Tag Archive: European central bank

When Do We Know These Are Delusional Markets

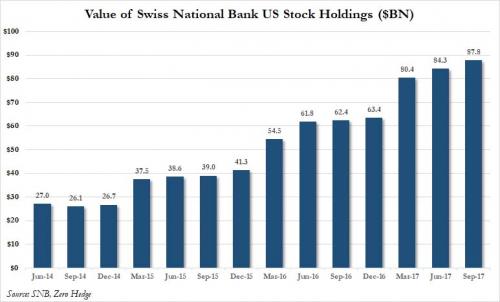

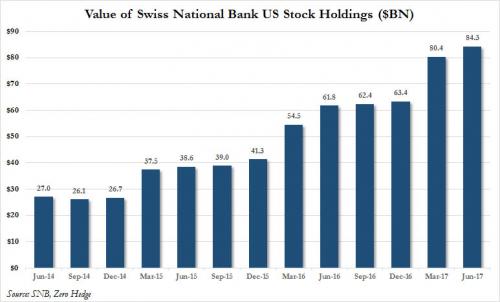

Signs of complacency and disconnect from fundamentals abound. So to sanity check, it may still be helpful to periodically remind ourselves of a few recent ones. In no particular order. The Swiss National Bank bought $ 100bn between US and European stocks. It now owns 26 million Microsoft shares (read).

Read More »

Read More »

Fighting inflation with FX, a real traders market

The much anticipated document (press release and link to full document) released by U.S. Trade Representative Robert Lighthizer said the Trump administration aimed to reduce the U.S. trade deficit by improving access for U.S. goods exported to Canada and Mexico and contained the list of negotiating objectives for talks that are expected to begin in one month.

Read More »

Read More »

The Swiss National Bank Owns $80 Billion In US Stocks – Here’s The Catch

Switzerland is a small country of just 8 million people, but they make an outsized impact on economics and finance and money. Because Switzerland is considered a safe haven and a well-run country, many people would like to hold large amounts of their assets in the Swiss franc. This makes the Swiss franc intolerably strong for Swiss businesses and citizens. So the Swiss National Bank (SNB) has to print a great deal of money and use nonconventional...

Read More »

Read More »

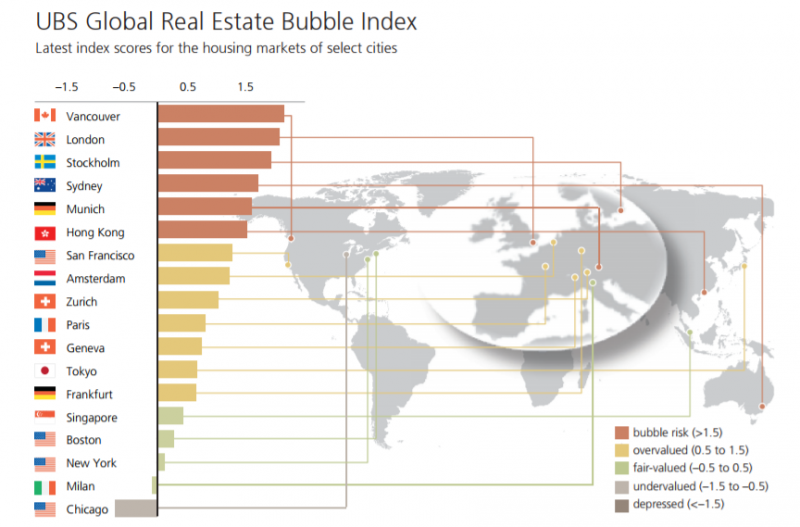

London Property Bubble Bursting? UK In Unchartered Territory On Brexit and Election Mess

Is the London property market heading for tough times? The most recent housing figures and a new Bank of England report suggest it may well be. Recent figures show that 77% of London houses sold in May went at below asking price, up from 72% in April.

Read More »

Read More »

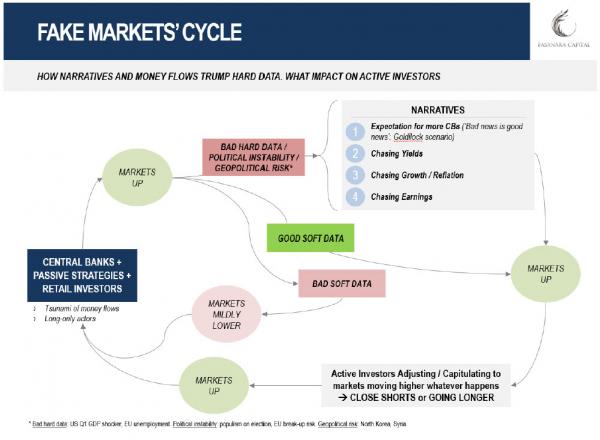

Central Banks Buying Stocks Have Rigged US Stock Market Beyond Recovery

Central banks buying stocks are effectively nationalizing US corporations just to maintain the illusion that their “recovery” plan is working because they have become the banks that are too big to fail. At first, their novel entry into the stock market was only intended to rescue imperiled corporations, such as General Motors during the first plunge into the Great Recession, but recently their efforts have shifted to propping up the entire stock...

