Tag Archive: Daily Market Update

Gold Looks A Better Bet Than UK Property

Dominic Frisby of Money Week looks at the historical relationship between UK house prices and gold (including some great charts), and concludes that your money is better off in the yellow metal than bricks and mortar.

Read More »

Read More »

Gold Mining Supply Looks Set To Decline

Global demand for gold is increasing while new discoveries of gold remain small. Gold mining output in Australia is forecast to decrease by 50% in the next eight years. Decline in global gold mining supply makes a price increase almost certain.

Read More »

Read More »

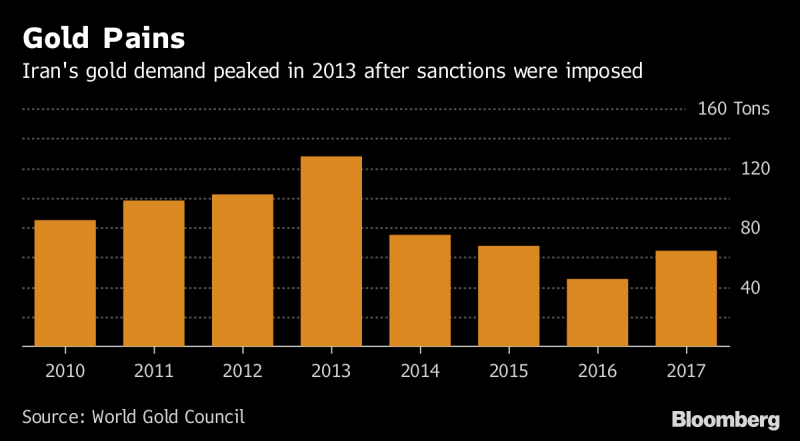

Iran’s Gold Demand May Surge On Trump Sanctions

Iran’s gold demand will probably be “strong” for the next few months and then gradually decline as U.S. sanctions start to take effect, according to the researcher who covers the country for Metals Focus Ltd. After a previous set of sanctions was imposed on Iran in 2012, it took two years for the country’s gold demand to start falling, according to data from the World Gold Council.

Read More »

Read More »

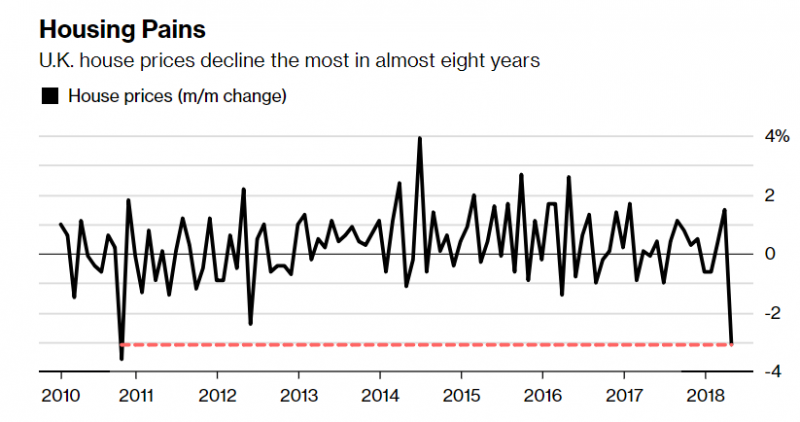

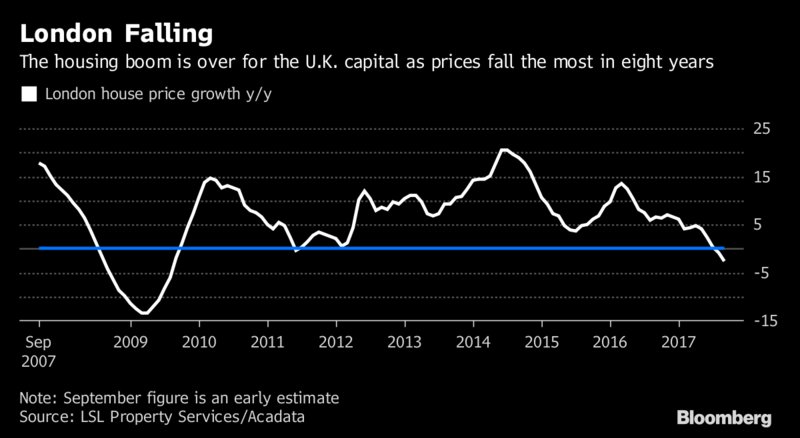

U.K. Home Prices Plunge 3.1percent In April – Largest Monthly Drop Since Financial Crisis In 2011

