

► Sichere Dir meinen Report, mit Tipps zu Gold, Aktien, ETFs und erhalte weitere Informationen, zu meinem neuen...

Read More »

Read More »

Dividenden-Könige Der Zukunft #shorts

?Hol dir 100 CHF Trading Credits bei einer Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

☛ Die BESTEN Gutscheine aus dem Finanzrudel ☚

Tools die ich tagtäglich nutze findet ihr hier. Mein 6-stelliges Aktien-Depot habe ich bei Swissquote und Yuh. Für meine privaten Finanzen nutze ich Zak von der Bank Cler. Meine Säule 3a für die Altersvorsorge betreibe ich bei frankly der Zürcher...

Read More »

Read More »

“Most People Will Lose All Their Money” – Warns Marc Faber

Marc Faber predicts that Most people will lose 50% of their money. He talks about some of the safe and cheap assets plus gold, silver and stocks.

He thinks the dollar is weak and one day the dollar will be the currency that nobody wants.

"Most People Will Lose All Their Money" - Warns Marc Faber

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

? ABOUT THIS CHANNEL :

If you’re new to this channel then I want to welcome you to “LifeWorthLiving”. This channel is...

Read More »

Read More »

Andreas Beck: Das musst Du bei Tesla verstehen & da haben sie den Anschluss verloren

"Tesla ist immer noch unglaublich hoch bewertet", sagt Dr. Andreas Beck im exklusiven Interview. Aber wie kommt er zu dieser These nach dem heftigen Absturz Teslas? Der Mathematiker und Portfolio-Experte erklärt, warum Investoren, die auf die Fundamentaldaten schauen, jetzt Tesla noch nicht kaufen können und warum es sich beim Kursverfall noch gar nicht um einen richtigen Absturz handelt. Beck erklärt anhand der evolutionären...

Read More »

Read More »

Absurdistan – Deutschland versagt auf breiter Front

✘ Werbung:

Mein Buch Allgemeinbildung ► https://amazon.de/dp/B09RFZH4W1/

Schon immer hat bei uns der #Amtsschimmel gewiehert. Doch seit zwei Jahrzehnten geht es mit der Leistung unserer #staatlichen #Institutionen massiv bergab. Wir sehen sogar bereits #Totalversagen auf zahlreichen Gebieten. Das bedeutet für die Zukunft nichts Gutes.

-

Unattraktivität Städte ► https://ifhkoeln.de/deutsche-innenstaedte-werden-selten-weiterempfohlen/...

Read More »

Read More »

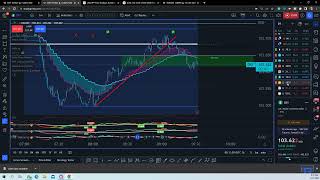

14R day shorting GBP and USD/CHF, oil was a setup

In this video I showcase the setups for selling into built-up longs in the NY session in cable and USD/CHF using SB strategy and an indicator template that I'm working on with rules...work in progress.

Read More »

Read More »

Das Geheimnis hinter dem Erfolg von Elon Musk #shorts

Vereinbare jetzt Dein kostenloses Beratungsgespräch??:

► https://go.investorenausbildung.de/3n29OKX

kostenloses Webinar ansehen???:

► https://go.investorenausbildung.de/3zRHbI0

Aktienanalyse auf Knopfdruck?:

► https://go.investorenausbildung.de/3zVtfwv

kostenloses Buch sichern?:

► https://go.investorenausbildung.de/3xJn7ow

▬ Über Mich ▬▬▬▬▬▬▬▬▬▬▬▬

Florian Günther ist der Kopf hinter Investorenausbildung.de. Er ist studierter Bankkaufmann und...

Read More »

Read More »

What to Do if You Bet Against the Chiefs

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(2/13/23) Aliens are landing, apparently, and markets are improving, despite what we may thing; the magnet for the market is the 50-DMA. As earnings season begins to wrap, the next CPI Report looms: January Credit Card use is higher; the three measures of inflation. Super Bowl anthems; Investor Convictions on thesis of market recession and...

