Tag Archive: Europe

The end of central banking as we know it

The severest crisis the European Central Bank (ECB) ever faced coincided with the early days of a new Executive Board. Over the past year and a half, the board’s six members, including the ECB’s president and vice president, have all been replaced, either because they resigned, or because their eight-year mandate expired.

Read More »

Read More »

Even The People ‘Printing’ The ‘Money’ Aren’t Seeing It

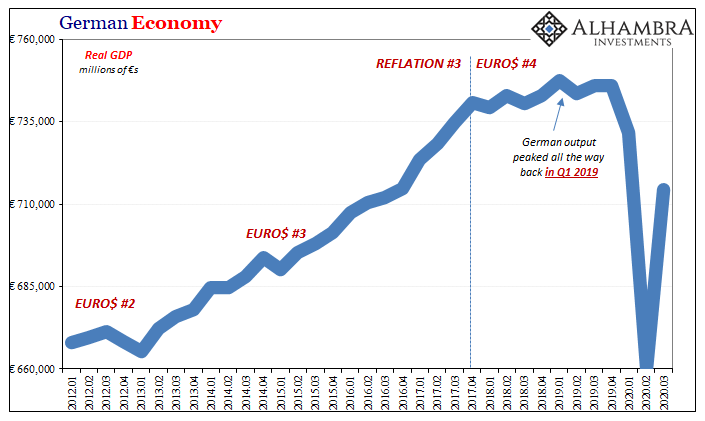

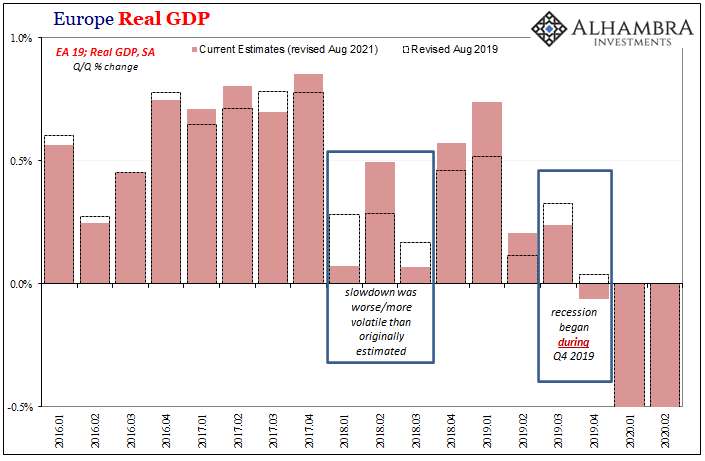

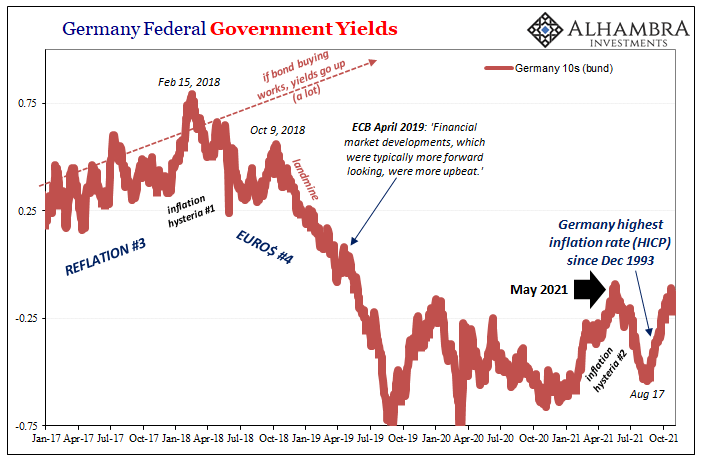

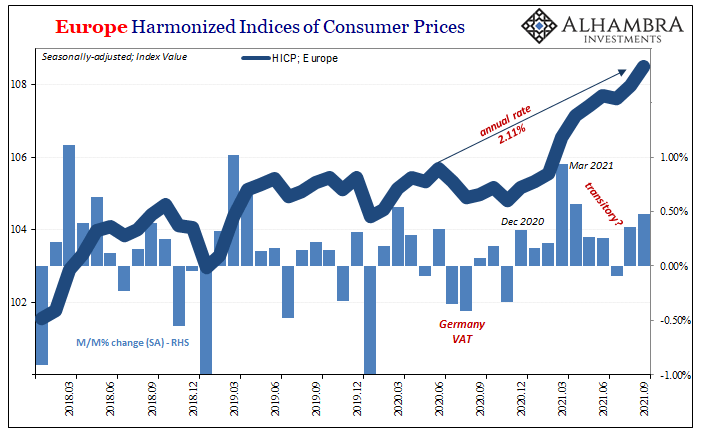

Everyone in Europe has long forgotten about what was going on there before COVID. First, an economy that had been stuck two years within a deflationary downturn central bankers like Italy’s new recycled top guy Mario Draghi clumsily mistook for an inflationary takeoff. Both the inflation puzzle and ultimately a pre-pandemic recession have taken a back seat to everything corona.Whereas Draghi spent those years howling for inflationary conditions...

