Tag Archive: EU

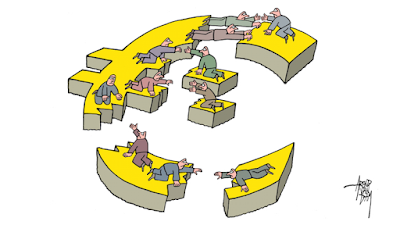

The end of central banking as we know it

The severest crisis the European Central Bank (ECB) ever faced coincided with the early days of a new Executive Board. Over the past year and a half, the board’s six members, including the ECB’s president and vice president, have all been replaced, either because they resigned, or because their eight-year mandate expired.

Read More »

Read More »

FX Daily, January 27: The Fed and Earnings on Tap

Overview: Risk appetites seem subdued even if GameStop's surge draws attention. Asia Pacific equities mostly slipped lower, and profit-taking was seen in Hong Kong and Seoul, which are off to an incredibly strong start to the year. Small gains were reported in Tokyo, Beijing, and Taipei.

Read More »

Read More »

FX Daily, December 17: Dollar Thumped

Overview: The prospects of a UK-EU deal and US stimulus continue to underwrite risk appetites and weigh on the dollar. Equity markets are moving higher. Led by Australia and China, the MSCI Asia Pacific Index rose to new record highs, while Dow Jones Stoxx 600 in Europe is at its best level since February.

Read More »

Read More »

FX Daily, December 16: Greenback Slides Ahead of FOMC as Optimism Underpins Risk Appetites

Overview: The S&P 500 snapped a four-day downdraft helped by optimism over the progress toward fiscal stimulus and some hope that a new trade deal can still be negotiated between the UK and EU. Europe reported better than expected PMIs. Equities are broadly higher, as are interest rates, while the dollar slumps.

Read More »

Read More »

FX Daily, November 19: Surging Virus Saps Risk Appetites

Overview: News that the New York City was closing the schools to contain the virus sent stocks reeling in late North American dealings yesterday and spurred some profit-taking in the Asia Pacific and Europe. Equities in the Asia Pacific region were mostly lower, though China, South Korea, and Australia's advanced and Tokyo markets were mixed.

Read More »

Read More »

FX Daily, November 17: Greenback Remains Under Pressure

Overview: Moderna's announcement did not spur nearly the magnitude of the disruption caused by Pfizer's similar announcement a week ago. Still, in the US, the NASDAQ underperformed the other indices, and the US Dow Industrials saw record highs.

Read More »

Read More »

FX Daily, November 13: Greenback Pares this Week’s Gains while the Turkish Lira Continues to Squeeze Higher

Overview: The largest bourses in the Asia Pacific region followed the US equity market lower, with the Nikkei posting its first loss in nine sessions. China, Hong Kong, and Australia moved lower as well. On the week, the MSCI Asia Pacific Index gained about 1% after rising 6.3% in the prior week.

Read More »

Read More »

FX Daily, November 9: Markets are not Waiting for Official Closure in the US

The new week has begun with robust risk appetites, driving stocks and stocks higher and sending the dollar broadly lower. Nearly all the equity markets in the Asia Pacific region gained more than 1%, except Malaysia and Indonesia.

Read More »

Read More »

FX Daily, September 29: Consolidation Still Featured

A consolidative tone continues across the capital markets. Equities have lost their momentum. The MSCI Asia Pacific Index was mixed, while Europe's Dow Jones Stoxx 600 is paring yesterday's sharp 2.2% gain. US shares are little changed but mostly softer.

Read More »

Read More »

FX Daily, July 22: Pang of Uncertainty Spurs Profit-Taking

The optimism among investors appears to have evaporated in the face of new US-Chinese tensions, possible delays in the next US fiscal stimulus, and new record virus infections in Australia and Hong Kong. US stocks had pared early gains yesterday, and the high-flying NASDAQ finished lower after setting new record highs.

Read More »

Read More »

FX Daily, July 21: Europe and Tech Lift Risk Appetites

Overview: The continued domination of the tech sector and Europe's tentative agreement are lifting equities and risk assets more generally today. Australia and Hong Kong's 2.3%-2.5% rally led Asia Pacific markets. The Dow Jones Stoxx 600 is higher for a third session and above its 200-day moving average for the first time since February.

