Tag Archive: Gold

SNB verlängert Goldabkommen, aber wozu?

Die SNB schreibt heute in einer Medienmitteilung: Um ihre Absichten in Bezug auf ihre Bestände an Gold darzulegen, geben die Beteiligten am Goldabkommen folgende Erklärung ab: Gold bleibt ein wichtiges Element der globalen Währungsreserven.

Read More »

Read More »

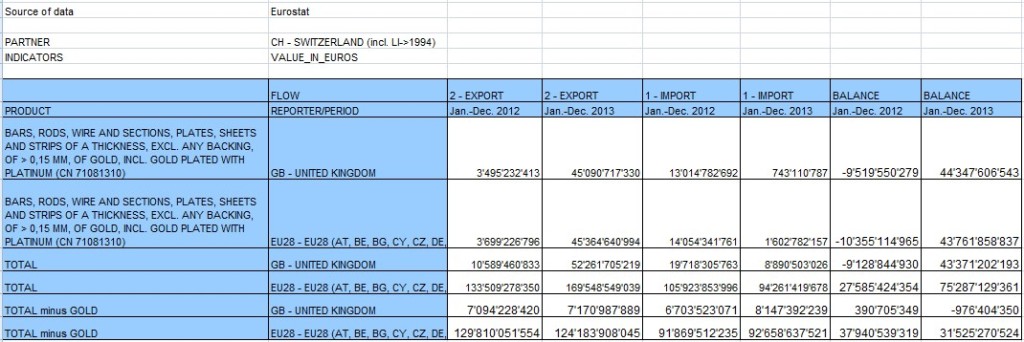

Official Eurostat Trade Balance Massively Distorted by UK Sales Of 1464 Tonnes of Gold To Switzerland

In 2013, private investors from the UK sold net (!) 1464 tons of physical gold (and similar) for a value 44.3 billion EUR. This was 1 464 000 kilograms each at the current price of 30254€ per kilo

Read More »

Read More »

SNB Q1/2014 Results: 1.7% annualized Yield on Seigniorage, 2% annualized Loss on FX Rate Change

The main task of a central bank occupied with QEE (quantitative easing or exchange intervention) is to obtain higher gains on seigniorage than it loses with its "ever appreciating" currency. Otherwise its equity capital would be absorbed.

Read More »

Read More »

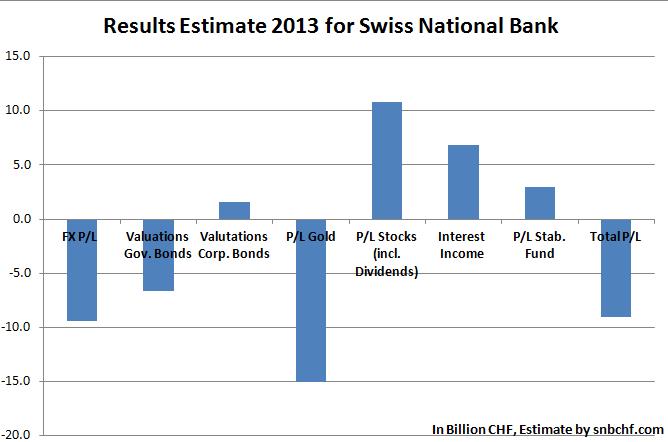

15 Billion SNB Losses on Gold in 2013, But 40 Billion SNB Profit on Gold between 2000 and 2012

For anybody complaining about gold that caused the big loss of the Swiss National Bank. Since 2000, the total SNB profit was 32.1 bln. CHF, of which 24.6 billion came from gold.

Read More »

Read More »

The Fed Will Remain Gold’s Strongest Supporter For Years

In the early 1980s the Fed stopped the wage-price spiral and destroyed the gold price. Today main-stream economists have discovered that rising company profits compared to stagnating wages could an issue for the U.S. economy. For us this implies that the ultimate Fed goal will be to increase wages and inflation. Consequently the Fed has become the biggest supporter of gold and silver prices.

