Speculative activity in the CME currency futures picked up in the latest reporting period. There were six significant gross position adjustments, which in our work is more than 10k contracts.

The gross short speculative euro position was reduced by 17.9k contracts, leaving 209.6k. Since early December, 53k gross short euro contracts were covered. During the same time, about 17k gross long contracts were added.

Speculators stayed long the yen for the second consecutive week, and at 25.3k contracts, is the largest net long position since October 2012. The gross longs rose by 10.9k contracts while the gross shorts were cut by 10.2k contracts, leaving 78.4k and 53.1k respectively. Since early December, the gross longs have risen by roughly the same amount that the gross shorts have been reduced.

Although the net short speculative position in sterling was unchanged at 30.5k contracts, it masks a significant reduction of exposure. The gross longs were reduced by nearly a quarter (10.4k contracts) to 34.3k. The gross shorts were trimmed by 10.3k contracts or almost 14% to 64.8k.

The bears added 11.8k contracts to the gross short Australian dollar position, lifting it to 71.6k contracts. In late-November, the gross short position was 110k contracts. Given the momentum and magnitude of the move, the gross short position is likely to have continued to grow.

Speculators are generally reduced exposures in the CFTC reporting week ending January 12. Of the sixteen gross position we track, ten were reduced. The exceptions were the gross long yen position and the gross short Aussie position as we have seen. Gross long speculative Australian dollar positions grew (2.5k contracts), and both long and short New Zealand dollar positions were grown slightly (300 contracts each) and the gross short Mexican peso position rose 7.5k contracts (to 103.4k).

The net speculative 10-year Treasury note position switched from 18.3k long to 43.2k contracts short. The longs took profits on 40.4k contracts, leaving 431.5k. The bears sold into the rally and growth the gross short position by 21.1k contracts (to 474.8k). The continued rally in US notes and bonds likely forced some of the late shorts out.

The speculative net long light sweet crude oil futures fell by 20.7k contracts. This was a function of more sellers than buyers, but the bulls did buy. They added 39.4k contracts to their gross long position, giving them 499.8k contracts. The bears were emboldened and added 60.1k contracts to their gross short position to 336.3k contracts.