Read More »

Read More »

Is the Central Bank’s Rigged Stock Market Ready to Crash on Schedule?

We just saw a major rift open in the US stock market that we haven’t seen since the dot-com bust in 1999. While the Dow rose by almost half a percent to a new all-time high, the NASDAQ, because it is heavier tech stocks, plunged almost 2%.

Read More »

Read More »

Remembering A Still Falling Hero: Small Business

On this holiday weekend known here in the U.S. as Memorial Day, I would like to make a slight turn in the narrative that many give little to no attention too, yet, is one of the most important underlying principles or fundamentals which helped shape, lift, mold, sustain, and create one of the world’s greatest economic powerhouses bar none.

Read More »

Read More »

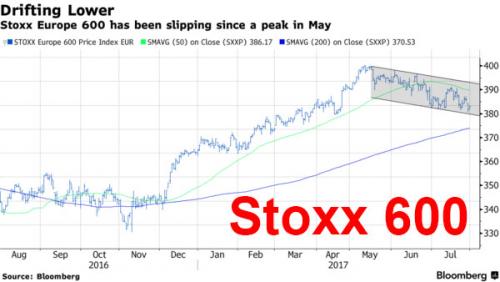

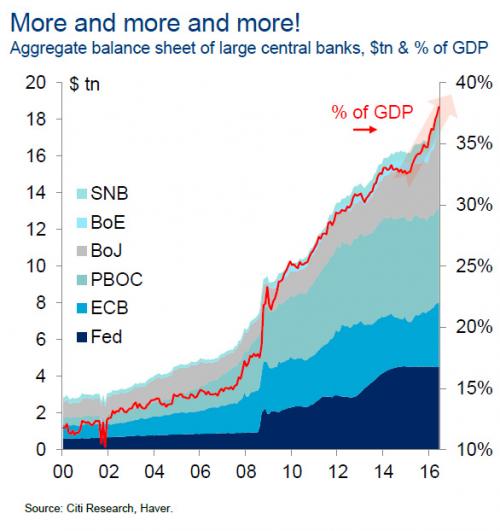

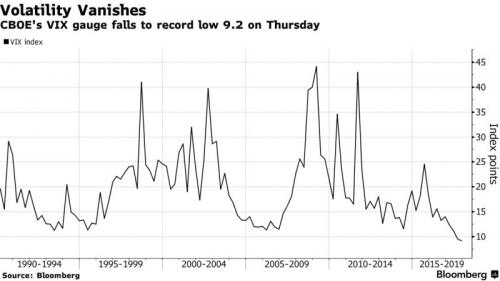

A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, "the largest CB buying on record."

Read More »

Read More »

Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

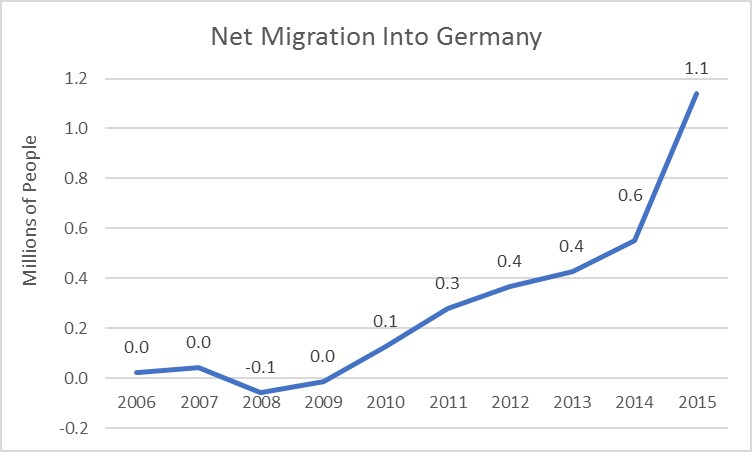

The change in nations Core populations (25-54yr/olds) have driven economic activity for the later half of the 20th century, first upward and now downward. The Core is the working population, the family forming population, the child bearing population, the first home buying, and the credit happy primary consumer. Even a small increase (or contraction) in their quantity drives economic activity magnitudes beyond what the numbers would indicate.

