Tag Archive: jobs

FX Daily, October 2: POTUS Infected: Is this the October Surprise?

Before a US election, there is often speculation of a last-minute game-changing development. News earlier today that the US President and his wife have tested positive for the Covid virus has injected a new unknown into not only the US election but the markets as well.

Read More »

Read More »

FX Daily, September 4: Markets Look for more Solid Footing, but Need to Get Passed US Jobs Data

The dramatic sell-off of US shares yesterday is the main focus, capturing the limelight from other forces, including today's US employment report. It was the third-worst session for the S&P 500 since the March 23 bottom, and the other two did not see follow-through selling.

Read More »

Read More »

FX Daily, August 07: Position Adjustment Dominates ahead of US/Canada Employment Reports

Escalating dramas may be behind the position adjustment today ahead of the US jobs data. The US and China feud expanded beyond Tiktok to WeChat, and efforts to tighten disclosure rules for Chinese companies listed in the US are nearing. The negotiations between the White House and the Democrats broke down, preventing or at least delaying additional stimulus.

Read More »

Read More »

FX Daily, July 2: Dollar Thumped Ahead of US Jobs Report

Market optimism over the possibility of a vaccine in early 2021 overshadowed the continued surge in US cases, where the 50k-a-day threshold of new cases has been breached. Following the NASDAQ close yesterday at record highs, global equities have advanced. Led by Hong Kong returning from yesterday's holiday, Asia Pacific equities rallied. Most local markets rose by more than 1%, though Tokyo and Taiwan lagged.

Read More »

Read More »

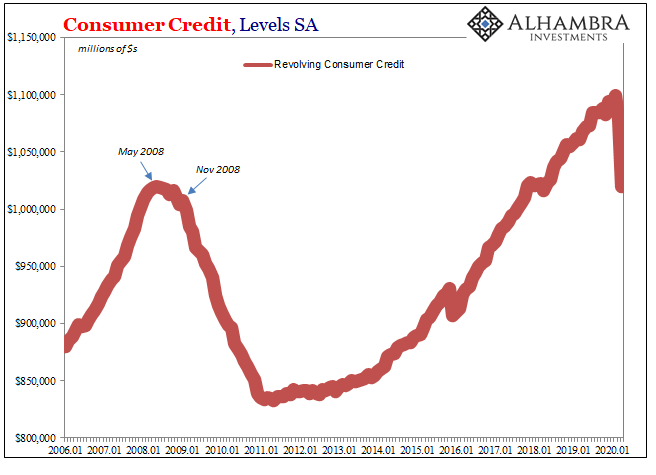

A Second Against Consumer Credit And Interest ‘Stimulus’

Credit card use entails a degree of risk appreciated at the most basic level. Americans had certainly become more comfortable with debt in all its forms over the many decades since the Great Depression, but the regular employment of revolving credit was perhaps the apex of this transformation. Does any commercial package on TV today not include one or more credit card offers? It certainly remains a staple of junk mail.

Read More »

Read More »

FX Daily, June 9: Profit-Taking Gives Turn Around Tuesday Its Name

Overview: The S&P 500 turning higher on the year was the last straw before an arguably overdue bout of profit-taking kicked-in and is the dominant feature today in the capital markets. It began slowly in the Asia Pacific region. Equities were mixed, and Australia's 2.4% rally and the 1.6% gain in Hong Kong stood out. Europe's Dow Jones Stoxx 600 was off for a second day (~1.3%), and US stocks are trading heavily, warning that the S&P 500 may give...

Read More »

Read More »

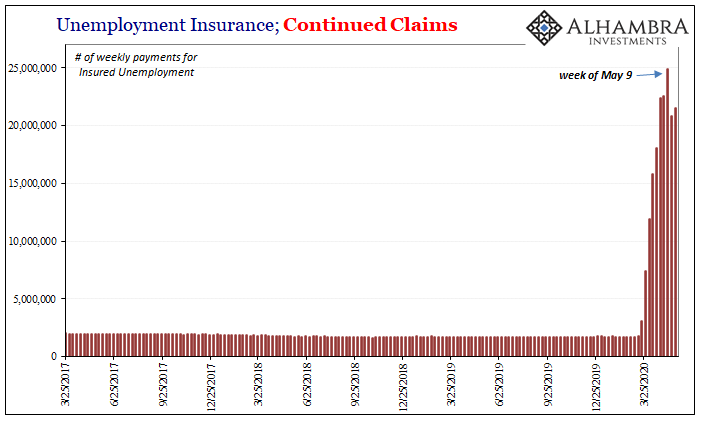

What Did Everyone Think Was Going To Happen?