Read More »

Read More »

FX Daily, January 29: Please Stay Seated, the Ride is not Over

Powerful corrective forces continue to grip the market. After a large rally to start the New Year, the correction is punishing. Most Asia Pacific equities markets were off again today to bring the week's loss to 2.5% to 5.5% throughout the region. Europe's Dow Jones Stoxx 600 is a little more than 1% lower on the day.

Read More »

Read More »

Seizing The Dirt Shirt Title

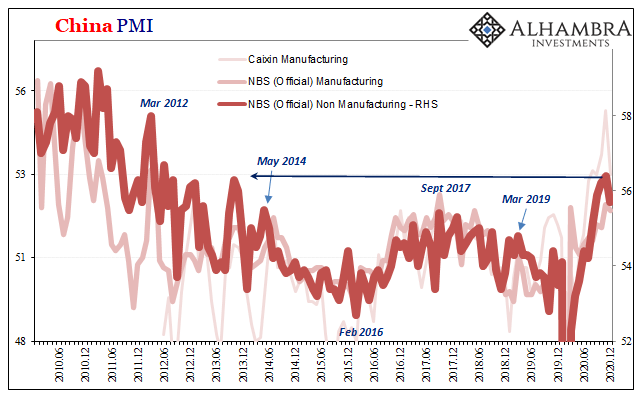

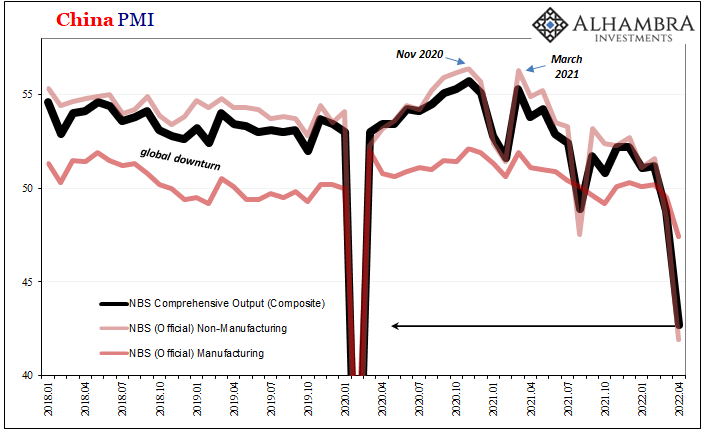

In mid-December 2019, before the world had heard of COVID, China’s Central Economic Work Conference had released a rather startling statement for the world to consume. In the West, everything was said to be on the up. Central banks had responded, forcefully, many claimed, more than enough to deal with that year’s “unexpected” globally synchronized downturn.

