Tag Archive: gold price

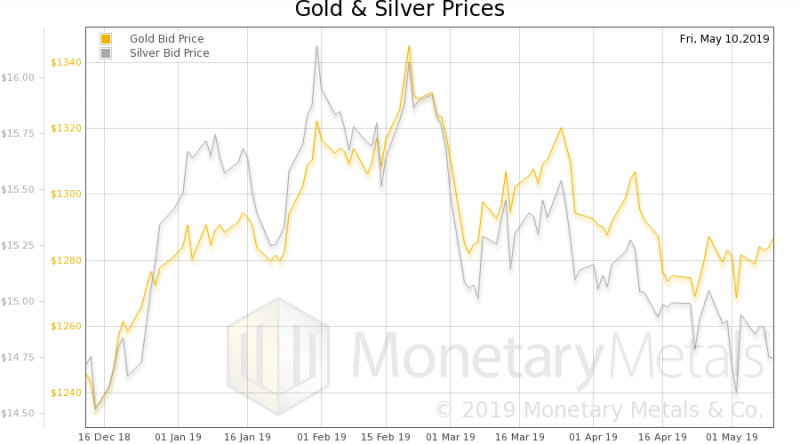

The Monetary Cause of Lower Prices, Report 12 May

We have deviated, these past several weeks, from matters monetary. We have written a lot about a nonmonetary driver of higher prices—mandatory useless ingredients. The government forces businesses to put ingredients into their products that consumers don’t know about, and don’t want. These useless ingredients, such as ADA-compliant bathrooms and supply chain tracking, add a lot to the price of every good.

Read More »

Read More »

Nonmonetary Cause of Lower Prices, Report 5 May

Over the past several weeks, we have debunked the idea that purchasing power—i.e. what a dollar can buy—is intrinsic to the currency itself. We have discussed a large non-monetary force that drives up prices. Governments at every level force producers to add useless ingredients, via regulation, taxation, labor law, environmentalism, etc.

Read More »

Read More »

Is Keith Weiner an Iconoclast? Report 28 Apr

We have a postscript to our ongoing discussion of inflation. A reader pointed out that Levis 501 jeans are $39.19 on Amazon (in Keith’s size—Amazon advertises prices as low as $16.31, which we assume is for either a very small size that uses less fabric, or an odd size that isn’t selling). Think of the enormity of this. The jeans were $50 in 1983. After 36 years of relentless inflation (or hot air about inflation), the price is down to $39.31. Down...

Read More »

Read More »

The Two Faces of Inflation, Report 22 Apr

We have a postscript to last week’s article. We said that rising prices today are not due to the dollar going down. It’s not that the dollar buys less. It’s that producers are forced to include more and more ingredients, which are not only useless to the consumer. But even invisible to the consumer. For example, dairy producers must provide ADA-compliant bathrooms to their employees.

Read More »

Read More »

New Inflation Indicator, Report 14 Apr

Last week, we wrote that regulations, taxes, environmental compliance, and fear of lawsuits forces companies to put useless ingredients into their products. We said: “For example, milk comes from the ingredients of: land, cows, ranch labor, dairy labor, dairy capital equipment, distribution labor, distribution capital, and consumable containers.”

Read More »

Read More »

What Causes Loss of Purchasing Power, Report 7 Apr

We have written much about the notion of inflation. We don’t want to rehash our many previous points, but to look at the idea of purchasing power from a new angle. Purchasing power is assumed to be intrinsic to the currency. We have said that the problem with the word inflation is that it treats two different phenomena as if they are the same.

Read More »

Read More »

Will Basel III Send Gold to the Moon, Report 2 Apr

A number of commentators have predicted that the rules of the Basel III bank regulations will cause gold to skyrocket (no, this article is not about our view that gold does not go up, that it’s the dollar going down, that the lighthouse does not go up, it’s the sinking ship going down in the storm).