Honestly, what did everyone think was going to happen? I know, I’ve seen the analyst estimates. They were talking like another six or seven perhaps eight million job losses on top of the twenty-plus already gone. Instead, the payroll report (Establishment Survey) blew everything away, coming in both at two and a half million but also sporting a plus sign.The Household Survey was even better, +3.8mm during May 2020. But, again, why wasn’t this...

Read More »

Read More »

FX Daily, June 5: Greenback Remains Soft Ahead of Employment Report, but Reversal Possible

The modest loss in the S&P 500 and NASDAQ yesterday did not signal the end of the bull run. All the markets in the Asia Pacific region rallied, with the Hang Seng among the strongest with a 1.6% advance that brought the week's gain to around 7.8%. South Korea's Kospi was not far behind with a weekly gain of 7.5%. In the past two weeks, the MSCI Asia Pacific Index is up nearly 10%.

Read More »

Read More »

FX Daily, June 4: Risk Taking Pauses Ahead of the ECB

Overview: After several days of aggressive risk-taking, investors are pausing ahead of the ECB meeting. Equities were mostly higher in the Asia Pacific region, though China was mixed, and Indian shares slipped. Europe's Dow Jones Stoxx 600 is snapping a five-day advance, and US shares are trading with a heavier bias. The S&P 500 gapped higher yesterday, and that gap (~3081-3099) offers technical support.

Read More »

Read More »

FX Daily, May 8: Jobs and Negative Fed Funds Futures

Overview: The S&P 500 closed near its session lows for the third day running yesterday but failed to deter the bulls in Asia-Pacific, where most markets rose by more than 1%. Taiwan, Korea, and Australia lagged a bit though closed higher. Europe's Dow Jones Stoxx 600 is firm, and the modest gains (~0.5%) would be enough to ensure a higher weekly close if it can be maintained.

Read More »

Read More »

FX Daily, March 06: Panic Deepens, US Employment Data Means Little

The sharp sell-off in US equities and yields yesterday is spurring a mini-meltdown globally today. Many of the Asia Pacific markets, including Japan, Australia, Taiwan, and India, saw more than 2% drops, while most others fell more than 1%. The MSCI Asia Pacific Index snapped the four-day advance had lifted it about 2.8% coming into today.

Read More »

Read More »

FX Daily, February 7: Dollar Rides High as Eurozone Disappoints, and Caution Sets In

Overview: A more cautious tone is evident today in the markets, which seem to have run well ahead of macro developments and evidence that the new coronavirus is not yet contained. After a roughly 3.5% advance in the past three sessions, the MSCI Asia Pacific index pulled back with nearly the markets in the region slipping.

Read More »

Read More »

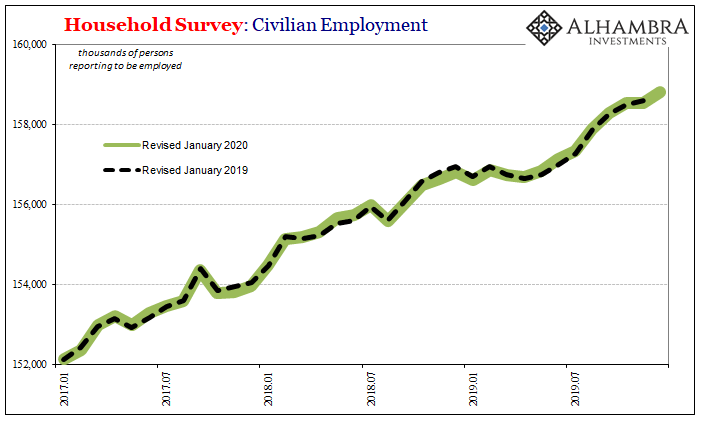

Very Rough Shape, And That’s With The Payroll Data We Have Now

The Bureau of Labor Statistics (BLS) has begun the process of updating its annual benchmarks. Actually, the process began last year and what’s happening now is that the government is releasing its findings to the public. Up first is the Household Survey, the less-watched, more volatile measure which comes at employment from the other direction. As the name implies, the BLS asks households who in them is working whereas the more closely scrutinized...

