Tag Archive: Credit Suisse

Credit Suisse and UBS Will Charge Negative Interests Above a Threshold

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such was worth 150 bps, this year on 28 bps. See the official news at FT Alphaville

Read More »

Read More »

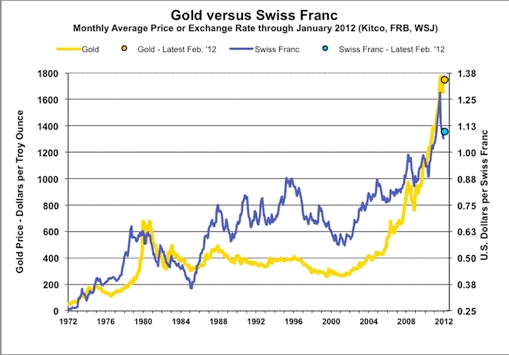

Gold, CHF, Brent Arbitrage Trading after Negative CS, UBS Interest Rates

Credit Suisse and UBS will charge negative interests for cash clearing clients above a threshold. Last year such news was worth 250 bps, on December 3 only 28 bips. One remembers August 26, 2011, when UBS only spoke of negative interests and consequently EUR/CHF rose from 1.1420 to 1.1688. At the time FX traders …

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 17

Submitted by Mark Chandler, from marctomarkets.com Nearly every development in recent days has been embraced by the foreign exchange market as a reason to continue to do what it has been doing since late July, and that is to sell the dollar. The German Constitutional Court ruling, allowing the European Stability Mechanism to …

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 10

Submitted by Mark Chandler, from marctomarkets.com Key policy makers are preparing new efforts to address the deterioration of financial and economic conditions. This is seen reducing tail risks, which allowed the rally in risk assets to be extended, and undermined the dollar. China is providing new fiscal support. The ECB announced its new Outright Market …

Read More »

Read More »

Net Speculative Positions, Technical Outlook, Global Markets Ahead of Eventful Week September 3rd

Submitted by Mark Chandler, from marctomarkets.com The week ahead kicks off what we expect to be a period of intense event risk. The combination of positioning, judging from the futures market and anecdotal reports, and the low implied volatility in currencies and equity markets warn of heightened risk in the period ahead. The week begins …

Read More »

Read More »

FX Technical Outlook, Net Speculative Positions, Global Markets, week August 27

Submitted by Mark Chandler, from marctomarkets.com There are two main drivers behind the price action in the foreign exchange market and they will likely persist in the days ahead. First, there continues to be position adjustment ahead of the what promises to be eventful few weeks. Second, the release of the minutes from the August 1 …

Read More »

Read More »

EUR/CHF, A History of Interventions: What markets say, July 2012

More Chatter About The EUR/CHF Peg The FT reports that Switzerland is ‘new China’ in currencies Chatter that the SNB was buying 3 billion francs worth of euros per day. “The picture is one of a central bank that’s not coping with how much money is coming in,” said Kit Juckes, foreign currency analyst at Société … Continue reading »

Read More »

Read More »

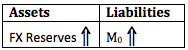

EUR/CHF, A History of Interventions: What markets say, June 2012

SNB In A Bind With Euro Holdings Today’s reserve data showed skyrocketing reserves at the Swiss National Bank as they defend the EUR/CHF floor. Reserves were at 365B francs at the end of Q2 compared to 245B at the end of March, with all the growth coming in the final two months of the quarter … Continue reading »

Read More »

Read More »

The win of the pro-bailout parties in the Greek elections was no win for the SNB

The win for the pro-bailout parties in the Greek elections was no win for the Swiss National Bank (SNB), even if the fear of an immediate bank-run and extreme money flows into Switzerland are avoided. Also the fact that QE3 is not coming in the next weeks did not help the SNB.

Read More »

Read More »

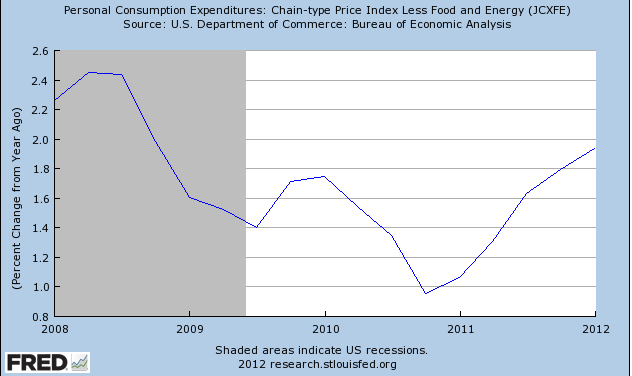

The vicious cycle of the US economy or why the US dollar must ultimately fall again

Just some simple words about the vicious cycle of the US economy and the consequences on the US dollar: A stronger USD will not rescue the US economy, quite the contrary. US companies will not hire in the US, but outsource or hire overseas. If they hire in the US, due to the high number …

Read More »

Read More »

Is the play time over for the SNB ? SNB Buys Euros Again, but the EUR/CHF does not move a pip

As also noticed by Credit Suisse, the Swiss National Bank had to buy euros and sell Swiss francs in the week of May 11th to May 18th. Their recent easy strategy to sell euros and buy Swiss Francs and to diversify from euros into other currencies may not continue.

Read More »

Read More »

EUR/CHF, A History, The Game Changes: April 2012

EUR/GBP: If You Want To Know Why Its Falling, Have A Look At The SNB Thanks Goose for the reminder that the SNB released figures on its FX reserves holdings and these showed a marked increase in GBP holdings. This has been a constant theme over the last few weeks/months, the SNB buys EUR/CHF in the marketplace … Continue reading »

Read More »

Read More »

Written in February 2012: Will the EUR/CHF never rise over 1.22 or 1.23 again?

Our analysis from February 2012 shows astonishing accurateness: It predicted that the euro would not rise against CHF and that the commodity currencies were overvalued and subject to correction.

Basic foreign exchange theory, the SNB price stability mandate and strong fundamentals for Switzerland and bad ones for the peripheral countries of the euro zone speak for the thesis that the EUR/CHF exchange rate might never go over the level of around...

Read More »

Read More »

EUR/CHF, A History, Market Betting on Floor Hike: February 2012

EUR/CHF Busy Doing Jack; Jordan Gobbing Off Later EUR/CHF sits at 1.2048, some 7 pips easier from when I started out. Barrier option interest sits at 1.2025 and ofcourse 1.2000. SNB interim head honcho Jordan speaks later this evening (18:30 GMT) in Zurich. Might be giving instructions on how to make his favourite alpine muesli … Continue reading...

Read More »

Read More »

EUR/CHF: A History of Interventions, April 2010

April 2010 Quick Look At The Order Books AUD/USD: stops below .9135 and again below .9070 USD/JPY: solid bids 92.70, stops below 92.40, heavy semi-official bids expected at 91.50 ( I’m hearing of “massive” stops below 90.50 so if market gets on a roll lower keep this level in mind) EUR/USD: looks like the order … Continue reading »

Read More »

Read More »

Recent History of the Swiss Franc: April 2009

A history of the EUR/CHF from the website ForexLive April 2009 Selling EUR/CHF Seems Akin To Poking Billy Goat Gruff With A Sharp Stick It seems to me selling the EUR/CHF cross down here is akin to poking the elder billy goat gruff with a sharp stick. You get it, Alpine meadows, goat herds….(Ok I know … Continue reading »

Read More »

Read More »