Tag Archive: Euro

Bi-Weekly Economic Review: Markets At Extremes

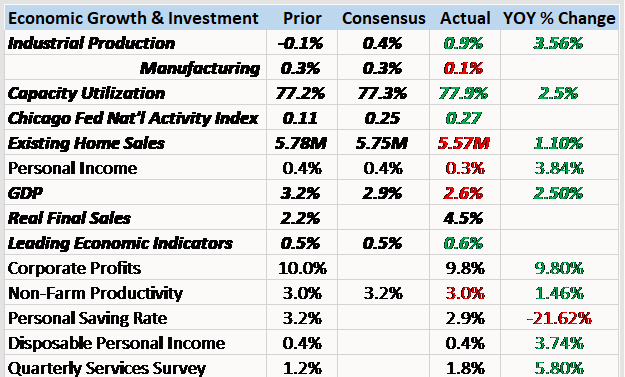

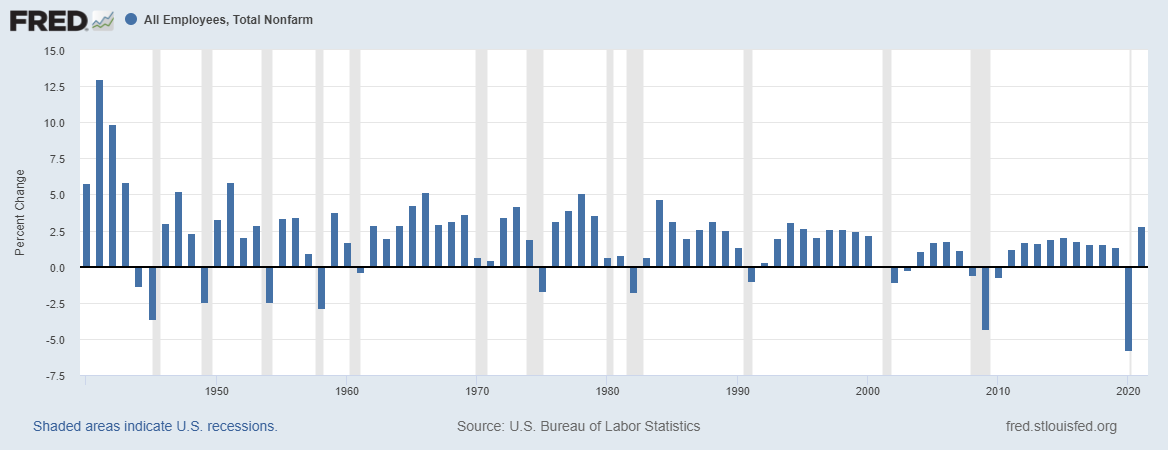

Production ended the year on a strong note but early readings from January are not as positive. The December industrial production report headline was strong at a 0.9% gain but a lot of that strength was in the mining (oil drilling) and utility sectors. Mining has actually led the way the last year as rig count has risen with drilling activity. I’d love to see our economy less dependent on the price of oil but that is what we’ve become over the...

Read More »

Read More »

Weekly Technical Analysis: 22/01/2018 – USD/JPY, EUR/USD, GBP/USD, USD/CHF

The USDCHF pair found solid support at 0.9564 barrier, which forced the price to rebound bullishly to approach testing the key resistance 0.9655, met by the EMA50 to add more strength to it, while stochastic shows clear overbought signals now.

Read More »

Read More »

La BNS vend des euros et achète des dollars

Entre la fin de l’année 2016 et la fin du 3ème trimestre 2017 (chiffres disponibles), les dirigeants de la BNS ont accru le volume des devises détenues par l’établissement de 65 milliards de francs environ. En 9 mois seulemen. Selon eux, ces investissements se justifient par le franc suisse qui serait trop fort face à l’euro. Et pour l’affaiblir, il faut acheter de l’euro, mécanisme qui expliquerait la croissance du bilan.

Read More »

Read More »

Weekly Technical Analysis: 15/01/2018 – USDJPY, EURUSD, GBPUSD, WTI Oil Futures

The USDCHF pair succeeded to break 0.9656 level and hold with a daily close below it, which confirms opening the way to extend the bearish wave towards our yesterday's mentioned next target at 0.9566, noticing that the price approaches retesting the broken level now.

Read More »

Read More »

Weekly Technical Analysis: 18/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, EUR/CHF

The USDCHF pair traded with clear negativity yesterday to break 0.9892 level and settles below it, which stops the recently suggested positive scenario and put the price within the correctional bearish track again, noting that there is a bearish pattern that its signs appear on the chart, which means that breaking its neckline at 0.9840 will extend the pair's losses to surpass 0.9800 and reach 0.9730 as a next station.

