Tag Archive: Federal Reserve

FX Weekly Preview: Things to Watch in the Week Ahead

"The sky is falling. The sky is falling," they cried, as equities plunged in December. It is signaling a recession, we were told. Instead, global equities have begun the year with a strong advance. The S&P 500 gapped higher ahead of the weekend, extending this year's rally to about 14%.

Read More »

Read More »

The Death of a Business Cycle

How do business cycles end? In the US, conventional wisdom is that they are murdered by the Federal Reserve. It is too slow to raise rates and then goes too quickly. This view is espoused by numerous well-respected economists and policymakers. President Trump's criticism of the Federal Reserve is anchored by such views.

Read More »

Read More »

Living In The Present

It’s that time of year again, time to cast the runes, consult the iChing, shake the Magic Eight Ball and read the tea leaves. What will happen in 2019? Will it be as bad as 2018 when positive returns were hard to come by, as rare as affordable health care or Miami Dolphin playoff games? Will China’s economy succumb to the pressure of US tariffs and make a deal?

Read More »

Read More »

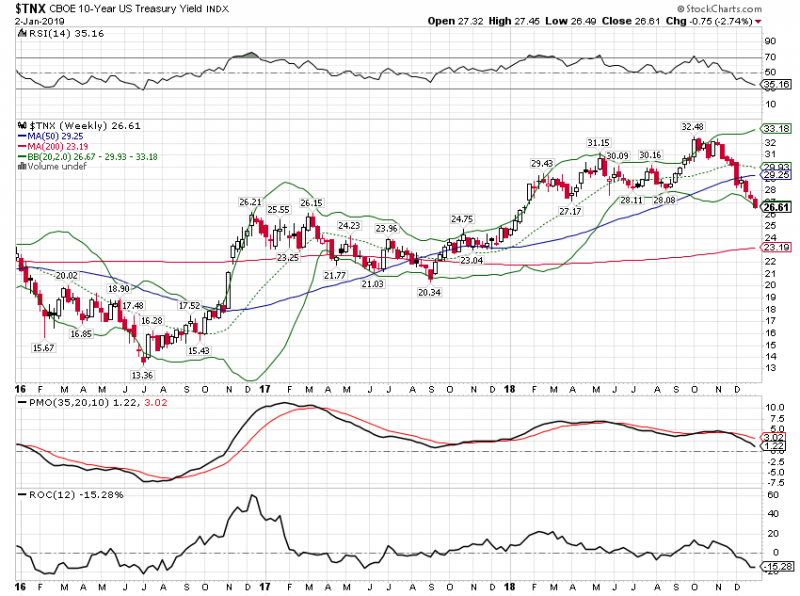

FX Weekly Preview: For the Millionth Time, Markets Exaggerate

The S&P 500 fell more than 12% in a few weeks. The 10-year Treasury yield fell nearly 40 bp. There were cries that the sky was falling. A recession is imminent, we are warned by prognosticators. The Fed went ahead and raised interest rates on March 21, 2018, and the S&P 500 proceeded to gap lower the next day and continued to sell-off the following day. Investors did not like the unanimous decision.

Read More »

Read More »

Technical Musings about the Euro and Dollar Anchored by Macro

The $1.1475-$1.1550 is an important area for the euro. Many bulls see a rounded bottom being carved and a break above it would be embraced as a confirmation. The lower-end corresponds to the 100-day moving average. Such a bottom pattern, if confirmed, would project toward $1.1800 the high in H2 18. On the downside, the low from H2 18 was near $1.1200. This is just above a key (61.8%) retracement of the January 2017-February 2018 rally.

Read More »

Read More »

Some Thoughts on What is Happening

People do not just disagree on what should and will happen, but they disagree on what has happened. As William Faulkner instructed: "The past is not dead. Actually, it's not even past. This is clear in the narratives about the sharp drop in equity markets.

Read More »

Read More »

FX Daily, December 20: Stocks Slump and the Dollar Slides as Market Concludes Fed is Mistaken

Overview: Once again the US equity market failed to hold on to even minimal upticks. The sharply lower close spurred follow-through selling in global equities. Few have been spared the wrath of investors who apparently were disappointed with the Fed and its reluctance to consider stopping the balance sheet unwind.

Read More »

Read More »

FX Weekly Preview: FOMC Dominates Week Ahead Calendar

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise.

