Tag Archive: $JPY

FX Daily, March 21: Euro Recovery Continues, Posts New Six Week High Other Currencies Mixed

Growing confidence that Le Pen will not be the next president of France following the televised debate for which two polls showed Macron doing best has lifted the euro and reduced the French interest rate premium over Germany. The euro pushed through $1.0800 after initially dipping below yesterday's lows.

Read More »

Read More »

FX Weekly Preview: Divergence Theme Questioned

Recent developments have given rise to doubts over the divergence theme, which we suggested have shaped the investment climate. There are some at the ECB who suggest rates can rise before the asset purchases end. The Bank of England left rates on hold, but it was a hawkish hold, as there was a dissent in favor of an immediate rate hike, and the rest of the Monetary Policy Committee showed that their patience with both rising price prices and the...

Read More »

Read More »

FX Daily, March 14: Brexit Takes Fresh Toll on Sterling, While Dollar Firms more Broadly

UK Prime Minister May got the parliamentary approval the courts ruled was necessary to formally trigger Article 50. It is not clear what UK she will lead out the EU. Scotland is beginning the legal proceedings to hold another referendum on independence. There is some talk that Northern Ireland, which voted to remain, might be allowed to rejoin the Republic of Ireland.

Read More »

Read More »

FX Daily, March 13: Bonds and Equities Rally, Dollar Heavy

Hit by profit-taking ahead of the weekend, despite US jobs data that remove the last hurdle to another Fed hike this week, the greenback remains on the defensive. It has softened against all the major currencies and many of the emerging market currencies. The chief exception is those in eastern and central Europe.

Read More »

Read More »

FX Weekly Preview: Succinct Views of Ten Events and Market Drivers: Week Ahead

The week ahead is the busiest week of the first quarter. It sees four major central meetings, including the Federal Reserve which is likely to raise rates for the second time in four months. The Dutch hold the first European election of the year, and the populist-nationalist party remains in contention for the top slot. The week concludes with the G20 meeting, the first that the Trump Administration's presence will be felt.

Read More »

Read More »

Time, The Biggest Risk

If there is still no current or present indication of rising economic fortunes, and there isn’t, then the “reflation” idea turns instead to what might be different this time as compared to the others. In 2013 and 2014, it was QE3 and particularly the intended effects (open ended and faster paced, a bigger commitment by the Fed to purportedly do whatever it took) upon expectations that supposedly set it apart from the failures of QE’s 1 and 2. This...

Read More »

Read More »

FX Daily, March 10: US Jobs Data: Deja Vu All Over Again?

A week ago, after nine Fed officials had spoken, the market widely expected Yellen and Fischer to confirm that the table was set for a rate hike later this month. They did, and the dollar and US interest rates fell. Now, after a strong ADP jobs report (298k), everyone recognizes upside risk to today’s national report, and the dollar has lost its upside momentum against most major currencies, but the Japanese yen.

Read More »

Read More »

FX Daily, March 09: Pre-ECB Squaring Lifts Euro in a Strong USD Context

The euro tested the lower of its range near $1.05 in Asia before short covering in Europe lifted back toward yesterday's highs near $1.0575. However, buoyed by the upside surprise in the ADP estimate of private sector jobs growth, the dollar is firmer against most other currencies today. The US 10-year yield is up 20 bp this week.

Read More »

Read More »

FX Daily, March 08: Dollar Bid as Rates Firm

The US dollar is moving higher against nearly all the other major foreign currencies today. As far as we can tell, the driving force remains interested rate considerations. US rates are rising in absolute terms and about Europe and Japan. The US 10-year yield is moving above the downtrend that has been in place since the day after the Fed hiked rates last December.

Read More »

Read More »

FX Daily, March 06: The Dollar Gives Back More Before Consolidating

The US dollar's pre-weekend pullback was extended in early European turnover but appeared to quickly run out of steam. The prospect of a constructive US employment report at the end of the week, especially given the steady decline in weekly initial jobless claims to new cyclical lows, underscores the likelihood that the Fed hikes rates next week. Bloomberg puts the odds above 90%, while the CME estimates a nearly 80% chance.

Read More »

Read More »

FX Weekly Preview: Four Sets of Questions and Tentative Answers for the Week Ahead

The week ahead features the ECB meeting and the US February jobs report. The Reserve Bank of Australia meets, Europe reports industrial production, Japan reports January current account figures, and China reports its latest inflation and lending figures. We frame this week's discussion of the drivers in terms of four sets of questions and offer some tentative answers.

Read More »

Read More »

FX Daily, March 02: Dollar Remains Bid

The US dollar is bid against the major currencies as the combination the increased expectation of a Fed rate hike and the President's commitment to fiscal stimulus buoys sentiment. The dollar-bloc, where speculators in the futures market, have grown a net long position, are leading the move.

