Tag Archive: Daily Market Update

IMF Warning: ‘World’s Financial System Is More Stretched, Unstable and Dangerous Than It Was On the Eve of the Lehman Crisis’

The International Monetary Fund (IMF) has again warned that the world’s financial system is more stretched, unstable and dangerous than it was on the eve of the Lehman crisis. Quantitative easing, zero percent interest rates and massive financial repression has pushed investors – and in the case of pension funds or life insurers, actually forced them – into taking on ever more risk.

Read More »

Read More »

Dutch Central Bank: Gold Bars ‘Always Retain Their Value, Crisis Or No Crisis’

◆ “Gold is the perfect piggy bank – it’s the anchor of trust for the financial system” says the Central Bank of the Netherlands ◆ “If the system collapses, the gold stock can serve as a basis to build it up again” astutely and prudently observes the Dutch Central Bank ◆ The Dutch people “hold more than 600 tonnes of gold. A bar of gold always retains its value, crisis or no crisis”

Read More »

Read More »

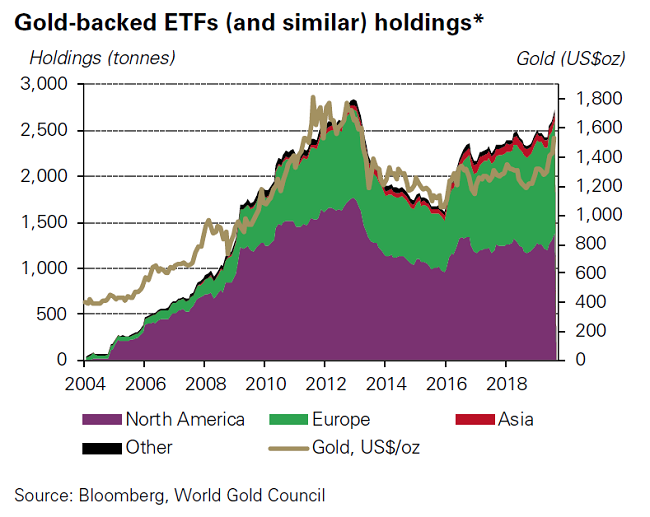

Gold ETFs See Holdings Reach All Time Record Highs In September

◆ Global gold ETF holdings reach all time record highs, increasing by 13.4% so far in 2019 on hedging and safe haven demand. ◆ Global gold ETFs, ETCs and similar products had US$3.9bn of net inflows across all regions, increasing their collective gold holdings by 75.2 tonnes(t) to 2,808t, the highest levels of all time in September.

Read More »

Read More »

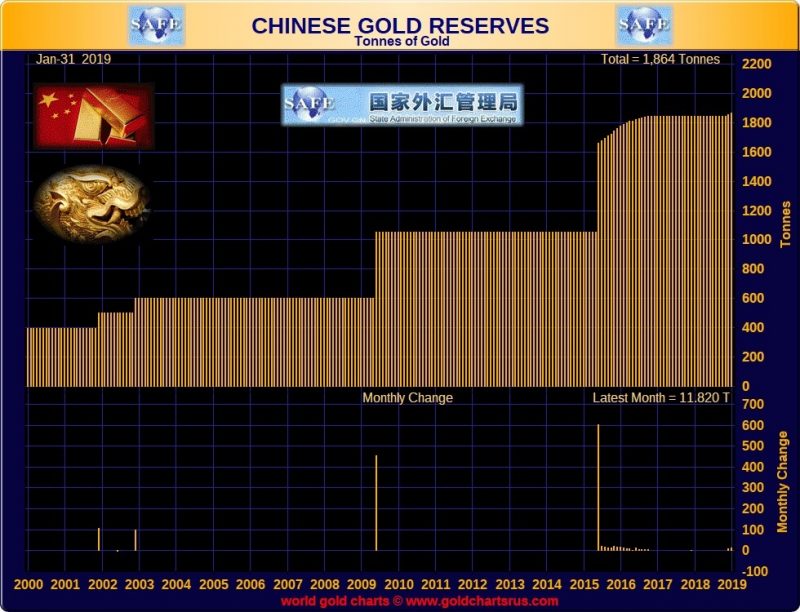

China’s Central Bank Buys 100 Tons Of Gold As Trade and Dollar Tensions With U.S. Escalate

◆ China has added more than 100 tons of gold bullion bars to its gold reserves since it resumed buying in December; China’s gold holdings rose to 62.64m ounces in September, an increase of 190,000 ounces in one month. ◆ The People’s Bank of China (PBOC) increased it’s gold reserves for a 10th straight month in September, reinforcing its standing as one of the major official accumulators as many creditor nation central banks stock up on the precious...