Read More »

Read More »

FX Daily, January 10: Jobs Friday: Asymmetrical Risks?

Overview: The first full week of 2020 is ending on a quiet note, pending the often volatile US jobs report. New record highs US equities on the back of easing geopolitical anxiety is a reflection of greater risk appetite that is evident across the capital markets. Asia Pacific equities mostly rose today, though Chinese shares and a few of the smaller markets saw small losses.

Read More »

Read More »

FX Weekly Preview: High-Frequency Data may Underscore Four Thematic Points

Full liquidity returns to the markets gradually in the coming days, and the week ahead culminates with the US December employment report. The highlights include the service and composite PMI readings, and December eurozone and China's CPI. The UK reports December PMIs, November GDP, and industrial output figures.

Read More »

Read More »

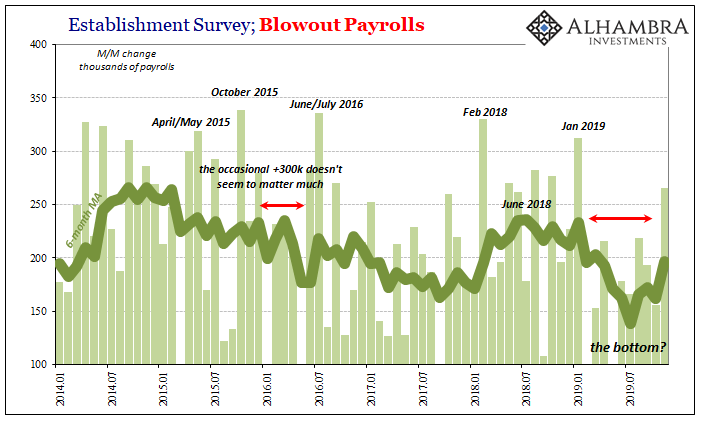

Disposable (Employment) Figures

If last month’s payroll report was declared to be strong at +128k, then what would that make this month’s +266k? Epic? Heroic? The superlatives are flying around today, as you should expect. This Payroll Friday actually fits the times. It wasn’t great, they never really are nowadays (when you adjust for population and participation), but it was a good one nonetheless.

Read More »

Read More »

FX Daily, December 6: And Now for the Employment Report

Overview: Asia Pacific equities closed higher today, with India being a notable exception. Hong Kong and South Korea led with 1% rallies. For the week, the MSCI index for the region advanced to snap a three-week decline. European and US bourses have not fared as well. The Dow Jones Stoxx 600 is paring this week's losses, but it is still off around 0.9% through the European morning session.

Read More »

Read More »

FX Daily, November 1: Dollar Remains on the Defensive Ahead of Jobs Report

Overview: An unexpected increase in China's Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of gains in China, Hong Kong, Korea, and Taiwan began November with a gain.

Read More »

Read More »

FX Weekly Preview: Fed’s Mid-Course Correction to be Challenged while ECB Resumes Bond Purchases

The week ahead will help shape the investment climate for the remainder of the year. The highlights include three central bank meetings (Federal Reserve, Bank of Japan, and the Bank of Canada). Among the high-frequency data, the US and the eurozone report the first estimates of Q3 GDP, and the US October jobs data and auto sales will be released. Investors will also get the preliminary Oct CPI for EMU.

Read More »

Read More »

FX Daily, October 4: The US Jobs Data to Close a Sobering Week

Overview: The recovery of US shares yesterday signaled today's fragile stability. Gains in Japan, Australia, and Taiwan blunted the losses elsewhere in the region, including a 1% slide in Hong Kong. The MSCI Asia Pacific Index fell for the third week. China's markets have been closed since Monday and will re-open Monday and may play some catch-up.

Read More »

Read More »