Tag Archive: Monetary Policy

Falling Yields, Rising Asset Prices -Rising Yields,Falling Prices

Our paper currency causes falling productivity, though not in terms of bushels per acre. What falls is productivity per dollar or euro of savings. This is the real meaning of the falling interest rate. When the rate was 10 percent, $1,000 of principal produced $100 of return. When it falls to two percent, then the same capital generates a return of only $20. Now with the Swiss 10-year bond, CHF 1,000 earns only CHF 1.3. Keith Weiner argues that one...

Read More »

Read More »

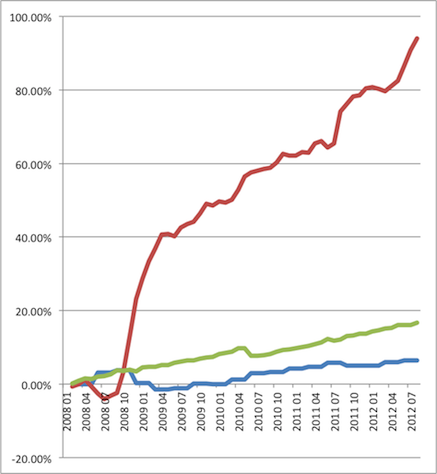

Rising Sight Deposits at SNB Means Rising SNB Debt

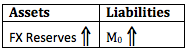

Money creation and sight deposits may have two points of view:

1. The central bank creates money - i.e. the SNB decides to increase sight deposits when it does currency interventions

2. Commercial banks create money - inflows in CHF on Swiss bank accounts make those banks increase their "sight deposits at the SNB. If inflows in CHF are higher than outflows then CHF must rise, unless the central bank does currency interventions.

We will present...

Read More »

Read More »

Swiss National Bank Monetary Policy Mandate – 2007 version vs. today

The mandate of the Swiss National Bank is concentrated on price stability, i.e. less than 2% inflation and to avoid deflation.

Read More »

Read More »