Read More »

Read More »

Chinese Buy Gold In Large Volume In Holiday Week as Gold Jewelry Sales ‘Soar’

Gold is marginally lower today at $1,503/oz and stocks are mixed ahead of what are set to be tense U.S. and China trade negotiations. Gold sales are expected to accelerate through the end of the year due to weakening global economic conditions, according to Mike McGlone, a Bloomberg Intelligence senior commodity strategist as quoted by China Daily (see below).

Read More »

Read More »

World’s Largest Gold ETF Sees Holdings Rise 1.8 percent to 924.94 Tonnes In One Day

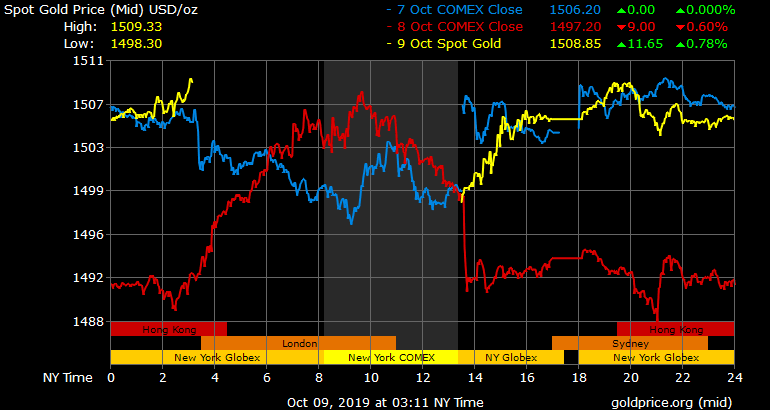

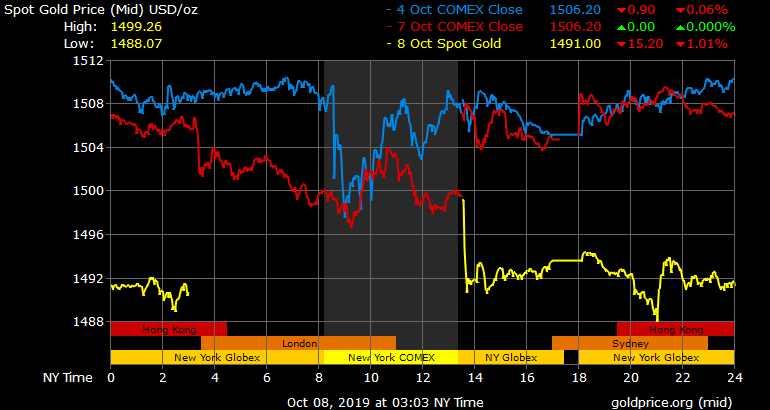

◆ Gold prices have inched 0.3% higher today as a sharp drop of nearly 2% yesterday has attracted bargain hunters. ◆ Gold tested support at $1,500/oz after another peculiar sell off in the futures market saw prices fall $30 in two hours on the COMEX yesterday with most of the selling coming after European and London markets had closed.

Read More »

Read More »

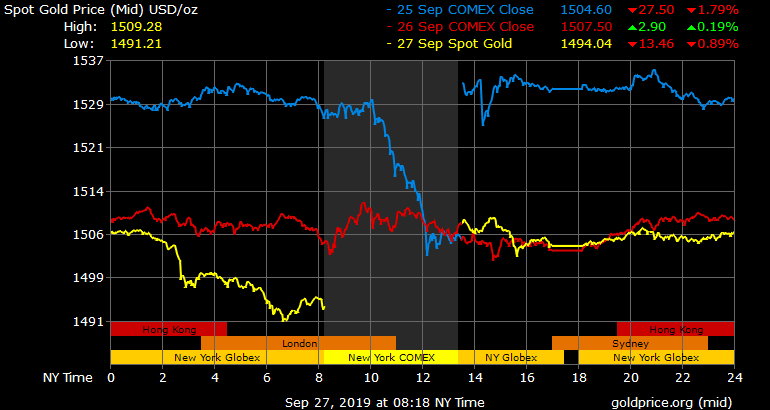

Gold At 3 Week High As Stocks and Dollar Fall On Trump’s Hard Line Stance Against Iran and China

◆ Gold has edged higher to reach three week highs at $1,535/oz today after Trump took a hard-line stance on China and Iran during his U.N. speech. ◆ Stocks fell in the U.S. yesterday and today in Europe on increasing political turmoil in the U.S. and the UK; Concerns about the global economy and the outlook for stocks is enhancing gold’s safe haven appeal.

