Tag Archive: Germany Current Assessment

The German Current Assessment rates current business conditions in Germany, without considering future expectations. It is a sub-index of the German Ifo Business Climate Index.

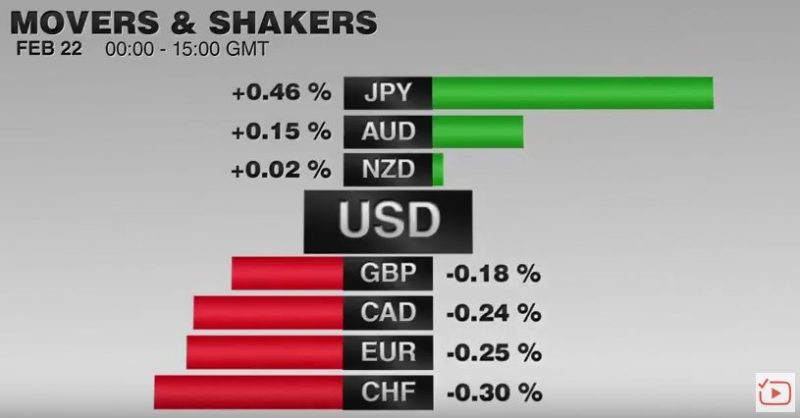

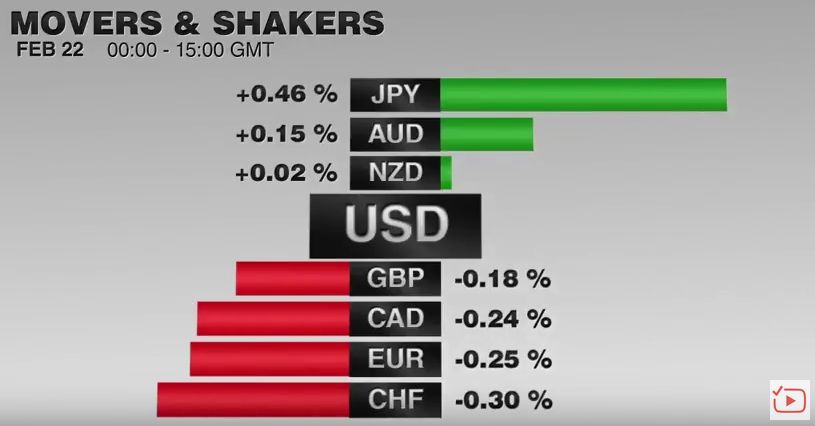

FX Daily, February 22: All Eyes on Equities

The dramatic reversal of US shares yesterday in the last hour of trading has once again pulled the proverbial rug beneath the feet of investors. The turn down, moreover, occurred near important technical levels, seemingly adding to the significance. Global equities have followed suit.

Read More »

Read More »

FX Daily, January 25: And Now, a Word from Draghi

With a backdrop of concern about US protectionism and a possible abandonment of the 23-year old strong dollar policy, and among the weakest sentiment toward the dollar in at least a decade, the ECB takes center stage. What a turn of events for Mr. Draghi, the President of the European Central Bank.

Read More »

Read More »

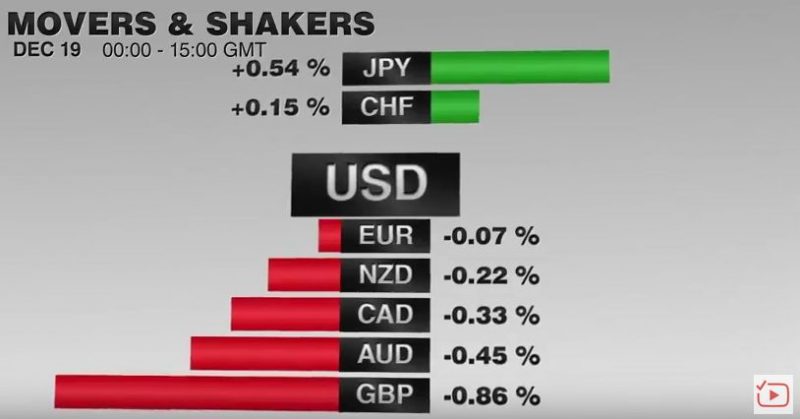

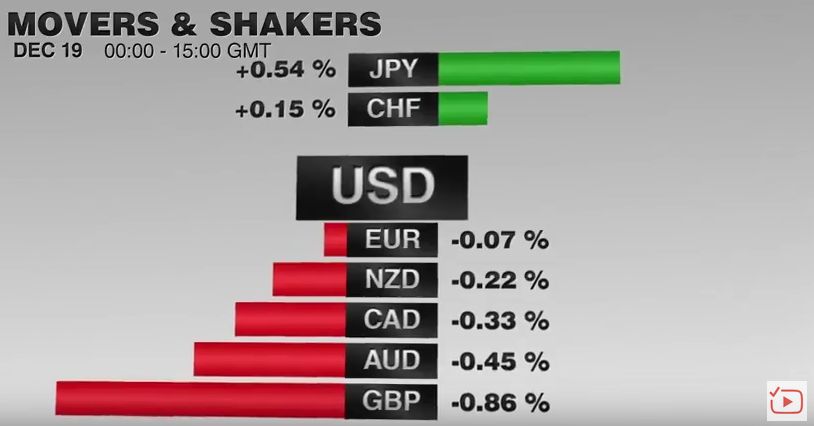

FX Daily, December 19: US Equities Set Pace, While Greenback Consolidates Inside Monday’s Ranges