U.K. home prices plunged the most in almost eight years in April, adding to signs of weakness in Britain’s property market. Values dropped 3.1 percent from March to an average 220,962 pounds ($299,140), mortgage lender Halifax said in a report Tuesday. That’s the biggest drop since September 2010. While that figure can be volatile, the quarterly measure also showed a decline. It fell 0.1 percent, a third straight drop.

Read More »

Read More »

Own Some Gold and Avoid Overvalued Assets

We could be heading for a golden age – or a return to the 1970s. The cost to the US government of borrowing money for a decade came within sniffing distance of 3% yesterday. The US ten-year Treasury yield is sitting at 2.96% as I write this morning, having got to 2.99% yesterday. Does this really matter? After all, 3% is just another number.

Read More »

Read More »

“Blood In The Streets” Of U.S. Gold Bullion Coin Market

Sales of U.S. Mint American Eagle gold coins dropped to their weakest April since 2007, while silver coin purchases for the month rose 10 percent higher than last year, U.S. government data showed on Monday. The U.S. Mint sold 4,500 ounces of American Eagle gold coins in April, down 25 percent from the year prior. However, April sales were up 29 percent from March.

Read More »

Read More »

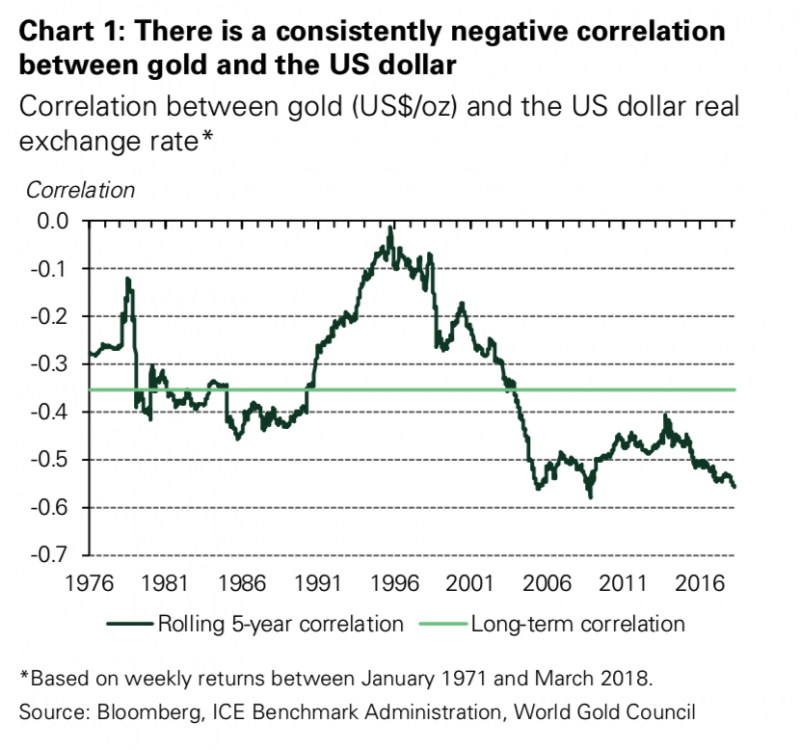

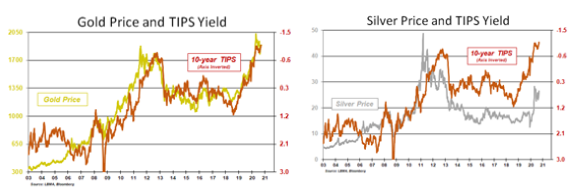

Gold Price Increasingly Influenced By Declining Dollar Rather Than Interest Rates

Gold Price Gains Due To Declining Dollar Rather Than Interest Rates. Investors should not be put off by higher interest rates, World Gold Council research finds they do not always have a negative impact on gold. Only short-term movements in gold are ‘heavily influenced by US interest rates’. Correlation between US interest rates and gold is waning, with US dollar a better indicator of short-term gold price. New findings will reassure gold investors...