Read More »

Read More »

Central Bank Gold Buying Is “Sustainable and Indeed May Accelerate”

Why central banks including China and Russia will keep buying gold due to concerns about the outlook for currencies, including the dollar and the euro, Mark O’Byrne, Research Director of GoldCore told Marketwatch. While the gold tonnage demand from central banks in recent months has been significant and near records, gold remains a tiny fraction of most central banks’ massive foreign-exchange reserves,” O’Byrne says, adding that the trend is...

Read More »

Read More »

Gold To $3,000/oz By End Of 2020 As The Dollar Will Fall Sharply – Ron Paul

Where Does Gold Go From Here? — Ron Paul’s “Cautious” Prediction. “Gold is an ‘insurance policy’ as the dollar will continue go down in value as it is printed” and it will end in a monetary “calamity”. “Gold is not money due to any man-made laws. Gold is money despite man-made laws, and is a product of the voluntary marketplace”.

Read More »

Read More »

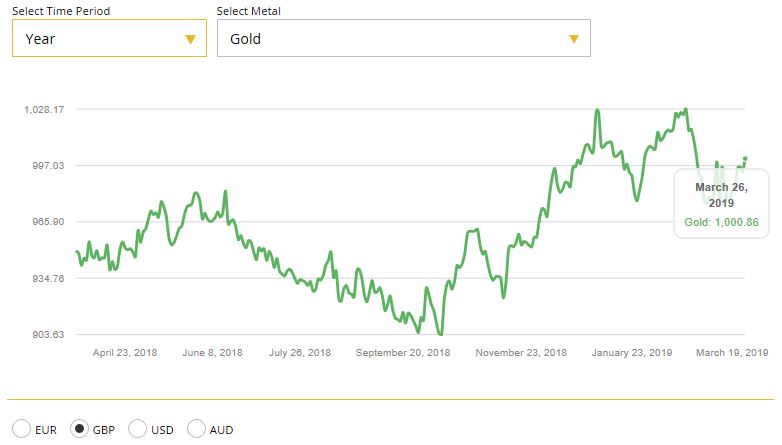

Gold Consolidates Near All Time High In British Pounds

Sterling is under pressure today and gold near all time record highs in sterling (see chart) due to the likelihood that Britain’s ruling Conservative party will elect Boris Johnson (aka ‘BoJo’) as its new leader and Prime Minister today.

Read More »

Read More »

Gold and Silver Will Surge to Record Highs Over $1,900 and $50 Per Ounce – IG TV Interview

Mark O’Byrne, founder at GoldCore, gives IG TV’s Victoria Scholar his outlook for gold and silver prices and why he believes they will surpass their record nominal high prices of 2011 in the coming years.

Read More »

Read More »

Gold To Reach 6 Year High Over $1,400 on Uncertain Outlook for Global Markets

Gold is finally gaining the traction needed to boost prices to a level not seen since 2013 as concern mounts over increased trade war tensions and the global growth outlook. Bullion may touch $1,400 an ounce this year as investors hedge risk, according to Rhona O’Connell, head of market analysis for EMEA and Asia regions at INTL FCStone Inc.

Read More »

Read More »

Gold Hits 10 Week High At $1,328/oz as Trade Wars Spur Safe Haven Demand

Gold has consolidated on yesterday’s gains and is marginally higher as risk aversion creeps back into markets. Gold rose 1.5% yesterday to its highest level in more than three months. Concerns that trade wars look set to escalate globally and fears that President Trump’s threat of tariffs on Mexico will hurt the global economy are spurring safe haven demand.

