Tag Archive: Korea

Emerging Markets: Week Ahead Preview

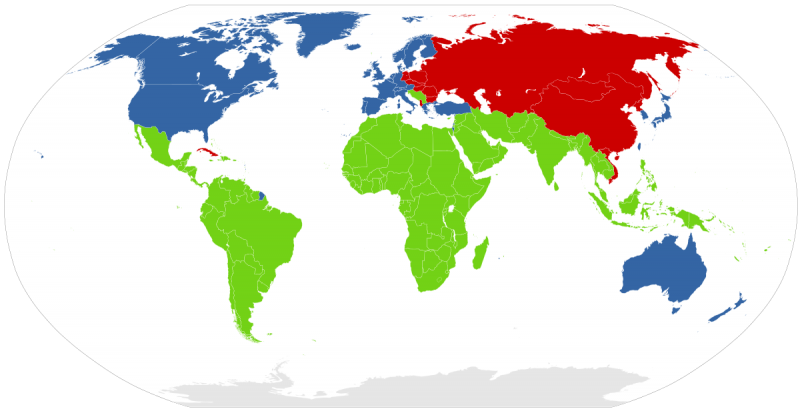

EM FX ended on a mixed note Friday, but capped off a very strong week overall. Best performers over the past week were RUB, ZAR, and COP, while the worst were PHP, CNY, and TWD. There is not much happening this week that could disrupt the weak dollar narrative, and so EM FX should continue to rally.

Read More »

Read More »

Emerging Markets: What Changed

Korea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Malaysia's central bank hiked rates for the first time in four years. Pakistan’s central bank unexpectedly hiked rates for the first time in over four years. Moody’s raised its outlook on Russia’s Ba1 rating from stable to positive. Argentina’s central bank surprised markets with its second straight 75 bp rate cut.

Read More »

Read More »

Emerging Markets: What Changed

China State Administration of Foreign Exchange (SAFE) disputed press reports that it was slowing or halting purchases of US Treasury bonds. Korean officials warned that it will take stern steps to prevent one-sided currency moves. Bulgaria is talking “intensively” with the ECB and other EU representatives about entering the Exchange Rate Mechanism by mid-year.

Read More »

Read More »

FX Daily, September 15: Short Note Ahead of the Weekend

Sporadic updates continue as the first of two-week business trip winds down. North Korea missile launch failed to have much impact in the capital markets. The missile apparently flew the furthest yet, demonstrating its ability to hit Guam. However, there was not an immediate response from the US. South Korea said it had simultaneously conducted its own drill which included firing a missile into the Sea of Japan (East Sea).

Read More »

Read More »

FX Daily, September 5: Greenback Mixed, North Korea and PMIs in Focus

Reports suggesting that North Korea is moving an ICBM missile toward launch pad in the western part of the country at night to minimize detection, while South Korea is escalating its military preparedness and the US seeks new sanctions, keep investors on edge. Risk assets are mixed. Gold is slightly lower. While the yen is stronger, the Swiss franc is heavier. Asia equities slipped, and European shares are recouping much of yesterday's 0.5% loss.

Read More »

Read More »

FX Daily, August 29: Dollar Losses Accelerate After North Korea Sends Missile over Japan

A brief period of quiet, which some may have confused with a change in posture, North Korea followed up the weekend's test of three ballistic missiles with what appears to have been an intermediate missile that flew over Japan. South Korea responded with its own symbolic display of force by dropping bombs by the DMZ.

Read More »

Read More »

FX Daily, August 24: Greenback Firmer in Becalmed Markets

The US dollar is enjoying a firmer tone in quiet. Sterling is stabilizing after grinding down to its lowest level since late June. The Mexican peso, which had dropped in thin trading in Asia and Europe yesterday following Trump's threat to exit NAFTA and force Congress to fund the Wall or face a government shutdown recovered fully and is now slightly higher on the week.

Read More »

Read More »

FX Daily, August 21: Dollar Edges Higher, While Equities Trade Heavily to Start the New Week

The US dollar is mostly firmer against most of the major and emerging market currencies. The main impetus appears to be some position adjustment emanating from equities. The equity markets turned south in the second half of last week and are moving lower today. Foreign investors appeared to have sold around $100 bln of European equities in 2016 and bought around a third back this year.

Read More »

Read More »

FX Weekly Preview: Transitioning to a New Phase

Jackson Hole marks the end of the investors' summer and a beginning of a challenging several weeks. The abandonment of national business leaders from Trump's advisory board and strong words by Republican Senator Corker, followed by the dismissal of the controversial Bannon, could be a turning point. Neither Yellen nor Draghi may not even address the current policy stance as they discuss the topic at hand, "Fostering Dynamic Global Economy", which...

Read More »

Read More »

FX Weekly Preview: Synthetic FX View — Macro and Prices

Economic data due out are unlikely to change macro views. Swiss franc's price action suggests some return to "normalcy" despite rhetoric remaining elevated. Sterling's 3.25 cent drop against the dollar looks over.

Read More »

Read More »

FX Daily, August 10: Tensions Remain Elevated, Dollar Firms

It is difficult to walk back the saber-rattling rhetoric. US Secretary of State Tillerson tried to defuse the situation, which had appeared to ease nerves in North America yesterday. However, references to the modernization of US nuclear forces, a multi-year project begun last year, spurred a fresh threat by North Korea to fire four intermediate range missiles near Guam in week's time.

Read More »

Read More »

FX Daily, August 09: North Korea lets EUR/CHF Collapse

The bellicose rhetoric from the US and North Korean officials is the main driver today. We would qualify that assessment by noting that first, the market moves are rather modest, suggesting a low-level anxiety among investors. Second, pre-existing trends have mostly been extended. Turning to Asia first, the Korea's equity market fell 1.1%. The Kospi has fallen for the past two weeks (~2.2%).

Read More »

Read More »

FX Daily, May 11: Canadian and New Zealand Dollars Get Whacked, While Greenback Consolidates

The US dollar has been mostly confined to about a 30 pip range against the euro and yen in Asia and the European morning. Sterling is under a little pressure after a series of poor data, including larger than expected falls in manufacturing and construction output, and a sharp widening of the trade deficit.

Read More »

Read More »

FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea's ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula.

Read More »

Read More »

FX Daily, April 14: Holiday Markets Remain on Edge

The holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar's strength from the sitting US President. While sending an "armada" toward the Korean peninsula, the US ordered a missile strike against Syria in retaliation for the use of chemical weapons and dropped the largest bomb in the world on Afghanistan.

Read More »

Read More »

FX Daily, April 13: Greenback Stabilizes After Trump Induced Slide

The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended Easter holiday.

Read More »

Read More »

FX Daily, April 11: Dollar Pushed Lower in Subdued Activity

The US dollar has a slight downside bias today through the European morning. The market does not seem particularly focused on high frequency data, though sterling traded higher after an unchanged year-over-year reading of 2.3%, and the euro traded higher after a stronger Germany ZEW survey.

Read More »

Read More »

FX Daily, April 10: Dollar Narrowly Mixed at Start of Holiday Week

The US dollar is narrowly mixed after a brief attempt in Asia to extend its pre-weekend gains fizzled, and a consolidative tone has emerged. The news stream is light and largely limited to the current Japanese account and the Sentix survey from Europe.

Read More »

Read More »

(5.2) FX Rates, the Balance of Payments Model and Central Bank Interventions

We will apply the balance of payments model for determining FX rate movements and FX interventions by central banks.

Read More »

Read More »