Read More »

Read More »

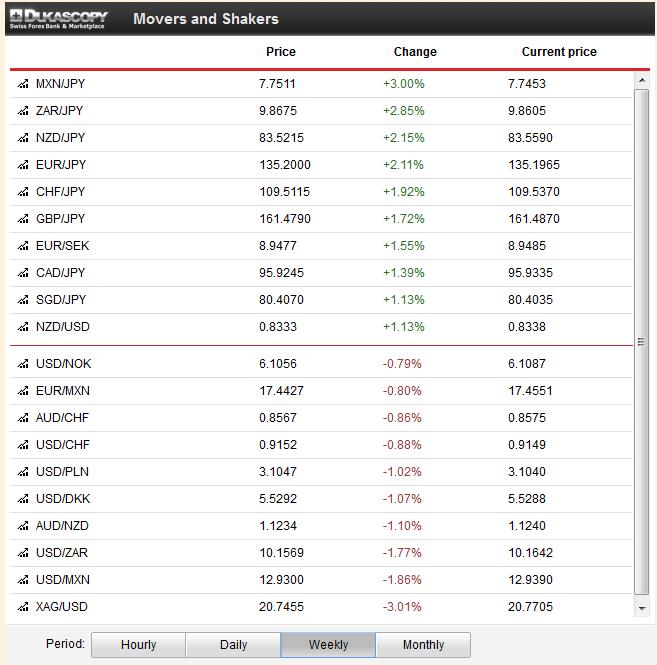

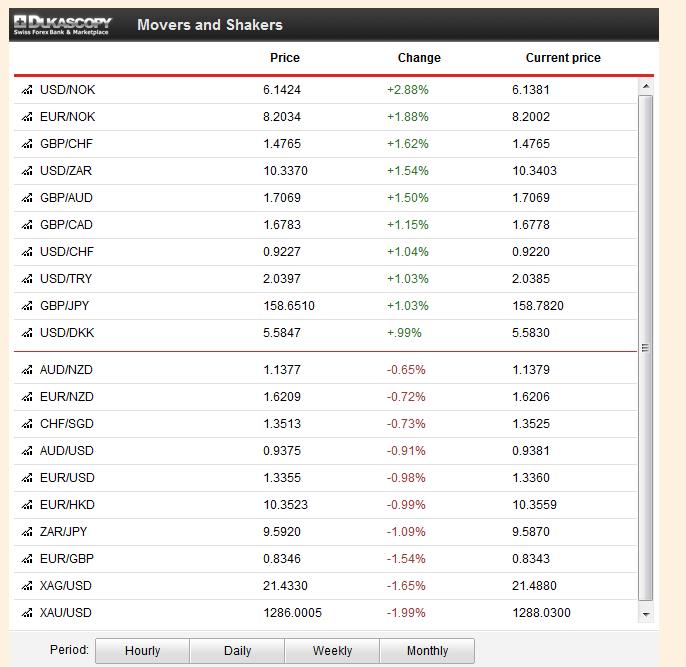

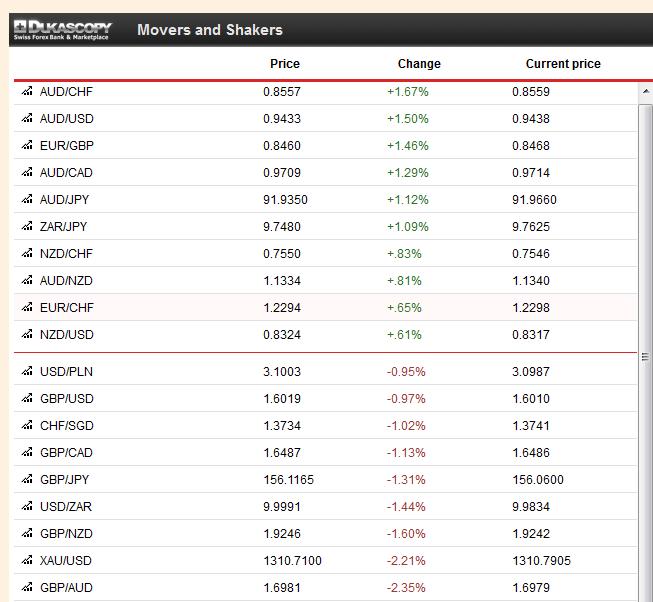

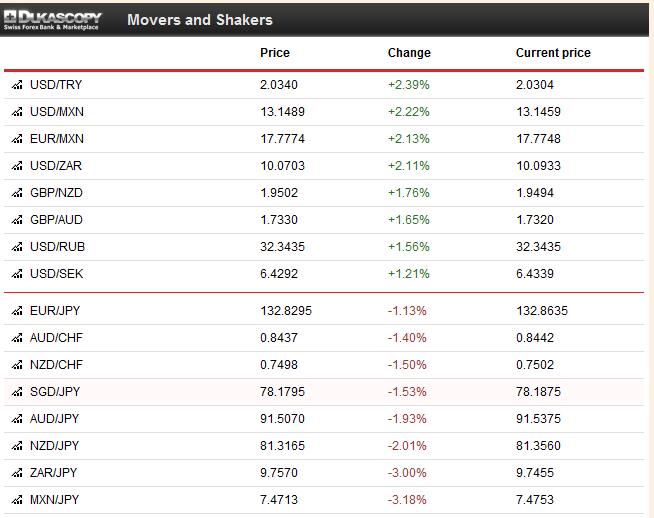

Fundamentals,FX,Gold and CHF:Week November 18 to November 22

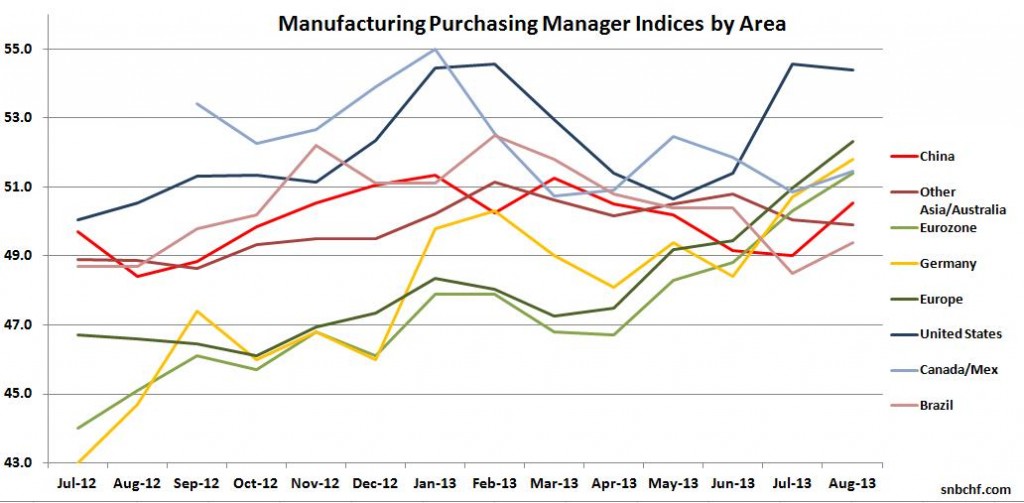

Fundamentals with highest importance: The HSBC Flash Purchasing Manager Index (PMI) for China weakened from 50.8 to 50.4. In particular, new export orders, output prices and employment started to decrease again, while output increased. The preliminary Markit manufacturing PMI for the United States edged up to 54.3 (vs. 52.3 expected), a 9-month high after the …

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 11 to November 15

Fundamentals with highest importance: In Janet Yellen’s hearing at the Senate Banking Commission, the future Fed chair emphasized the need to provide support to the economic recovery and to overcome low inflation. Her speech supported equities, gold and US Treasuries. GDP in the Euro zone rose by 0.1% QoQ in line with expectations, but less …

Read More »

Read More »

