Tag Archive: $JPY

FX Daily, September 7: Emerging Markets Stabilize While Euro Shrugs Off Disappointing Data

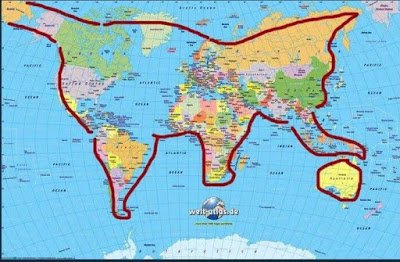

The global capital markets are finishing the week on a more stable note than it began. Indeed, since the middle of the week, many of the besieged emerging market currencies, like the South African rand, Turkish lira, and Argentine peso have posted some corrective upticks. Today, the MSCI Emerging Market Index is snapping a seven-day slide register a modest gain, ahead of the Latam session.

Read More »

Read More »

FX Daily, September 6: Fragile Calm Weighs on Greenback

The global capital markets are calmer today. This is not preventing the MSCI Emerging Market Index from extending its drop into the seventh consecutive session, but there has been a respite in the sell-off of emerging market currencies, where the Mexican peso, South African rand, Turkish lira, and Indonesian rupiah are modest, modest gains. At the same time, the Philippine peso, Korean won, and Indian rupee continued to weaken.

Read More »

Read More »

FX Daily, September 05: Continuing EM Pain Helps the Dollar, but does Little for Yen

The dollar is posting gains against most of the emerging market and major currencies. The MSCI Emerging Markets Index is off 1.6% and extending the drop to a sixth consecutive session. Indonesia's bourse saw the largest decline (~3.75%) in the region. In part, it reflects concern that the rupiah's weakness (falling now nine of the past 10 sessions) will boost corporate debt servicing costs.

Read More »

Read More »

FX Daily, September 04: Dollar Gains Broadly

The US dollar is rising against all the major and emerging market currencies today. The signals from the White House suggest strong pressure will be exerted on Canada to sign on to NAFTA 2.0 or risk losing part of its auto sector, which of course is primarily the production of US brands. At the same time, the US is in no mood to negotiate with Europe or China.

Read More »

Read More »

The Big Picture 18-24-Month Outlook: Some Preliminary Projections

The winding down of the North's summer provides a suitable time to consider not the near-term outlook, which many investors do on a daily basis, but to reflect on where we are heading down the road a bit. What will the next 18-24 months hold? Of course, we harbor no illusions of prescient vision and accept the hazards of the assignment and so should the reader.

Read More »

Read More »

FX Daily, August 31: Month-End Adjustments and Tentative Stabilization in Emerging Markets Ease Demand for Dollars but Not Yen

The dramatic price action seen yesterday among several emerging market currencies is eased today, but here at month-end, demand for risk-assets is tentative at best. The macro backdrop, including the increase in US core inflation, expectations for continued hikes by the Federal Reserve, and unambiguous signals that trade tensions will increase in the coming weeks dampens the risk appetite.

Read More »

Read More »

FX Daily, August 30: Brexit Optimism Underpins Sterling

The US dollar is mostly firmer, while global equities are softer and bonds little changed. The Turkish lira and South African rand remain under pressures. However, there does not appear to be an overall theme in today's markets.

Disappointing data from Australia and New Zealand has seen the Antipodean currencies move lower. New Zealand's business confidence fell to a ten-year low, and this sent the Kiwi tumbling. Its nearly 0.9% fall...

Read More »

Read More »

FX Daily, August 29: Dollar Finds Support, but Downside Correction May Not be Over

The US dollar has steadied after pulling back in recent days, but the downside correction does not appear complete, and month-end flows are still a risk to picking a dollar-bottom. The Australian dollar is the weakest of the majors. The main drag is paradoxically Westpac, one of Australia's largest banks, raised the variable rate mortgage by 14 bp to 5.38%. Others are expected to follow.

Read More »

Read More »

FX Daily, August 28: Greenback Remains On Defensive

Corrective forces continue to weigh on the US dollar. Sometimes the narratives drive the price action and sometimes the price action drives the narratives. Currently the latter appears to hold sway. The dollar's downside correction began around the middle of the month, well before Powell's August 24 Jackson Hole speech.