Read More »

Read More »

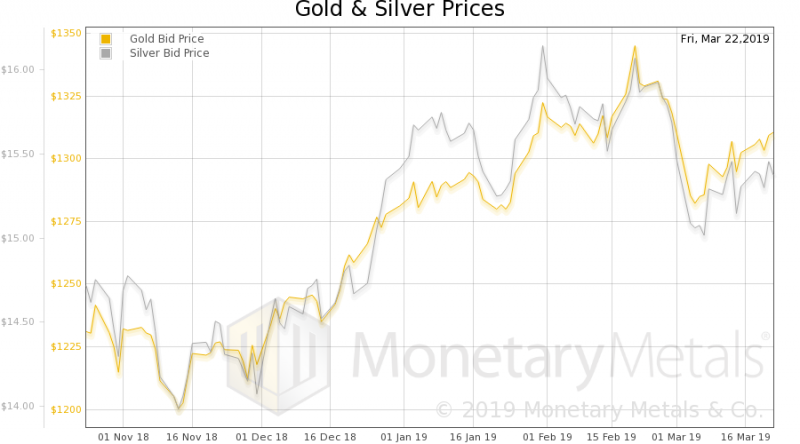

On Board Keynes Express to Ruin, Report 24 Mar

Last week, I ranted about the problem with our monetary system and trajectory: falling interest rates is Keynes’ evil genius plan to destroy civilization. This week, I continue the theme—if in a more measured tone—addressing the ideas predominant among the groups who are most likely to fight against Keynes’ destructionism.

Read More »

Read More »

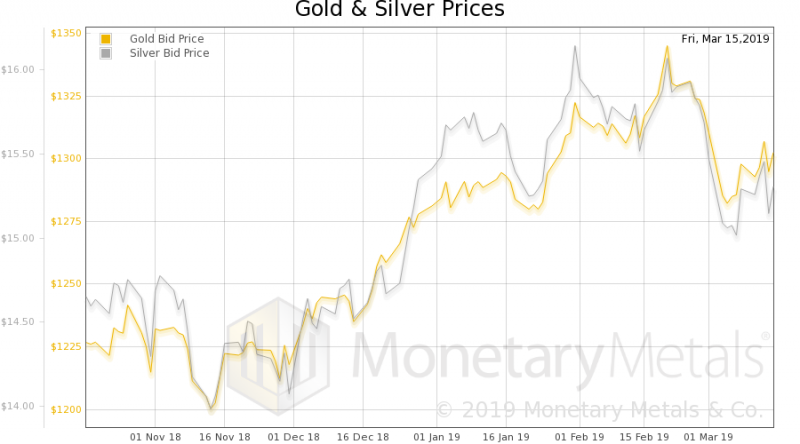

Keynes Was a Vicious Bastard, Report 17 Mar

My goal is to make you mad. Not at me (though I expect to ruffle a few feathers with this one). At the evil being wrought in the name of fighting inflation and maximizing employment. And at the aggressive indifference to this evil, exhibited by the capitalists, the gold bugs, and the otherwise-free-marketers.

Read More »

Read More »

The Duality of Money, Report 10 Mar

This is a pair of photographs taken by Keith Weiner, for a high school project. It seemed a fitting picture for the dual nature of money, the dual nature of wood both as logs to be consumed and dimensional lumber to be used to construct buildings.

Read More »

Read More »