Read More »

Read More »

FX Daily, December 2: Euro Rally Stalls while Brexit Concerns Trip Sterling

The selling pressure that drove the dollar lower yesterday has abated, and the greenback is paring yesterday's loss, though the dollar-bloc currencies are showing some resilience. EC negotiator Barnier briefed ministers that the same three issues that have bedeviled the trade talks with the UK remain unresolved (fisheries, level playing field, and a conflict resolution mechanism).

Read More »

Read More »

Meanwhile, Outside Today’s DC

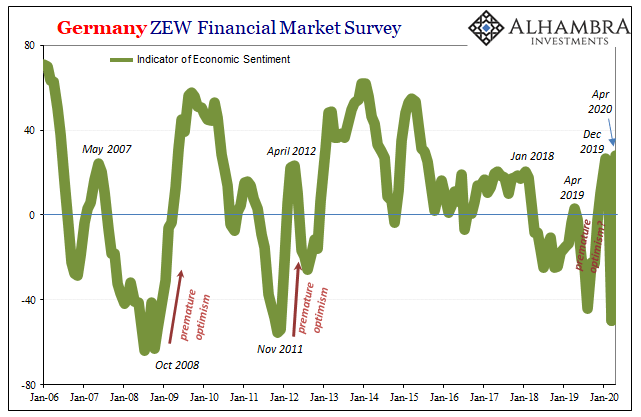

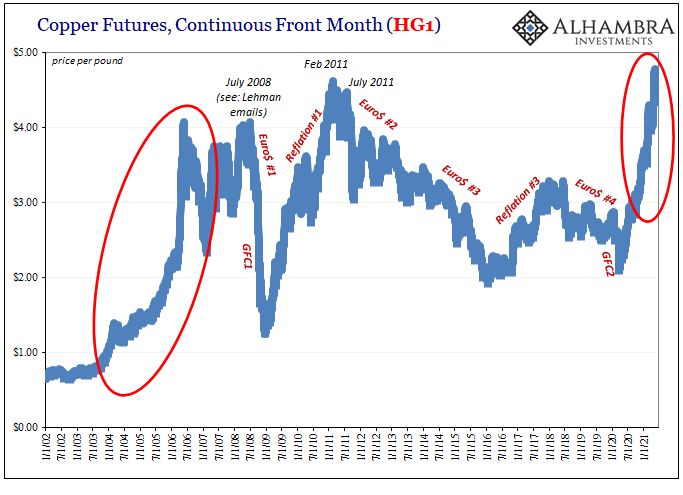

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

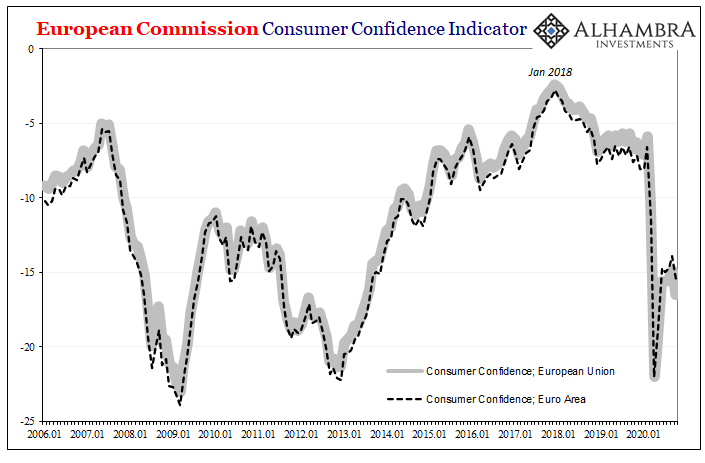

Consumer Confidence Indicator: Anesthesia

Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom.

Read More »

Read More »

It Was Bad In The Other Sense, So Now What?

