Tag Archive: Deposits

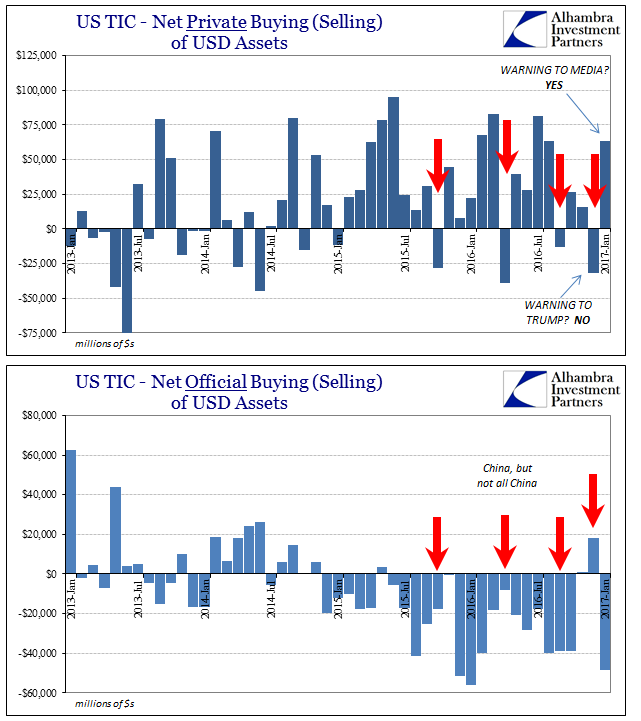

TIC Analysis of Selling

When the Treasury Department released its Treasury International Capital (TIC) data for December, what was a somewhat obscure report suddenly found mainstream attention. Private foreign investors had sold tens of billions in US securities primarily US Treasury bonds and notes which the media then made into some kind of warning to then-incoming President Trump. It was supposed to be a big deal, the kind of rebuke reserved for disreputable leaders of...

Read More »

Read More »

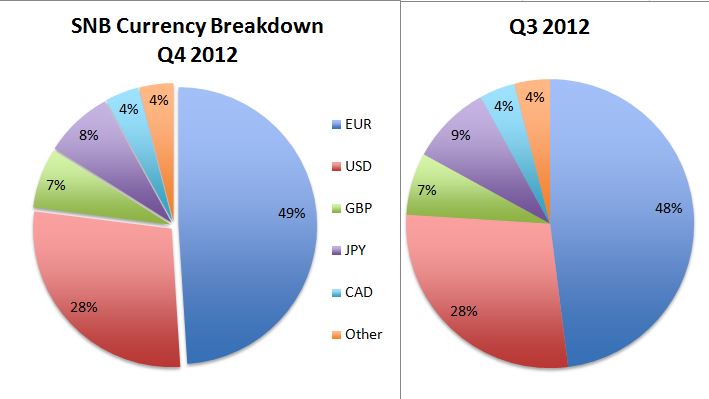

SNB Reserves Rise by 8 bln. CHF Thanks to Stronger USD, GBP, CAD and some FX Purchases

In March 2013, the foreign currency reserves of the Swiss National Bank (SNB) rose by 8 bln. CHF from 437 bln. to 445 bln. mostly thanks to valuation gains on US dollar, sterling and Canadian dollar. full details

Read More »

Read More »

Dijsselbloem: The End of the Bankers’ and Bond Holders’ Moral Hazard

We have insisted in several posts that the northern euro zone is very reluctant to continuously bail out the periphery and in particular its banks. The euro group chief Dijsselbloem has confirmed this now.