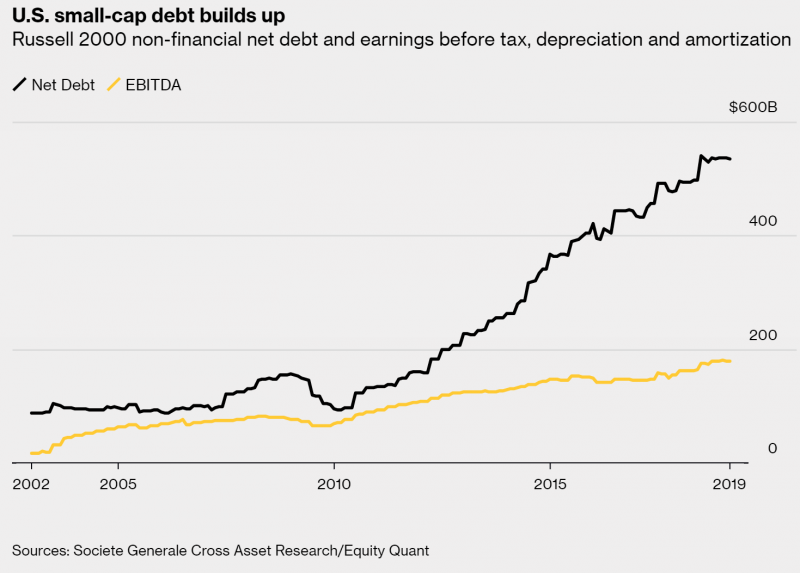

Is Capital Creation Beating Capital Consumption? Report 3 Mar

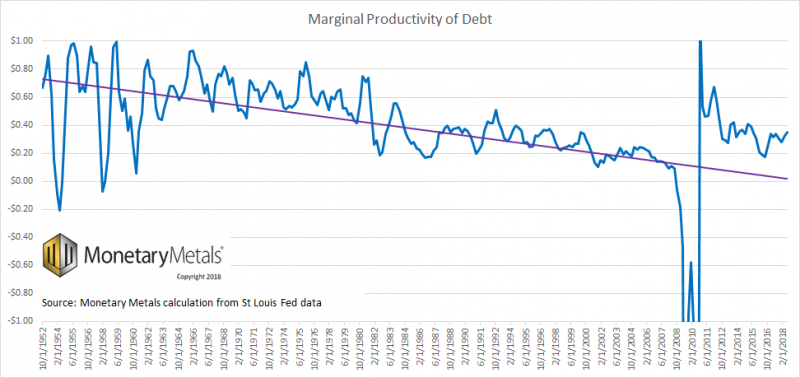

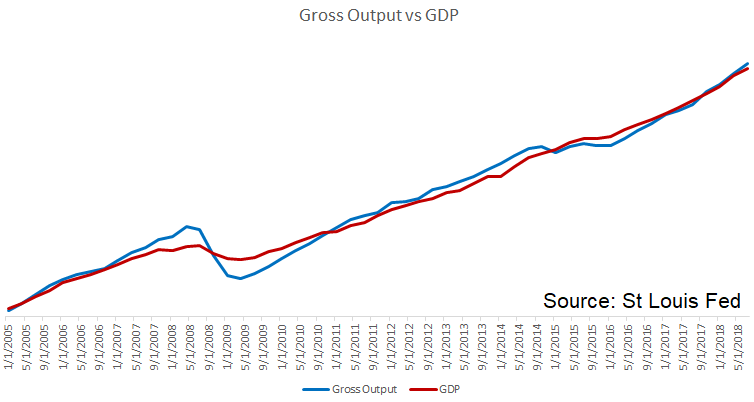

We have written numerous articles about capital consumption. Our monetary system has a falling interest rate, which causes both capital churn and conversion of one party’s wealth into another’s income. It also has too-low interest, which encourages borrowing to consume (which, as everyone knows, adds to Gross Domestic Product—GDP).

Read More »

Read More »

Is Lending the Root of All Evil? Report 24 Feb

Ayn Rand famously defended money. In Atlas Shrugged, Francisco D’Anconia says: “So you think that money is the root of all evil? . . . Have you ever asked what is the root of money? Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them.

Read More »

Read More »

Central Planning Is More than Just Friction, Report 17 February

It is easy to think of government interference into the economy like a kind of friction. If producers and traders were fully free, then they could improve our quality of life—with new technologies, better products, and lower prices—at a rate of X. But the more that the government does, the more it burdens them. So instead of X rate of progress, we get the same end result but 10% slower or 20% slower.