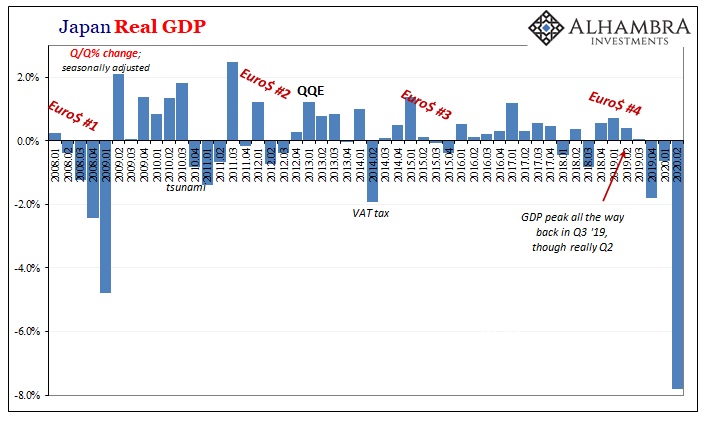

According to the latest figures, Japan has tallied 56,074 total coronavirus cases since the outbreak began, leading to the death of an estimated 1,103 Japanese citizens. Out of a total population north of 125 million, it’s hugely incongruous.

Read More »

Read More »

August Survey Data and Beyond

Economists are often lampooned because of their inability to forecast changes in the business cycle. But the pandemic helped them overcome the challenge this time. A record contraction in Q2 was anticipated before in March. Similarly, economists generally expected the recovery after the March-April body blow.

Read More »

Read More »

FX Daily, August 07: Position Adjustment Dominates ahead of US/Canada Employment Reports

Escalating dramas may be behind the position adjustment today ahead of the US jobs data. The US and China feud expanded beyond Tiktok to WeChat, and efforts to tighten disclosure rules for Chinese companies listed in the US are nearing. The negotiations between the White House and the Democrats broke down, preventing or at least delaying additional stimulus.

Read More »

Read More »

FX Daily, August 4: Markets Looking for Fresh Directional Cues

Asia Pacific equities rallied after the US shares rallied with the Nasdaq reaching record highs after it and the S&P 500 gapped higher yesterday. Japan and Hong Kong led the rally with more than 2% gains, while the Shanghai Composite lagged with about a 0.1% gain.

Read More »

Read More »

US Stall? Only Half The Imagined “V” May Indicate One, Too

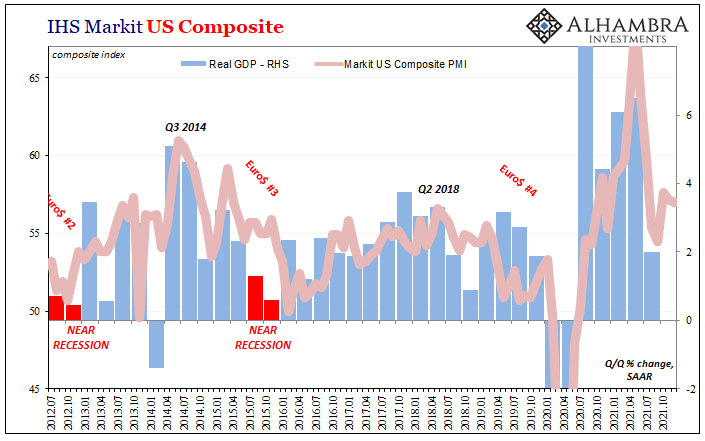

These are not numbers that are consistent with a robust rebound. In fact, they don’t indicate very much of one at all. IHS Markit’s flash PMI’s for July 2020 instead look way too much like the sentiment indicators in Germany and Japan. Though they are now back near 50, both services and manufacturing, that doesn’t actually indicate what everyone seems to think it does.

Read More »

Read More »

Second Wave Global Trade

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting.

Read More »

Read More »

FX Daily, June 26: Investors Wrestle with Notion that More Covid Cases mean More Stimulus

It may be that a new surge in virus cases will elicit more policy support from officials, but the immediate focus may be on the economic disruption. The number of US cases is reaching records, and at least a couple of states are stopping their re-opening efforts. Several other countries, including parts of Australia, Japan, and Germany, are wrestling with the same thing, And some emerging markets, like Brazil and Mexico, have not experienced a lull.

