Tag Archive: Economics

A Problem Emerges: Central Banks Injected A Record $1 Trillion In 2017… It’s Not Enough

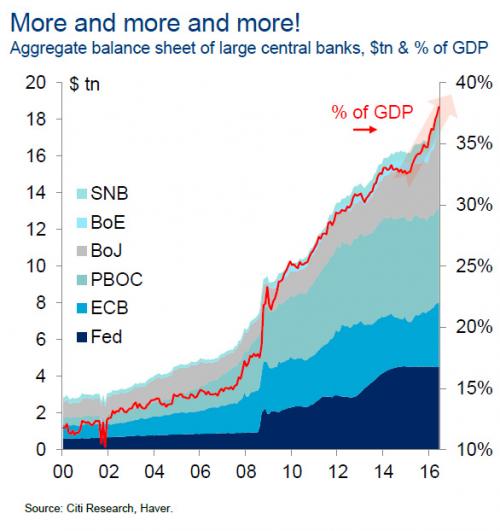

Two weeks ago Bank of America caused a stir when it calculated that central banks (mostly the ECB & BoJ) have bought $1 trillion of financial assets just in the first four months of 2017, which amounts to $3.6 trillion annualized, "the largest CB buying on record."

Read More »

Read More »

True Cognitive Dissonance

There is gold in Asia, at least gold of the intellectual variety for anyone who wishes to see it. The Chinese offer us perhaps the purest view of monetary conditions globally, where RMB money markets are by design tied directly to “dollar” behavior. It is, in my view, enormously helpful to obsess over China’s monetary system so as to be able to infer a great deal about the global monetary system deep down beyond the “event horizon.”

Read More »

Read More »

Video: The Swiss National Bank Is Acting Like A Hedge Fund

We discuss the fact that Central Banks have basically morphed into Hedge Funds with similar risky investing strategies, except they buy without any regard to the underlying fundamentals of the assets they are buying. When did the Swiss Citizens say it was the proper role for the Swiss National Bank to be buying US Stocks? How is this stimulating the Swiss Economy?

Read More »

Read More »

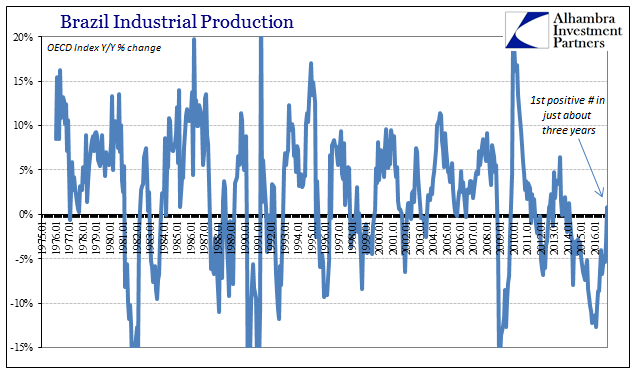

Brazil: Continuing Problems

The cruelest part, perhaps, of this economic condition globally is how it plays against type. In all prior cycles, economies of all kinds and orientations all over the globe would go into recession and then bounce right of it once at the bottom. It was often difficult to see the bottom, of course, but once recovery happened there was no arguing against it.

Read More »

Read More »

80 percent Of Central Banks Plan To Buy More Stocks

Regular readers remember how, when we first reported around the time of our launch eight years ago that central banks buy stocks, intervene and prop up markets, and generally manipulate equities in order to maintain confidence in a collapsing system, and avoid a liquidation panic and bank runs, it was branded "fake news" by the established financial "kommentariat."