Read More »

Read More »

What They Don’t Want You to Know about Prices, Report 10 Feb

Last week, in part I of this essay, we discussed why a central planner cannot know the right interest rate. Central planner’s macroeconomic aggregate measures like GDP are blind to the problem of capital consumption, including especially capital consumption caused by the central plan itself.

Read More »

Read More »

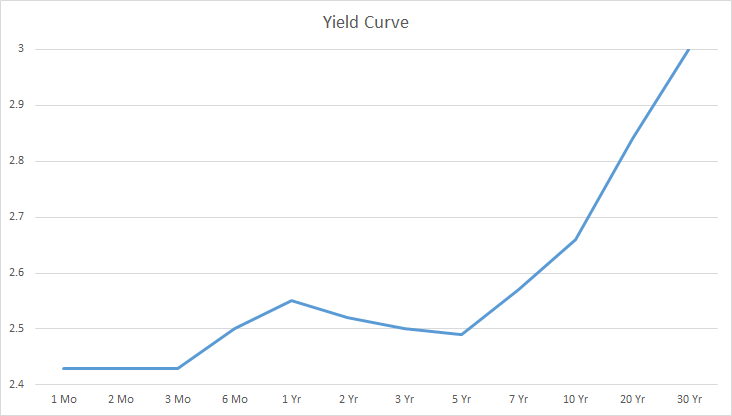

Who Knows the Right Interest Rate, Report 3 Feb 2019

On January 6, we wrote the Surest Way to Overthrow Capitalism. We said: “In a future article, we will expand on why these two statements are true principles: (1) there is no way a central planner could set the right rate, even if he knew and (2) only a free market can know the right rate.” Today’s article is part I that promised article.

Read More »

Read More »

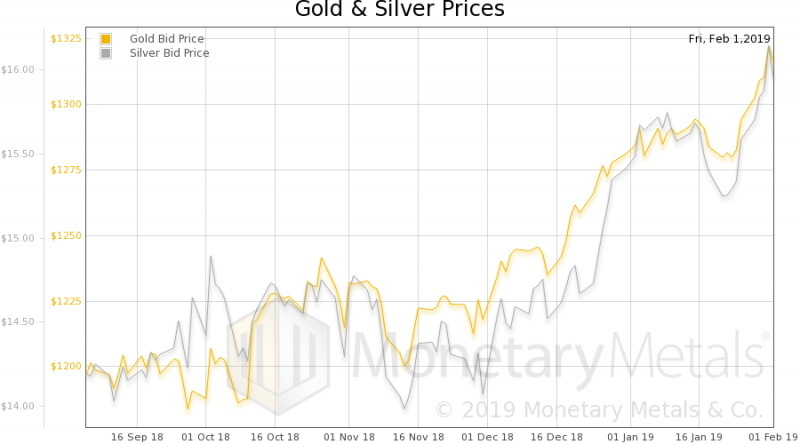

Buy Bitcoin or Gold? Bitcoin Buyers Investing In Gold In 2019

Buy bitcoin or gold? Bitcoin buyers are investing in gold in 2019. Poll of 4,000 bitcoin buyers shows their No 1 investment in 2019 is gold. “Gold lost to bitcoin and now it’s going the other way…” says ETF strategist.

“Gold is a store of value and there’s no disputing that…”

Read More »

Read More »

