Tag Archive: Currency Positioning

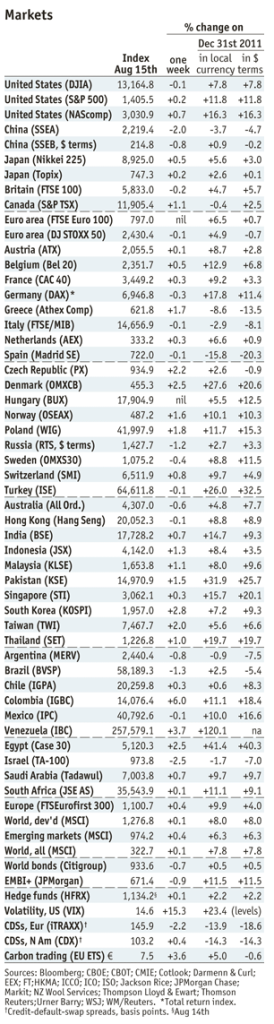

FX Technical Outlook, Net Speculative Positions, Global Markets, week August 27

Submitted by Mark Chandler, from marctomarkets.com There are two main drivers behind the price action in the foreign exchange market and they will likely persist in the days ahead. First, there continues to be position adjustment ahead of the what promises to be eventful few weeks. Second, the release of the minutes from the August 1 …

Read More »

Read More »

Net Speculative Positions , Global Markets and Outlook, week from August 20

Currency Positioning and Outlook, week from August 20 Submitted by Mark Chandler, from marctomarkets.com The market is like expectant parents who don’t know the gender of the fetus. They know something big is around the corner, but they don’t have enough information to make some important decisions. They can contemplate the future, but there …

Read More »

Read More »

Net Speculative Positions and Outlook, week of August 13

Currency Positioning and Outlook, week of August 13 Submitted by Marc Chandler from MarctoMarkets.com Market positioning in the week ending August 10 suggests that speculators in the futures market generally agree with our assessment that ECB President Draghi’s recent proposal was not a game changer. The recent pattern continued. Essentially what this entails is buying …

Read More »

Read More »

Net Speculative Positions and Technical Analysis,week from August 6

Currency Positioning and Technical Analysis, week from August6 Submitted by Marc Chandler from MarctoMarkets.com The overall technical tone of the US dollar is suspect. During the last few months, it has been trending lower against the dollar-bloc currencies, Canadian and Australian dollars and the Mexican peso. The greenback has trended higher against the euro and Swiss …

Read More »

Read More »

EUR/CHF, A History, The Game Changes: April 2012

EUR/GBP: If You Want To Know Why Its Falling, Have A Look At The SNB Thanks Goose for the reminder that the SNB released figures on its FX reserves holdings and these showed a marked increase in GBP holdings. This has been a constant theme over the last few weeks/months, the SNB buys EUR/CHF in the marketplace … Continue reading »

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor Hike: February 2012

EUR/CHF Busy Doing Jack; Jordan Gobbing Off Later EUR/CHF sits at 1.2048, some 7 pips easier from when I started out. Barrier option interest sits at 1.2025 and ofcourse 1.2000. SNB interim head honcho Jordan speaks later this evening (18:30 GMT) in Zurich. Might be giving instructions on how to make his favourite alpine muesli … Continue reading...

Read More »

Read More »

EUR/CHF: One Year of Free Market (07/2010-07/2011): November 2010

EUR/CHF Continues Lower Presently down at 1.3055 from early 1.3090, having been as low as 1.3037 so far. Earlier I was reading comments made by UBS economist Huenerwadel, who said “At least from a fundamental point of view and aware of the increased long CHF positioning, very little speaks in favour of a materially higher EUR/CHF … Continue reading...

Read More »

Read More »

EUR/CHF: A History of Interventions, May 2010

ForexLive Asian Market Open: EUR Worries Return The big Sovereign players couldn’t get enough of the EUR when it was at 1.40 and now it looks like they can’t get out quick enough. The BIS has been a regular seller on behalf of other central banks, the SNB are quietly trying to offload what they … Continue reading »

Read More »

Read More »