US tax changes appear to be providing fuel for the year-end advance that has carried the major indices to new record highs. The coattails are a bit short, and while global equity markets are firm, they are unable to match the strength of US. Despite a heavier tone in Japan, Taiwan, and Korea, the MSCI Asia Pacific Index edged higher for the second session but remains around one percent below the record highs set in late November.

Read More »

Read More »

FX Daily Rates, November 24: Euro Continues to Push Higher

The euro is edging higher to trade at its best levels since the middle of last month. It is drawing closer to the $1.1880 area, which if overcome, could point to return to the year's high seen in early September near $1.2100. There is a combination of factors lifting the euro. The recent data, including yesterday's flash PMI, suggests that the regional economy is re-accelerating here in Q4.

Read More »

Read More »

FX Daily, October 25: Sterling and Aussie Interrupt the Waiting Game

Most participants seemed comfortable marking time ahead of tomorrow's ECB meeting, and an announcement President Trump's nominations to the Federal Reserve. However, softer than expected Australian Q3 CPI and a stronger than expected UK Q3 GDP injected fresh incentives. Australia reported headline CPI rose 0.6% in Q3.

Read More »

Read More »

FX Daily, September 25: Euro and Kiwi Dragged Lower

The end of the Grand Coalition in Germany and the need for a coalition in New Zealand are weighing on the respective currencies. The euro was marked down in Asia and briefly dipped below $1.19 before recovering to $1.1940 by the middle of the Asian session. It was sold to new lows in the European morning after the weaker than expected IFO survey. Today's survey stands in contrast to the recent PMI and ZEW survey and matches the mood of the market....

Read More »

Read More »

FX Daily, August 25: Is the Janet and Mario Show a New Episode or Rerun?

The event that investors have been waiting for and the media frequently linked to whatever price action has taken place has arrived: Yellen and Draghi's speeches later today. Yellen is first. She will speak at 10:00 am ET. This is toward the end of the European trading week. Draghi speaks late in the North American session--3:00 pm ET.

Read More »

Read More »

FX Daily, July 25: Summer Markets Ahead of FOMC

The global capital markets are subdued today; a dearth of fresh news and tomorrow's FOMC meeting are making for light activity and limited price movement. The US dollar is little changed against most of the major currencies. The net change on the day through most of the European morning is +/- 0.15%. The exception is the Norwegian krone and Swedish krona, which is about 0.25% stronger.

Read More »

Read More »

FX Daily, June 26: Italian Markets Shrug off Banking Morass and Local Election Results

The US dollar is mostly slightly firmer as North American dealers return to their posts. Ideas that the UK Tories are getting close to a deal with the DUP appears to be lending sterling a modicum of support, as it tries to extend its uptrend into a fourth session. The Japanese yen is the weakest of the majors, rising equities, and yields, spurs the dollar to re-challenge last week's high near JPY111.80.

Read More »

Read More »

FX Daily, May 23: Greenback Remains Soft

The US dollar cannot get out of its own way, it seems. With a light economic schedule, there is little to offset the continued drumbeat of troubling political developments. The latest turn, as reported first in the Washington Post, that President Trump asked heads of intelligence groups to also publicly deny collusion with Russia.

Read More »

Read More »

FX Daily, April 24: Dramatic Response to French Election

The results of the first round of the French election spurred a dramatic response in the capital markets. Our thesis that there is no populist-nationalist wave sweeping the world is supported by the previous results in Austria, the Netherlands, and now France.

Read More »

Read More »

FX Daily, February 22: Euro Meltdown Continues

February has been cruel to the euro. Of the sixteen sessions this month, counting today, the euro has risen in four, and two of those were last week. Its new four-day slide pushed it below $1.05 for the first time in six weeks as European markets were opening. The $1.0560 area that was broken yesterday, and provided a cap today is 61.8% retracement objective of last month's rally.

Read More »

Read More »

FX Daily, January 25: Dollar is on the Defensive Despite Firmer Rates

The US dollar is softer against nearly all the major currencies. Participants appear to be growing increasingly frustrated with emerging priorities of the new US Administration. They want to hear more details and discussion of the tax reform, deregulation, and infrastructure plans.

Read More »

Read More »

FX Daily, December 19: EUR/CHF Dives under 1.07

Once again a line in sand for the Swiss National Bank is broken. The EUR/CHF falls under 1.07. But trading algorithms are like this: When the EUR/USD is falling, then the EUR/CHF must follow. The SNB decided not to intervene any more at 1.07.

Read More »

Read More »