Read More »

Read More »

Toward A New World Order, part III

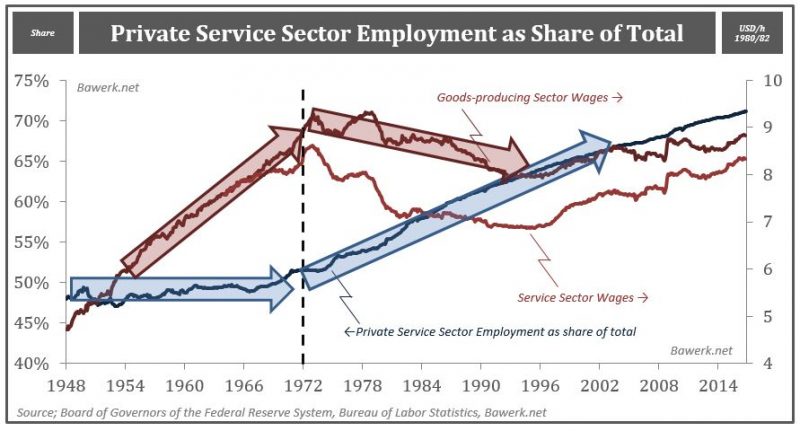

A new world order is coming of age and the transition is painful to accept for a Western middle class with a deep-seated sense of entitlement. We showed how the West feels threatened globally in Toward a New World Order and followed up explaining how this translate into domestic politics in Toward a New World Order Part II. We will now continue this series by showing how gross economic mismanagement have created the new political class that we...

Read More »

Read More »

WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but... growth, and inflation, and supply cuts, and growth again... Well that de-escalated quickly... As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th.

Read More »

Read More »

Former CEO Of UBS And Credit Suisse: “Central Banks Are Past The Point Of No Return, It Will All End In A Crash”

Remember when bashing central banks and predicting financial collapse as a result of monetary manipulation and intervention was considered "fake news" within the "serious" financial community, disseminated by fringe blogs? In an interview with Swiss Sonntags Blick titled appropriately enough "A Recession Is Sometimes Necessary", the former CEO of UBS and Credit Suisse, Oswald Grübel, lashed out by criticizing the growing strength of central banks...

Read More »

Read More »

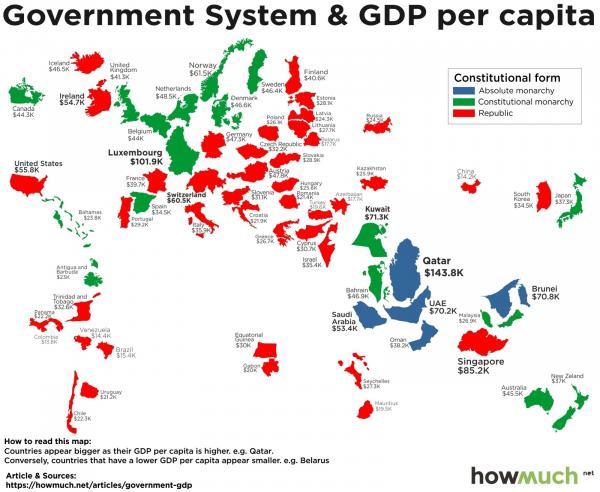

Which Government System Is The Best For People’s Wealth?

We have created a map which shows the per-capita GDP based upon the type of government in a country. The larger the country appears on the map, the higher the GDP per capita.

Read More »

Read More »

Toward a New World Order, Part II

One of the most widespread misconceptions in the realm of politics is the notion of a left-right axis. This has been used over and over to explain political outcomes and paint the various factions as polar opposites. For example, in the US the two main parties, the Republicans (right) and Democrats (left), are often portrayed as a fight between good and evil.

Read More »

Read More »

Fed GDP Projections

“It is not surprising the Fed once again failed to take action as their expectations for economic growth were once again lowered. In fact, as I have noted previously, the Federal Reserve are the worst economic forecasters on the planet.

