Tag Archive: China

China’s Pooh Lesson

It’s one of those “nothing to see here” moments for Economists trying not to appreciate what’s really going on in China therefore the global economy. The slump in China’s automotive sector dragged on through October, with year-over-year sales down for the fourth straight month.

Read More »

Read More »

FX Weekly Preview: DOTS in the Week Ahead: Divergence, Oil, Trade and Stocks

The Federal Reserve's confidence in the economy and its need to continue to gradually increase interest rates stands in sharp contrast to most of the other major central banks. The European Central Bank will finish its asset purchases at the end of the year, but it is in no position to begin to normalize interest rates. Indeed, the risk is that it may feel compelled to off another Targeted Long-Term Repo, which would, in effect, allow the borrowers...

Read More »

Read More »

The Future is Already Here–It is Just Not Evenly Distributed

When William Gibson would say that "the future is already here-it is just not evenly distributed," he was referring to how wealth and location determine one's access to technological advances (the future). Yet it equally can apply to the US-Chinese relationship.

Read More »

Read More »

FX Weekly Preview: Stocks, Trade, and the Fed in the Week Ahead

Last month's downdraft in equities spooked investors. The fear that is often expressed is that the end of the business cycle may coincide with the end of a credit cycle and a return to 2008-2009 crisis. It seems like an increasing number of economists agree with the sentiment expressed by President Trump that the Fed is too aggressive.

Read More »

Read More »

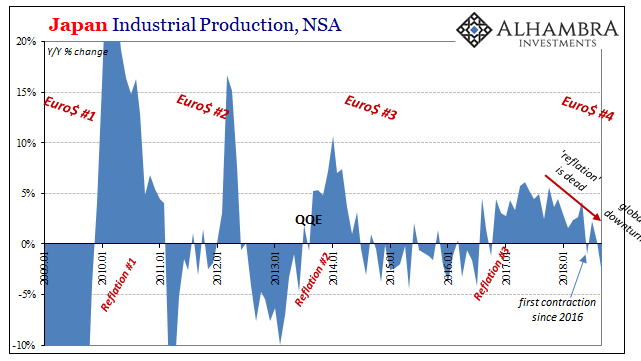

China Now Japan; China and Japan

Trade war stuff didn’t really hit the tape until several months into 2018. There were some noises about it back in January, but there was also a prominent liquidation in global markets in the same month. If the world’s economy hit a wall in that particular month, which is the more likely candidate for blame? We see it register in so many places. Canada, Europe, Brazil, etc.

Read More »

Read More »

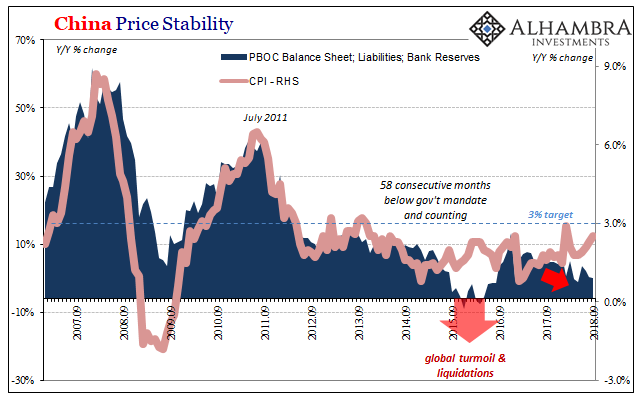

Raining On Chinese Prices

It was for a time a somewhat curious dilemma. When it rains it pours, they always say, and for China toward the end of 2015 it was a real cloudburst. The Chinese economy was slowing, dangerous deflation developing around an economy captured by an unseen anchor intent on causing havoc and destruction. At the same time, consumer prices were jumping where they could do the most harm.