| 12-Jan | Commitment of Traders | |||||

| Net | Prior | Gross Long | Change | Gross Short | Change | |

| Euro | -146.5 | -160.6 | 63.2 | -3.7 | 209.6 | -17.9 |

| Yen | 25.3 | 4.1 | 78.4 | 10.9 | 53.1 | -10.2 |

| Sterling | -30.5 | -30.5 | 34.3 | -10.4 | 64.8 | -10.3 |

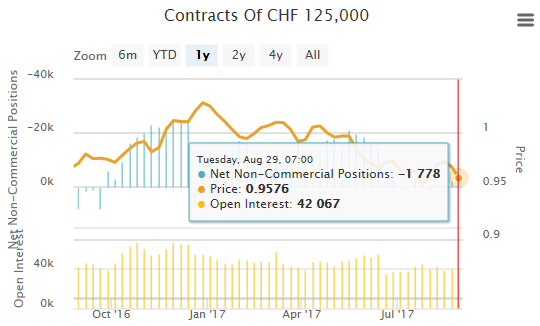

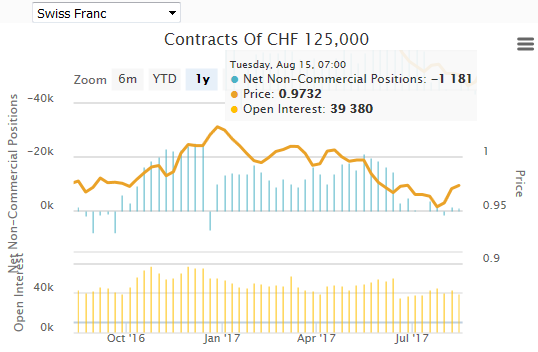

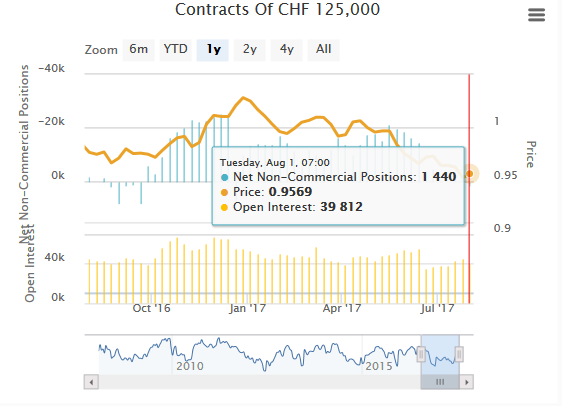

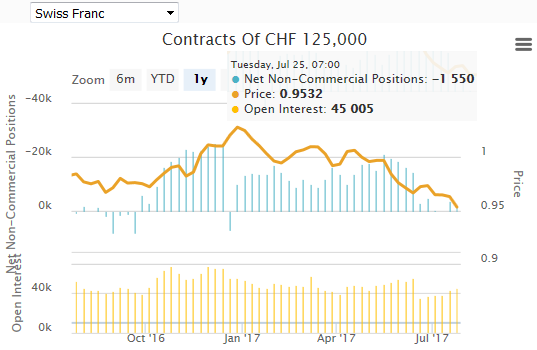

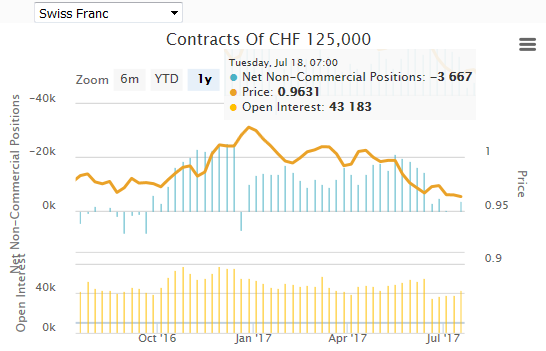

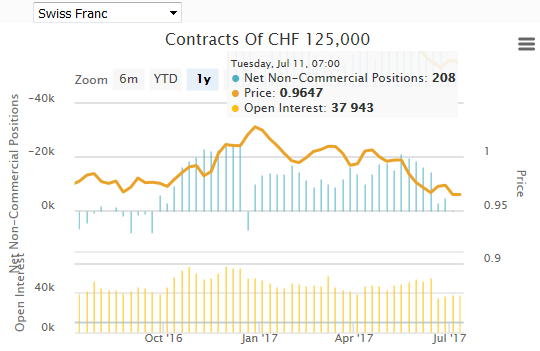

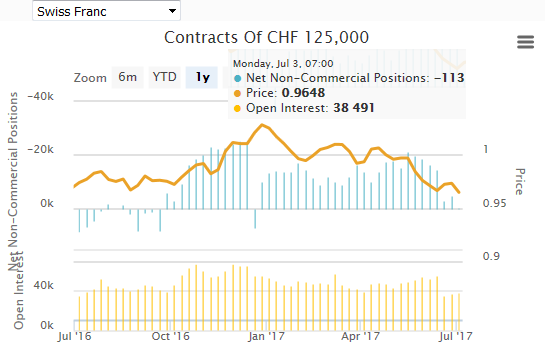

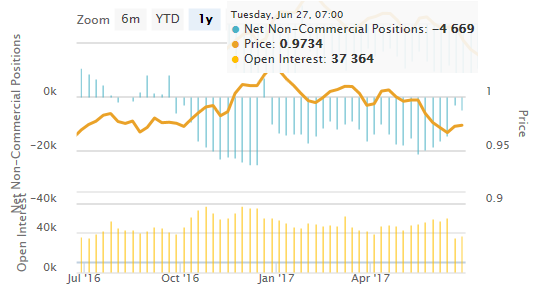