Read More »

Read More »

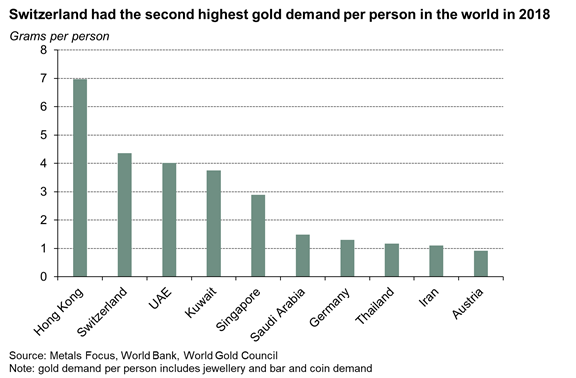

Gold Investment In Switzerland Remains Very Popular

Investors in Switzerland like gold and it is the second most popular investment after property or real estate20% plan to invest in gold in the next 12 monthsAlmost two-thirds buy or invest in precious metals at their bank; fewer than one-in-ten buy gold online

Read More »

Read More »

Gold Tops $1,300/oz As Trade Wars Escalate and Increased Risk of U.S. War With Iran

Gold sees safe haven demand push it to highest in one month as it breaches key $1,300/oz and £1,000/oz levels. U.S. China trade wars escalates as China retaliates and imposes tariffs on $60 billion of U.S. goods. Increased risk of war in Middle East after U.S. alleges Iran bombed Saudi oil vessels destined for the U.S.

Read More »

Read More »

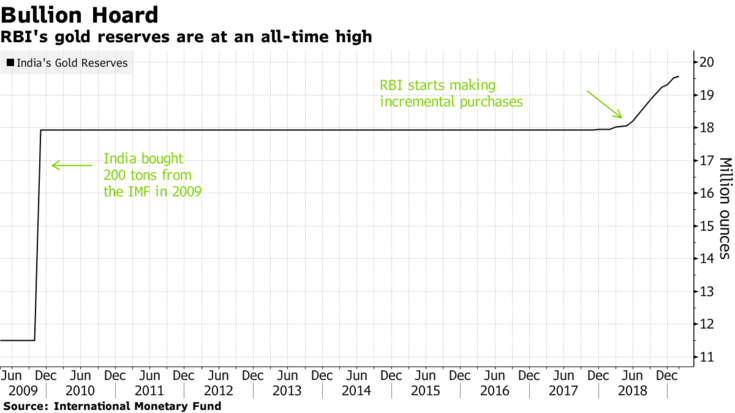

World’s Central Banks Want More Gold – India May Buy 1.5M Ounces In 2019

Royal Bank of India (RBI) may buy another 1.5 million oz this year according to OCBCMany other central banks including large creditor nations Russia and China are also adding to gold holdings. India’s central bank is likely to join counterparts in Russia and China scooping up gold this year, adding to its record holdings and lending support to worldwide gold bullion demand as top economies diversify their reserves.

Read More »

Read More »

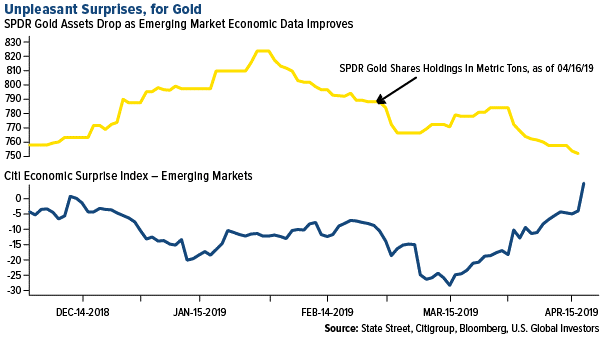

SWOT Analysis:Venezuela Sells $400 Million Worth Of Gold Bullion

The best performing metal this week was palladium, up 3.52 percent as CPM Group noted that the price could climb to $1,800 on supply constraints. Gold traders and analysts switched from bullish to mostly neutral or bearish on the yellow metal this week, according to the weekly Bloomberg survey.

Read More »

Read More »

Brexit and Learning To “Live With Boom and Bust Economic Cycles”

Generations of people have learned to live with boom and bust economic cycles. Years of relative plenty were followed, as night follows day, by grief including high unemployment and forced emigration on a large scale. In fact, if you go back much beyond the late 1960s, it would not be too cynical to say the cycles were often more about going from bust to really busted, as for decades the country was hit by crippling rates of largely enforced...

Read More »

Read More »

Gold Gains On Recession Concerns and ‘No Deal’ Brexit Risks

– Gold gains due to concerns about slowing growth, monetary and geopolitical risks

– Increasing possibility of ‘No Deal’ Brexit heightens recession risks in UK, Ireland

– Brexit uncertainty is impacting UK & Irish economies; Likely do long term damage

– UK sees sharp slowdown in mortgage approvals in February as housing market slows

– Gold surges to near all time record highs in Australian dollars at $1,860/oz

– Gold in sterling, euros and...

Read More »

Read More »

China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning.

The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces.

Read More »

Read More »