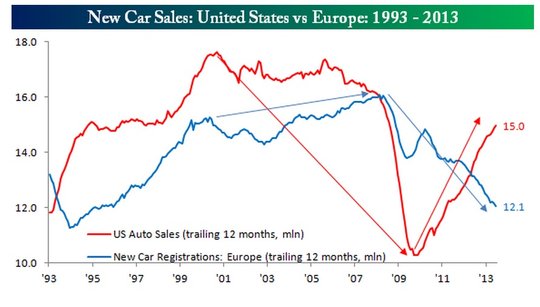

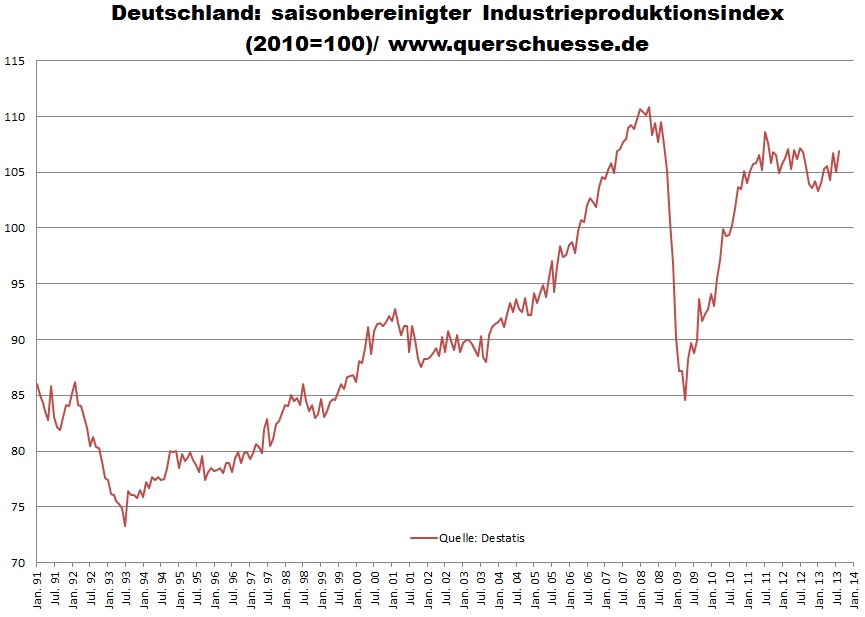

Fundamentals,FX,Gold and CHF: Week November 4 to November 8

Fundamentals with highest importance: The U.S. GDP release for Q3, showed that despite the recent U.S. critique with Germany, the Americans are trying to follow the successful Germans: for the first time since Q1/2012 and Q2/2011 exports rose more than imports. GDP was up 2.8%, but not driven by consumption, it was mostly helped by …

Read More »

Read More »

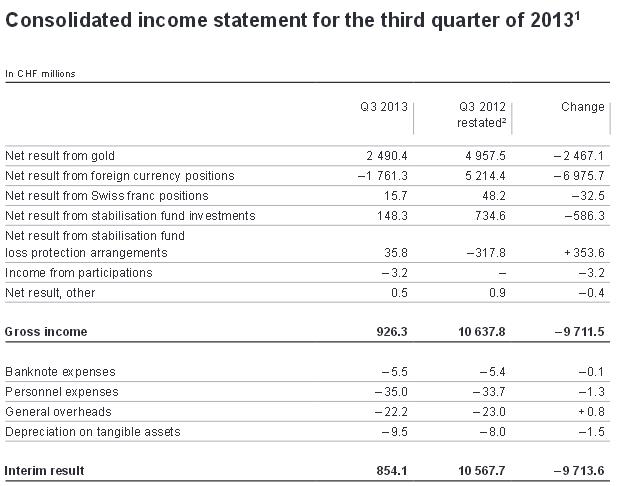

In Which Positions Does the SNB Win and Where Does it Lose Money: Details on the Q3 Results

UPDATE October 31, The official press release focused on the results for Q1 to Q3. The loss was 6.4 billion after a 7.3 bln. CHF loss in the first two quarters. Over all three quarters especially gold and the yen weakened the central bank’s positions. For the third quarter, it means that income was positive … Continue reading »

Read More »

Read More »

Fundamentals, FX, Gold and CHF: Week October 21 to 25

Major Fundamental Events The week contained a lot of important fundamental events, in particular Non-Farm Payrolls and preliminary “flash” PMI readings. Highest importance for FX rates Non-Farm Payrolls (NFPs) weakened to 148K, private NFPs to 126K, both against 180K expected. Especially the private NFPs were disappointing. The decrease in the unemployment rate from 7.3% …

Read More »

Read More »

Week October 14 to 18, A Close Look at China’s Fundamental Data

Weekly Overview of FX Rates Movements The week was driven by the following factors: Solid Chinese economic data including a 7.8% rise in GDP. The end of the debt ceiling debate, at least for now. The expectation by the Fed member Evans that the government shutdown has delayed Fed tapering. San Francisco Fed’s Williams …

Read More »

Read More »