Read More »

Read More »

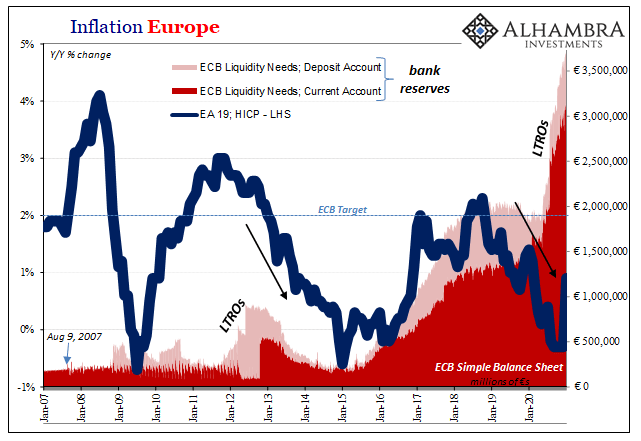

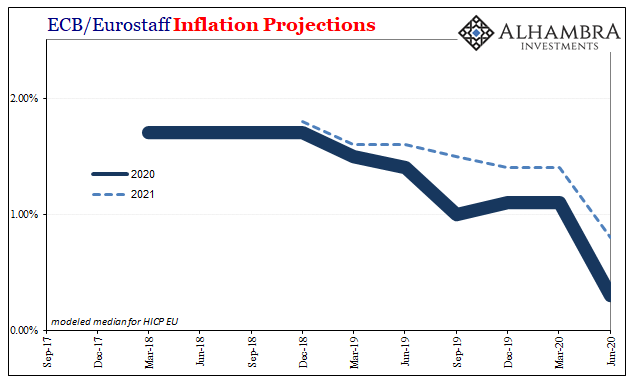

ECB Doubles Its QE; Or, The More Central Banks Do The Worse You Know It Will Be

A perpetual motion machine is impossible, but what about a perpetual inflation machine? This is supposed to be the printing press and central banks are, they like to say, putting it to good and heavy use. But never the inflation by which to confirm it. So round and round we go. The printing press necessary to bring about consumer price acceleration, only the lack of consumer price acceleration dictates the need for more of the printing press.

Read More »

Read More »

The global economy doesn’t care about the ECB (nor any central bank)

The monetary mouse. After years of Mario Draghi claiming everything under the sun available with the help of QE and the like, Christine Lagarde came in to the job talking a much different approach. Suddenly, chastened, Europe’s central bank needed assistance. So much for “do whatever it takes.”They did it – and it didn’t take.Lagarde’s outreach was simply an act of admitting reality.

Read More »

Read More »

FX Daily, April 24: Markets Limp into the Weekend

Overview: The reversal in US equities yesterday set the stage for today's losses. All the Asia Pacific bourses fell today but Australia. For the week, the regional index is off more than 2%. Europe's Dow Jones Stoxx 600 was flat for the week coming into today's sessions. It is off around 0.5% in late morning activity.

Read More »

Read More »

The Greenspan Bell

What set me off down the rabbit hole trying to chase modern money’s proliferation of products originally was the distinct lack of curiosity on the subject. This was the nineties, after all, where economic growth grew on trees. Reportedly. Why on Earth would anyone purposefully go looking for the tiniest cracks in the dam?

Read More »

Read More »

FX Daily, April 10: Eight Things to Know about Global Capital Markets on Good Friday

Most of the financial centers in Europe and North America are closed today for the Good Friday holiday. Many markets in Europe will also be closed on Monday. Here is a summary of key developments.

Read More »

Read More »

FX Daily, April 9: Three Deals Needed ahead of Holiday Weekend

Overview: Three deals need to be struck. First, the Eurogroup of finance ministers needs to reach an agreement of proposals for joint action to the heads of state. Second, oil producers need to cut output if prices are to stabilize. Third, the US Congress needs to strike a deal to provide more funding. Investor seems hopeful, and risk appetites are have lifted equities.

Read More »

Read More »