Tag Archive: Federal Reserve

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

"We're gonna need a bigger Bullard"

- overheard on a trading desk this morning.

Yesterday, when looking at the market's "Bullard 2.0" moment, which was a carbon copy of the market's kneejerk surge higher response to Bullard's "QE4" comments fr...

Read More »

Read More »

Janet Yellen Fights the Tide of Falling Interest

The Fed is going to have to take back this interest rate hike (Dec 16). The process that sets the interest rate is complex. I have written many words on its terminal decline. However, there are two simple reasons why the trend remains downward.

Read More »

Read More »

The Dog That Did not Bark

In the famous Sherlock Holmes Story, the detective identified the perpetrator from the fact that a dog didn’t bark. The dog didn’t bark because it dog knew the perp. This story makes a good analogy to what happened on Thursday, Sep 17. Perhaps I should say what did not happen.

The Fed did not raise the interest rate.

Read More »

Read More »

The Fed and the Cotton Candy Market

For Keith Weiner the Federal Reserve operates like a Cotton Candy Machine for the housing market. It creates a massive bubble, financed with debt. It spins the price of a house, with the help of credit and debt, into something many times its original size.

Read More »

Read More »

The Gold Standard For Democrats

Keith Weiner describes how the Fed pushes down the interest rate and due to that, it drives up prices of food and rents. This implies that businesses are clearly priviliged against workers. The gold standard does the opposite, if prefers savings and workers. Hence Democrats should be fan of the gold standard.

Read More »

Read More »

What Drives the Economy: Consumer Spending or Saving/Investment?

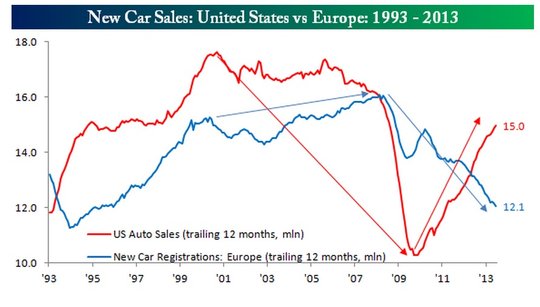

The concerted actions in September 2012 between the two big central banks reflected two fundamental economic principles: The Fed opted for Keynes' law, the ECB for Say's Law with conditionality. And apparently the ECB was successful.

Read More »

Read More »

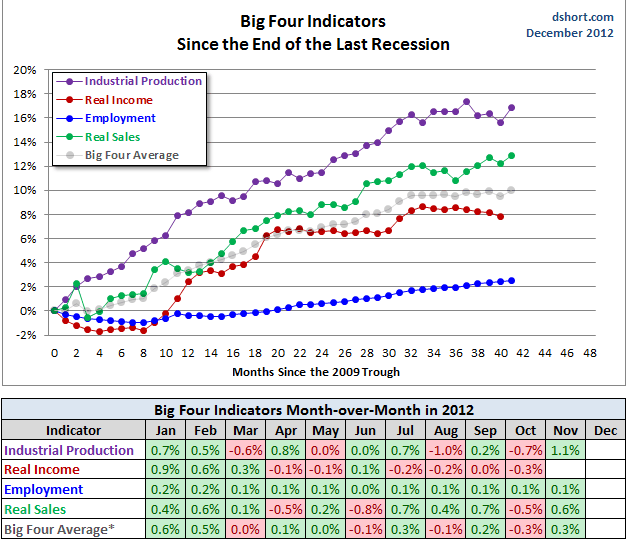

US Economic Indicators

The four best US economic indicators, in form of concurrent indicators, can be seen at Doug Short, here in detail.

Read More »

Read More »

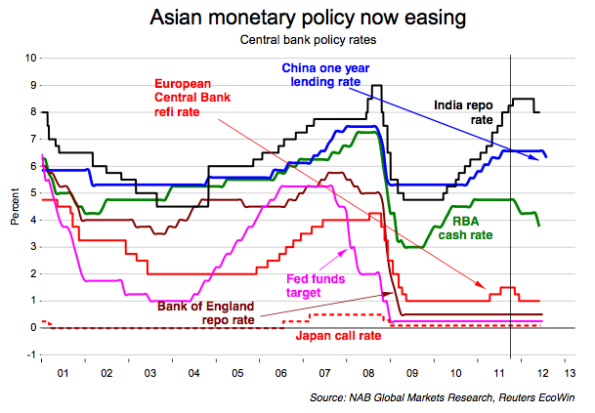

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

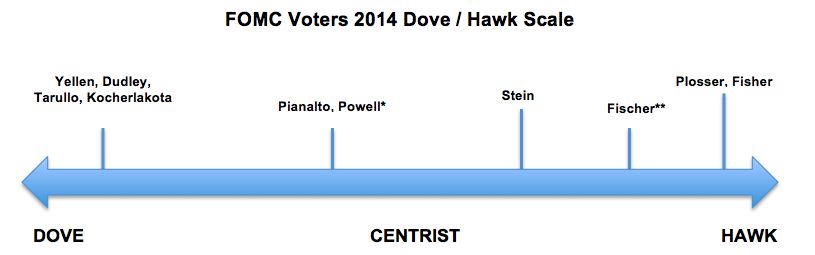

Fed FOMC: Who is Hawk, Who is Dove? 2015 Update

Composition of the Fed's Federal Open Market Committee (FOMC composition), needed to know if the Fed is opting for quantitative easing or not.