Read More »

Read More »

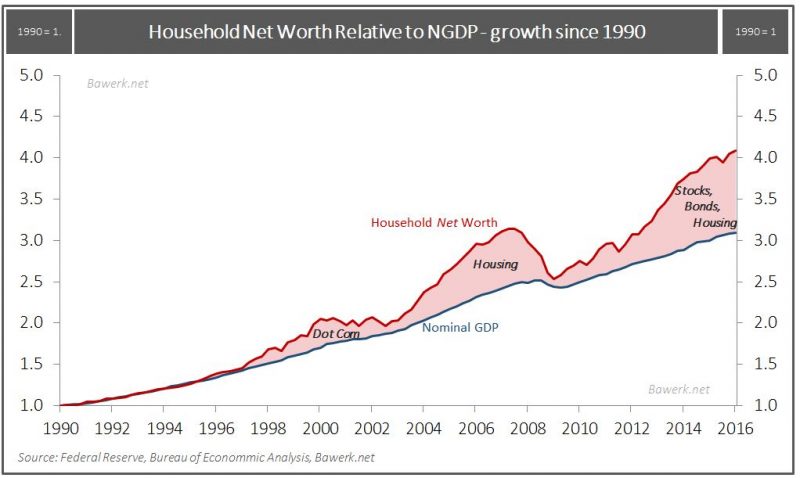

Do our money managers really believe this will end well?

An economic bubble is essentially an economic activity that cannot sustain itself without a continuous influx of new money and credit to bid away real resources from self-funding endeavors. Financial bubbles are obviously closely related as financial...

Read More »

Read More »

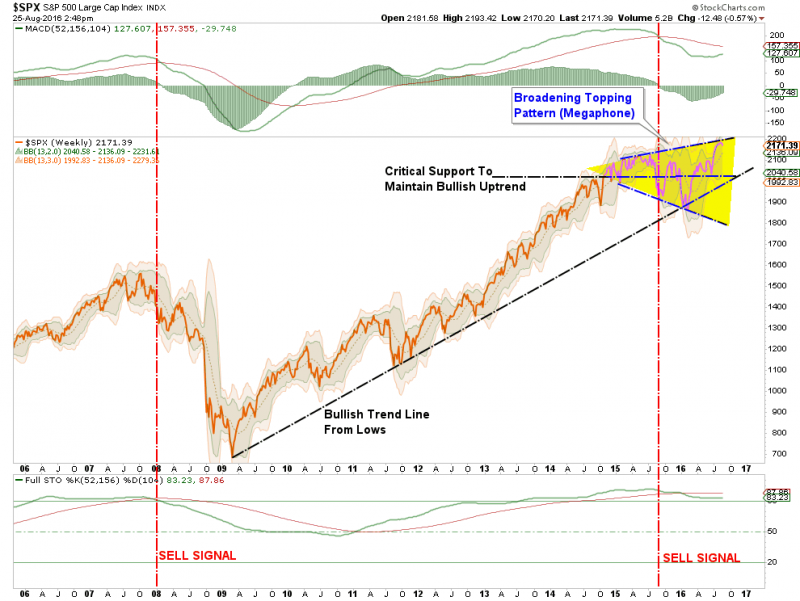

Weekend Reading: Another Fed Stick Save, An Even Bigger Bubble

As I noted on Thursday, the Fed non-announcement gave the bulls a reason to charge back into the markets as “accommodative monetary policy” is once again extended through the end of the year. Of course, it is not surprising the Fed once again failed ...

Read More »

Read More »

Labour Productivity, Taxes and Okun’s Law

The great “science” of economics once discovered an empirical relationship between GDP and unemployment that has been dubbed Okun’s Law. It simply states that the unemployment rate rises as GDP contracts, or vice versa, as production shrinks less peo...

Read More »

Read More »

Mission Creep – How the Fed will justify maintaining its excessive balance sheet

FOMC have changed their normalizing strategy several times and we now see the contours of yet another shift. The Federal Reserve was supposed to reduce its elevated balance sheet before moving interest higher as it would be impossible to increase the fed funds rate in the old fashioned way when the market was saturated with trillions of dollars in excess reserves.