Read More »

Read More »

Droht jetzt eine Korrektur? | Blick auf die Woche | KW 07

Wir befinden uns eindeutig in einer Korrektur. Sowohl der S&P 500 als auch der NASDAQ 100 setzen von ihren Februar-Hochpunkten zurück. Beim DAX kam es am Freitag sogar zu einem Trendbruch.

Read More »

Read More »

Berlin Wahl: Alles bleibt wie es ist! Berliner reagiert

Gestern fand die Wahlwiederholung in Berlin statt. Die CDU wurde zur stärksten Kraft gewählt, doch ich halte eine Schwarz-Grün Koalition für unwahrscheinlich. Eher noch Schwarz-Rot, aber wahrscheinlich wird es wieder eine Rot-Rot-Grüne Regierung in Berlin geben.

? bis zu 100 Euro bei Depoteröffnung ► http://link.aktienmitkopf.de/Depot *

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine Dividenden mit dieser App...

Read More »

Read More »

KI MANIPULIERT Fotos! #chatgpt

Künstliche Intelligenz wird immer beeindruckender, heutzutage scheint es ein Klacks verschiedene Fotos über KI zu manipulieren oder gar neu zu erstellen. Mein ganzes Video zum Thema KI findet ihr hier:

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das erfolgreichste Wirtschaftsbuch 2021

"Die größte Chance aller Zeiten" bestellen?

Auf Amazon: https://amzn.to/3WePFAu oder mit Signatur:...

Read More »

Read More »

Yen Retreats Ahead of Formal BOJ Announcement Tomorrow and US CPI

Overview: A consolidative tone is mostly the theme of the day. The revisions to the US CPI announced before the weekend add to the uncertainty and focus on tomorrow's report. At the same time, investors watch ongoing air space activity that has led to a few objects being shot down over the US and Canadian airspace.

Read More »

Read More »

Dow Jones technical analysis: Watching for a possible busted bear flag!

Dow Jones traders alert: Don't miss out on a possible trading opportunity! In this video, we examine what happens when a technical chart pattern "busts" and the impact it can have on your trades.

We take a look at the Dow Jones futures (YM) on the four-hour chart and analyze the recent breakdown of the bear flag. We also explore the potential for a bullish opportunity if the price enters and stays inside the bear flag.

For early traders...

Read More »

Read More »

Inflation: Deutschland VS. die Schweiz |Philipp Vorndran /Flossbach von Storch AG

Update Wirtschaft | 13.02.2023 | Samir Ibrahim

Die Börse im Ersten | ARD

Täglich Aktuelles von der Frankfurter Börse. Wie steht der DAX? Was waren die Tops und die Flops des Tages?

Inhaber Video- und Inhaltsrechte:

©2022 ARD - https://www.ard.de

#Börse #DAX #Wirtschaft

Read More »

Read More »

BACKTESTING FÜR EINSTEIGER

✅ Gratis Trading Basiskurs: https://thomasvittner.com/traderkurs1

▶️ Alle Ausbildungsangebote: https://thomasvittner.com/trading-angebote/

? Gefällt Dir dieses Video? ?

Dann freue ich mich über einen Daumen nach oben, oder über einen Kommentar und wenn Du es an Menschen weiterleitest, denen es auch im Trading weiterhelfen kann.

✍️ Trading Fachbeiträge direkt aus dem Thomas Vittner Börsen-Blog +++++++++++++

Trading lernen:...

Read More »

Read More »

Switzerland’s ‘cash initiative’ – what’s at stake?

Swiss citizens look set to vote on a people’s initiative to try to ensure their economy never becomes cashless. What do the campaigners behind the idea really want?

Read More »

Read More »

The New Normal: Death Spirals and Speculative Frenzies

There is an element of inevitability in play, but it isn't about central bank bailouts, it's about Death Spirals and the collapse of unsustainable systems. The vapid discussions about "soft" or "hard" landings for the economy are akin to asking if the Titanic'sencounter with the iceberg was "soft" or "hard:" either way, the ship was doomed, just as the global economy is doomed by The New Normal of Death Spirals and Speculative Frenzies.

Read More »

Read More »