Read More »

Read More »

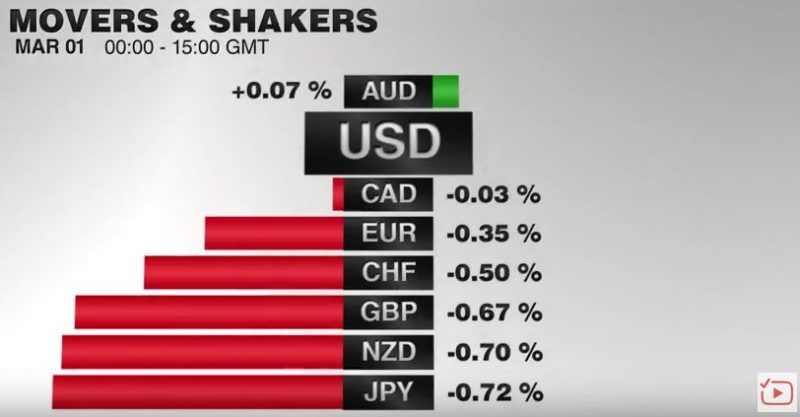

FX Daily, March 01: Greenback Bounces, More Fed than Trump

The much-anticipated speech by US President Trump was light on the details that investors interested in, like the tax reform, infrastructure initiative, and deregulation. There appears to be an agreement to repeal the national healthcare, but there is no consensus on its replacement.

Read More »

Read More »

FX Daily, February 27: Asia Stumbles, Europe Recovers, Waiting for Trump

The late recovery in US equities before the weekend did little good for Asian markets. Nearly all the Asian equity markets moved lower, led by the 1.0% decline in Japan's Topix. It was the third successive loss for the Topix, which is the long losing streak of the year so far. The MSCI Asia Pacific Index lost 0.6%, further pushing it off the 17-month high seen last week.

Read More »

Read More »

FX Weekly Preview: Macroeconomics and Psychology

There is a broad consensus around the macroeconomic picture. The headwinds slowing the US economy in H1 16 have eased, and above trend growth in H2 16 appears to be carrying into 2017. Q4 16 GDP is expected to be revised to 2.1% up from 1.8%. Many economists appear to accept that a good part, though not all, of the decline in the estimated trend growth in the US, is a function of demographic considerations.

Read More »

Read More »

FX Daily, February 24: Anxiety? What Anxiety?

The US dollar is finishing the week on a mixed note in choppy activity in narrow ranges. It is an apt way to finish this week, which has been largely directionless as investors wait for fresh incentives, and are especially looking toward Trump's speech to a joint session of Congress next week.

Read More »

Read More »

FX Daily, February 23: Dollar Chops About, as “Fairly Soon” Does not Mean mid-March

The US dollar is confined to narrow ranges today within yesterday's ranges. Equity markets posted small gains in Asia and have an upside bias in Europe. Core bond yields are softer, and today this includes France, but peripheral European 10-year benchmark yields are 3-6 bp firmer. Italian bonds are the poorest performer, while the 10-year Dutch bond yields are off the most (3.2 bp to 0.56%) despite the looming election.

Read More »

Read More »

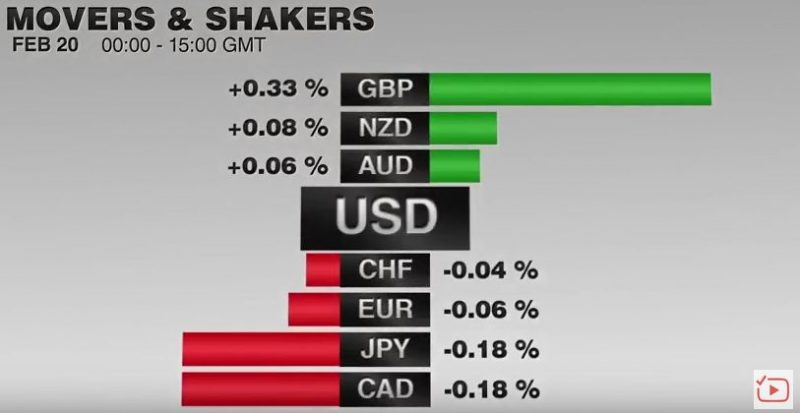

FX Daily, February 20: Marking Time on Monday

US markets are closed for the Presidents' Day holiday, but it hasn't prevented its pre-weekend gains giving a bullish tone to global equities. The S&P 500 and NASDAQ recovered from early weakness to close at new record levels before the weekend. Global equity markets are following suit today.

Read More »

Read More »

FX Weekly Preview: Number One Rule of the Game is Stay in the Game

Light economic calendar in the week ahead, but anticipation of US tax reform may underpin dollar and equities. European politics are in flux (France, Italy, Greece) and this may see spreads widen over Germany. Russia's outlook was upgraded by Moody's before the weekend, and China has announced no coal imports this year from North Korea. Brazil is expected to cut Selic by 75 bps.

Read More »

Read More »

FX Daily, February 17: Greenback Stabilizes Ahead of the Weekend

The US dollar is finishing the week on a steady to firmer note against the major currencies but the Japanese yen. The softer yields and weaker equity markets often are associated with a stronger yen. For the week as a whole, the dollar is mostly lower, though net-net it has held its own against sterling, the euro and Canadian dollar.

Read More »

Read More »