Read More »

Read More »

Weekly Technical Analysis: 11/12/2017 – USD/CHF, USD/JPY, EUR/USD, GBP/USD, Gold

The USDCHF pair begins to bounce higher after approaching from 0.9892 level, supported by the EMA50 that meets the mentioned level, while stochastic shows clear bullish trend signals on the four hours time frame. Therefore, these factors encourage us to keep our positive expectations in the upcoming period, waiting for visiting 1.0038 level as a next main station, being aware that breaking 0.9892 will stop the expected rise and turns the price back...

Read More »

Read More »

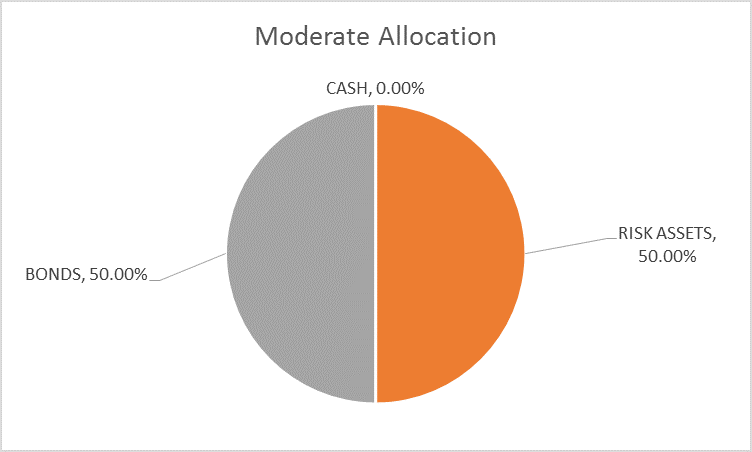

Global Asset Allocation Update: Step Away From The Portfolio

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolios this month. The post Fed meeting market reaction was a bit surprising in its intensity. The actions of the Fed were, to my mind anyway, pretty much as expected but apparently the algorithms that move markets today were singing from a different hymnal.

Read More »

Read More »

