Tag Archive: Daily Market Update

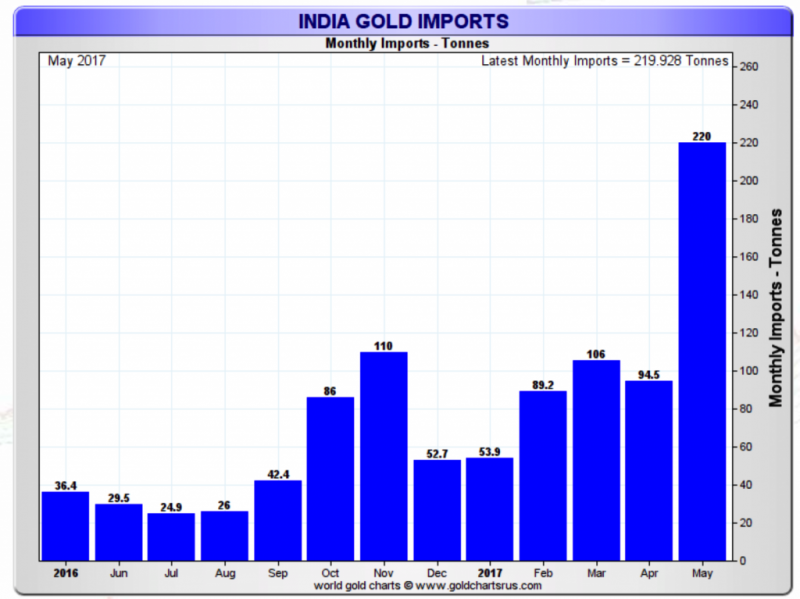

India Gold Imports Surge To 5 Year High – 220 Tons In May Alone

Gold imports into India have surged in the last six months thanks to festivals, economic recovery and concerns over a new tax regime and the push for the cashless society in India. Imports totalled 521 tonnes in the first half of this year, compared to just 510 tonnes in all of 2016.

Read More »

Read More »

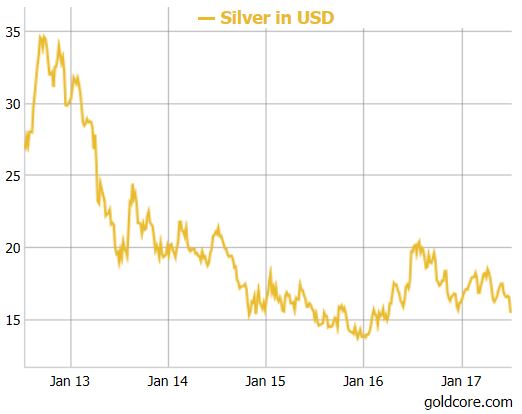

“Silver’s Plunge Is Nearing Completion”

– Silver’s plunge is nearing completion – Bloomberg analyst. Silver’s 10% sharp fall in seconds remains “mystery”. Plunge despite anemic global supply and strong demand .Total silver supply declined in ’16 – lowest level since ’13. Silver mine production down in ’16, first time in 14 years. Total silver supply decreased by 32.6 Mln Ozs in 2016

.Supply deficit in 2016- fourth consecutive year (see table). “Falling knife” caution but opportunity...

Read More »

Read More »

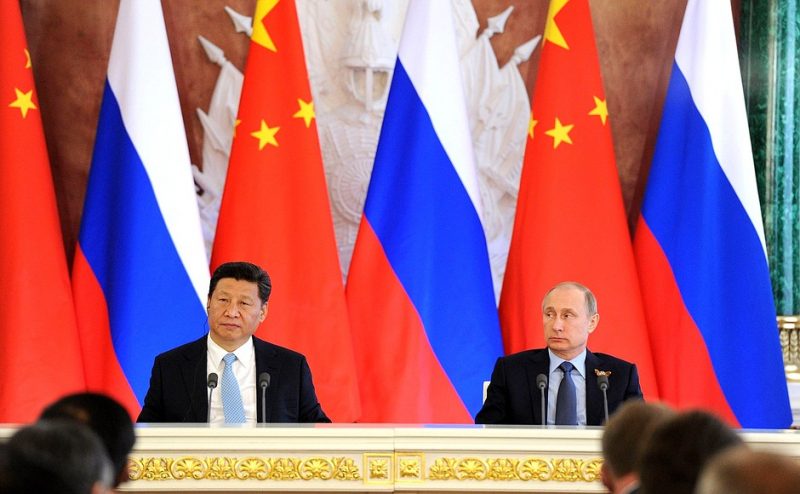

China, Russia Alliance Deepens Against American Overstretch

China and Russia allied on Syria and North Korea. Beijing & Moscow economic & monetary ties deepen. Trump needs Russia in order to maintain balance of power in superpower triumvirate. Sino-Russian relations currently in their “best time in history” says Chinese President ahead of G20.

