Tag Archive: ECB

Meanwhile, Outside Today’s DC

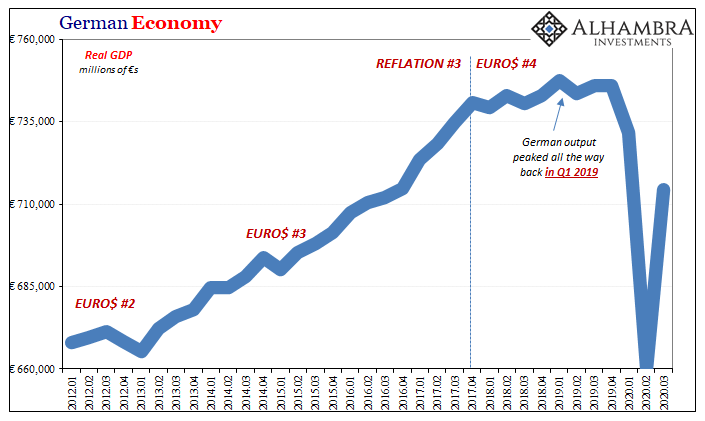

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage.

Read More »

Read More »

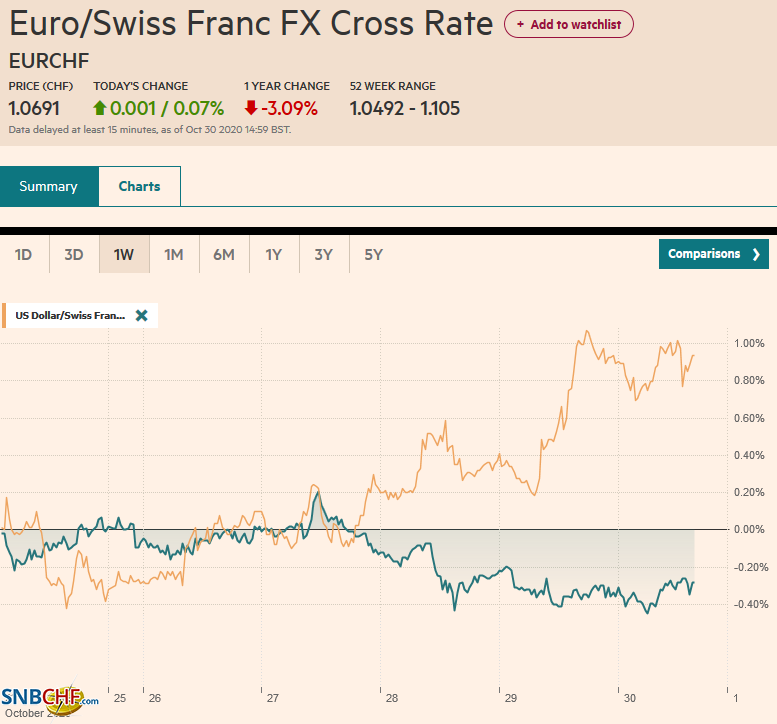

FX Daily, October 30: Investors Scared Before Halloween

Investors punished US tech giants for not delivering perfection as prices apparently had discounted, and the subsequent sell-off coupled with month-end dynamics has rocked global equities. Asia Pacific bourses were a sea of red, led by a 2.5% decline in the tech-heavy South Korean Kospi, but most major markets were off more than 1%.

Read More »

Read More »

FX Daily. October 29: Markets Continue to Struggle

The spreading virus that is shutting down large parts of Europe, while the US is reluctant to return to lockdowns and refuses to have a nationwide requirement for masks in public hit risk assets yesterday. The S&P posted its largest decline in four-months yesterday (~3.5%), and the selling carried into the Asia Pacific region.

Read More »

Read More »

FX Daily, October 27: Markets Take Collective Breath and Beijing Tweaks Fixing Mechanism

The surging pandemic sapped the risk-taking appetites as some investors hunker down for what could be a volatile period ahead. The S&P 500 lost nearly 3% at its lows before rebounding 1% in late dealings.

Read More »

Read More »

FX Daily, October 16: Deja Vu All Over Again

It was like deja vu all over again. First, the market reacted immodestly to headlines indicating there was little chance of pre-election fiscal stimulus in the US. It was hardly new news. Then the market seemed to react with surprise that there was no last-minute breakthrough in the UK-EU trade negotiations.

Read More »

Read More »

FX Daily, October 14: UK Blinks on Threat to Walk Away on Eve of EU Summit

Overview: Turn around Tuesday saw the dollar bounce, particularly against the Australian dollar and European currencies, among the majors. Sterling pared earlier losses on reports that the UK would not walk away from the talks just yet, while the euro remains on its back foot.

Read More »

Read More »

FX Daily, October 08: Markets Catch Collective Breath

The S&P 500 and NASDAQ closed at their highest levels in around a month yesterday, recouping Tuesday's presidential tweet-driven drop. We thought the market overreacted to the end of the fiscal talks as many had already recognized that a stimulus agreement was unlikely before the election, but the near round-trip seen in stocks and bonds was surprising.