Read More »

Read More »

SNB Sight Deposits: Only Slight Increase of 370 Million Francs despite Cyprus

The SNB published the weekly monetary data for the week of the "Cyprus crisis": SNB sight deposits are slightly up 400 million francs, mostly due to local banks. Details

Read More »

Read More »

In Week Before Cyprus SNB Sight Deposits Rise Slightly by 250 Million Francs

The SNB published the weekly monetary data for the week before the Cyprus event: SNB sight deposits are slightly up 250 million francs, mostly due to other sight deposits (companies, the Swiss confederation, foreign banks) while local banks reduced their deposits slightly. Details

Read More »

Read More »

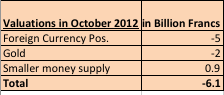

SNB Valuation Losses in October: Around 6 Billion Francs

The Swiss National Bank (SNB) had valuation losses of around 6 billion francs in October due to the weaker EUR/CHF exchange rate and a weaker gold price.

Read More »

Read More »

Isn’t it wonderful to trade with a strong central bank behind you?

Isn’t it wonderful to have a strong central bank like the SNB sitting behind you when trading Forex? Losses are limited to the floor of 1.20 and in the meantime you can gain forward swaps with the higher euro zone interest rates. Today the Swiss National Bank (SNB) decided in its monetary policy assessment …

Read More »

Read More »

SNB prints nearly 5 billion francs in one week, FX traders poised to get ripped off

As we expected in our post “What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?“, long-time investors, global macro funds and US investment banks are moving into gold and the Swiss franc again. The SNB had to buy euros and print new Swiss francs of around 5 billion francs last week, as … Continue reading »

Read More »

Read More »

What’s this crazy movement in EUR/CHF ? SNB Floor Hike ?

On Friday there was a big movement in the EUR/CHF. First it went up to 1.2154, fell later down to 1.2080 in the main American trading and rose again to 1.21 in the low-volume trading time. We repeat our entry from Friday, because we continuously updated the post after new developments, e.g. after the … Continue reading »

Read More »

Read More »

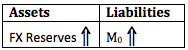

The Big Swiss Faustian Bargain: Differences between SNB, ECB and Fed Money Printing Explained

In this post we show that the risks the Fed, the ECB and the Bundesbank incur are far smaller than the one the Swiss SNB takes. The Fed has “just” an inflation risk, that could cost 200 billion US$, 1.2% of US GDP. The ECB and Bundesbank have the risk that the euro zone splits … Continue reading »

Read More »

Read More »

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »

