Tag Archive: ECB

ECB Measures Background: How to Reduce German Competitiveness and Talk down the Euro

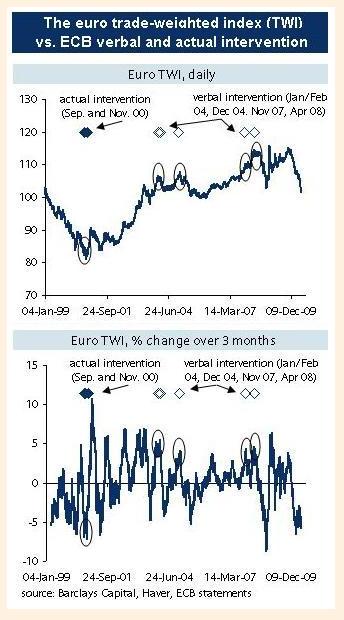

In our view, the ECB measures of June 2014 want to increase German lending, spending, salaries and inflation. Finally they target a reduction of German competitiveness. The ECB wanted to talk down the euro but will not succeed. We explain why the measure are bullish for the euro. We expect EUR/USD of 1.40 in the … Continue...

Read More »

Read More »

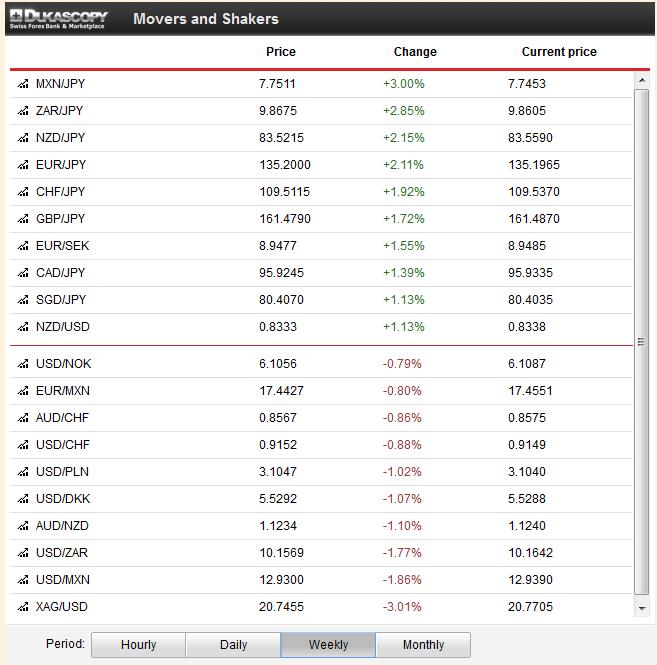

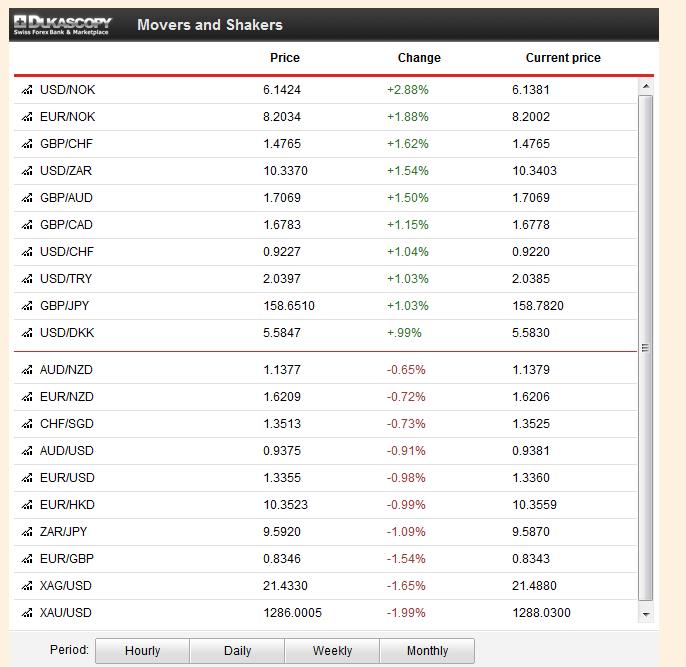

Fundamentals,FX,Gold and CHF:Week November 18 to November 22

Fundamentals with highest importance: The HSBC Flash Purchasing Manager Index (PMI) for China weakened from 50.8 to 50.4. In particular, new export orders, output prices and employment started to decrease again, while output increased. The preliminary Markit manufacturing PMI for the United States edged up to 54.3 (vs. 52.3 expected), a 9-month high after the …

Read More »

Read More »

Fundamentals,FX,Gold and CHF:Week November 11 to November 15

Fundamentals with highest importance: In Janet Yellen’s hearing at the Senate Banking Commission, the future Fed chair emphasized the need to provide support to the economic recovery and to overcome low inflation. Her speech supported equities, gold and US Treasuries. GDP in the Euro zone rose by 0.1% QoQ in line with expectations, but less …

