Tag Archive: Germany Industrial Production

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

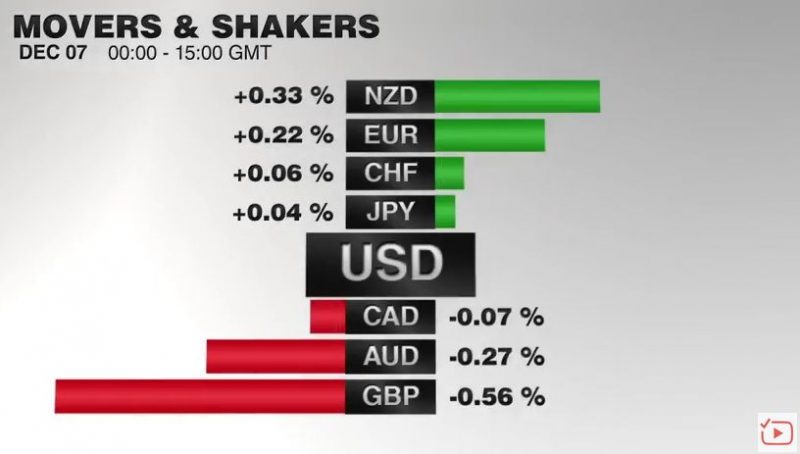

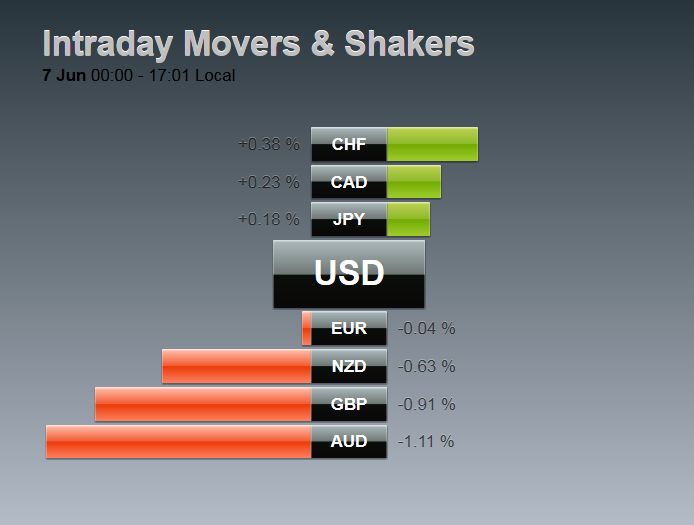

FX Daily, December 07: Greenback is Broadly Steady While Sterling Slides

The US dollar is little changed against most of the major currencies. Sterling is the notable exception, losing about 0.75% to trade at three-day lows. It was on the defensive in early European turnover but got the run pulled from beneath by the unexpectedly poor data. UK industrial output fell by 1.3% in October. The median forecast was for a small increase.

Read More »

Read More »

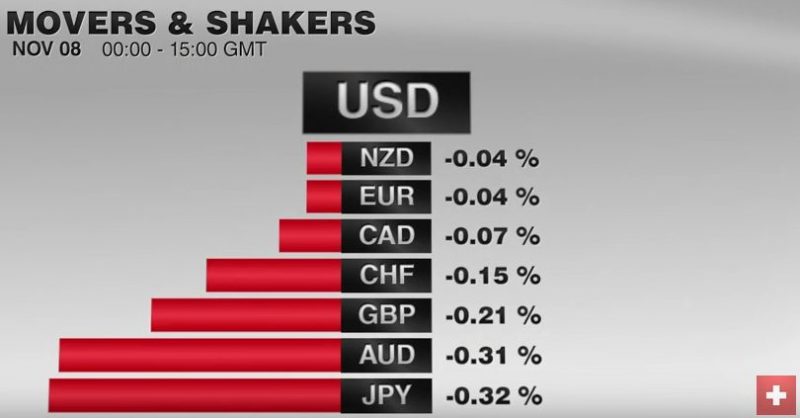

FX Daily, November 08: Consolidation Featured as Market Catches and Holds Breath

The equity markets snapped their losing streak yesterday and are consolidating today. The US dollar is narrowly mixed. The euro and sterling are slightly firmer, but well within yesterday's ranges. The dollar-bloc is a bit lower, and once again the Australian dollar is struggling to sustain moves above $0.7700.

