Tag Archive: FOMC

FX Daily, June 16: Will the Fed Talk the Talk?

With the outcome of the FOMC meeting awaited, the dollar is narrowly mixed in quiet turnover. The Scandis are the weakest (~-0.3%) among the majors, while the Antipodeans are the strongest (~+0.25%). JP Morgan's Emerging Market Currency Index is snapping a three-day decline

Read More »

Read More »

FX Daily, June 15: Commodities Ease though Oil remains Firm

The new record high in the S&P 500 and the NASDAQ's sixth gain in seven sessions may have helped lift Asia Pacific markets today. Only China and Hong Kong did not participate. MSCI's regional index rose for its fourth consecutive session. Europe's Dow Jones Stoxx 600 is moving higher for the eighth session in a row.

Read More »

Read More »

FX Daily, June 14: Dollar Becalmed as Markets Wait for US Leadership

The short squeeze that lifted the US dollar ahead of the weekend has seen limited follow-through buying, and instead a consolidative tone emerged. Europe is searching for direction and perhaps waiting for US leadership after a quiet Asia Pacific session, with several centers closed for holiday today (China, Hong Kong, Taiwan, and Australia).

Read More »

Read More »

FX Daily, April 8: Calm Capital Markets See the Dollar Drift

Overview: Global stocks are moving higher today. Fears of a new lockdown in Tokyo amid rising covid cases weighed on Japanese stocks, a notable exception as the MSCI Asia Pacific Index rose for its fifth session of the past six. Europe's Dow Jones Stoxx 600 is edging to new record highs today and is advancing for its fifth session of the past seven.

Read More »

Read More »

FX Daily, January 28: A Sea of Red Gives the Dollar a Bid

The steepest loss in US equities since last October is rippling through the capital markets in the form of de-risking. The rout is not over, and the S&P 500 is poised to gap lower. Many of the largest markets in the Asia Pacific region were off around 2%.

Read More »

Read More »

FX Daily, January 27: The Fed and Earnings on Tap

Overview: Risk appetites seem subdued even if GameStop's surge draws attention. Asia Pacific equities mostly slipped lower, and profit-taking was seen in Hong Kong and Seoul, which are off to an incredibly strong start to the year. Small gains were reported in Tokyo, Beijing, and Taipei.

Read More »

Read More »

FX Daily, January 25: A Subdued Start to a Big Week

What promises to be an eventful week has begun off on a mostly subdued note. Asia Pacific equities moved higher, again led by Hong Kong and ostensibly mainland buying. The Hang Seng rose 2.4% to bring this year's gain to 10.75%. South Korea's Kospi also increased by more than 2%, and, so far this month, it is up almost 11.7%.

Read More »

Read More »

FX Daily, November 5: The Dollar Slides and the Yuan Jumps

Overview: The markets did not wait for the final vote count and took stocks and bonds higher while pushing the greenback lower. While it appears Biden will be the next US President, investors seemed to like the fact that his agenda will be checked by a Senate that may remain in Republican hands. Stocks are on a tear.

Read More »

Read More »

FX Daily, September 2: Corrective Pressures Give the Greenback a Reprieve

After poking above $1.20 for the first time in more than two years, the euro reversed lower yesterday and is continuing to succumb to profit-taking pressures today. Comments from ECB's Lane appeared to trigger a reversal yesterday throughout the currency markets.

Read More »

Read More »

FX Daily, September 1: Dollar Lurches Lower

The US dollar has been sold-off across the board. The euro approached $1.20, and sterling neared $1.3450. The greenback traded below CAD1.30 for the first time since January. Most emerging market currencies but the Turkish lira, are also advancing today.

Read More »

Read More »

FX Daily, August 31: Month-End Gyrations and the Fed’s Ad Hocery

Markets are searching for direction at month-end. Asia Pacific shares outside of Japan lower. Berkshire Hathaway confirmed taking a $6 bln stake in Japanese trading companies over the past year, and the pullback in the yen helped lift shares. The MSCI Asia Pacific Index rose 2% last week.

Read More »

Read More »

FX Daily, July 29: Greenback Slips Ahead of the FOMC

Global equity markets are stabilizing today, and the dollar is once again on its back foot. Chinese markets led a mixed regional performance with a 2%-3% gain, while South Korea and Hong Kong markets also advancing. The strength of the yen appears to weigh on Japanese shares.

