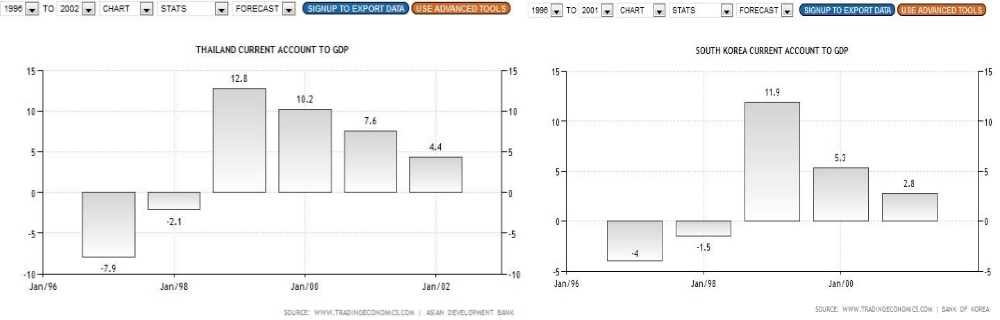

Two additional criteria important for Emerging Markets: High foreign debt, a weak net investment position and a current account deficit increases government bond yields.

Read More »

Tag Archive: current account

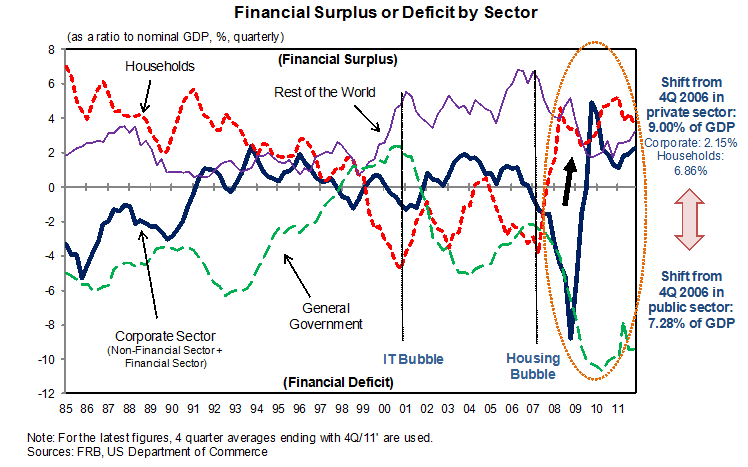

7d) Richard Koo’s and other Sector Balances

A list of long-term sector balances and related provided by Nomura's research institute and its chief economist Richard Koo.

Read More »

Read More »

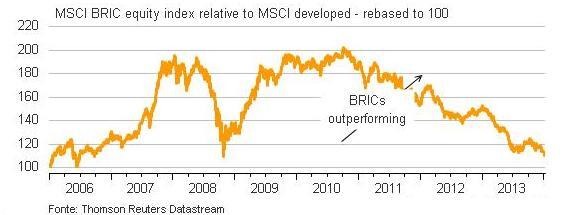

Last Week’s Sell-Off: More on the Discrepancy between Developed and Emerging Markets

Last week’s decline in stock markets was probably caused by the HSBC manufacturing PMI for China that contracted for the first time in months, and possibly also by the rapid fall of UK unemployment rates and Bank of England’s response to it. As the rising gold price showed, Fed “tapering fears” were not at the …

Read More »

Read More »

How European Leaders Are Successfully Implementing Say’s Law

The concerted actions in September 2012 between the two big central banks reflected two fundamental economic principles: The Fed opted for Keynes' law, the ECB for Say's Law with conditionality. And apparently the ECB was successful.

Read More »

Read More »

Our March 2013 Analysis: “Volcker Moment Redux”: Upcoming Weakness of Emerging Markets

The 2010 QE2 is a reason why many emerging markets started to slow considerably in the course of 2012. We reckon that this weakness will continue. Bizarrely QE2 helped to reduce global imbalances.

Read More »

Read More »

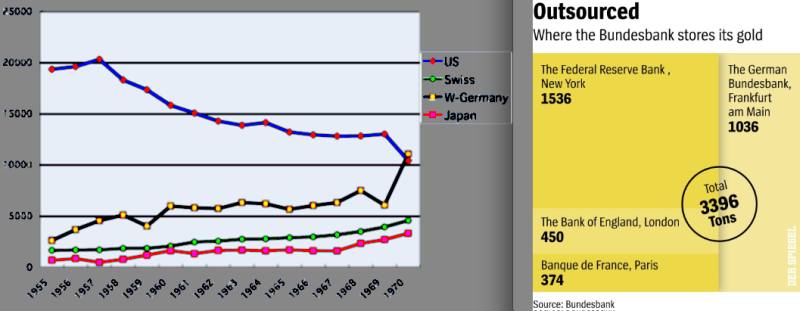

The Collapse of the Bretton Woods System, the German Current Account and Gold Reserves

German, Swiss and Japanese gold reserves rose continously in the Bretton Woods system, whereas American and British reserves fell.