Read More »

Read More »

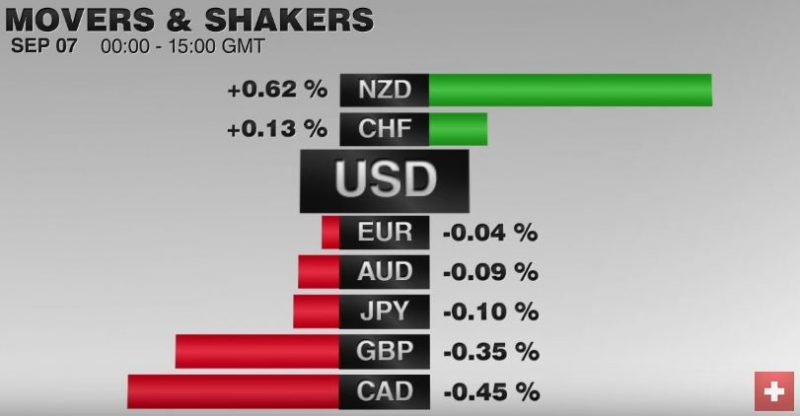

FX Daily, September 07: Dollar Stabilizes, but Hardly Recovers

Disappointing industrial output figures from Germany and UK are helping stabilize the US dollar after yesterday's shellacking. Investors have been fickle about the prospects for a rate hike this month, and the unexpected dramatic slide in the service spurred a downgrading of such expectations, and a flight out of the dollar. It was not simply a quest for yields, though that was part of it. Surely the yen and euro's strength is not a function of...

Read More »

Read More »

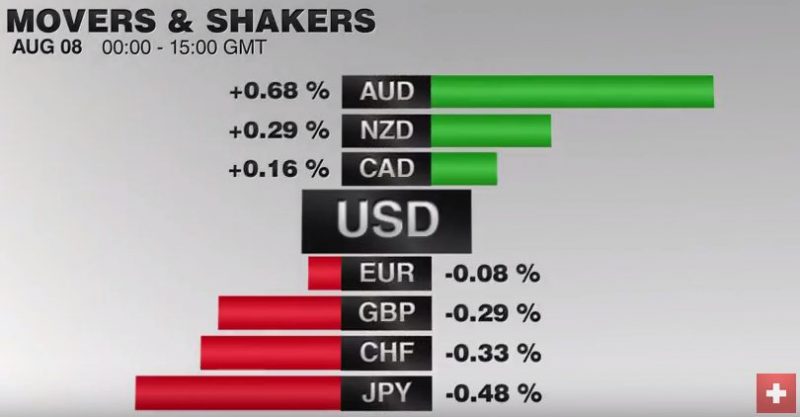

FX Daily, August 08: Stocks Up, Bonds Down, Dollar and Yen are Heavy

Investors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia.

Read More »

Read More »

FX Daily, July 07: Sterling Bounces Two Cents, but Does not Appear Sustainable

Amid a better if not strong risk appetite, sterling has rallied two cents from yesterday's lows near $1.28 to poke through the $1.30 level in the European morning. It was helped by an industrial production report that was better than expected. Industrial and manufacturing output fell 0.5% in May. This was around half of the expected decline after a strong April advance (2.1% and 2.4% respectively).

Read More »

Read More »