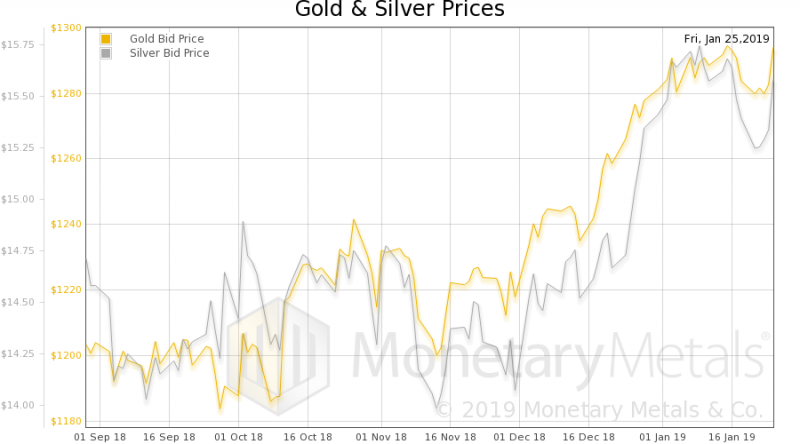

Gold Consolidates Above $1,300 After 1.2 percent Gain Last Week

Gold futures settled above $1,300 an ounce on Friday, with prices for the yellow metal at their highest since June as the U.S. dollar pulled back and investors eyed geopolitical turmoil and global growth worries. Rising gold prices reflect “political uncertainty” in the U.S., Eurozone, Venezuela and pockets of South America, as well as China-U.S. trade talks, said George Gero, managing director in RBC.

Read More »

Read More »

Modern Monetary Theory: A Cargo Cult, Report 20 Jan 2019

Newly elected Representative Alexandria Ocasio-Cortez recently said that Modern Monetary Theory (MMT) absolutely needed to be “a larger part of our conversation.” Her comment shines a spotlight on MMT. So what is it? According to Wikipedia, it is: “a macroeconomic theory that describes the currency as a public monopoly and unemployment as the evidence that a currency monopolist is restricting the supply of the financial assets needed to pay taxes...

Read More »

Read More »

The Dollar Works Just Fine, Report 20 Jan 2019

Last week, we joked that we don’t challenge beliefs. Here’s one that we want to challenge today: the dollar doesn’t work as a currency, because it’s losing value. Even the dollar’s proponents, admit it loses value. The Fed itself states that its mandate is price stability—which it admits means relentless two percent annual debasement (Orwell would be proud).

Read More »

Read More »

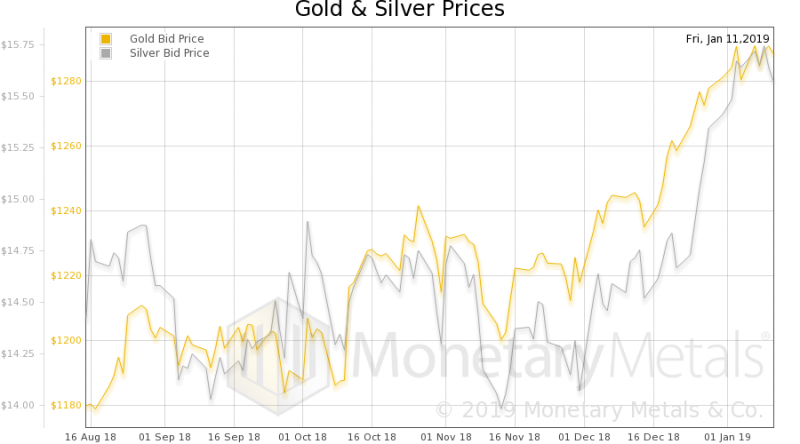

Rising Interest and Prices, Report 13 Jan 2019

For years, people blamed the global financial crisis on greed. Doesn’t this make you want to scream out, “what, were people not greedy in 2007 or 1997??” Greed utterly fails to explain the phenomenon. It merely serves to reinforce a previously-held belief.