Fundamentals, Gold and FX Movements, Week October 7 to Oct. 12

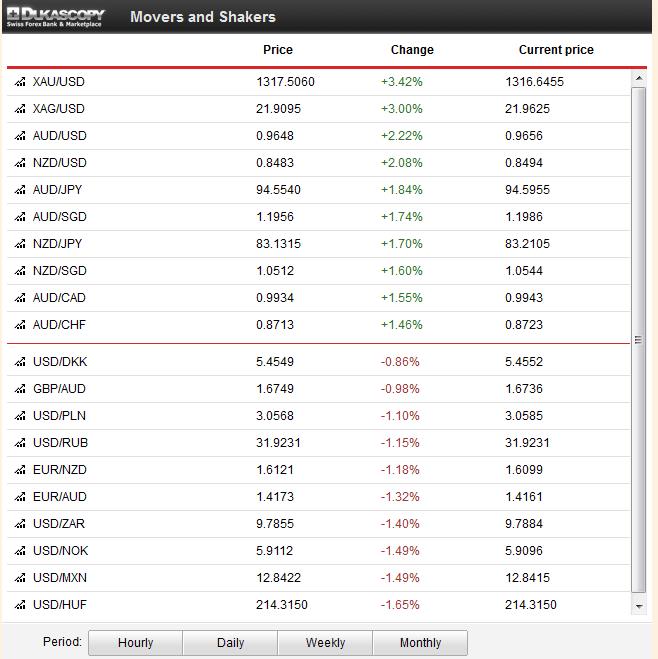

Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) . Weekly Overview Hopes on a compromise between Obama and republicans on the U.S. debt ceiling and high U.S. initial unemployment claims sustained …

Read More »

Read More »

Fundamentals, Gold and FX Movements, Week September 30 to October 4

Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) . The clear winner of the week was the Aussie, supported by a positive PMI and positive news from the RBA. In the previous …

Read More »

Read More »

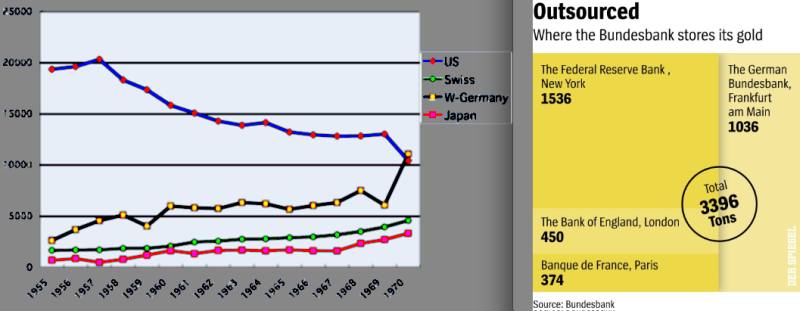

The Collapse of the Bretton Woods System, the German Current Account and Gold Reserves

German, Swiss and Japanese gold reserves rose continously in the Bretton Woods system, whereas American and British reserves fell.

Read More »

Read More »

Fundamentals and FX Movements, Week September 23 to September 27

Weekly summary of fundamental news on FX with a focus on CHF and gold price movements. Weekly price movements The U.S. budget discussion and rather bad U.S. fundamental data made JPY and CHF the winners of the week. After weeks of improvements, the currencies of the Emerging Markets and carry trade currencies, like NZD, AUD …

Read More »

Read More »

Fundamentals and FX Movements, Week September 16 to September 20

Weekly summary of fundamental news with a focus on CHF and gold price movements. Friday, September 20:The St. Louis Fed president James Bullard explained that the Fed was close to tapering 10 bln. $ and that markets overreacted after the FOMC with their strong performance. As a consequence the S&P500 inched down by 0.6% while …

Read More »

Read More »

Fundamentals and FX Movements, Week September 9 to Sept. 13

The weekly summary of global fundamental news with focus on CHF and gold price movements. Friday, September 13:The leading news came from U.S. retail sales and the Michigan consumer sentiment. Retail sales were up +0.2% instead of 0.5% expected, sales excluding autos and gas +0.1% (vs +0.3% exp.) The Michigan consumer sentiment disappointed at 76.8 …

Read More »

Read More »

Our Detailed Estimate of SNB Q2 Results: 17 Billion Francs Loss, The Reality 18 Billion

UPDATE: July 30th, 2013: Our estimate for the quarterly loss missed the reality by 1 billion francs. The quarter results: 18.3 billion francs loss. The loss for H1 was 7.3 billion CHF. July 1st 2013: We estimate that the Swiss National Bank (SNB) obtained a loss of 17.3 billion francs in the second quarter 2013. … Continue reading »

Read More »

Read More »