Read More »

Read More »

FX Daily, July 20: Markets Yawn, Deal or No Deal

Overview: While there are signs that Europe has reached a compromise on the grant/loan issue, the spillover into the markets is quite limited. China, with Shanghai's 3.1% gain, led a few markets in the Asia Pacific region higher, including Japan and India. Most markets were lower, and Europe's Dow Jones Stoxx 600 is a fractionally firmer, recovering from initial losses.

Read More »

Read More »

FX Daily, July 17: Markets Limp into the Weekend

Chinese stocks stabilized after yesterday's sharp fall and most Asia Pacific equity markets, but Tokyo rose today. European shares are little changed, but the Dow Jones Stoxx 600 is still poised to hold on to modest gains for the third consecutive week.

Read More »

Read More »

FX Daily, July 15: The Dollar Slumps and EU Court Rules in Favor of Apple

A recovery in US stocks yesterday, coupled with optimism over Moderna's vaccine, is providing new fodder for risk appetites today. Equities are being driven higher, and the dollar is under pressure. Most equity markets in Asia advanced. China and Taiwan were exceptions, and, in fact, the Shanghai Composite fell for the second consecutive session for the first time in a month.

Read More »

Read More »

FX Daily, June 11: Are Risk Appetites Satiated, or Simply Taking the Day Off?

Many observers are attributing the sell-off in risk assets today to the Federal Reserve's pessimistic outlook, yet, as we note below, the Fed's median GDP forecast this year is better than many international agency forecasts, including the OECD's that was issued yesterday. Moreover, some near-term trends were already in place.

Read More »

Read More »

FX Daily, May 27: China and Hong Kong Pressures are Having Limited Knock-on Effects

Overview: The S&P 500 gapped higher yesterday, above the recent ceiling and above the 200-day moving average for the first time since early March. The momentum faltered, and it finished below the opening level and near session lows. The spill-over into today's activity has been minor. The heightened tensions weighed on China and Hong Kong markets, but Japan, South Korea, Taiwan, and Indian equity markets rose.

Read More »

Read More »

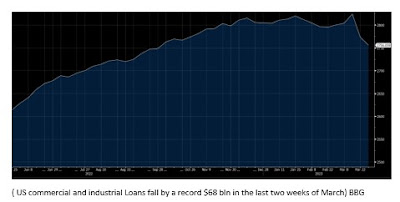

FX Daily, May 20: Fed Funds Futures No Longer Imply Negative Rates

Overview: Another late sell-off of US equities, ostensibly on questions over Moderna's progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little changed, but reflects a split.

Read More »

Read More »

FX Daily, May 19: Optimism Burns Eternal

Overview: Hopes for a vaccine and a German-French proposal to break the logjam at the EU for a joint recovery effort helped propel equities higher yesterday. There was strong follow-through in the Asia Pacific region, where most markets advanced by more than 1% today. However, the bloom came off the rose, so to speak, in Europe. After a higher opening, markets reversed lower, and the Dow Jones Stoxx 600 is off about 0.75% in late morning turnover.

Read More »

Read More »

FX Daily, May 12: Markets Tread Water, Looking for New Focus

Overview: Investors seem to be in want of new drivers, leaving the capital markets with little fresh direction. While Japanese and China equities were little changed, several markets in the region, including Australia, Hong Kong, Taiwan, and India, were off more than 1%. European bourses are mostly higher after the Dow Jones Stoxx 600 slipped 0.4% yesterday.

Read More »

Read More »

Cool Video: TD Ameritrade-Stocks, the Dollar and the Trap Laid by the German Court

Here is a nine-minute clip of a chat I had with Ben Lichtenstein at TD Ameritrade. Ben captures futures traders' energy and breadth of vision. Often in institutional settings, one develops a specialization, but in my experience, futures traders are more likely to look across the markets and asset classes. It is one of the lasting lessons learned early in my career on the floor of the CME.

Read More »

Read More »