Read More »

Read More »

Fundamentals,FX,Gold and CHF: Week November 4 to November 8

Fundamentals with highest importance: The U.S. GDP release for Q3, showed that despite the recent U.S. critique with Germany, the Americans are trying to follow the successful Germans: for the first time since Q1/2012 and Q2/2011 exports rose more than imports. GDP was up 2.8%, but not driven by consumption, it was mostly helped by …

Read More »

Read More »

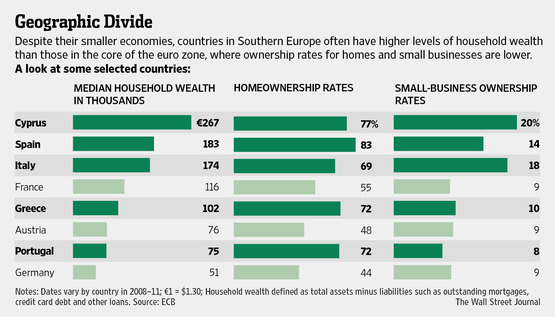

The European Transfer Union From North To South and from Poor to Rich between 1999 and 2007

Cheap ECB rates and rising home prices helped to enrich Southern Europeans between 1999 and 2007. Germany's middle-class and poor, most of them not owning a home, were the ones that financed it.

Read More »

Read More »

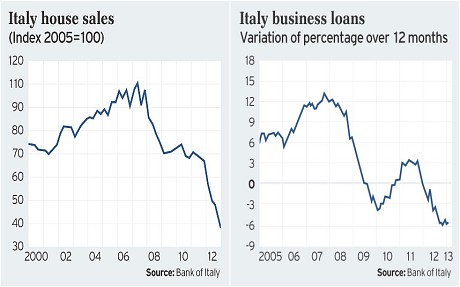

European Wealth Reports: Why “Median” Italians are Far Richer than Germans

We explain why according to the European wealth reports "median" Italians are more wealthy than Germans. The main reasons are high savings and accumulation of wealth for the average family until the 1990s, often invested in homes and real estate. Low ECB interest rates finally let the value of the home rise strongly.

Read More »

Read More »