Read More »

Read More »

FX Daily, August 27: A Dog Day of Summer

Last week's dollar losses were initially extended in Asia before it came back bid. The euro briefly poked through $1.1650 for the first time in three weeks. However, the gains were sold into, and the euro finished the Asian session near $1.16, where there is a 782 mln euro option expiring, and 2.4 bln euros struck at $1.1625.

Read More »

Read More »

FX Daily, August 24: Greenback Marks Time Ahead of Powell

The US dollar is paring some of yesterday's gains in quiet turnover ahead of Fed Chief Powell's speech at Jackson Hole, the week's last highlight. The euro and sterling are trading inside yesterday's ranges, which the dollar has extended its gains against the yen to reach a two-week high near JPY111.50.

Read More »

Read More »

FX Daily, August 23: Dollar Rebounds

After correcting lower since the middle of last week, and pushed faster if not further by President Trump's comments, the US dollar is rebounding against most of the major and emerging market currencies today. After an initial wobble on the back of the FOMC minutes, the greenback's recovery began in earnest.

Read More »

Read More »

FX Daily, August 22: Markets Take US Political Developments in Stride

News that President Trump's personal lawyer claimed he was instructed by the candidate to commit a federal crime and, separately, his the former campaign manager was found guilty on eight counts is hardly impacting the global capital markets.

Read More »

Read More »

FX Daily, August 21: Trump Comments Hit Dollar, Little Impact on Rates

The US dollar is broadly lower following President Trump's comments yesterday, criticising Fed policy and reiterating his previously made claim that China and the EU are manipulating their currencies. We suggested that last week's presidential tweet that identified strong capital inflows into the US may not have been written by President Trump.

Read More »

Read More »

FX Daily, August 20: Greenback Consolidates Pre-Weekend Pullback in Quiet Turnover

The US dollar is slightly firmer against most of the major currencies, as the light participation and lack of fresh news see a consolidative tone emerge after the pullback at the end of last week. Although markets in Turkey are closed for a nearly week-long holiday, it has not prevented the lira from weakening. After closing a little below TRY6.02 before the weekend, the greenback has moved to TRY6.15 in the European morning.

Read More »

Read More »

FX Weekly Preview: Five Traps in the Week Ahead

Officials have taken steps to make it more difficult and more expensive to short the lira, but that did not prevent a 5% slide ahead of the weekend. There is no interest rate, within reason, that can compensate for such currency risk.

Read More »

Read More »

FX Daily, August 17: Dollar Limps into the Weekend

The US dollar is trading heavily against most of the world's currencies today. The main exceptions come from the emerging markets where the Turkish lira, Russian ruble, and Mexican peso are the chief exceptions, and their losses are modest. This week's dollar gains are being pared in largely corrective activity and amid a light news stream.

The threat of more sanctions on Turkey if it does not release the American pastor is helping the...

Read More »

Read More »

FX Daily, August 16: Emerging Markets Stabilize, Dollar Eases a Little

Two developments have helped turned sentiment, or at least arrested the markets' momentum. First, the developments in Turkey, where officials have taken a few measures that will make it somewhat more difficult to access the lira.

Read More »

Read More »

Great Graphic JPY Struggles at Trendline

This Great Graphic is a weekly bar chart of the dollar-yen exchange rate. It shows a three-year downtrend line (white line). The US dollar had popped above it last month, but this proved premature and has not closed about it for a month. The trendline is found near JPY111.55 now.

Read More »

Read More »

FX Daily, August 15: Lira Rallies on Cut in Swaps, but Fails to Dent Dollar Demand

The Turkish lira is extending yesterday's recovery today on the back of actions by officials that are aimed at limiting foreign access to the lira to short. Without introducing new capital controls, regulators halved the amount of swap transactions banks can do to 25% of shareholder equity. This is meant to make it more difficult to access lira in the offshore swaps market, which is an important channel.

Read More »

Read More »