Read More »

Read More »

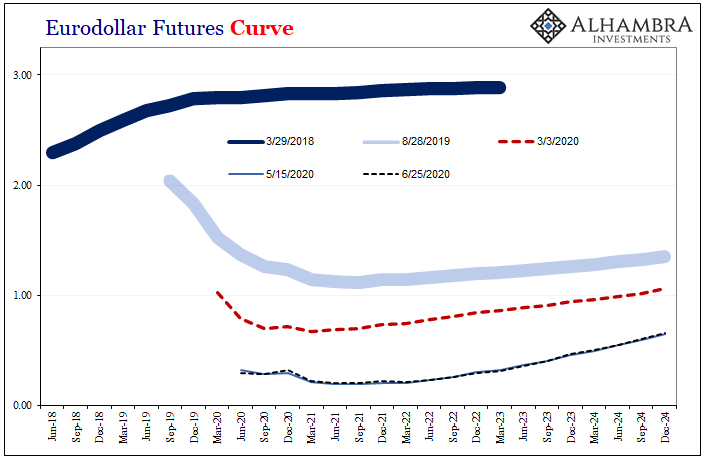

Wait A Minute, What’s This Inversion?

Back in the middle of 2018, this kind of thing was at least straight forward and intuitive. If there was any confusion, it wasn’t related to the mechanics, rather most people just couldn’t handle the possibility this was real. Jay Powell said inflation, rate hikes, and accelerating growth. Absolutely hawkish across-the-board.And yet, all the way back in the middle of June 2018 the eurodollar curve started to say, hold on a minute.

Read More »

Read More »

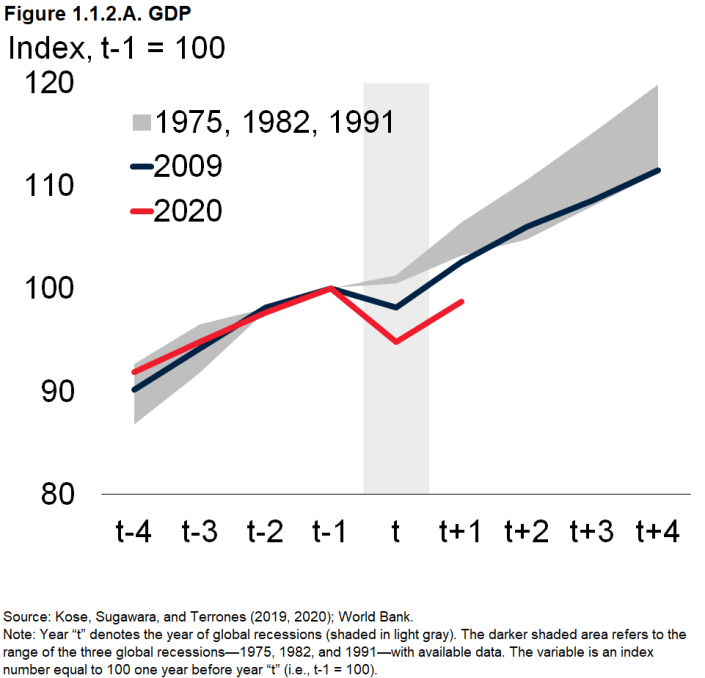

This Thing Is Only Getting Started; Or, *All* The V’s Are Light On The Right

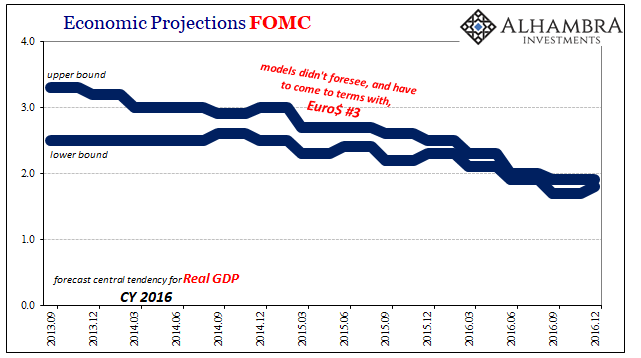

The Federal Reserve’s models really are the most optimistic of the bunch. With the policy meeting conducted today, no surprises as far as policies go, we now know what ferbus has to say about everything that’s happened this year. Skipping the usual March projections, what with the FOMC totally occupied at the time by a complete global monetary meltdown Jay Powell now says “we saw it coming”, the central bank staff released the calculations...

Read More »

Read More »

Why The FOMC Just Embraced The Stock Bubble (and anything else remotely sounding inflationary)