Read More »

Read More »

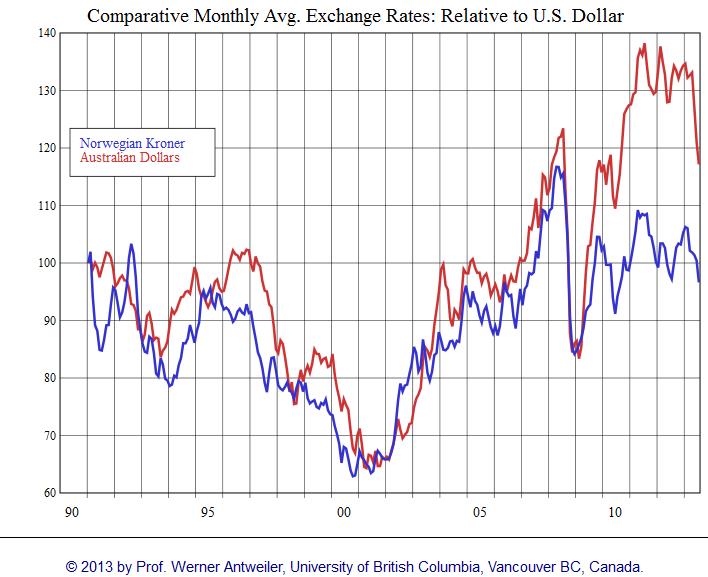

Why There Won’t Be A Strong Dollar, Even If The Financial Establishment Thinks So

In this second part of our series we provide arguments why the widely expected strong dollar period might not come. We look at the most important economic indicators that might justify a stronger dollar: the ISM manufacturing index and the interest rate differences between the U.S. and Europe.

Read More »

Read More »

Strong Dollar: the Parallels Between Now, the 1980s and 1998-2002, Part 1: Austerity

We examine the relationship between strong dollar phases and austerity in other parts of the world. Between 1983 and 1985 one reason for the strong dollar were high real interest rates in the U.S. after the defeat of the Great Inflation period, the enforced austerity in Southern America and cheap commodity prices caused by generally …

Read More »

Read More »

