Tag Archive: $JPY

FX Weekly Preview: The Week Ahead: It’s Not about the Data

High frequency economic reports will be not be among the key drivers of the capital markets in the week ahead.The light schedule, consisting mostly of industrial production in Europe, inflation for Scandinavia, and US retail sales, will have minimal impact on rate expectations.

Read More »

Read More »

FX Daily, October 07: Sterling Stabilizes After Harrowing Drop, Now Jobs

Sterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480.

Read More »

Read More »

US and Canada Jobs: Sill Strong Enough for a Rate Hike

The US grew 156k jobs in August, missing the median estimate by about 16k. The July series was revised up by 16k. The unemployment and participate rate ticked up 0.1% to 5.0% and 62.9% respectively. Hourly earnings rose 0.2% to lift the year-over-year rate to 2.6% from 2.4%. The average work week increased to 34.4 hours from 34.3.

Read More »

Read More »

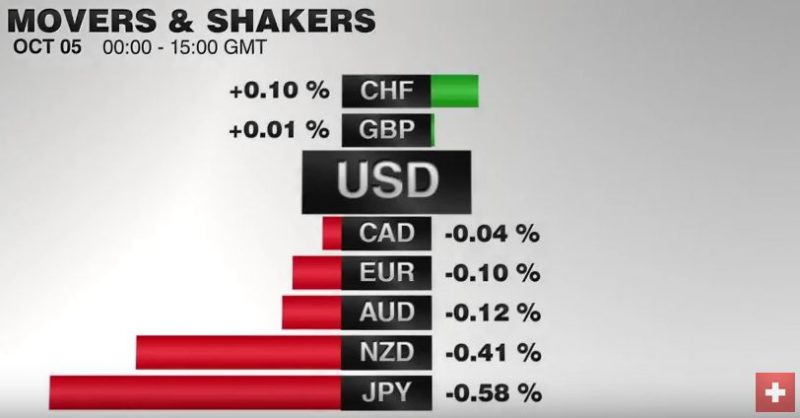

FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

After the sudden rise to 1.0973 the EUR/CHF is falling again. The volatiliy is related to the CHF speculative postion, that suddenly was Short CHF. Traders that moved with the SNB Window Dressing for Q3 are closing their shorts again.

Read More »

Read More »

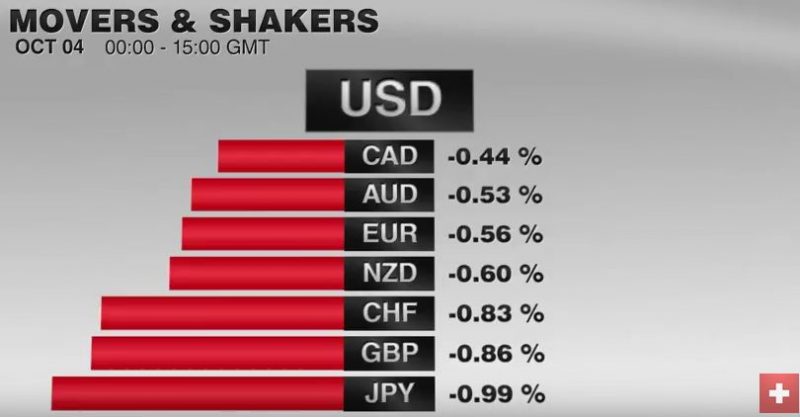

FX Daily, October 04: Sterling’s Slide Continues, EUR/CHF Soars Again

UK Prime Minister May's comments at the Tory Party Conference over the weekend played up the risk of what has been dubbed a hard Brexit and triggered a slide in sterling saw it fall to new 30-year+ low against the dollar just below $1.2760. The EUR/CHF has soared again. Later during the day, it has even achieved 1.0970.

Read More »

Read More »

The Yen in Three Charts

The dollar is taking out a several month downtrend against the yen. The correlation between the yen and the S&P 500 has broken down. The US 2-year premium over Japan has steadily risen.

Read More »

Read More »

FX Daily, October 03: May’s Confirmation Sends Sterling Lower

Sterling has a bad case of the Monday blues. Even the moon looks distraught. Prime Minister May has confirmed earlier suggestions that she will trigger Article 50 to formally begin its divorce proceedings from the EU at the end of Q1 17. Several officials have already hinted this time frame, though many have been skeptical that Article 50 would be triggered at all, given the complexities of the issues.

Read More »

Read More »

FX Daily, September 30: SNB Intervenes to Polish Q3 Results

True to its recent habit, the US dollar is finishing the week on a firm note. On the month, though, the greenback has fallen against most of the majors, but sterling, the Canadian dollar, and the Swedish krona. Global equities are trading heavily, and investors' angst is lending support to bond markets.

Read More »

Read More »

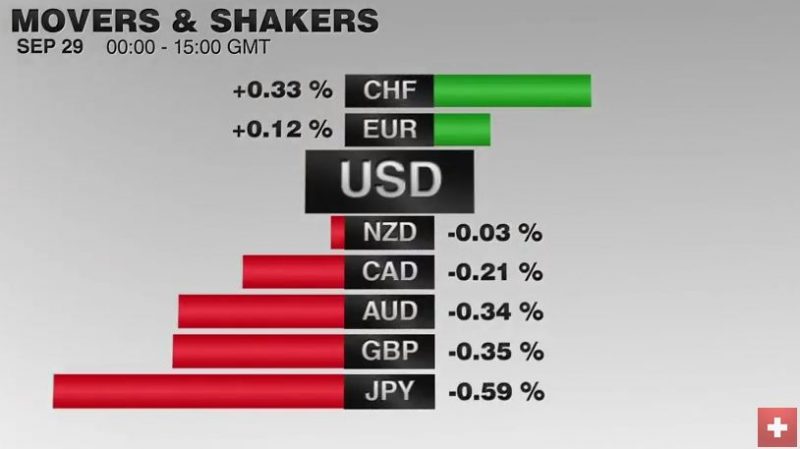

FX Daily, September 29: Dollar Quietly Bid, while Market is Skeptical of OPEC Deal

The US dollar has firmer against most major and emerging market currencies. It remains well within its well-worn ranges, which continue to be narrow. A notable exception today is the yen's weakness. While the majors are mostly off marginally and now more than 0.3%, the yen is 0.75% lower. That puts the greenback at a six-day high (~JPY101.75) at its best.

Read More »

Read More »

FX Daily, September 28: Dollar Mostly Firmer, but Going Nowhere Quickly

The US dollar is enjoying a firmer bias today, but it remains narrowly mixed on the week. It is within well-worn ranges. Of the several themes that investors are focused on, there have not significant fresh developments. In terms of monetary policy, both Draghi and Yellen speak today. The former is behind closed doors with a Germany parliamentary committee.

Read More »

Read More »