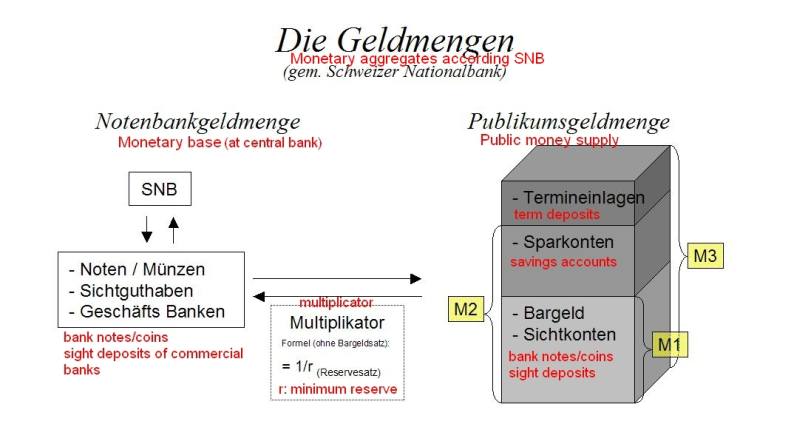

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

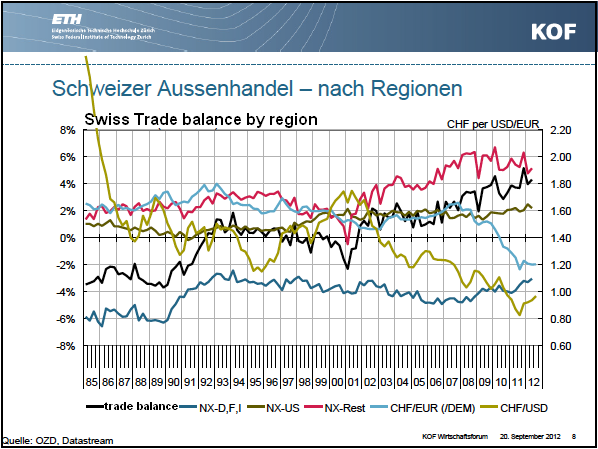

Potential losses due to money printing are for the Fed: 1.2% of GDP, Bundesbank: 5% of GDP, SNB: 12% of GDP.

Read More »

Read More »

Ways to the Northern Euro

Two ways for building the Northern euro, exit of Southern members or slow creation of Northern euro with currency interventions of central banks.

Read More »

Read More »

Because They Knew What They Were Doing: The Parallels between European and SNB Leaders

Similarly as European leaders knew what they were doing with the euro, namely introducing a not feasible currency, Swiss National Bank did between 2005 and 2008, namely the absolutely wrong thing.

Read More »

Read More »

The Fairy Tale of Rising Competitiveness in the European Periphery

In our post we look on two questions concerning competitiveness for the European periphery: When will local production be cheaper than imported products? Do people have the money to buy these local products? It does not help reducing labor costs if local production costs still more than imported products. The second aspect is: even if …

Read More »

Read More »

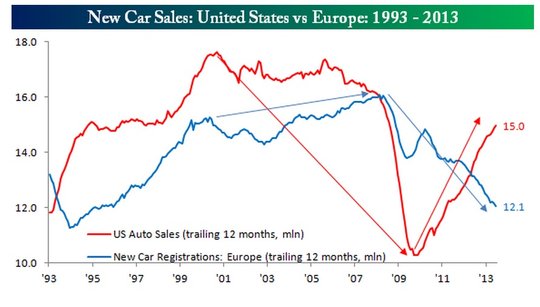

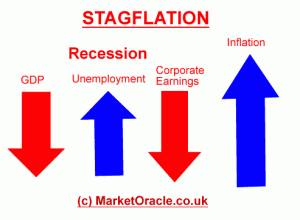

Euro Morons: Hyperinflation Successfully Avoided, Stagflation Successfully Created

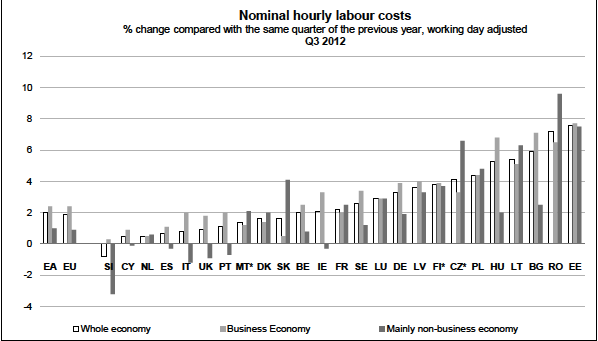

Keeping Greece in euro zone, eurocrats or better “euro morons” have successfully avoided a weak drachma and a following Greek hyperinflation. Instead they successfully created stagflation. Currently European HICP inflation is at 2.5%, far above the max. 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% …

