Tag Archive: Commitments of Traders

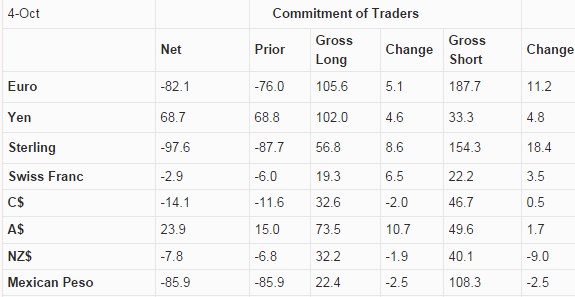

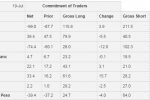

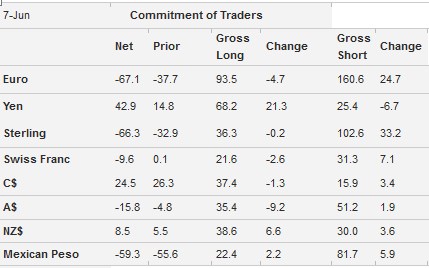

Weekly Speculative Positions: Speculators Slash Yen and Aussie Longs, Net CHF nearly unchanged

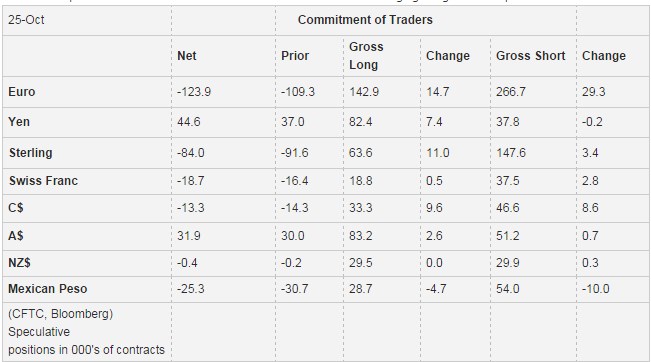

Speculators remain Long CHF against USD. The figure is nearly unchanged at 4.0 k CHF contracts. For CHF, both shorts and longs increased.

This weeks major change was in the yen and in AUD. Speculators strongly reduced their longs.

Read More »

Read More »

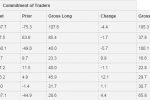

Sentiment Shift Evident in Speculative Adjustment in Currency Futures

Speculative positioning in the currency futures began to adjust before the latest signals from the Federal Reserve about the prospects for a summer hike and the widening of interest rate differentials. In the CFTC reporting week ending May 17, the day before the FOMC minutes were released speculators mostly reduced gross long currency positions and added …

Read More »

Read More »

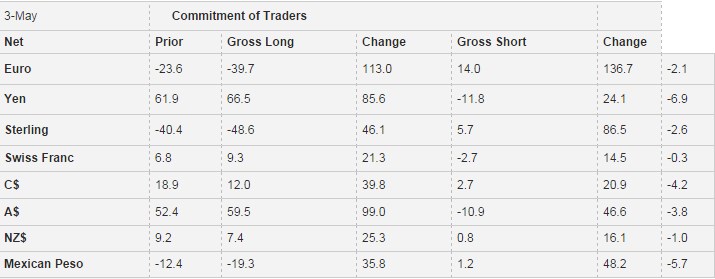

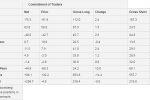

Weekly Speculative Positions: Significant Position Adjustments

The US dollar staged an impressive reversal against many of the major foreign currencies on May 3. In the following week, speculators in the currency futures market made significant adjustment in their holdings. We identified a change in the gross position in the currency futures of 10k contracts or more to be significant. In the week …

Read More »

Read More »

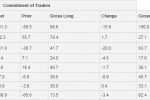

Weekly Speculative Positions: Cutting Longs in Yen and Swiss Franc

Speculators in the futures market continued to pare short foreign currency positions but were cautious about expanding long positions in the CFTC reporting week ending May 3. In fact, two of the three largest adjustments were the cutting of gross long Japanese yen and Australian dollar positions. Yen Speculators took profits on 11.8k contracts of …

Read More »

Read More »

Weekly Speculative Postions: Euro and Yen Exposure Trimmed ahead of FOMC and BOJ

Speculators in the futures market made mostly small position adjustments in the sessions leading up to the FOMC and BOJ meetings. During the Commitment of Traders reporting week ending April 26, the largest adjustment of speculative position in the currency futures was the 12.5 k build of gross long Australian dollar contracts. The accumulation …

Read More »

Read More »

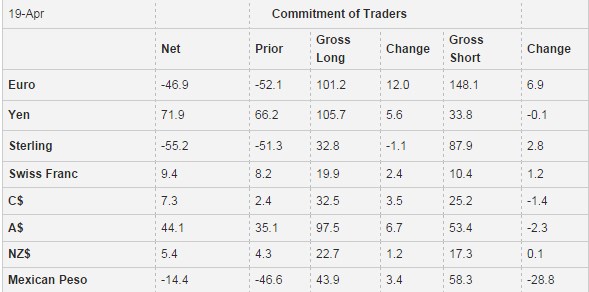

Weekly Speculative Positions: Reduction of US Dollar Exposure at What may be the Bottom

Speculators in the futures market continued to press a bearish view of the US dollar the CFTC reporting week ending April 19. For one and half month traders continue to increase their long CHF position against the dollar. It has risen to 7.3k contracts.