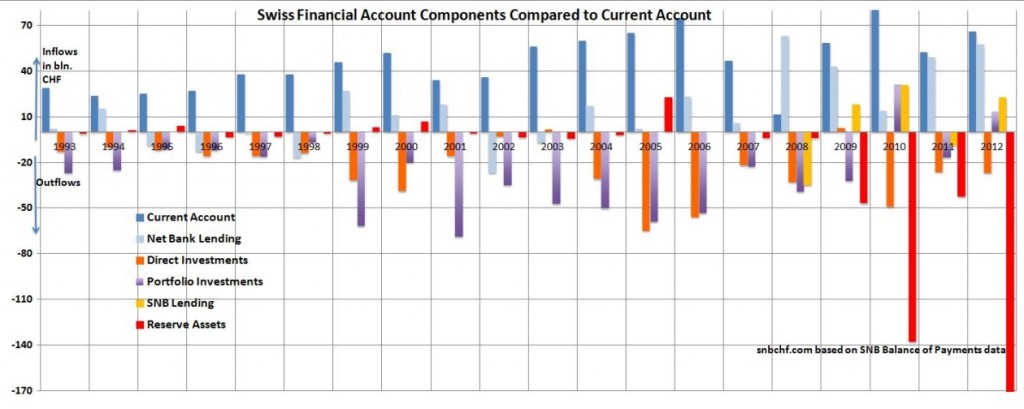

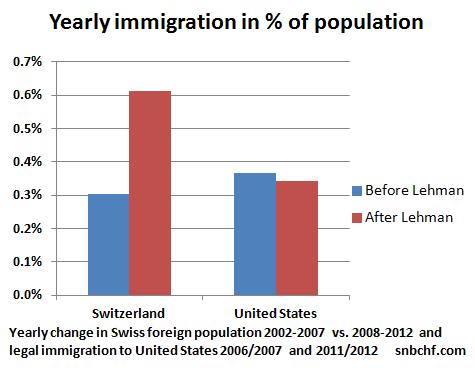

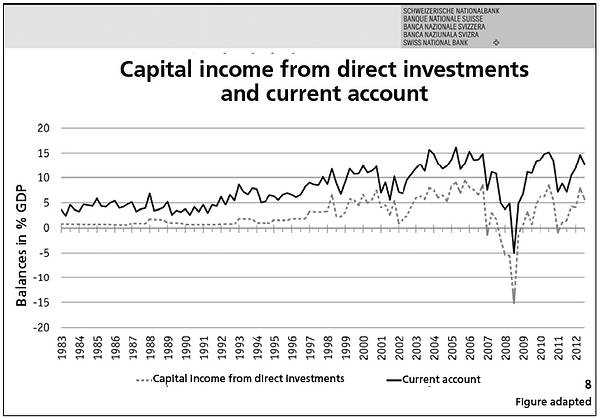

Danthine’s Latest Statements Imply that SNB Might Remove Cap in 2014

SNB Vice Chairman Jean-Pierre Danthine is undoubtedly the most hawkish member of the governing board, an opposite personality to the rather interventionist and Keynesian hedge fund manager Philip Hildebrand. Danthine has perfectly understood that times for the SNB might get hard again in 2014. Jean-Pierre Danthine has made some comments recently: – Swiss franc stays …

Read More »

Read More »

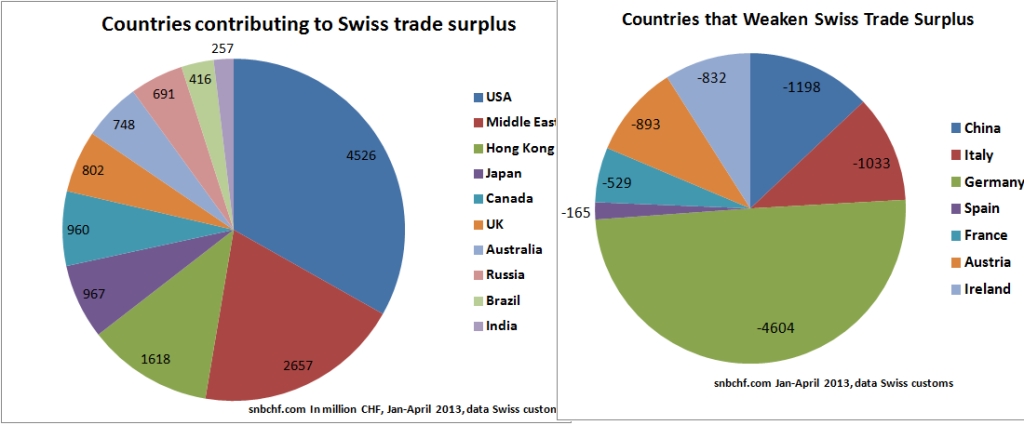

The Swiss Trade Surplus: A Really Global Economy

The Swiss trade balance for goods clearly indicates its global orientation. Switzerland has a trade surplus with the US, Canada, the UK and many emerging markets. Swiss exports are mostly luxury products and pharmaceuticals. The total surplus for the 4 first months in 2013 was 7.7 billion CHF, about 1.2% of GDP, annualized around …

Read More »

Read More »

GDP Comparison BRICS Developed Markets

Beautiful charts by Goldman's Jim O'Neill that help to understand the former and future growth of different emerging, "growth markets", the BRICS. We criticise his partially over-optimistic views.

Read More »

Read More »

Which Of The Six Major Fundamental Factors For Gold And Silver Are Still Positive? Which Are Not? (April 2013)

Having identified the 6 fundamental price factors previously we speak about the gold-silver ratio. We explain which fundamental factors speak for an increase of gold and silver prices and which don't.

Read More »

Read More »

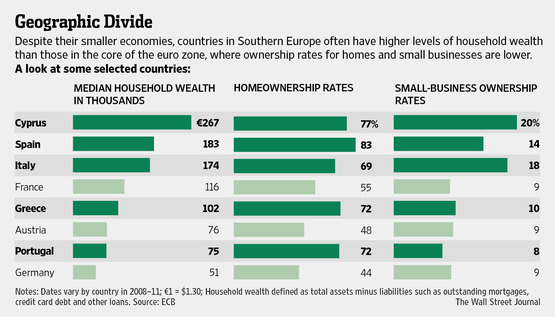

The European Transfer Union From North To South and from Poor to Rich between 1999 and 2007

Cheap ECB rates and rising home prices helped to enrich Southern Europeans between 1999 and 2007. Germany's middle-class and poor, most of them not owning a home, were the ones that financed it.

Read More »

Read More »