Read More »

Read More »

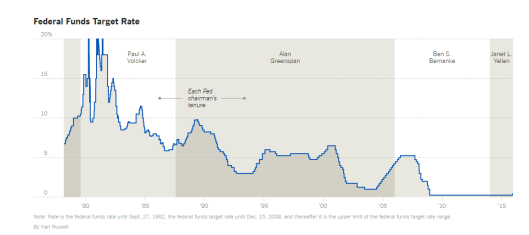

What Will Trump Do About The Central-Bank Cartel?

The US is by far the biggest economy in the world. Its financial markets — be it equity, bonds or derivatives markets — are the largest and most liquid. The Greenback is the most important transaction currency. Many currencies in the world — be it the euro, the Chinese renminbi, the British pound or the Swiss franc — have actually been built upon the US dollar.

Read More »

Read More »

Martin Armstrong: “EU in Disintegration Mode”

Famous market forecaster Martin Armstrong wrote a recent article describing the current situation in Europe. Similar to our article, “Trouble Brewing in the EU”, the Armstrong's piece discusses growing discontent and fractures in the E.U. Martin Armstrong observes that,

Read More »

Read More »

Who Owns the Public Gold: States or Central Banks?

It’s a common misconception that the world’s major central banks and monetary authorities own large quantities of gold bars. Most of them do not. Instead, this gold is owned by the sovereign states that have entrusted it to the respective nation’s central bank, and the central banks are merely acting as guardians of the gold. Tracing the ownership question a step further, what are sovereign states?

Read More »

Read More »

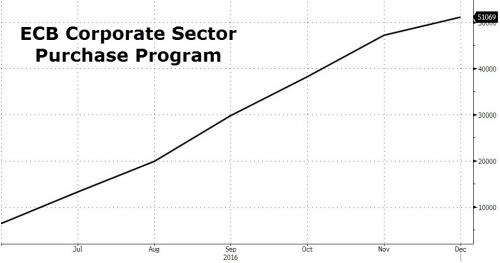

ECB Assets Rise Above 36 percent Of Eurozone GDP; Draghi Now Owns 10.2 percent Of European Corporate Bonds

The ECB's nationalization of the European corporate bond sector continues. In the ECB's latest update, the six central banks acting on behalf of the Euro system provided an update on the list of corporate bonds they bought. They bought into 810 issuances with a total of €573bn in amount outstanding.

Read More »

Read More »

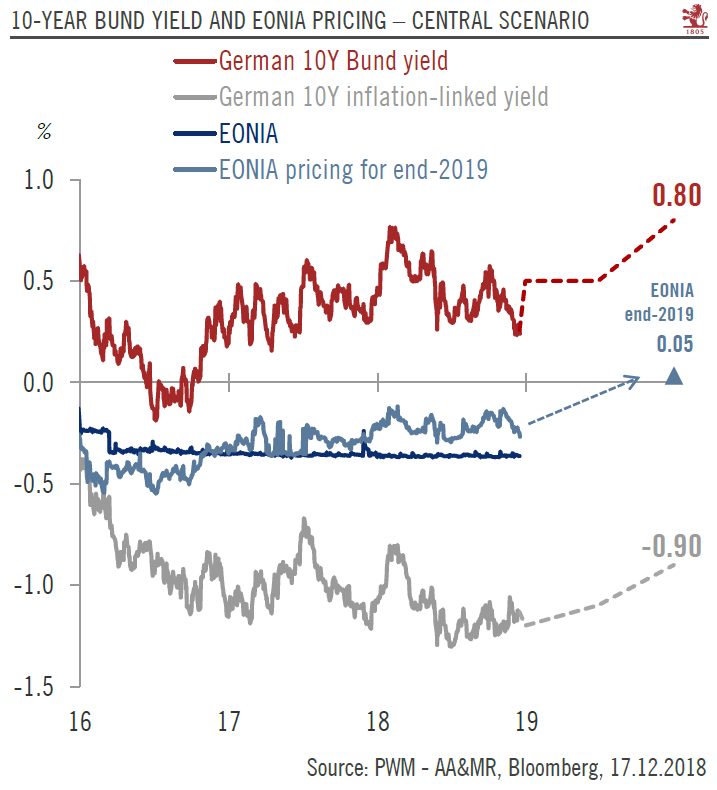

These Are The 3 Main Issues For Europe In 2017

What will the year ahead look like for Europe? 2017 will be another chapter in the European Union’s slow unraveling… a process that has been underway for over a decade. The EU is a union in name only. The transfer of sovereignty to Brussels was never total, and member states are independent countries… each with their own interests at stake.

Read More »

Read More »