Tag Archive: newsletter

Whats The Best Way Forward Charles Hugh Smith

We are currently in the midst of a significant and complicated transition from one era to another. This transition is characterized by confusion and complexity because there are people who are benefiting from the current system and they will resist any change. Meanwhile, there are also forces of adaptation and evolution that are working to determine the best way forward.

Watch more of this short video from Turmoil Ahead As We Enter The New Era...

Read More »

Read More »

Poor People in Developing Countries Find Alternatives to Commercial Banking

People are innovative—if government doesn't get in the way. Entrepreneurs in developing countries find alternatives for people cut off from commercial banking services.

Original Article: "Poor People in Developing Countries Find Alternatives to Commercial Banking"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

The Impossibility of Equality

[Excerpt from chapter 7 of Power and Market in Man, Economy, and State with Power and Market, pp. 1308–12.]

Probably the most common ethical criticism of the market economy is that it fails to achieve the goal of equality. Equality has been championed on various “economic” grounds, such as minimum social sacrifice or the diminishing marginal utility of money (see the chapter on taxation above). But in recent years economists have recognized that...

Read More »

Read More »

ACHTUNG: Habeck plant VERBOT (Öl- und Gasheizungen)

Hast du eine Öl- oder Gasheizung daheim? Dann aufgepasst, Robert Habeck möchte diese schon ab 2024 im Schein des Klimawandels verbieten! Warum das leider kein Witz ist, was genau geplant wird und wie es auch dich betreffen kann, das erfährst du in dieser Folge "Finanzielle Intelligenz".

Mein Blog:

https://www.friedrich-partner.de/blog/neueste-blog-posts

► Mein Merch:

https://shop.marc-friedrich.de/

► Mein neues Buch

Du möchtest das...

Read More »

Read More »

Is Now the Right Time to Buy Stocks?

Regardless of whether the stock market was soaring, or whether it was crashing, there's always an opportunity to make money in the stock market.

There are three characteristics of the stock market that make it such a great vehicle to build wealth. Remember the richest man in the world, Warren Buffet, used the stock market to build his wealth.

The three characteristics are:

Liquidity

Agility

Scalability

To learn more about the stock market...

Read More »

Read More »

Max investiert 1’200€/MONAT und will 100k erreichen! | Sparkojote Dividenden Donnerstag

?Hol dir 100 CHF Trading Credits Aktien-Depoteröffnung ►► http://sparkojote.ch/swissquote *

(only for swiss residents)

Der #DividendenDonnerstag Livestream findet jeden Donnerstag um 19:00 Uhr auf YouTube statt, zusammen mit Johannes Lortz philosophieren wir über #Dividenden #Aktien, das Investieren, die Börse und vieles mehr.

??Kanal von Johannes ►► @Johannes Lortz

#DividendenDonnerstag #2023 #Finanzrudel

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

★...

Read More »

Read More »

Ich SOLL meine VIDEOS LÖSCHEN!

Schon merkwürdig, dass innerhalb von ganz kurzer Zeit alle Kooperationsverträge gekündigt werden, weil... ja wieso eigentlich? Am Geld kann es jedenfalls nicht liegen.

??5 Euro Startbonus bei Bondora ►► https://goo.gl/434rmp *

? Tracke deine Dividenden mit dieser App http://myfinances24.de/mydividends24

? Mein Buch! Der Rationale Kapitalist ►►http://amzn.to/2kludNT

?JETZT auch als Hörbuch bei Audible ►► https://goo.gl/iWvTRR

Du willst mehr über...

Read More »

Read More »

Marc Faber US Dollar as Reserve Currency: Time to Say Goodbye

Marc Faber ? US Dollar as Reserve Currency: Time to Say Goodbye

Marc Faber ? US Dollar as Reserve Currency: Time to Say Goodbye

"There are no safe havens in a money printing environment. The Fed is built to print and they will not stop," Marc Faber says

__________________________________________________

#marcfaber #dollar

__________________________________________________

Enjoyed the video? Comment below! ?

? Subscribe to KAIZ ADAM...

Read More »

Read More »

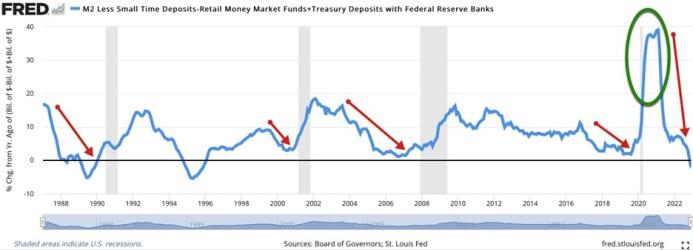

The Coming Recession Will Be a Global One

Over one hundred years ago, Austrian economist Ludwig von Mises discovered what causes the boom-bust business cycle.

As Mises explained, the boom is caused by central and commercial banks creating money out of thin air. This lowers interest rates, which encourages businesses to borrow this newly created money to fund capital-intensive investment projects.

The bust is caused when the money creation process slows. It is then that businesses discover...