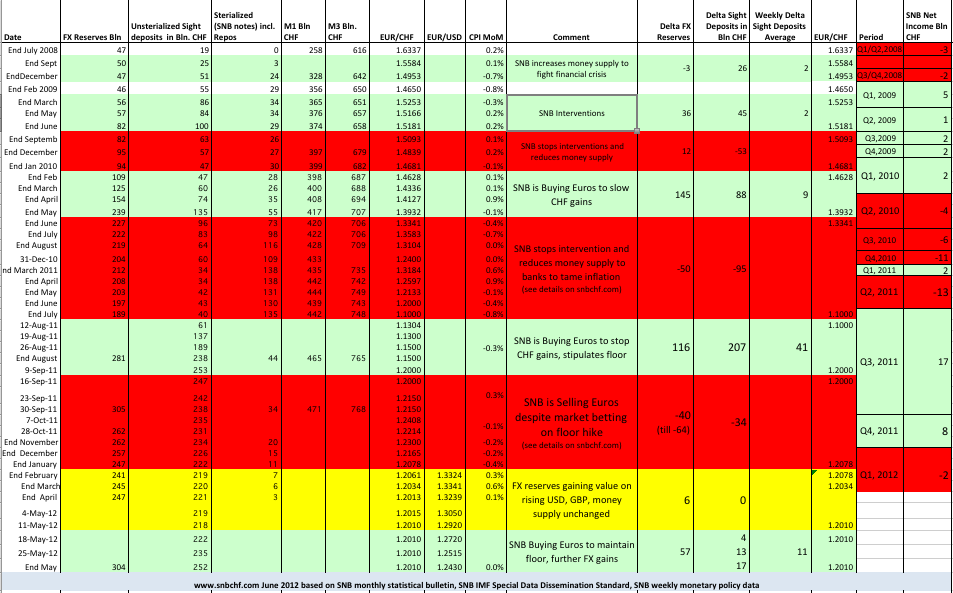

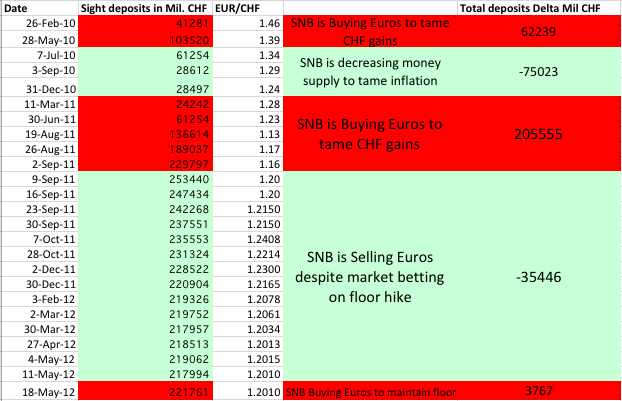

Another week, another 14 bln. francs printed

According to the newest monetary data, in the week ending June 8th, the unsterialized money supply (as measured in sight deposits of domestic and foreign banks and deposits by the Swiss confederation) increased by 14 billion Swiss francs.

Read More »

Read More »

A central bank running suicide ? SNB prints at pace never seen since EUR/CHF parity in August 2011

The most recent money supply data from the Swiss National Bank (SNB) has shown increases of huge amounts. As compared with its loss of 19 bln. francs in 2010 (3% percent of the Swiss GDP), the central bank printed tremendous 17.3 bln. in the week ending in June 1st and 13 bln. in the one …

Read More »

Read More »

Huge rise in Currency Reserves: The SNB has restarted the printing press

The game for the Swiss National Bank seems to have changed completely. Again the central bank had increase money supply, as measured by deposits at the SNB by local banks and other sight deposits, this time even by 13219 mil. francs (source). This money printing implies that the SNB had to buy in Euros in …

Read More »

Read More »

SNB’s Jordan admits that EUR/CHF floor will not be raised

For the first time the chairman of the Swiss National Bank Jordan has admitted that the EUR/CHF floor of 1.20 will not be raised. In an interview with the Swiss Sonntagszeitung, here also cited by Bloomberg, he said:

Read More »

Read More »

Rumors about tax on Swiss deposits for foreigners and further SNB measures: SNB begging for pips

Exactly when the US had a relatively good Markit Flash PMI, rumors are sent out that deposits in CHF for foreigners should be taxed. To send out this rumor together with good US data seems to be intentional. According to Banque CIC the SNB has declined to comment. We remember the last SNB meeting when similar rumors circulated.

Read More »

Read More »

Will the SNB double or triple the forex reserves before they give in ?

Some economists have claimed that the Swiss National Bank (SNB) will be always able to maintain the floor. As opposed to George Soros’ defeat of the Bank of England, the SNB is able to print money ad infinitum, whereas the BoE had limited currency reserves to support sterling. The question, however, is where this “infinitum” …

Read More »

Read More »

Is the play time over for the SNB ? SNB Buys Euros Again, but the EUR/CHF does not move a pip

As also noticed by Credit Suisse, the Swiss National Bank had to buy euros and sell Swiss francs in the week of May 11th to May 18th. Their recent easy strategy to sell euros and buy Swiss Francs and to diversify from euros into other currencies may not continue.

Read More »

Read More »

Former SNB chief economist: Capital controls are just empty words

A former SNB chief economist says that capital controls are impossible, just empty words. In case of a Euro break-up the Swissie must rise together with USD, GBP and JPY An article, surprisingly from the usually left-wing Tagesanzeiger, more or less closely translated with some additional remarks.

Read More »

Read More »

SNB buys Swiss Francs and sells Euro: Welcome to the EUR/CHF peg

Why the big Q1 loss of the SNB was actually a big win for the central bank Anybody watching the EUR/CHF exchange rate this year was wondering why the volatility the pair saw last year had completely left. The pair slowly fell from 1.2156 over 1.2040 at the end of Q1 to 1.2014 today. FX … Continue reading...

Read More »

Read More »