Read More »

Read More »

Buy Gold Near $1,200 “As Insurance” – UBS Wealth

Yesterday North Korea sent the US a ‘package of gifts’ for Independence Day. Unsurprisingly the successfully tested and launched intercontinental ballistic missile (ICBM) was not well received. US Secretary of State Rex Tillerson called the move a “new escalation of the threat” to the U.S. and its allies and that “global action is required to stop a global threat.”

Read More »

Read More »

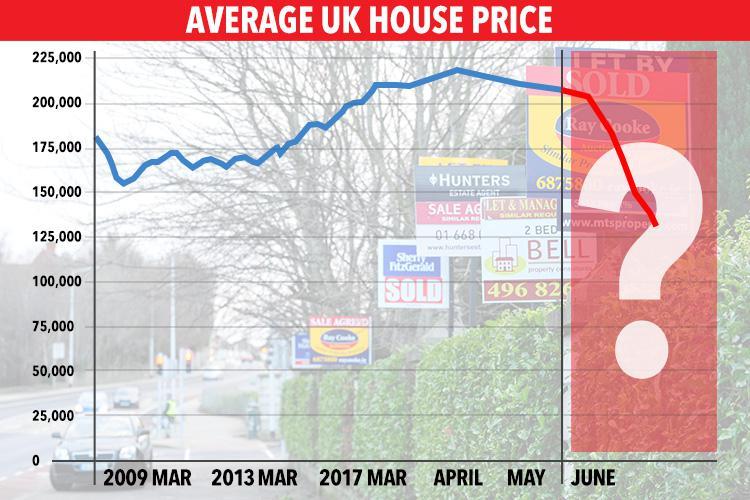

UK At ‘Edge of Worst House Price Collapse Since 1990s’

UK house prices on brink of massive 40% collapse. UK at ‘edge of worst house price collapse since 1990s’– Two leading economists warn of property crash– “We are due a significant correction in house prices”– Brexit and wages failing to keep up with inflation to trigger collapse. Trend starting in London before fanning out to rest of UK. UK homeowners unconcerned – 58% expect prices to rise. Over 1 million mortgages under threat in UK. Concerns of...

Read More »

Read More »

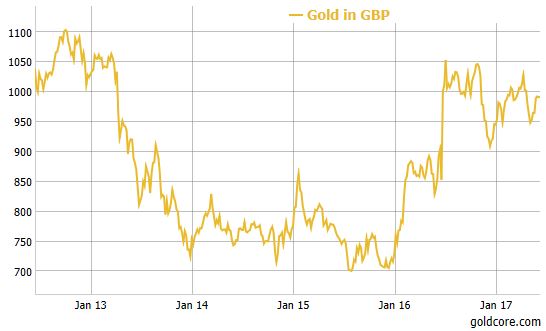

Gold Up 8 percent In First Half 2017: Builds On 8.5 percent Gain In 2016

Gold up 8% in first half 2017; builds on 8.5% gain in 2016. U.S. dollar down 6.5% – worst quarter in seven years. Gold higher in all currencies except Draghi’s euro – Gold outperforms bonds; similar gains as stock indices. S&P 500 and Dax outperform gold marginally. World stocks (MSCI World) up 10%; gold outperforms Eurostoxx (+6%) & FTSE (+2.3%). Silver up 3.7% in first half ; builds on 15% gain in 2016.

Read More »

Read More »

Only Gold Lasts Forever

his current state of play won’t last forever. Only Gold lasts forever. Some days it can feel a little rough being a gold investor. In today’s article Dominic Frisby is certainly feeling that way. Sometimes it can be all too easy to get caught up in the day to day chat around prices. Some forget that the reasons why they invested are still strong, even if it feels like the price isn’t.

