Tag Archive: $JPY

Macro Cheat Sheet

Rising US rates in absolute terms and relative to other countries, coupled with the policy-mix and US tax reform are the main drivers. The market has nearly completely discounted three more Fed hikes by the end of next year, while the Fed has signaled that four hikes may be appropriate.

Read More »

Read More »

FX Daily, October 09: A (Short) Reprieve For China while the Dollar Stays Firm

The small gains in China's Shanghai Composite and the yuan is helping sentiment today. News that Italy's budget watchdog may reject the government's fiscal plans has helped stabilize Italian assets initially, but renewed pressure quickly materialized. Most Asian equities retreated while Europe's Dow Jones Stoxx 600 is struggling to snap a three-day slide. US shares are trading heavily in Europe.

Read More »

Read More »

FX Daily, October 08: China and European Woes Weigh on Equities but Buoy the Dollar

Overview: The markets are having a rough adjustment to the return of the Chinese markets are the week-long holiday. The cut in the required reserves failed to lift investor sentiment. The Shanghai and Shenzhen Composites fell almost 4%, and the yuan slid nearly 0.8%. It is an unusually large decline for the closely managed currency. The offshore yuan fell by a little more than 0.5%.

Read More »

Read More »

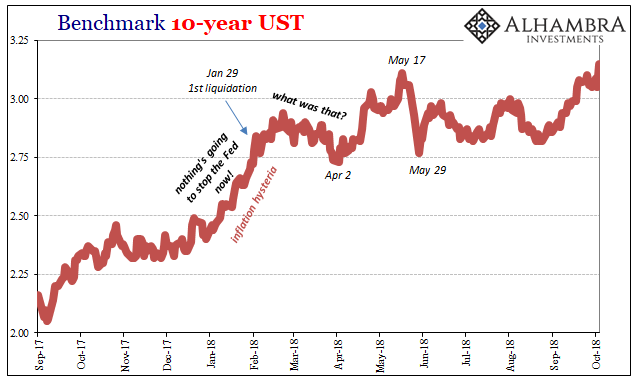

A Few Questions From Today’s BOND ROUT!!!!

On April 2, the benchmark 10-year US Treasury yield traded below 2.75%. It had been as high as 2.94% in later February at the tail end of last year’s inflation hysteria. But after the shock of global liquidations in late January and early February, liquidity concerns would override again at least for a short while. After April 2, the BOND ROUT!!!! was re-energized and away went interest rates.

Read More »

Read More »

FX Daily, October 04: Dollar Consolidates Gains while Yields Continue to Rise

The US dollar is consolidating yesterday's gains against most of the major currencies, though the dollar bloc is underperforming. Bond yields are moving higher, and equities are lower. With a light data and events stream, the price action itself is the news.

Read More »

Read More »

FX Daily, October 02: Greenback Advances

The US dollar is rising against most of the major and emerging market currencies. The Swiss franc and the Japanese yen are the exceptions and are holding their own. Global equities are mixed. Asia, excluding Japan, was mostly lower, with 1.2% losses in Taiwan and South Korea and 2.5% drop in Hong Kong and in the H-shares that trade there.

Read More »

Read More »

A Word About the Q2 COFER Report

The IMF reports the most authoritative currency allocation of global reserves at the end of every quarter with a quarter delay. Invariably, an economist, strategist, or journalist is inspired to write why some data nugget confirms the demise of the dollar as the dominant currency.

Read More »

Read More »

FX Daily, September 28: Dollar Remains Firm While Italy is Punished

The US dollar's post-Fed gains have been extended, though the upside momentum appears to be stalling. Japan's Nikkei advanced 1.35% on the back of the yen's declines and reached its highest level since 1991. Chinese shares (A and H) rallied amid reports that MSCI and FTSE-Russell are boosting Chinese shares in their benchmarks.

Read More »

Read More »

FX Daily, September 26: The Dollar Index has Fallen Four of the Five Times the FOMC met this Year

The US dollar is trading with a softer bias in tight ranges. The euro and sterling have been confined to yesterday's ranges, while the greenback briefly traded above JPY113.00 for the first time in two months. The South African rand and Turkish lira are leading the most emerging market currencies higher. Asian equities moved higher, led by Hong Kong, which returned from yesterday's holiday.

Read More »

Read More »

FX Daily, September 25: Greenback Remains at the Fulcrum

The major currencies are mixed in quiet turnover. Most of the European currencies are firmer, while the dollar-bloc currencies, yen and Swiss franc are softer. Emerging market currencies are steady to higher, though there are a few exceptions in Asia, where the Indonesian rupiah and the Chinese yuan are off about 0.3%, while the Indian rupee and Malaysian ringgit are around 0.2% lower.