Read More »

Read More »

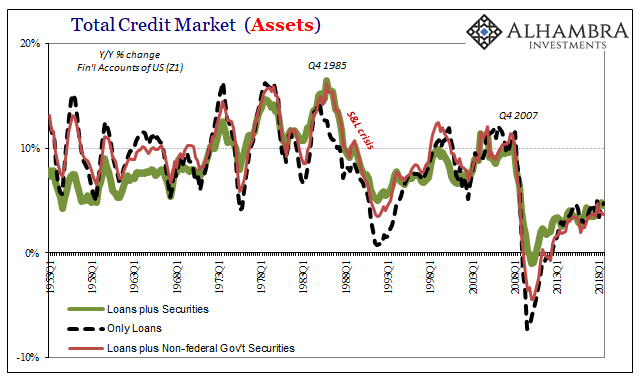

US Banks Haven’t Behaved Like This Since 2009

If there is one thing Ben Bernanke got right, it was this. In 2009 during the worst of the worst monetary crisis in four generations, the Federal Reserve’s Chairman was asked in front of Congress if we all should be worried about zombies. Senator Bob Corker wasn’t talking about the literal undead, rather a scenario much like Japan where the financial system entered a period of sustained agony – leading to the same in the real economy, one lost...

Read More »

Read More »

Cool Video: Bloomberg Economic Discussion

I joined Chris Wolfe from First Republic Wealth Management on the set of Bloomberg's Daybreak to discuss market developments and the outlook for the US economy. We generally agreed that while the economy is slowing it is doing so from unsustainably strong levels.

Read More »

Read More »

FX Daily, November 29: Reluctant to Extend Dollar Losses

Overview: The biggest US equity advance since Q1 has helped lift global markets today. The MSCI Asia Pacific Index rose for the fourth session, and nearly all the bourses in the region rallied with the notable exception of China and Hong Kong. Almost all the sectors in Europe are rallying but energy and real estate. US oil inventories rose three times more than expected and Putin expressed little support for fresh output cuts.

Read More »

Read More »

FX Weekly Preview: Powell and Draghi, Xi and Trump

The investment climate will be shaped by three events next week. ECB President Draghi's testimony before the European Parliament to kick-off the week. Fed Chairman Powell speaks to the NY Economic Club in the middle of the week. Presidents Trump and Xi are to meet at the G20 meeting to end the week in hopes of dialing back the escalating trade conflict. Also at the G20 summit, the NAFTA2.0 is expected to be signed, and the steel and aluminum...

Read More »

Read More »

FX Weekly Preview: Unfinished Business

Often, and apparently wrongly attributed to Mark Twain is the observation that it is not what we know that gets into trouble, but "what we know that just ain't so." Now though, investors suffer from a different problem. Several processes are in motion, and there is little confidence in their outcomes. Among these are Brexit, US-China trade, the trajectory of Fed policy, and the EC's efforts to enforce the agreed-upon budget rules.

Read More »

Read More »

Cool Video: Fox Biz TV Broad Economic Discussion

I joined Charles Payne on Fox Business TV for a broad economic discussion today. Payne, like many, are concerned that the Fed continues to tighten and worries this is going to end the business cycle. He also argued that the strong dollar was a significant threat of US multinational earnings.

Read More »

Read More »

FX Weekly Preview: DOTS in the Week Ahead: Divergence, Oil, Trade and Stocks

The Federal Reserve's confidence in the economy and its need to continue to gradually increase interest rates stands in sharp contrast to most of the other major central banks. The European Central Bank will finish its asset purchases at the end of the year, but it is in no position to begin to normalize interest rates. Indeed, the risk is that it may feel compelled to off another Targeted Long-Term Repo, which would, in effect, allow the borrowers...

Read More »

Read More »

FX Weekly Preview: Stocks, Trade, and the Fed in the Week Ahead

Last month's downdraft in equities spooked investors. The fear that is often expressed is that the end of the business cycle may coincide with the end of a credit cycle and a return to 2008-2009 crisis. It seems like an increasing number of economists agree with the sentiment expressed by President Trump that the Fed is too aggressive.

Read More »

Read More »

Cool Video: Bloomberg Discussion of Late US Cycle

An assessment of the US economy is an important input into the expectations of the dollar's behavior in the foreign exchange market. As a currency strategist, my views of the US economy are often subsumed in discussions or talked about indirectly by talking about Fed policy. However, in this clip with Alix Steel and David Westin, I have an opportunity to sketch outlook for the US economy.

Read More »

Read More »

Fed Delivers, Market Yawns

The Federal Reserve did what it was widely to do. The fed funds target range was lifted 25 bp to 2.00-2.25%. Three-quarters of Fed officials anticipate a hike in December. The market had discounted around an 80% chance. The Fed sticks with the three rate hikes in 2019 and one in 2020. The year-end rate in 2021 is the same as in 2020.

Read More »

Read More »

FX Weekly Preview: Next Week’s Drivers

It is a testament to the Federal Reserves communication and the evolution of investors' understanding that we can say that the rate hike that the central bank will deliver is not as important as what it says. A rate hike is a foregone conclusion. According to the CME's model, there is about an 85% chance of December hike discounted as well.

Read More »

Read More »