Read More »

Read More »

FX Daily, September 29: Consolidation Still Featured

A consolidative tone continues across the capital markets. Equities have lost their momentum. The MSCI Asia Pacific Index was mixed, while Europe's Dow Jones Stoxx 600 is paring yesterday's sharp 2.2% gain. US shares are little changed but mostly softer.

Read More »

Read More »

FX Daily, September 25: Sentiment Remains Fragile Ahead of the Weekend

The dramatic week is finishing on a quieter note. The modest gains in US equities yesterday helped the Asia Pacific performance today. Most markets but China and Hong Kong pared the weekly losses, and easing regulations in Australia spurred a rally in financials that saw its stock market close higher on the week.

Read More »

Read More »

FX Daily, September 24: Darkest Before Dawn

The two recent market developments, push lower in stocks, and higher in the dollar is continuing. Tuesday's gains in the S&P 500 and NASDAQ were unwound on Wednesday and this is helping drag global markets lower. The MSCI Asia Pacific Index fell for the fourth consecutive session today and many markets (India, Shenzhen, Taiwan, and Korea) fell more than 2% and most others were off more than 1%.

Read More »

Read More »

FX Daily, September 21: Risk Appetites Join Tokyo on Vacation

Global equity markets are off to a poor start to the week, and the dollar appears to be enjoying a safe-haven bid. Tokyo markets are closed until Wednesday, while Asia-Pacific stocks tumbled, and the regional index is unwinding last week's gains. The Dow Jones Stoxx 600 is off around 2.7% near midday in Europe.

Read More »

Read More »

FX Daily, September 18: When Every Thing is Said and Done, More is Said than Done

Asia Pacific equities have taken the march on the US. Led by a 2% rally in Shanghai, most regional markets but Australia closed the week with gains. A two-week fall in the MSCI Asia Pacific Index has been snapped. European stocks are little changed, and the Dow Jones Stoxx 600 is holding on to its second week of gains.

Read More »

Read More »

FX Daily, September 11: Still Reluctant to take Euro above $1.19 but Sterling Remains Unloved

Yesterday's roller-coaster price action has not had much impact on today's activity. The slide in US equities after early gains failed to prevent Japanese, Chinese, and Hong Kong equities from advancing, though other markets in the region were not as resilient.

Read More »

Read More »

FX Daily, September 10: ECB and Beyond

Overview: A strong recovery in US stocks, a softer dollar, and higher gold and oil prices may signal the end of the brief though dramatic correction, but the market is in a bit of a holding pattern ahead of the ECB meeting. Most of the major equity markets in the Asia Pacific region stabilized, except for Hong Kong and China.

Read More »

Read More »

FX Daily, September 09: Investor Anxiety Continues to Run High Despite Some Stability in the Capital Markets

News that the AstraZeneca Phase 3 test had to be stopped to study the adverse reaction of one subject added to the uncertainty of investors amid one of the more significant reversals of risk appetites since March. Equities continued to slump in the Asia Pacific region, with many large markets off more than 1%, led by Australia's more than 2% decline.

Read More »

Read More »

FX Daily, September 3: Corrective Forces Maintain Grip

The US dollar is continuing to recover after hitting new lows earlier in the week. It is lower against all the major currencies and most of the emerging markets. A report in the Financial Times suggesting that there is a concern about the euro's recent strength at the ECB has added a bit more fuel to the move, and the euro, which had pushed above $1.20 earlier in the week, briefly traded below $1.18.

Read More »

Read More »

FX Daily, September 2: Corrective Pressures Give the Greenback a Reprieve

After poking above $1.20 for the first time in more than two years, the euro reversed lower yesterday and is continuing to succumb to profit-taking pressures today. Comments from ECB's Lane appeared to trigger a reversal yesterday throughout the currency markets.

Read More »

Read More »

FX Daily, September 1: Dollar Lurches Lower

The US dollar has been sold-off across the board. The euro approached $1.20, and sterling neared $1.3450. The greenback traded below CAD1.30 for the first time since January. Most emerging market currencies but the Turkish lira, are also advancing today.

Read More »

Read More »

FX Daily, August 31: Month-End Gyrations and the Fed’s Ad Hocery

Markets are searching for direction at month-end. Asia Pacific shares outside of Japan lower. Berkshire Hathaway confirmed taking a $6 bln stake in Japanese trading companies over the past year, and the pullback in the yen helped lift shares. The MSCI Asia Pacific Index rose 2% last week.

Read More »

Read More »

Science of Sentiment: Zooming Expectations Wonder

It had been an unusually heated gathering, one marked by temper tantrums and often publicly expressed rancor. Slamming tables, undiplomatic rudeness. Europe’s leaders had been brought together by the uncomfortable even dangerous fact that the economic dislocation they’ve put their countries through is going to sustain enormously negative pressures all throughout them. What would a “united” European system do to try and fill in this massive hole?The...

Read More »

Read More »