Read More »

Read More »

FX Daily, September 20: The Mixed Performance Makes it Difficult to Talk about The Dollar

Sometimes the dollar is the key mover, but sometimes, like today, it seems to be the fulcrum, reflecting disparate moves among other currencies. While the euro is at two-month highs, the yen is near two-month lows. The euro is bouncing off two-month lows and the 100-day moving average against sterling. Most emerging market currencies are advancing against the dollar today.

Read More »

Read More »

FX Daily, September 19: Dollar Trades Heavily as Emerging Markets Follow China

One would not have a clue looking at global equities that there has been a sharp escalation in trade tensions in the past 36 hours. As was well tipped the US imposed a 10% tariff on $200 bln of Chinese goods and indicated that the tariff will rise to 25% at the start of next year. President Trump also threatened to quickly follow up with another tariff on $267 bln of Chinese goods it retaliated.

Read More »

Read More »

Dollar Slips, though Emerging Markets Trade Heavily

The US dollar is beginning the new week on a soft note, as China threatens not to accept the invitation for trade talks in Washington if the US imposes new tariffs on $200 bln of its goods, which the Wall Street Journal reports could come as early as today. Meanwhile, the MSCI Emerging Markets Index is giving back half of the 2.5% rally seen in the second half of last week.

Read More »

Read More »

FX Weekly Preview: Dollar Pullbacks Remain Shallow as Rate Differentials Widen

The trajectory of monetary policy in the US and Europe has been fairly clear. There is practically no doubt that the Fed will hike rates on September 26. Despite softer than expected PPI and CPI figures, the market has become more confident of another move in December. The Federal Reserve's balance sheet unwind reaches its maximum velocity of $50 bln a month in Q4.

Read More »

Read More »

FX Daily, September 14: Dollar Losses Extended

The US dollar remains on the defensive after retreating yesterday. Its losses against the most of the major and emerging market currencies are being extended today. The combination of softer US inflation coupled with a less dovish than expected ECB, a Bank of England lifting growth forecasts, while warning that a Brexit without an agreement could spur higher mortgage rates, and a more aggressive rate hike by Turkey conspired to force the dollar...

Read More »

Read More »

FX Daily, September 13: Vulnerable To Disappointment

There is an eerie calm in the markets ahead of the highlight for the day and week. The central banks of the eurozone, UK, and Turkey hold policy meetings, and the US reports August CPI. The greenback is a mostly firmer, with the Australian dollar as the notable exception. On the one hand, we would note that is it higher for the fourth consecutive sessions, after finding some support near $0.7100 earlier in the week.

Read More »

Read More »

FX Daily, September 12: Dollar Chops in Narrow Ranges

Eurostat confirmed that EMU industrial output fell for a second consecutive month in July. The 0.8% decline was larger than expected and is the third decline of such a magnitude in four months and weighed on the euro. German and Spanish industrial output had surprised on the downside last week, and Italy matched suit today with a report showing a 1.8% contraction, much larger than expected, and bringing the year-over-year rate to -1.3% (workday...

Read More »

Read More »

FX Daily, September 11: Dollar May Prove Resilient if it is Turn Around Tuesday

The euro and sterling extended their recovery from the US hourly earnings lows seen before the weekend. However, the move stalled in the European morning, after the UK reported better than expected earnings itself. Sterling approached the 61.8% retracement of the decline from the July high (~$1.3365) found just below $1.31. It has been correcting higher since reaching almost $1.2660 on August 15.

Read More »

Read More »

FX Daily, September 10: Initial Extension of Euro and Sterling Losses Stall

The US dollar's pre-weekend gains were extended against most the major currencies, but the euro, sterling, and Australian dollar have recovered in the European morning. Emerging markets currencies are mixed. The Indian rupee is the weakest(of the emerging market currencies (~-0.8%) following the widening of the Q2 current account deficit at the end of last week and ahead of the August trade deficit which is expected to show the impact of rising...

Read More »

Read More »

Jump in Hourly Earnings is Key to US Jobs, while Canada adds 40k Full-Time Positions

The 201k rise in US non-farm payrolls edged above the median forecasts, but the 50k downward revision to the past two-months removes the gloss. It is the first August report in seven years that the initial estimate was above the Bloomberg median. The most important part of the report was the 0.4% jump in hourly earnings, lifting the year-over-year rate to a new cyclical high of 2.9%.

Read More »

Read More »