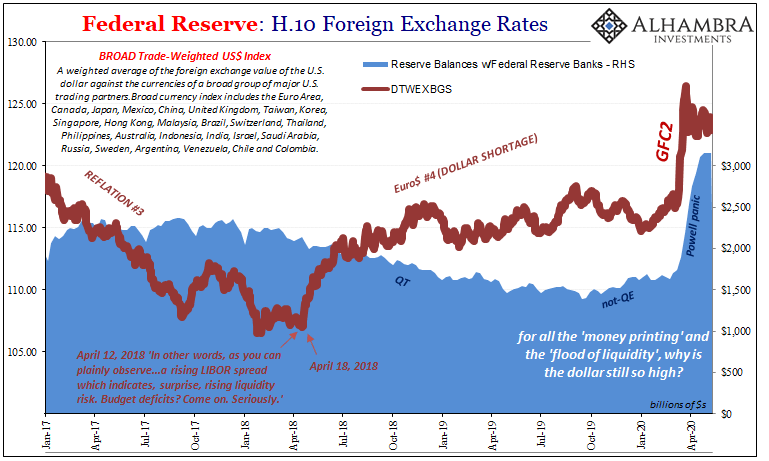

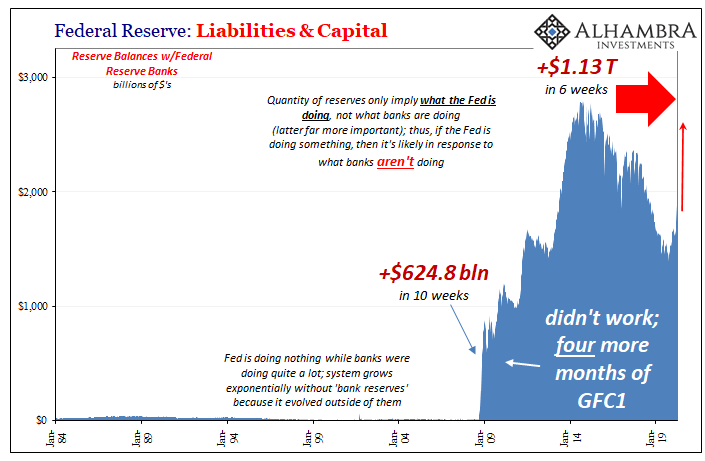

The job, as Jay Powell currently sees it, means building up the S&P 500 as sky high as it can go. The FOMC used to pay lip service to valuations, but now everything is different. He’ll signal to all those fund managers by QE raising bank reserves, leading them on in what they all want to believe is “money printing” (that isn’t).

Read More »

Read More »

So Much Bond Bull

Count me among the bond vigilantes. On the issue of supply I yield (pun intended) to no one. The US government is the brokest entity humanity has ever conceived – and that was before March 2020. There will be a time, if nothing is done, where this will matter a great deal.That time isn’t today nor is it tomorrow or anytime soon because it’s the demand side which is so confusing and misdirected.

Read More »

Read More »

The Global Engine Is Still Leaking

An internal combustion engine that is leaking oil presents a difficult dilemma. In most cases, the leak itself is obscured if not completely hidden. You can only tell that there’s a problem because of secondary signs and observations.If you find dark stains underneath your car, for example, or if your engine smells of thick, bitter unpleasantness, you’d be wise to consider the possibility.

Read More »

Read More »

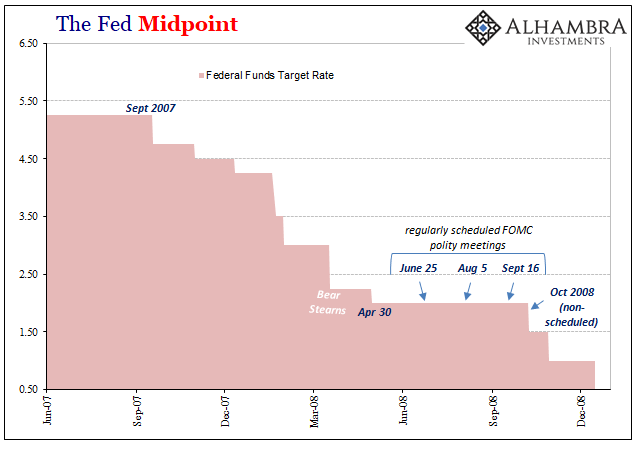

A Day For Rate Cuts

Well, that wasn’t he had in mind. The whole point of a rate cut, any rate cut let alone an emergency fifty, is to signal especially the stock market that the Fed is in the business of…something. The public has been led, by and large, to assume that something good happens when the Fed Chair shows up on TV.

Read More »

Read More »

History Shows You Should Infer Nothing From Powell’s Pause

Jay Powell says that three’s not a crowd, at least not for his rate cuts, but four would be. As usual, central bankers like him always hedge and say that “should conditions warrant” the FOMC will be more than happy to indulge (the NYSE). But what he means in his heart of hearts is that there probably won’t be any need.

Read More »

Read More »

The FOMC Channels China’s Xi As To Japan Going Global

The massive dollar eruption in the middle of 2014 altered everything. We’ve talked quite a lot about what Euro$ #3 did to China; it sent that economy into a dive from which it wouldn’t escape. And in doing so convinced the Chinese leadership to give growth one more try before changing the game entirely once stimulus inevitably failed.

Read More »

Read More »