SNB Monetary Assessment June 2013: Very risk-averse, nearly hawkish tone

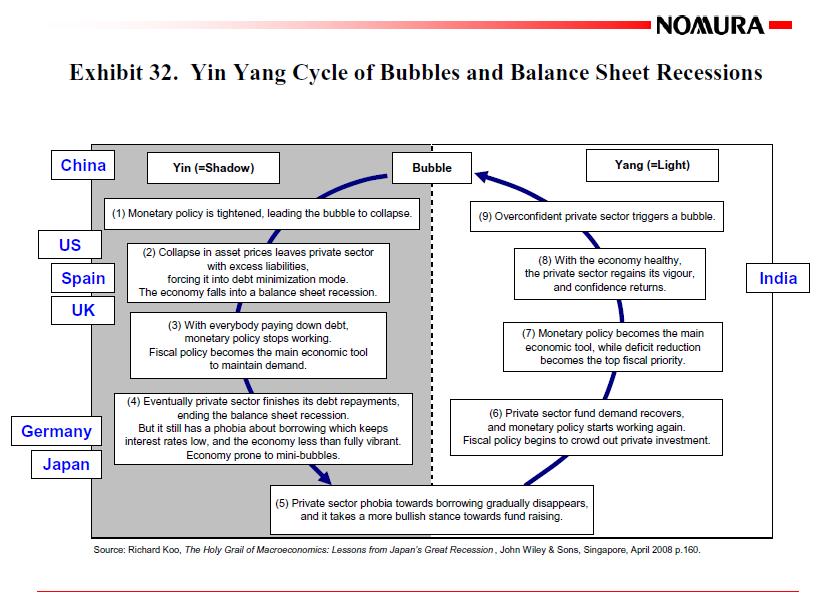

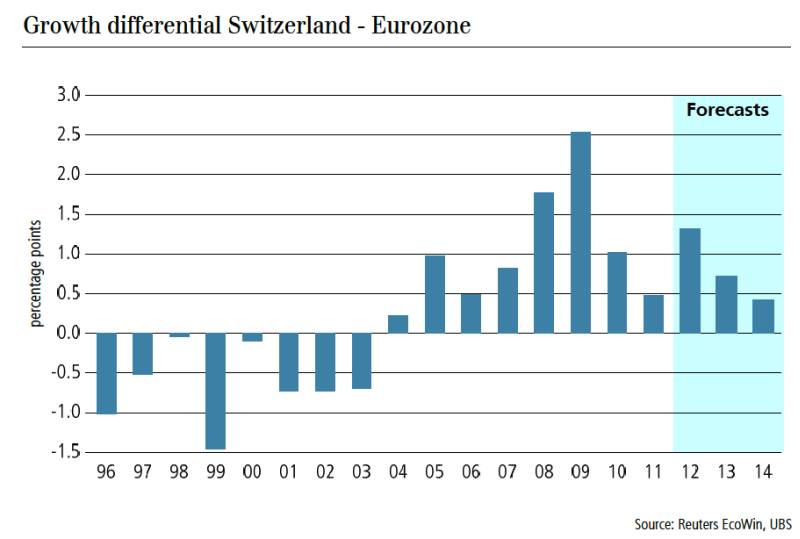

The Swiss National Bank (SNB) delivered a, for her standards, very hawkish monetary assessment with the focus on the risks in the financial sector. This does not come as a surprise for us. Each time, after the United States has recovered from a crisis – just like now – inflation and risks increased in Switzerland. …

Read More »

Read More »

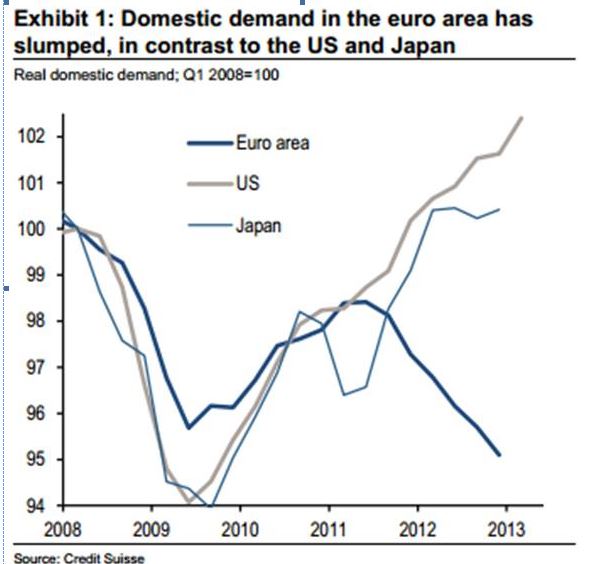

Balance of Payments Crisis: Did the Fed Cause the Euro Crisis with Excessive Monetary Easing?

The Fed's excessive monetary easing QE2 caused an inflationary period, that created a balance of payments crisis during which the Eurozone members were obliged to introduce excessive austerity measures.

Read More »

Read More »

SNB Monetary Assessment March 2013

In its monetary assessment the SNB maintains the EUR/CHF floor and warned against further risks in the euro zone. The SNB has downgraded the inflation path to -0.2% (previously-0.1%) in 2013 and +0.2% (+0.4%) in 2014.We do not completely agree.

Read More »

Read More »

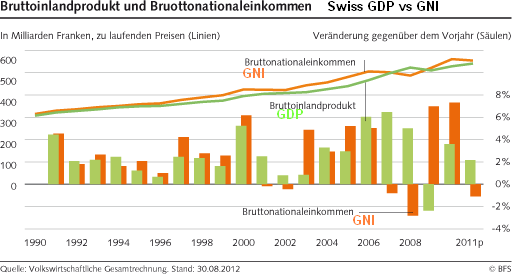

History of SNB monetary policy assessments vs. economic data

History of SNB monetary policy assessments vs. the Swiss gross national product (GDP) and gross national income (GNI).