Read More »

Read More »

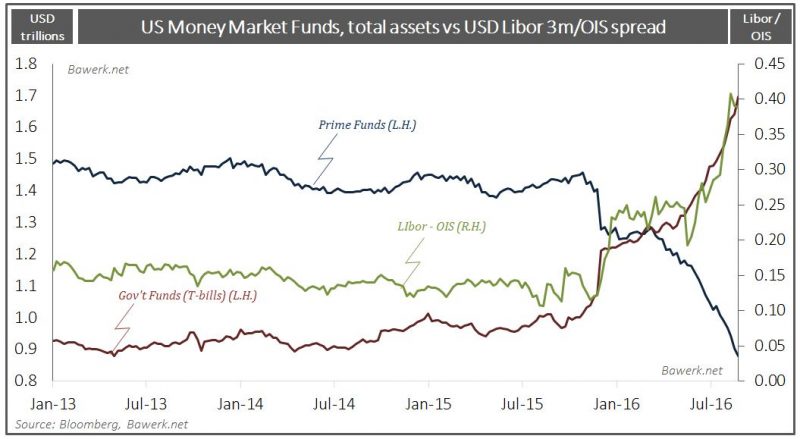

Weekend Reading Negative Rates: The Coin Flip Market

As summer begins to fade, and kids return to school, the focus once again turns to the annual event of Central Bankers in Jackson Hole, Wyoming. However, if you only looked at the market as a gauge as to the excitement of the event, well it must have been one pretty boring after-party.

Read More »

Read More »

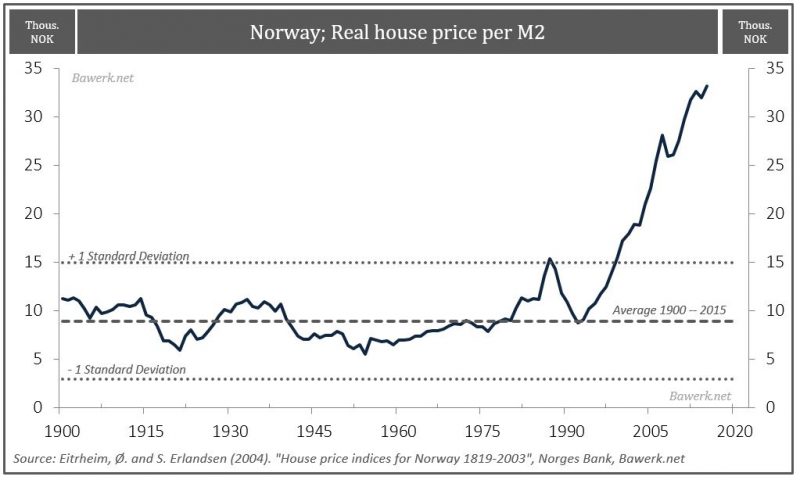

Norway: Towards Stagflation

We have all heard the incredible stories of housing riches in commodity producing hotspots such as Western Australia and Canada. People have become millionaires simply by leveraging up and holding on to properties. These are the beneficiaries of a global money-printing spree that pre-dates the financial crisis by decades.

Read More »

Read More »