Read More »

Read More »

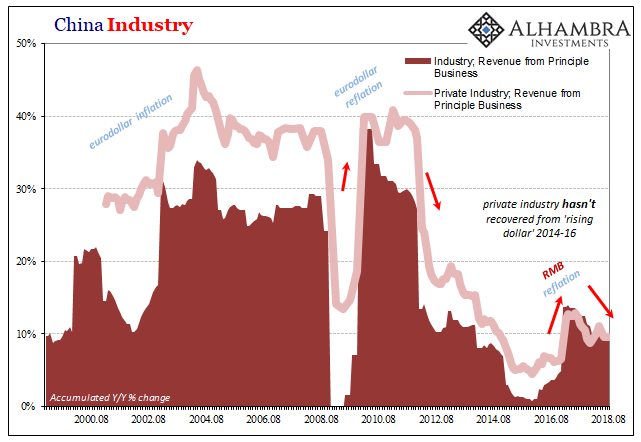

China’s Industrial Dollar

In December 2006, just weeks before the outbreak of “unforeseen” crisis, then-Federal Reserve Chairman Ben Bernanke discussed the breathtaking advance of China’s economy. He was in Beijing for a monetary conference, and the unofficial theme of his speech, as I read it, was “you can do better.” While economic gains were substantial, he said, they were uneven.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX was whipsawed last week but ended on a firm note. We look past the noise and believe that the true signals for EM remain higher US interest rates and continued trade tensions, both of which are negative. Turkish markets reopen after a week off. Nothing fundamentally has changed there, and so it still poses some spillover risk to wider EM.

Read More »

Read More »

Three Things that may Disappoint Investors

There are three areas that we suspect that many investors are vulnerable to disappointment. NAFTA, trade talks with China, and Powell speech at Jackson Hole on Friday. With problems elsewhere, the Trump Administration has been playing up the likelihood of an agreement as early as today with Mexico, which would be used, apparently to deliver a fait accompli to Canada.

Read More »

Read More »

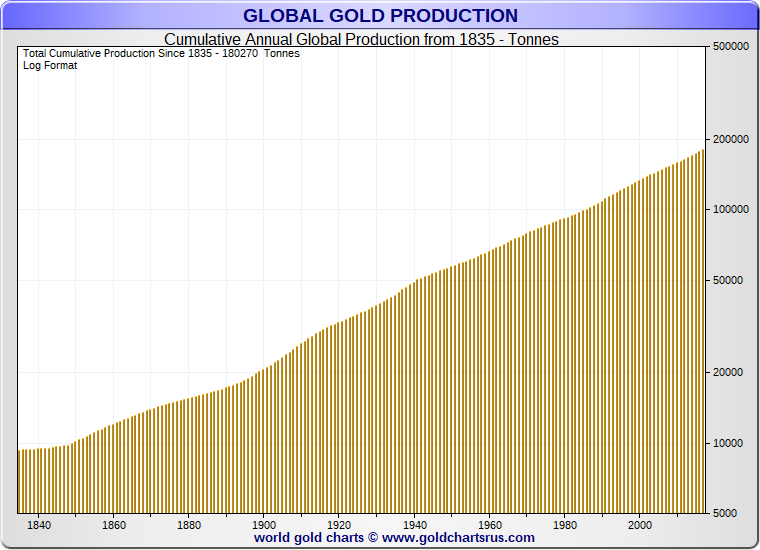

Annual Mine Supply of Gold: Does it Matter?

The topic of how much extractable gold is left in the world has become increasingly discussed within the last few years. This is because of increased focus on ‘peak gold’ and also a concern about remaining levels of unextracted gold reserves. Peak gold is a term referring to the phenomenon of annual gold mining supply peaking (i.e. the rate of gold extraction increases until it peaks at maximum gold output and subsequently diminishes).

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.

Read More »

Read More »

The Yin and Yang of the US-China Relationship

Chimerica always seemed like an oversimplification of a complex and dialectic relationship between the US and China. However, it did express an underlying truth, that China's rise over the last 40 years has been predicated on Deng Xiaoping's political and economic reforms and, importantly, the world of free-trade (a reduction in tariff barriers to trade) promoted by the United States.

Read More »

Read More »

What Chinese Trade Shows Us About SHIBOR

Why is SHIBOR falling from an economic perspective? Simple again. China’s growth both on its own and as a reflection of actual global growth has stalled. And in a dynamic, non-linear world stalled equals trouble. Going all the way back to early 2017, there’s been no acceleration (and more than a little deceleration). The reflation economy got started in 2016 but it never went anywhere. For most of last year, optimists were sure that it was just the...