Read More »

Read More »

SNB Monetary Policy Assessment December 2012: (Nearly) Full Text

The SNB decided to maintain the floor at 1.20 and the Libor target between 0% and 0.25%. As we expected in our outlook on the assessment, there were still important downwards drivers of inflation after the strong appreciation of the franc. Therefore, the SNB has moved its inflation expectations downwards for 2013 to minus 0.1% …

Read More »

Read More »

SNB Monetary Policy Assessment Outlook

On Thursday, December 13th, 2012, at 09.30 CET, the Swiss National Bank (SNB) holds its quarterly monetary policy assessment meeting. As we explained in the “drivers of Swiss inflation” post, inflation pressures will remain subdued for the next 2-3 years, because the effects of the quick rise of the franc and weakening global growth need to …

Read More »

Read More »

SNB Monetary Data Week October 26

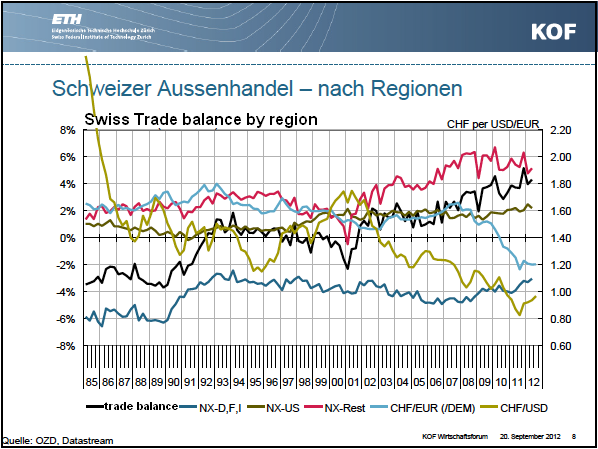

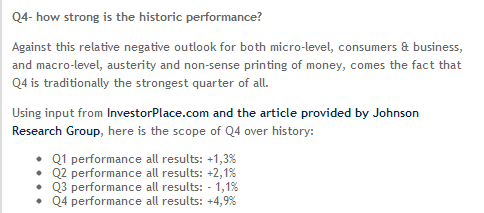

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Despite the seasonal effects between October and March, the SNB is not able to sell currency reserves consistently. Traditionally the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was possibly already anticipated …

Read More »

Read More »

SNB Monetary Data Week October 19

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was …

Read More »

Read More »

SNB Monetary Data Week October 12

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks …

Read More »

Read More »

SNB Monetary Data Week October 5

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger and stocks rise over the autumn months …

Read More »

Read More »

SNB Monetary Data Week of September 28

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally the United States and the USD dollar become stronger over the autumn months till …

Read More »

Read More »

Do Swiss companies prefer to hold cash at the SNB instead of local banks ?

The most recent SNB monetary data show that more and more companies are increasing their deposits at the central bank at a quicker speed than local banks. Might this be missing trust in the Swiss banking system ?

Read More »

Read More »

Isn’t it wonderful to trade with a strong central bank behind you?

Isn’t it wonderful to have a strong central bank like the SNB sitting behind you when trading Forex? Losses are limited to the floor of 1.20 and in the meantime you can gain forward swaps with the higher euro zone interest rates. Today the Swiss National Bank (SNB) decided in its monetary policy assessment …

Read More »

Read More »

What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the … Continue reading »

Read More »

Read More »

The Full English Translation of the Interview with Thomas Jordan

Here a translation of the interview with the president of the Swiss National Bank, Thomas Jordan, in the finance magazine ECO of the Swiss television SF1. Here the original German video. Question: Given that the SNB has reserves of over 200 bln. Euros, are you still able to sleep ? Jordan: We are in a … Continue reading...

Read More »

Read More »