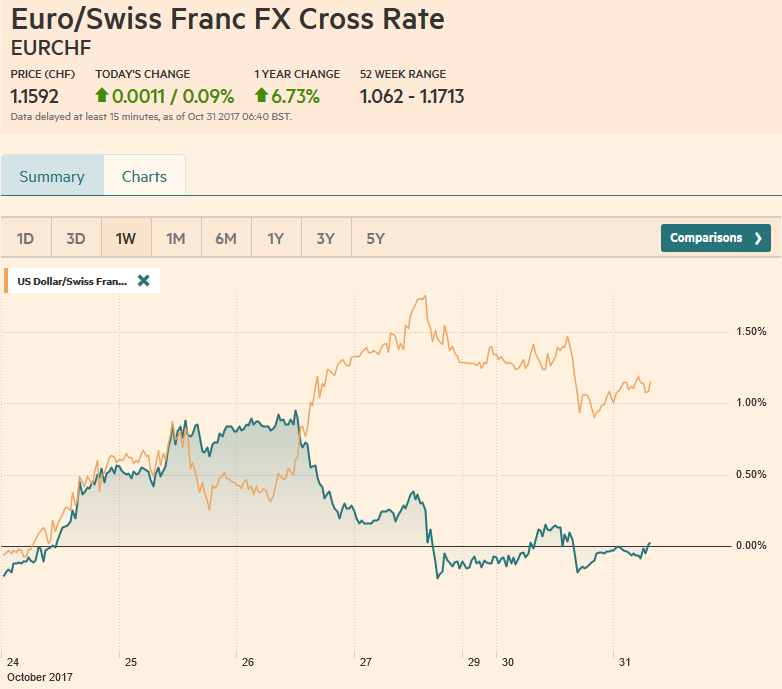

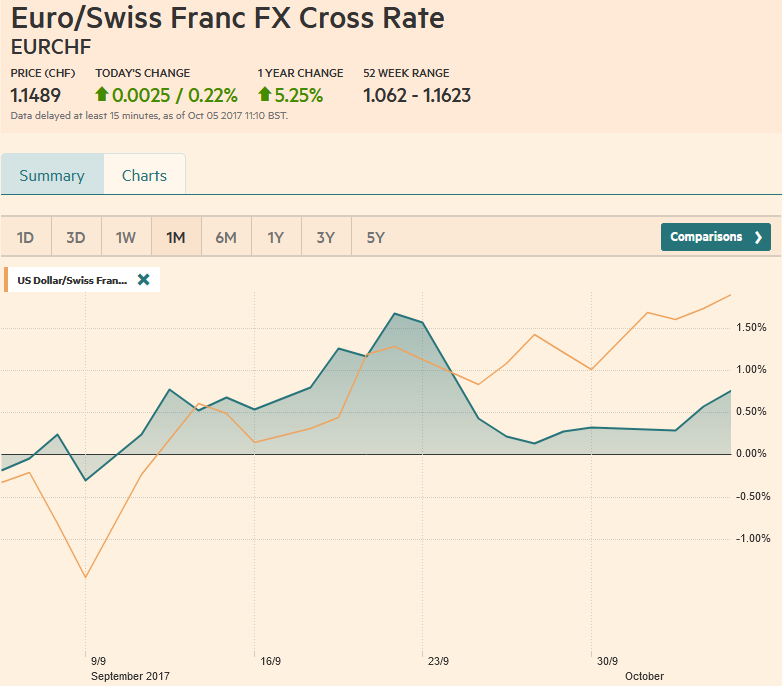

FX Weekly Review, September 04 – 09: Draghi Dovish? EUR and USD falling against CHF

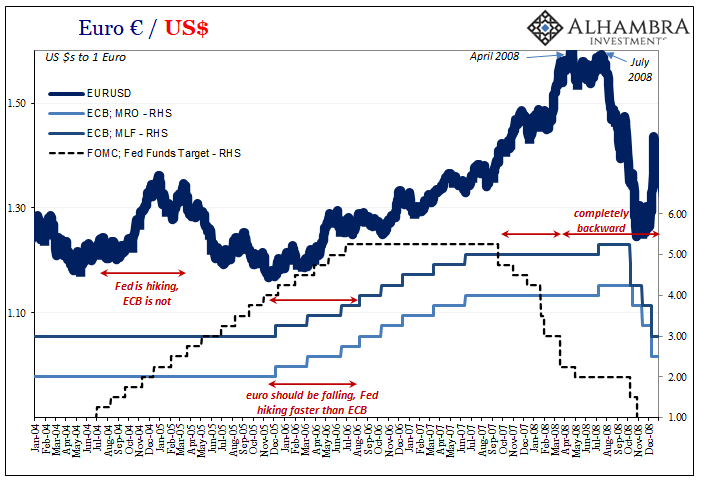

The euro rose close to CHF 1.15 with the ECB meeting this week. Finally traders realized that the ECB committed not to hike rates for a very long time. The ECB will review and take a first decision on the bond purchasing program this autumn. However, this program will come to an end only when the inflation target of 2% becomes in reach.

Read More »

Read More »