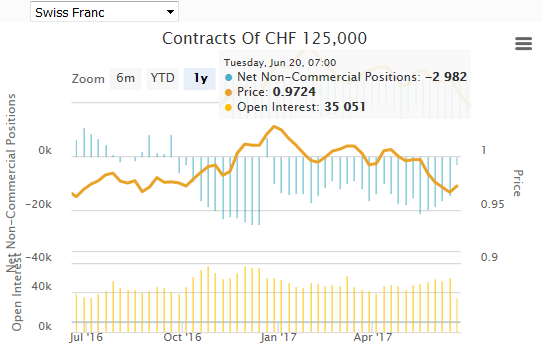

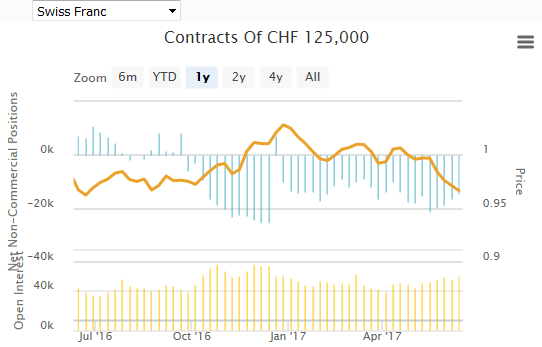

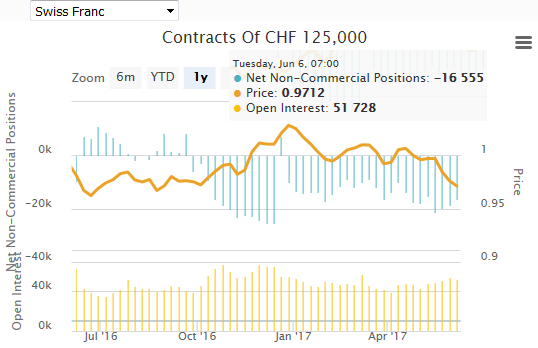

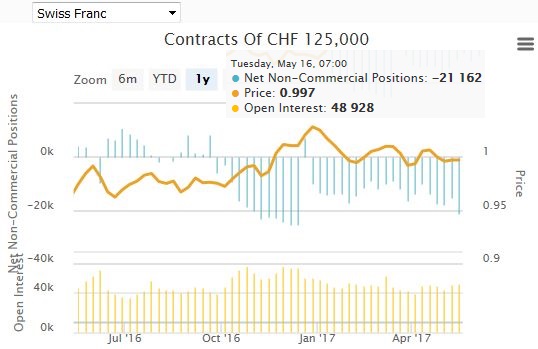

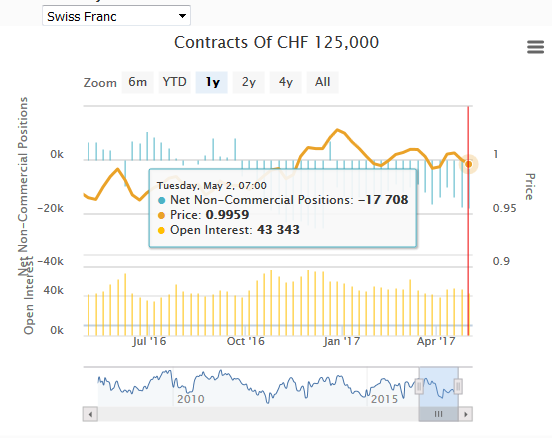

| Swiss Franc | 3.0 | 3.6 | 24.5 | -1.9 | 21.2 | -1.6 |

| C$ | -59.2 | -60.0 | 38.8 | -2.1 | 98.1 | -3.0 |

| A$ | -23.0 | -13.8 | 48.5 | 2.5 | 71.6 | 11.8 |

| NZ$ | 1.5 | 1.6 | 17.1 | 0.3 | 15.6 | 0.3 |

| Mexican Peso | -74.0 | -62.0 | 29.4 | -4.5 | 103.4 | 7.5 |

(CFTC, Bloomberg) Speculative positions in 000's of contracts |

||||||

Tags: Commitments of Traders,Speculative Positions