Read More »

Read More »

London House Prices See Fastest Quarterly Fall Since 2009 Crisis

London house prices fell by 3.2% in the first quarter – Halifax. Brexit, financial and geo-political uncertainty lead to falls. Excluding sale of seven £10m-plus houses in London, prices were down 3.4% in the year. UK house prices climb by just 0.4% in April, the slowest increase since 2008 for same period. Sales transactions fall by 19% and asking versus selling prices show turning into buyers’ market. Homeowner or not, buy physical gold to hedge...

Read More »

Read More »

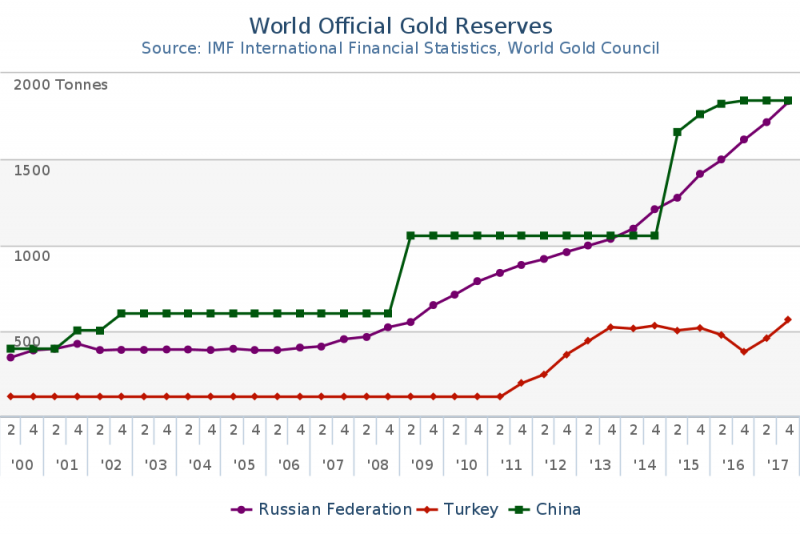

Russia Buys 300,000 Ounces Of Gold In March – Nears 2,000 Tons In Gold Reserves

Russia buys 300,000 ounces of gold in March and nears 2,000t in gold reserves. Russia now holds just over 1,861 tonnes, more than officially reported by China at 1,842t. Both Russia and China have the power to destabilise US dollar by dumping dollar-denominated assets. Turkey has removed all gold held in the U.S. opting for Bank of England and BIS. Turkey follows trend set by both Germany, Netherlands and others to remove gold reserves stored in...

Read More »

Read More »