Read More »

Read More »

Some Initial Consequences of Trade Tensions

The Trump Administration argues that other countries have been taking unfair advantage of the US on trade for years, and what many are calling a trade war is really only the US finally saying enough. The US has taken many several countries, including China, to the WTO for trade violations and wins the vast majority of cases it has brought.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX has come under pressure again due to ongoing trade tensions and rising US rates but saw some modest relief Friday after the PBOC announcement on FX forwards. This helped EM FX stabilize, but we do not think the negative fundamental backdrop has changed. Best performers last week were MXN, PHP, and PEN while the worst were TRY, ZAR, and KRW.

Read More »

Read More »

Global Asset Allocation Update

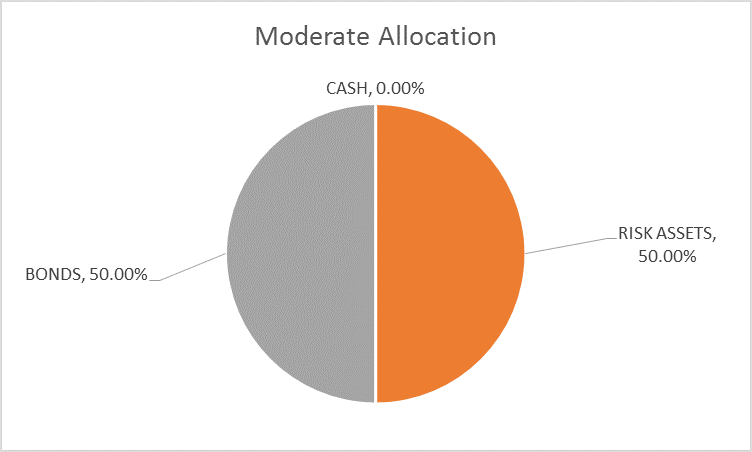

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY.

Read More »

Read More »

Tensions Beyond Trade

Chinese officials do not seem to appreciate the extent of its isolation. The disruption from the US as Trump positions the US as a revisionist power-one that wants to alter the world order, which it was instrumental in constructing, may have obscured the fact that China's practices are a source of frustration and animosity broadly and widely.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX enjoyed a respite from the ongoing selling pressures, with most currencies up on the week vs. the dollar. Best performers were CLP, MXN, and ZAR while the worst were TRY, CNY, and COP. BOJ, Fed, and BOE meetings this week may pose some risks to EM FX.

Read More »

Read More »

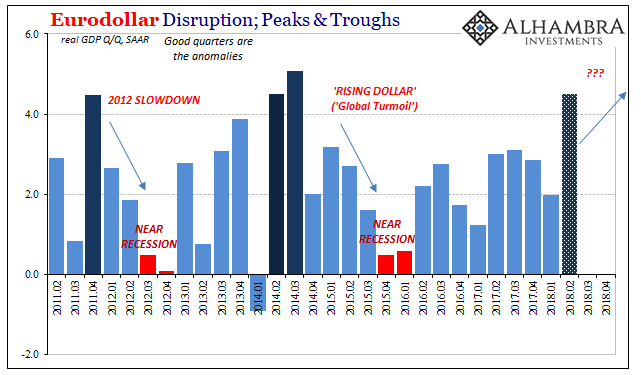

The Top of GDP

In 1999, real GDP growth in the United States was 4.69% (Q4 over Q4). In 1998, it was 4.9989%. These were annual not quarterly rates, meaning that for two years straight GDP expanded by better than 4.5%. Individual quarters within those years obviously varied, but at the end of the day the economy was clearly booming.

Read More »

Read More »

FX Weekly Preview: For the Millionth Time: Investors Exaggerate Trade Tensions at Their Own Peril

You would never have guessed it reading many of the op-eds and pundits pronouncing the end to globalization or the West, or liberalism. Global equities have rallied. Of course, stock prices are not the end all and be all, but it stands in stark contrast to the cries that the sky is falling.

Read More »

Read More »