Read More »

Read More »

Weekly Speculative Position: Switch to Net Long Canadian Dollar and Set New Record Gross Long Yen

Speculators in the futures market were not particularly active in Commitment of Traders reporting week ending April 5. There was only one gross position adjustment which we regard as significant (defined as a 10k contract change), and that was in the yen. Yen bulls extended their gross long position by 13.3k contract to new record …

Read More »

Read More »

Weekly Speculative Position: Yen Longs Near Record Levels

The most extreme speculative positioning, judging from the futures market is the long yen position. The bulls added another 3.4k contracts, lifting the gross long position to 82.8k contracts. The record was set in 2008 at 94.7k contracts. The gross short position was trimmed by 4.5k contracts, leaving 29.5k. It is the smallest gross short position …

Read More »

Read More »

Weekly Speculative Positions: Pile into Sterling and Take Profits on Long Aussie

After a relatively quiet period into the run-up to the ECB, speculative activity markedly increased in the CFTC reporting week ending the day prior to the conclusion of the FOMC meeting. Two speculative gross currency position adjustments stand out. First, speculators appeared to have bought a record amount of sterling contracts. The gross long position more …

Read More »

Read More »

Weekly Speculative Positions: Cut Long Sterling Exposure While Adding to Long Aussie

The Commitment of Traders reporting period ending March 8 showed little position adjusting ahead of the ECB meeting two days later. A little more than 3/4 of the gross positions we track saw less than 5k contract change and only two were above 6k. The gross long speculative sterling position was cut by a quarter …

Read More »

Read More »

Weekly Speculative Positions: Small Changes

The position adjustment among speculators in the currency futures market were minor in the reporting week that ended February 23. There was only one gross adjustment we regard as significant (more than 10k contracts). The Mexican officials sprung a bear trap and forced speculators to cover. There were 15.8k gross short peso in speculative hands that …

Read More »

Read More »

Weekly Speculative Position: Dollar Bullish Speculators Still Hesitant

The CFTC Commitment of Traders reporting week ending February 16 was short due to the US holiday. This may have contributed to the small adjustments to speculative positioning in the currency futures. It also may reflect the lack of convictio...

Read More »

Read More »

Weekly Speculative Positions: Speculators Continue to Press

There are two broad developments in speculative positioning in the Commitment of Traders report in the week ending February 9. First, the market turbulence saw speculators reduce exposure. Of the 16 gross positions we track, 11 were reducing ...

Read More »

Read More »

Weekly Speculative Positions: Big Position Adjustment for Euro, Smaller for Yen

The latest Commitment of Traders report covers the week ending February 2 that included the FOMC meeting and the BOJ's surprise cut. There was also speculation of a potential deal between Russia and OPEC to cut output. Speculative position adjustment in the futures market was more limited than one might have expected. Speculators cut 10.5k gross …

Read More »

Read More »

Weekly Speculative Positions: Speculators Added to Long Yen Position Ahead of BOJ

The latest CFTC Commitment of Traders report covers the five sessions through January 26, the day before the FOMC concluded its two-day meeting and three days before the BOJ's announcement. Speculators hardly changed their positioning during th...

Read More »

Read More »

Weekly Speculative Positioning before the Reversal

The latest Commitment of Traders report that covers the four sessions through January 19 saw speculators anticipating the continuation of the current moves. Of the sixteen gross positions we track, only five were in reducing exposures. Last week there was only six increased exposures. With the benefit of hindsight, we know that something changed a day …

Read More »

Read More »

Weekly Speculative Positions: Boosted Long Yen Positions, but Mostly Trimmed Exposures

Speculative activity in the CME currency futures picked up in the latest reporting period. There were six significant gross position adjustments, which in our work is more than 10k contracts. The gross short speculative euro position was reduced by 17.9k contracts, leaving 209.6k. Since early December, 53k gross short euro contracts were covered. During the same …

Read More »

Read More »

Weekly Speculative Positions: First Net Long Yen in 3 Years

Due to the holidays, the CFTC has been releasing its Commitment of Traders report late. With this week's report, the normal Friday release schedule resumes.

The latest report covers the shortened week through January 5. It is not surpr...

Read More »

Read More »

Weekly Speculative Positions: Significant Position Adjustment Ahead of FOMC Meeting

Speculative position adjustments in the currency futures were minimal in the immediate aftermath of the ECB's December 3 meeting and US employment data the following day. However, activity dramatically increased in the days ahead of the FOMC meeting on December 16. In most Commitment of Traders reports the gross position adjustment of 10k or more …

Read More »

Read More »