Read More »

Read More »

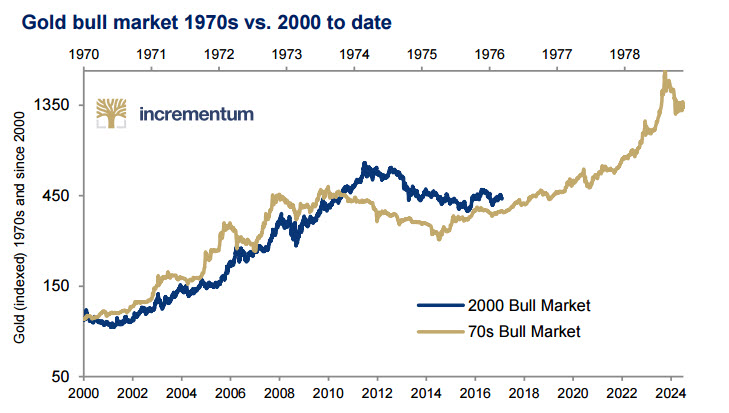

In Gold we Trust Report: Must See Gold Charts and Research

The 11th edition of the annual “In Gold we Trust” is another must read synopsis of the fundamentals of the gold market, replete with excellent charts by our friend Ronald-Peter Stoeferle and his colleague Mark Valek of Incrementum AG.

Read More »

Read More »

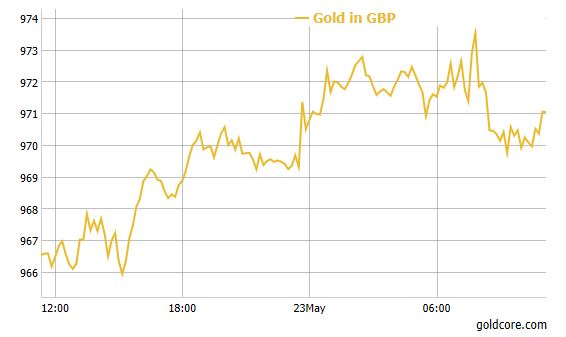

Gold Prices Steady On UK Election Risk; ECB Meeting and Geopolitical Risk

Gold held steady on Thursday as investors awaited cues on market direction amid a number of geopolitical events later in the day that could boost the safe-haven demand for the metal.

Read More »

Read More »

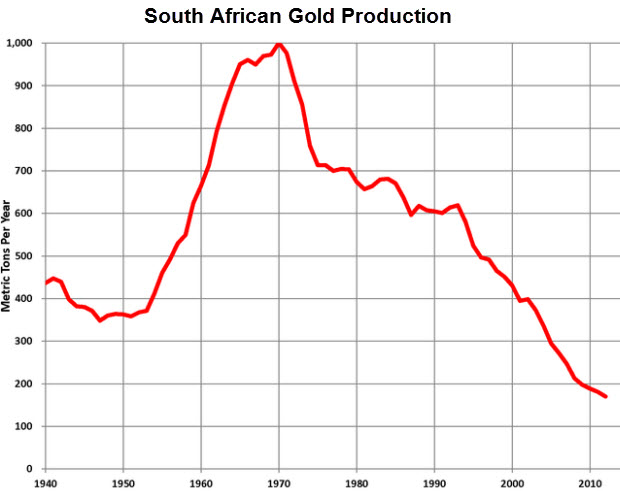

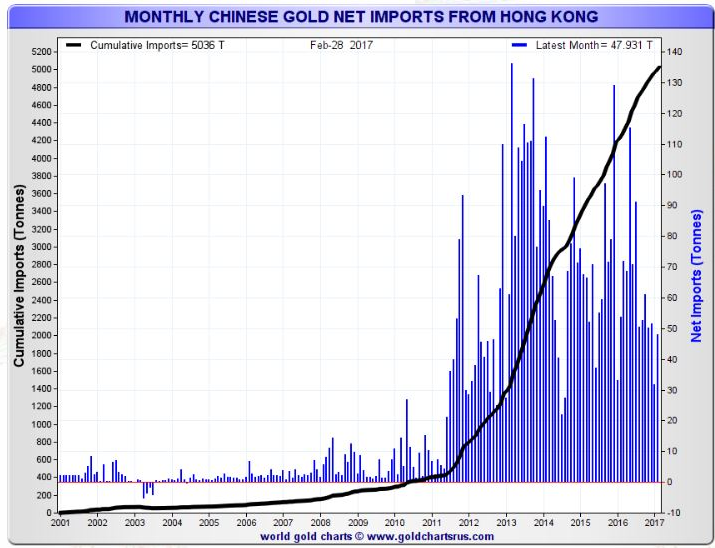

Gold Prices Break 6-Year-Long Downtrend On Safe Haven and 50percent Surge In Chinese Demand

Gold prices break 6 year down trend on safe haven demand (see charts). Chinese gold demand set to surge 50% to 1,000 metric tonnes. Chinese demand for gold bars on track to surge more than 60 percent in 2017. Geopolitical risk internationally leading to safe haven demand. UK election, terrorism and rising tensions in Middle East supporting gold after attacks in London and attacks in Iran today.