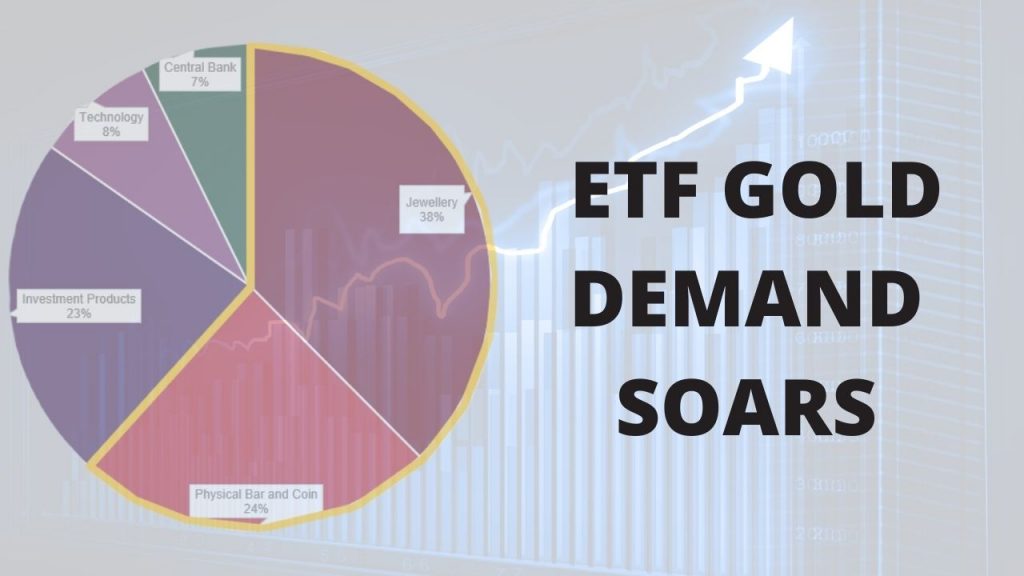

Family Offices and HNWs Invest In Gold Again

Family Offices and HNWs Are Investing In Gold Again. Rising interest by family offices and high-net-worth (HNW) into gold bullion investments. Gold ETF assets have reached almost $100 billion due to HNWs and pension funds’ increased demand. Volatility in equities, concerns over trade wars, Trump’s Presidency and other economic worries are spurring demand for gold coins and bars. Prudent money ‘trickle’ back into gold as investors are reminded of...

Read More »

Read More »

Silver Bullion Remains Good Value On Positive Supply And Demand Factors

Silver bullion remains good value on positive supply and demand factors. Industrial demand set to continue to climb from 2017, into 2018 and beyond. Speculators are bearish on silver as net short positions in silver futures reach record. Investment demand sees silver ETF holdings at eight-month high of 665.4 million ozs. 2017 saw fifth consecutive annual physical deficit in scrap silver, of 26 moz. Global silver mine production fell 4% last year,...

Read More »

Read More »

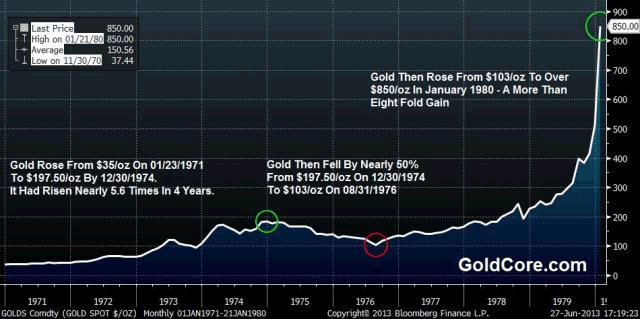

New All Time Record Highs For Gold In 2019

New all time record highs for gold in 2019. ‘Powerful bull market’ will likely send gold to $5,000 to $10,000. If USD & Treasuries keep falling, stocks may decline at ‘moment’s notice’. Traditional portfolio of stocks and bonds will not protect investors. “Gold will replace bonds as the go-to hedge”.

Read More »

Read More »