Read More »

Read More »

Dr. Gerd Kommer: ETF vs. Immobilien – DIESE Anlageklasse bringt mehr Rendite ein

Während unserer München-Reise haben wir uns mit ETF-Experte und Autor Dr. Gerd Kommer ausgetauscht. Er ist als einer der angesehensten Experten für unabhängige Kapitalanlage-Themen in Deutschland bekannt und hat bereits mehrere erfolgreiche Bücher veröffentlicht. Sein Buch “Souverän investieren mit Indexfonds und ETFs” hat uns maßgeblich dazu veranlasst, ein tieferes Verständnis für Finanz-Themen zu entwickeln.

In dieser gemeinsamen Podcast-Folge...

Read More »

Read More »

KI-Hype! Die neue Dotcom-Blase? #shorts

Wie doll ähnelt der aktuelle KI-Hype der Dotcom-Blase?

Kostenloses Depot eröffnen: ►► https://link.finanzfluss.de/go/depot?utm_source=youtube&utm_medium=580&utm_campaign=comdirect-depot&utm_term=kostenlos-25&utm_content=yt-desc *?

In 4 Wochen zum souveränen Investor: ►► https://link.finanzfluss.de/go/campus?utm_source=youtube&utm_medium=580&utm_campaign=ff-campus&utm_term=4-wochen&utm_content=yt-desc ?

ℹ️...

Read More »

Read More »

ACHTUNG: Bill Gates kauft Heineken

Bill Gates Investments standen schon öfter in der Kritik. So sorgt er auch in den letzten Tagen wieder für Aufsehen, durch seinen Ankauf von der internationalen Brauerei Heineken. Aber ist die negative Sicht auf Alkoholaktien gerechtfertigt oder war dieses Investment vielleicht doch sehr clever? Meine Antwort zu dieser Frage erfährst du in diesem Video.

Sicher dir jetzt Tickets für das kommende Mindset- Seminar

https://jensrabe.de/mindset

0:00...

Read More »

Read More »

America’s $2trn green boost, explained

America is spending trillions of dollars in an effort to make the country stronger, greener and richer. These are the three key things you need to know about the plan and its chances of success.

00:00 - A new green America

00:30 - Democrats are being ambitious

01:14 - Manufacturing will move to America

01:53 - Planning could be a stumbling block

To read more about Biden’s plans to remake America’s economy: https://econ.st/3IEGNiP

For our most...

Read More »

Read More »

One Year Later in Ukraine: Washington and NATO Got It Very Wrong

It’s been a year since the Russian invasion of Ukraine. In spite of claims from the regime and its media allies that Russia was the next Third Reich and would soon roll through half of Europe, it turns out that was never even remotely true.

In fact, things have unfolded more or less just like we predicted here at mises.org: the Russians aren’t even close to occupying any place in Europe beyond eastern Ukraine. It’s not Munich 1938. Economic...

Read More »

Read More »

Uncovering The Secret To Profit During High Inflation – Marc Faber Revealed!

Uncovering The Secret To Profit During High Inflation – Marc Faber Revealed!

Marc Faber talks about the inflation, the FED, Money printing, the stock market.

▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬▬

? ABOUT THIS CHANNEL :

If you’re new to this channel then I want to welcome you to “LifeWorthLiving”. This channel is all about Economy, Finance, News, business and money. We try our best to create and deliver the best financial educational videos to help many people...

Read More »

Read More »

USD moving higher in early NY trading. What is fueling the gains? ForexLive Video

In this video, we discuss the USD's early US trading gains on lower initial jobless claims and stronger employment data.

We also analyze the key technical areas for GBPUSD, USDJPY, EURUSD, and USDCAD, highlighting the risk-defining levels for each pair.

Read More »

Read More »

When the Private Sector Is the Enemy

Rest in peace, "technolibertarianism." There was a time when many believed tech entrepreneurs would usher in a new era of freedom. Unfortunately, the new tech elites are technocratic collaborators with the regime.

Original Article: "When the Private Sector Is the Enemy"

This Audio Mises Wire is generously sponsored by Christopher Condon.

Read More »

Read More »

Will the Fed Hike 50bp?

HAVE YOU SUBSCRIBED TO "Before the Bell?" https://www.youtube.com/channel/UCFmyKJKseEMQp1d14AjvMUw

(3/2/23) Investors should be on alert today following yesterday's program-trading driven markets; breaking through support at the 200-DMA could spur accelerated selling by the bots. When to act? Avoid knee-jerk response, and look for the selling stampede to conclude. Hopes for a Fed pause or pivot are running into reality. The foibles of...

Read More »

Read More »

Debunked: “Red States Are Just Welfare Queens”

This episode of Radio Rothbard revisits a point in our previous episode about the popular claim on leftwing Twitter that red-state America would be a "third world country" without support from the federal government. Ryan McMaken and Tho Bishop discuss Ryan's recent article on the topic, as well as the legacy of populist politics, and the unseen consequences of uniparty addiction to DC money.

Recommended Reading

"No, Red...

Read More »

Read More »