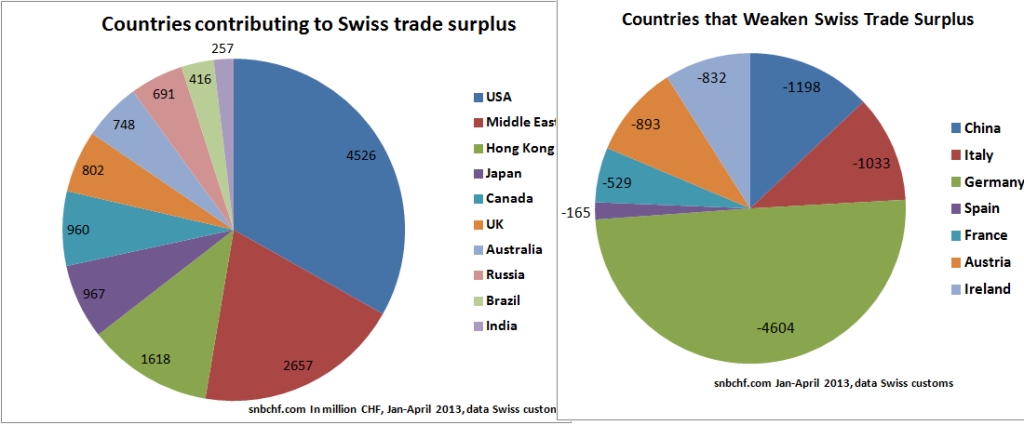

Fundamentals, Gold and FX Movements, Week October 7 to Oct. 12

Our weekly summary of fundamental news on FX that aims to explains price movements, with particular emphasis on the possibly biggest mysteries: the gold price (GLD) and the Swiss franc (FXF) . Weekly Overview Hopes on a compromise between Obama and republicans on the U.S. debt ceiling and high U.S. initial unemployment claims sustained …

Read More »

Read More »

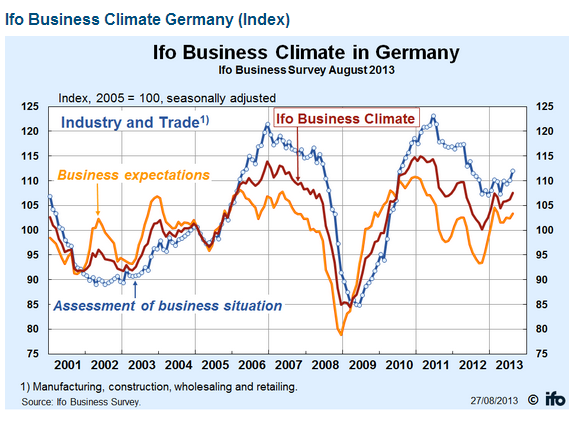

Fundamentals and FX Movements, Week September 9 to Sept. 13

The weekly summary of global fundamental news with focus on CHF and gold price movements. Friday, September 13:The leading news came from U.S. retail sales and the Michigan consumer sentiment. Retail sales were up +0.2% instead of 0.5% expected, sales excluding autos and gas +0.1% (vs +0.3% exp.) The Michigan consumer sentiment disappointed at 76.8 …

Read More »

Read More »

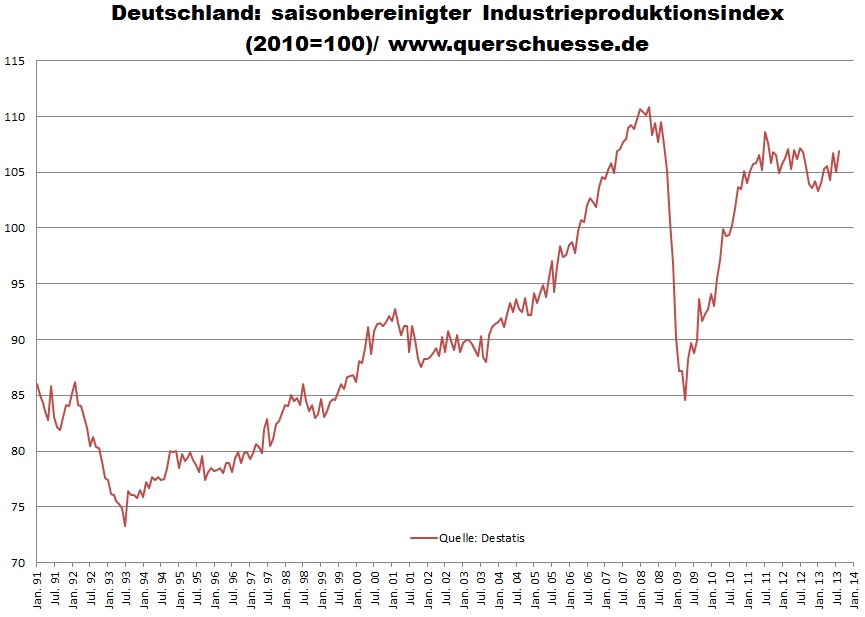

Swiss industrial production unimpressed by global slowing

Swiss industrial production rose by 3% in the first quarter 2013 compared with the same quarter of the previous year. Turnover rose by 3.7%. Details

Read More »

Read More »

Recent History of the Swiss franc: January to February 2009

Swissy Sees Some Slight Improvement Swissy is seeing some slight improvement in afternoon trade, the EUR/CHF cross presently down at 1.4900 from the 1.4990 session high posted earlier. The general flight to perceived safety, with gold fast approaching $1,000, will be playing a part with swissy’s safe haven premium coming into play. However how …

Read More »

Read More »