Read More »

Read More »

Deposit Bail In Risk as Spanish Bank’s Stocks and Bonds Crash

Deposit bail in risk as stocks and bonds of Spanish bank – Banco Popular – crash. Banco Popular stock crashes most on record – down 63% this year to 34 euro cents. Spanish bank tells employees – “Don’t panic”. Risk of Spanish banking crisis as Banco Popular credit curve inverts. Banco Popular needs to find at least €4 billion more capital – analysts.

Read More »

Read More »

Uncertainty Thanks to Twitter and UK Elections

Gold hits five-week high. Reaches $1,273.74/oz, highest since April 25th. Sterling recovers after UK polls point towards a hung Parliament. Expected Fed-tightening capped gains. 90-dead in Kabul, further signs of increasing tension in Middle East. Trump expected to pull out of Paris Accord and Trump’s anti-Iran axis already feuding.

Read More »

Read More »

Manchester Attack Sees Asian Stocks Fall, Gold Firm

The appalling attack in Manchester overnight in which over 22 people have been killed has led to a slight uptick in risk aversion in markets. Investors are cautious after police said they were treating a bombing at a concert in the Manchester Arena as a “terrorist incident”.

Read More »

Read More »

Gold Investment Is the Ultimate Guide for Tech Investors In 500 Words

Tech is the umbrella word for all things fashionable to invest in right now. Take the recent flotation of Snap Inc. (parent company of teen and narcissists’ favourite app SnapChat), everyone wanted in on the $20 billion flotation. Snap is likely a sign of a tech bubble that will cost a lot of savers and investors huge amounts of money … again.

Read More »

Read More »

Keiser Report Interview: Peak Gold, Silver On Small Finite Planet

Peak Gold and Silver On “Small Finite Planet” With Near Infinite Currency. Peak gold and silver and the case for peak precious metals on “our small, finite planet” was the topic for discussion on the latest episode of the the Keiser Report.

Read More »

Read More »

London Property Market Vulnerable To Crash

London property market vulnerable to crash. House prices in London are falling. London property up 84% in 10 years (see chart). House prices have risen over 450% in 20 years. Brexit tensions as seen over weekend and outlook for U.K. economy to impact property. Global property bubble fragile – Risks to global economy. Gold bullion a great hedge for property investors.

Read More »

Read More »

Gold Bullion Imports Into China via Hong Kong More Than Doubles in March

Gold bullion imports into China via main conduit Hong Kong more than doubled month-on-month in March, data showed on Tuesday as reported by Reuters. Net-gold imports by the world’s top gold consumer through the port of Hong Kong rose to 111.647 tonnes in March from 47.931 tonnes in February, according to data emailed to Reuters by the Hong Kong Census and Statistics Department.

Read More »

Read More »

Gold Sovereigns – ‘Treasure’ Trove Found In UK – Don’t Be The Piano Owner

The gold sovereigns – semi-numismatic gold coins made up of both gold sovereigns and half gold sovereigns dating from the reigns of Victoria, Edward VII and George V – were discovered inside an old piano after it was donated to a school last year.

Read More »

Read More »

Silver, Platinum and Palladium as Investments – Research Shows Diversification Benefits

Silver, platinum and palladium see increased role as investment vehicles. Increase in academic output on the white precious metals is in line with this. Silver and particularly gold are safe haven assets. Silver was a safe haven at times during which gold failed to be. Platinum and palladium less so but have diversification benefits.

Read More »

Read More »

Trump To “Bully” Fed Into Printing Money – Negative for Stocks, Positive for Gold

David McWilliams has written an interesting article in which he puts forward the case that Trump is likely to turn on the “enemy within,” the Federal Reserve and bully them into “printing money.” He points out that this was seen in 1971 when Nixon bullied the Fed into printing and debasing the dollar. McWilliams says this would be bad for stocks markets which would fall in value as was seen in the 1970s.

Read More »

Read More »

.jpg)