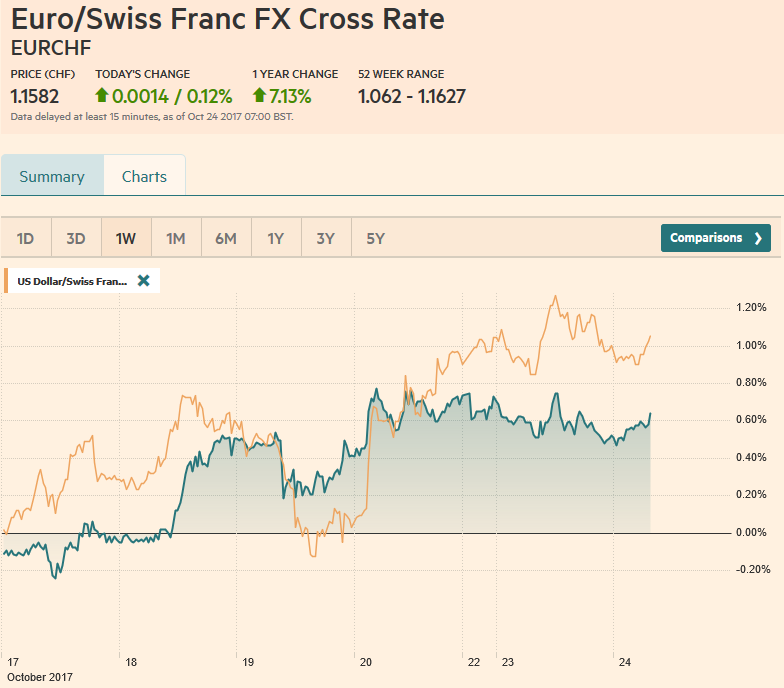

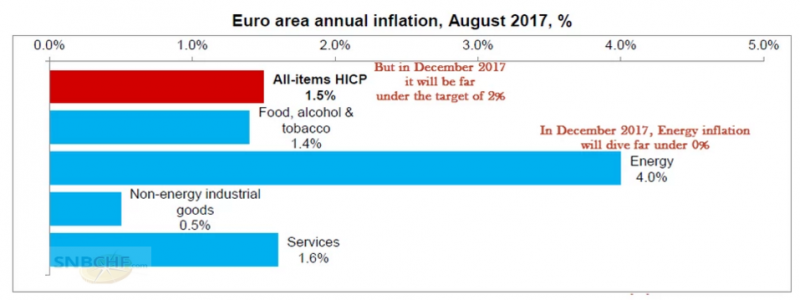

FX Weekly Review, August 28 – September 02: The end of big euro rise?

For us, the sudden euro rise from 1.08 to 1.14 is an illusion, the euro will fall sooner or later again. Macron will not help the French economy and low core inflation will prevent that the ECB ends her bond buying program.

Read More »

Read More »

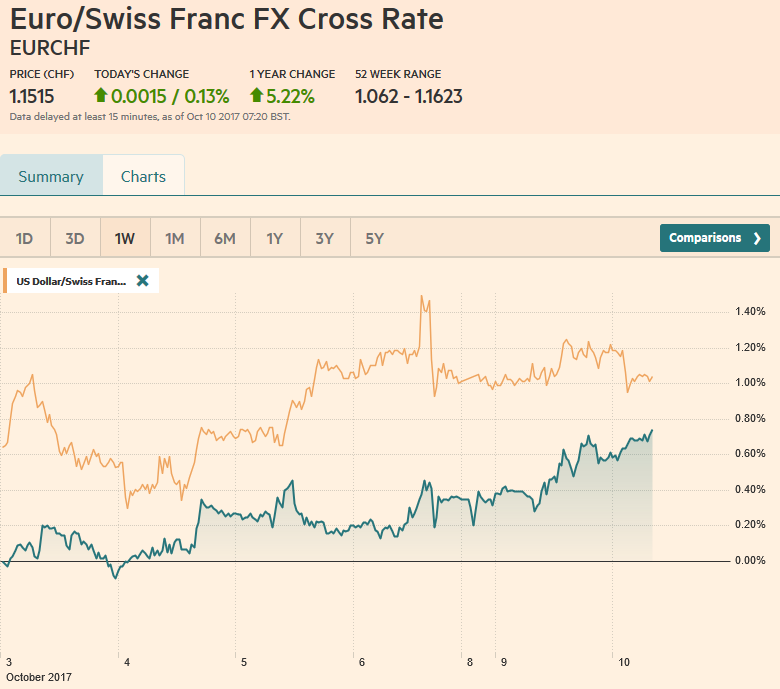

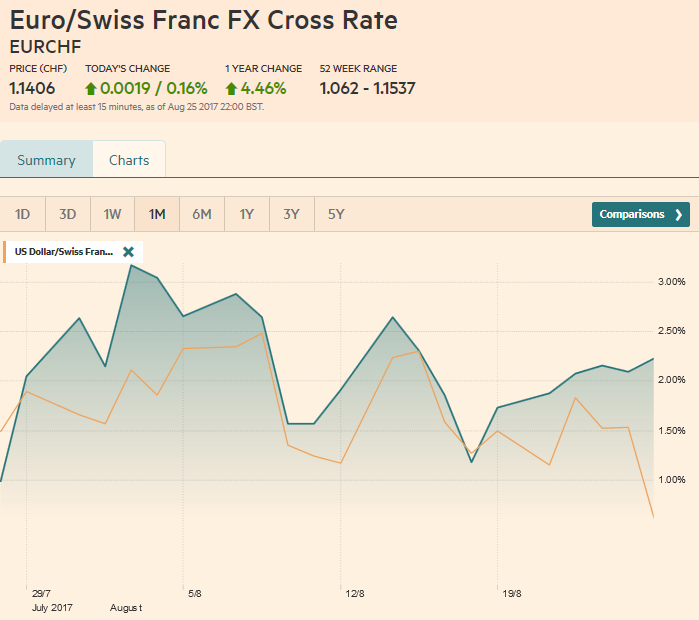

FX Weekly Review, August 21 – August 26: Dollar Loses its Gains Against CHF

The broad technical condition of the dollar deteriorated materially before the weekend. The dollar had some gains versus the franc during the last month, but it lost all during the last days.The EURCHF continues with a 2.5% win for the last month.

Read More »

Read More »