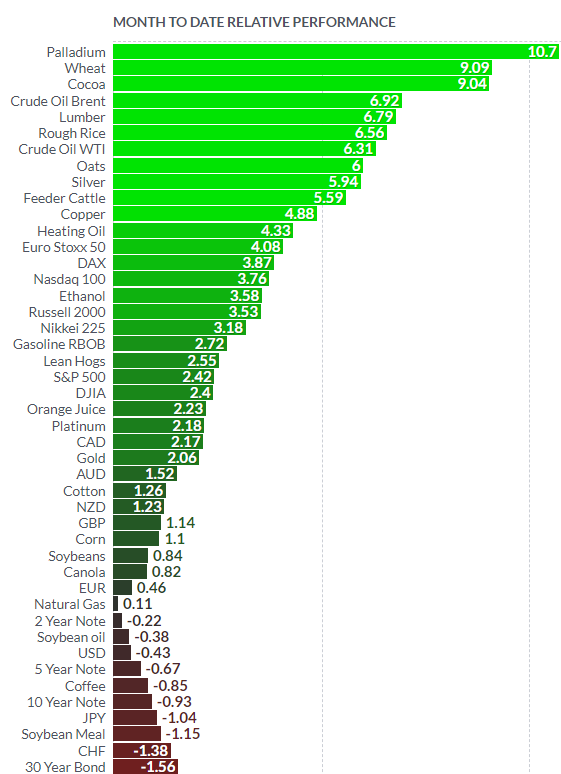

Palladium Bullion Surges 17percent In 9 Days On Russian Supply Concerns

Palladium bullion has surged a massive 17% in just nine trading days. From $895/oz on Friday April 6th to over $1,052/oz today (April 19th). The price surge is due to palladium being due a bounce after falling in the first quarter and now due to Russian supply concerns. In a volatile month, precious metals and commodities have been the clear winners so far, with palladium having the greatest gains of all – up 10.7% in April (see table below).

Read More »

Read More »

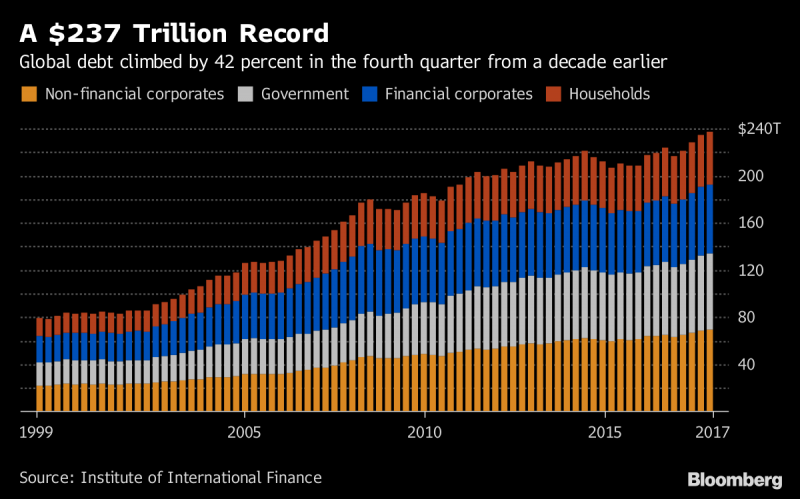

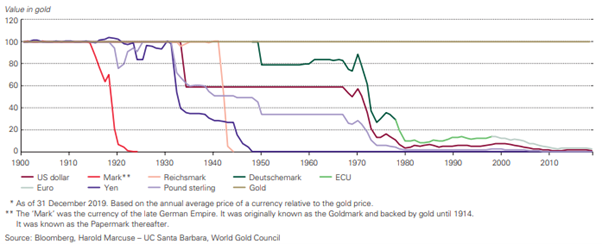

Global Debt Bubble Hits New All Time High – One Quadrillion Reasons To Buy Gold

Global debt bubble hits new all time high – over $237 trillion. Global debt increased 10% or $21 tn in 2017 to nearly a quarter quadrillion USD. Increase in debt equivalent to United States’ ballooning national debt. Global debt up $50 trillion in decade & over 327% of global GDP. $750 trillion of bank derivatives means global debt over $1 quadrillion. Gold will be ‘store of value’ in coming economic contraction. Global debt is the mother of all...

Read More »

Read More »

Volatile Week Sees Oil and Palladium Surge Over 8percent, Gold and Silver Marginally Higher and Stocks Gain

Gold & silver eke out small gains; palladium surges 8% and platinum 2%. Oil (WTI) surges over 8% to over $66.90/bbl; supply disruption risk. U.S. dollar and Treasuries fall; geopolitical, trade war and fiscal concerns. Stocks rally and shrug off trade war, macro and geo-political risks. Bitcoin, major cryptos (Ethereum, Ripple etc) rise sharply. Russia-US tensions high: Trump warns attack ‘could be very soon or not so soon at all’.