Read More »

Read More »

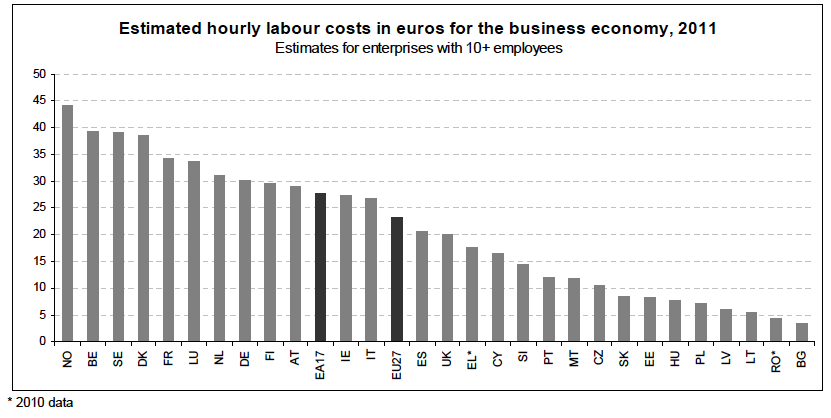

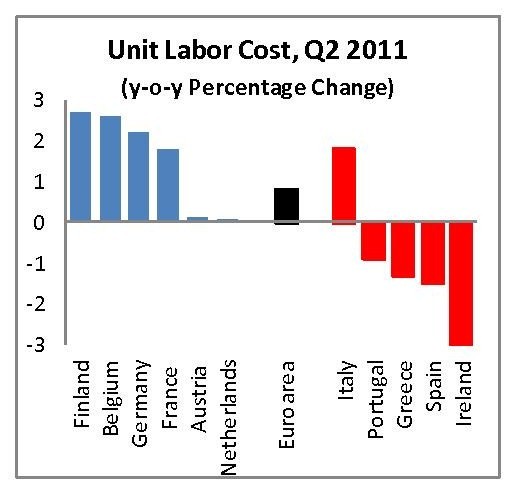

Falling Unit Labour Costs, but Rising Production Prices in the Periphery. Is this Competitiveness?

Currently European HICP inflation is at 2.5%, far above the 2.0% official ECB mandate, but the euro is becoming weaker and weaker. German salaries are rising with 2.6% per year. At the same time, the ECB cannot hike interest rates, because it wants to provide cheap money to the periphery. The periphery continues to buy German products, even …

Read More »

Read More »

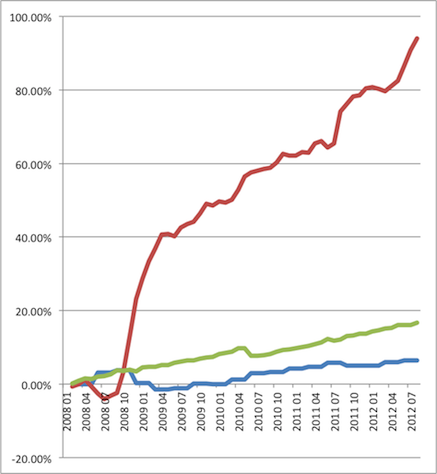

SNB Monetary Data Week October 26

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Despite the seasonal effects between October and March, the SNB is not able to sell currency reserves consistently. Traditionally the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was possibly already anticipated …

Read More »

Read More »

SNB Monetary Data Week October 19

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks appreciation was …

Read More »

Read More »

SNB Monetary Data Week October 12

Seasonal effects, the good months for the SNB and the US economy, but weaker ones for emerging markets and Switzerland, have started Given that the seasonal effects between October to March have started, the SNB might be able to sell some currency reserves. Traditionally both the USD gets stronger and stocks rise over the autumn months till January. This year’s stocks …

Read More »

Read More »