Read More »

Read More »

Receive a Daily Mail from this Blog

Live Currency Cross Rates

On Swiss National Bank

On Swiss National Bank

-

SNB’s Chairman Schlegel: A few months of negative inflation wouldn’t be a problem

14 days ago -

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

2025-07-31 – Interim results of the Swiss National Bank as at 30 June 2025

2025-07-31 -

SNB Brings Back Zero Percent Interest Rates

2025-06-26 -

Hold-up sur l’eau potable (2/2) : la supercherie de « l’hydrogène vert ». Par Vincent Held

2025-06-24

Main SNB Background Info

Main SNB Background Info

-

SNB Sight Deposits: decreased by 3.6 billion francs compared to the previous week

2025-12-17 -

The Secret History Of The Banking Crisis

2017-08-14 -

SNB Balance Sheet Now Over 100 percent GDP

2016-08-29 -

The relationship between CHF and gold

2016-07-23 -

CHF Price Movements: Correlations between CHF and the German Economy

2016-07-22

Featured and recent

-

Ruhestand ist dein Ende

Ruhestand ist dein Ende -

Kilo Koala Silver Coin: Unbelievable Size (Watch This Coin!)

Kilo Koala Silver Coin: Unbelievable Size (Watch This Coin!) -

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa

Der wahre Grund? #politik #krieg #deutschland #europa #wirtschaft #russland #ukraine #putin #usa -

Warum Lebensverlängerung nicht das eigentliche Problem löst.

Warum Lebensverlängerung nicht das eigentliche Problem löst. -

Strategie-Fehler korrigieren: So überlebt dein Portfolio jede Krise

Strategie-Fehler korrigieren: So überlebt dein Portfolio jede Krise -

Silber & Gold: Kommen jetzt neue Rekorde?

Silber & Gold: Kommen jetzt neue Rekorde? -

Private Credit Funds Falling Out Of Favor

Private Credit Funds Falling Out Of Favor -

Wichtige Morning News mit Oliver Klemm #537

Wichtige Morning News mit Oliver Klemm #537 -

Quartalszahlen Crash – United Health Aktie 22% im Minus!

Quartalszahlen Crash – United Health Aktie 22% im Minus! -

Covid ist nicht vorbei – die Folgen bleiben

Covid ist nicht vorbei – die Folgen bleiben

More from this category

What Problem Does Gold Solve?

What Problem Does Gold Solve?14 Sep 2022

The Russian Gold Standard

The Russian Gold Standard28 Aug 2022

Why we couldn’t be happier that gold is boring

Why we couldn’t be happier that gold is boring23 Aug 2022

More energy blows are dealt to Europe, causing a cold chill to be even colder

More energy blows are dealt to Europe, causing a cold chill to be even colder13 Aug 2022

A muddled message from The Fed

A muddled message from The Fed29 Jul 2022

When Rock begins to beat Paper

When Rock begins to beat Paper24 Jul 2022

Gold traders on trial: Only buy physical

Gold traders on trial: Only buy physical15 Jul 2022

Is Gold Starting to Behave Itself?

Is Gold Starting to Behave Itself?14 May 2022

The ‘Friend- Shoring’ of Gold- A New World Order?

The ‘Friend- Shoring’ of Gold- A New World Order?24 Apr 2022

Is The Ruble Backed By Gold Now?

Is The Ruble Backed By Gold Now?16 Apr 2022

Gold Price Today – Gareth Soloway

Gold Price Today – Gareth Soloway24 Mar 2022

Gold Gives You Personal Sovereignty

Gold Gives You Personal Sovereignty9 Mar 2022

SWIFT Ban: A Game Changer for Russia?

SWIFT Ban: A Game Changer for Russia?4 Mar 2022

The ‘Fed Put’ – Gone Until There’s Blood in the Streets

The ‘Fed Put’ – Gone Until There’s Blood in the Streets30 Jan 2022

European Energy Crisis: 4 Things You MUST Know!

European Energy Crisis: 4 Things You MUST Know!23 Jan 2022

Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes

Gold Price News: Gold Down 1% in Wake of More Hawkish Federal Reserve Meeting Minutes9 Jan 2022

Why Governments Hate Gold

Why Governments Hate Gold27 Nov 2021

Gold is Boring – That’s Why You Should Own It!

Gold is Boring – That’s Why You Should Own It!4 Nov 2021

Gold Leads the Way for Silver

Gold Leads the Way for Silver10 Sep 2021

The Changing Role of Gold

The Changing Role of Gold20 Aug 2021