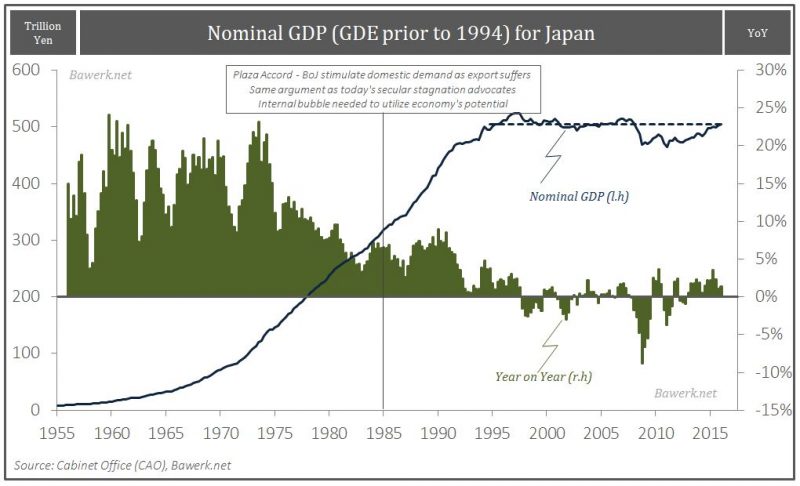

Stupid is What Stupid Does – Secular Stagnation Redux

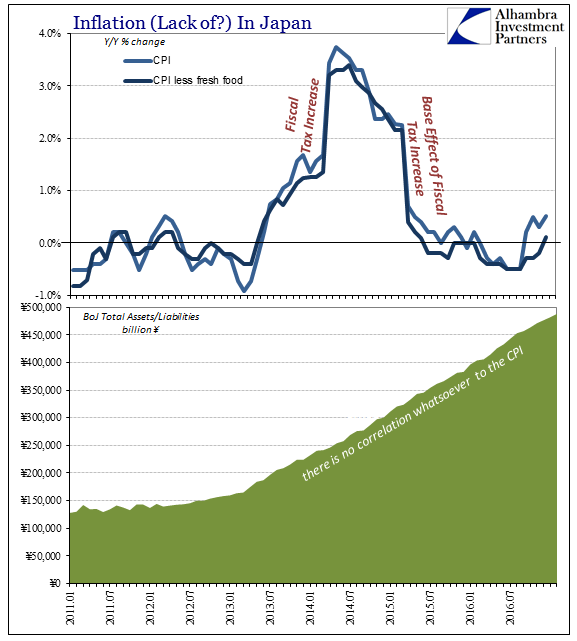

Which country, the United States or Japan, have had the fastest GDP growth rate since the financial crisis? Due to Japan’s bad reputation as a stagnant, debt ridden, central bank dependent, demographic basket case the question appears superfluous. The answer seemed so obvious to us that we haven’t really bothered looking into it until one day we started thinking about the demographic situation in the two countries.

Read More »

Read More »

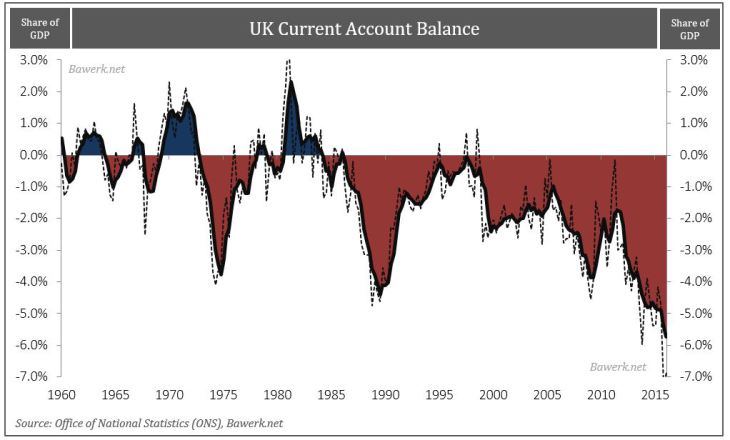

Brexit or not, the pound will crash

Status quo, as our generation know it, established in 1945 has plodded along ever since. It is true that it have had near death experiences several times, especially in August 1971 when the world almost lost faith in the global reserve currency and in 2008 when the fractional reserve Ponzi nearly consumed itself. While the recent Brexit vote seem to be just another near death experience.

Read More »

Read More »

Money confuses and blurs economic relations

Money, generally accepted medium of exchange, acts as a veil that confuse and blurs economic relations. This is especially true when it comes to intertemporal considerations. Whilst probably the most important institution in a free market, money can be highly destructive when politicized.

Read More »

Read More »