Read More »

Read More »

Quantitative Easing, its Indicators and the Swiss Franc

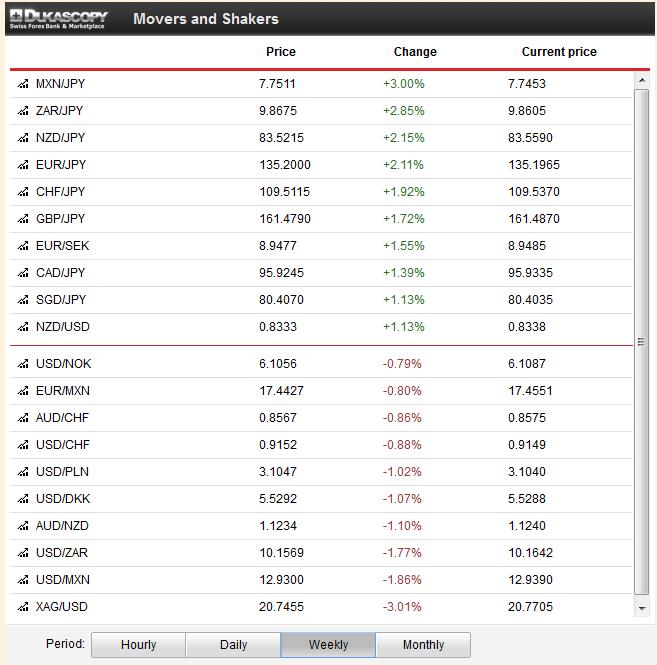

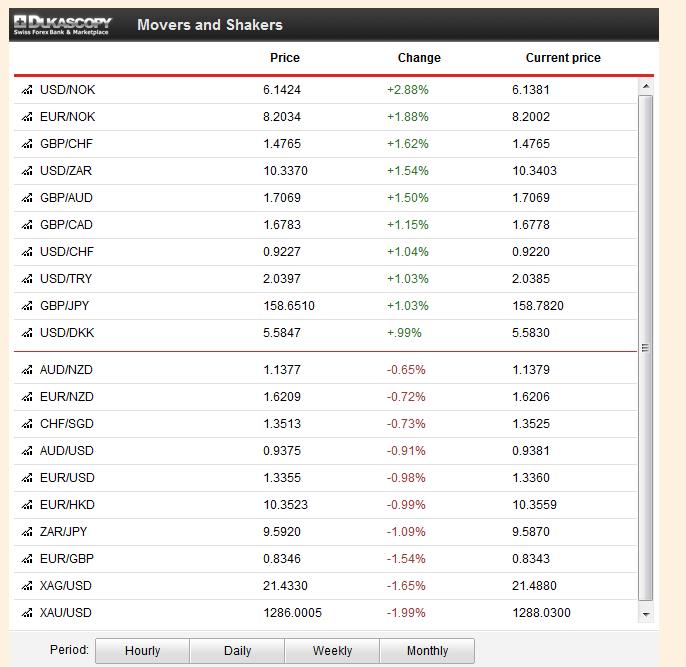

The main drivers of demand for Swiss francs are the euro crisis and, even more, the behavior of American investors, who go out of the dollar in the fear of bad US economic data and/or Quantitative Easing (QE). Risk-friendly investors move into risky assets like stocks or currencies of emerging markets, while risk-averse investors fear inflation and buy inflation-resistant assets like Swiss francs.

Read More »

Read More »

The Fed Poisons The Stock Market

The Fed has pumped trillions of dollars into the financial system since 2008. The unintended consequences of this bank bailout have spilled over into the markets. Fed money injections go directly into bonds, tending to push up their prices.

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 18 to November 22

Fundamentals with highest importance: The HSBC Flash Purchasing Manager Index (PMI) for China weakened from 50.8 to 50.4. In particular, new export orders, output prices and employment started to decrease again, while output increased. The preliminary Markit manufacturing PMI for the United States edged up to 54.3 (vs. 52.3 expected), a 9-month high after the …

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 11 to November 15

Fundamentals with highest importance: In Janet Yellen’s hearing at the Senate Banking Commission, the future Fed chair emphasized the need to provide support to the economic recovery and to overcome low inflation. Her speech supported equities, gold and US Treasuries. GDP in the Euro zone rose by 0.1% QoQ in line with expectations, but less …

Read More »

Read More »

Fundamentals,FX,Gold and CHF: Week November 4 to November 8

Fundamentals with highest importance: The U.S. GDP release for Q3, showed that despite the recent U.S. critique with Germany, the Americans are trying to follow the successful Germans: for the first time since Q1/2012 and Q2/2011 exports rose more than imports. GDP was up 2.8%, but not driven by consumption, it was mostly helped by …

Read More »

Read More »

History of Wrong Forecasts by Swiss and Fed Economists: Update September 2013

Or how to talk down and how to talk up an economy with wrong forecasts American and Swiss mentalities are very different, the Americans have the tendency not to care about the future a lot, the Swiss, however, do things only after careful consideration of potential risks. This tendency can be proven economically with … Continue reading...