Read More »

Read More »

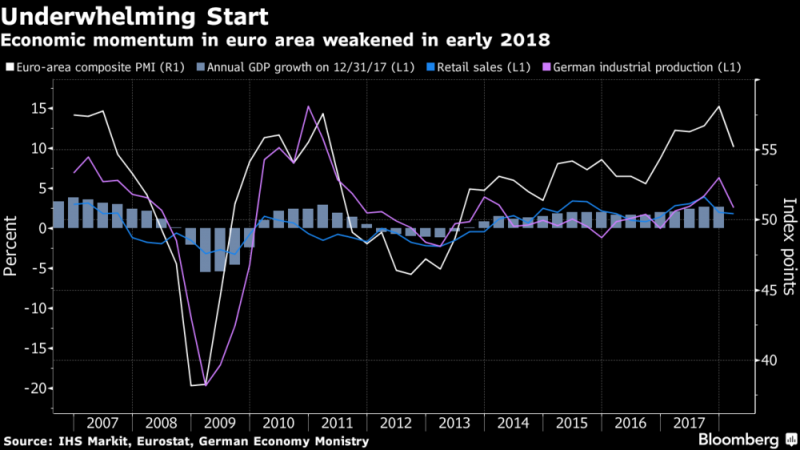

EU and Euro Exposed To Risks Including Trade Wars and War With Russia In Middle East

– EU and euro face growing risks including trade wars, energy independence and war with Russia in Middle East. – Middle East war involving Russia may badly impact energy dependent & fragile EU. – Trade and actual wars on European doorstep show the strategic weakness of the EU. – Toxic combination due to growing anti-EU and anti-Euro sentiment in many EU nations.

Read More »

Read More »

Trump Tweets Russia “Get Ready” For Missiles In Syria – Gold, Oil Rise and Stocks Fall

Dow set to drop 300 points at open after Trump tweet today. Stocks see sell off and gold pops to test resistance at $1,350/oz. US stock futures suggest over 1% losses at New York open. Oil surged to a two-week high and has surged nearly 7% this week. U.S. bombing Syria may provoke escalation of conflict with Russia and wider conflict in volatile Middle East.

Read More »

Read More »

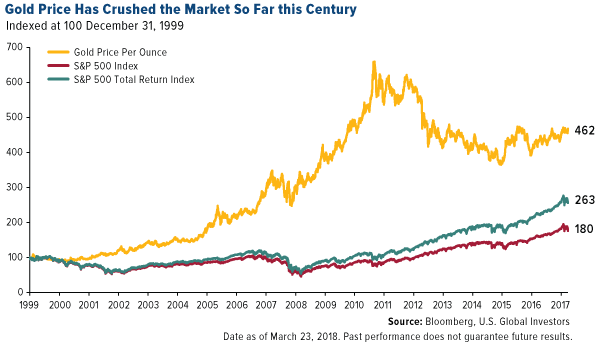

Gold Out Performs Stocks In 2018 and This Century By Ratio Of Two To One

– Gold outperforming stocks in 2018 and this century (see chart)

– Gold up close to 2% in 2018 while S&P 500 is down 2%

– Trump trade wars and Kudlow as Trump chief economic advisor is gold bullish

– Given gold’s performance, Kudlow’s dismissal of gold as “end of the world insurance” is “irrational”

– Market volatility could drive gold to $1,500/oz in 2018 – Holmes

Read More »

Read More »

Jamie Dimon Warns Of Potential ‘Market Panic’

Jamie Dimon Warns Of Potential ‘Market Panic’. JPMorgan Chase CEO Jamie Dimon sees ‘chance of market panic’. In annual letter to shareholders Dimon warns of increased inflation and interest rates. Concerned QE unwinding could cause chaos as ‘markets will get more volatile’.

Read More »

Read More »

Silver Bullion: Should We Be Worried About Silver?

Silver Bullion: Should We Be Worried About Silver? Bloomberg’s Mike McGlone silver “set to test the $18 an ounce resistance level”. LBMA report: volume of silver ounces transferred in February fell by 24%. Standard Chartered: gold-silver ratio and supply/demand fundamentals favour silver. Gold/silver ratio at near two-year high on silver’s underperformance. Silver COT reports remain more bullish than at any time in history.

Read More »

Read More »