Read More »

Read More »

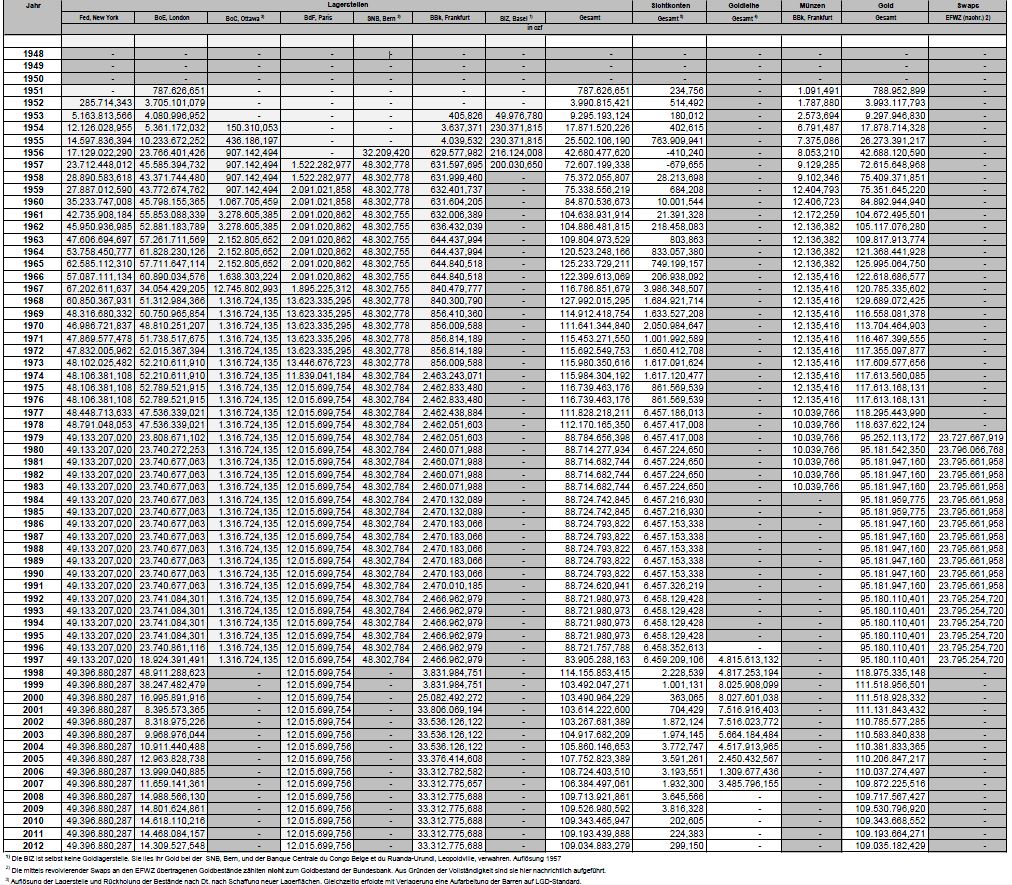

The List German Gold Transactions 1951-2012

The German Bundesbank decided to opt for full transparency of their gold reserves and their whereabouts since the second world war. Our details:

Read More »

Read More »

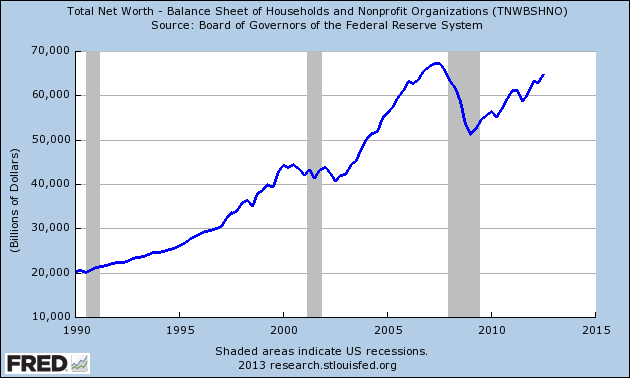

Recreating the Asset Bubble: The Fed’s Plan for Economic Recovery

The Fed's plan is recreate an asset bubble, so that economic actors have enough time to forget about the latest one and adjust their rational expectations about low future growth to the upside. Read the Circle...

Read More »

Read More »