Tag Archive: China

FX Daily, March 29: Bonds and Stocks are Firm, While the Greenback Consolidates Upticks

The choppy US equity session yesterday, ultimately ending with modest losses as the tech sector remained under pressure, has been shrugged off in Asia and Europe, where modest gains have been seen. The dollar is little changed after yesterday's gains, and bonds are mostly firmer.

Read More »

Read More »

FX Weekly Preview: The Investment Climate

The investment meme of a synchronized global upturn has been undermined by the recent string of US and European economic data. The flash March eurozone composite reading fell to 55.3, the lowest reading since January 2017. Although Q4 17 US GDP may be revised higher (toward 2.8% from 2.5%) mostly due to greater inventory accumulation, the curse of weak Q1 GDP appears to be showing its hand again, with forecasts now coming in below 2%.

Read More »

Read More »

FX Daily, March 22: Dollar Trades Off

The US dollar has not recovered from the judgment that yesterday's that Fed was not as hawkish as many had anticipated. There was no indication that officials thought they were behind the curve or prepared to accelerate the pace of hikes. Powell is comfortable with the broad policy framework that has been established but seemed to have little time for the summing up of the individual forecasts (dot plot).

Read More »

Read More »

The Boom Reality of Uncle He’s Globally Synchronized L

Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open. Many here had been expecting that outgoing PBOC...

Read More »

Read More »

Emerging Markets: What Changed

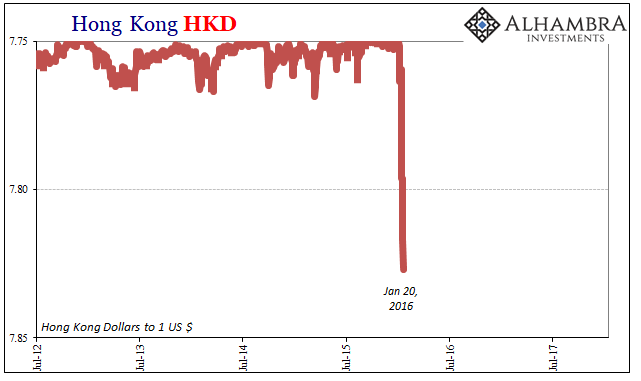

Hong Kong may impose a tax on unsold apartments as an effort to increase supply and cool off the housing market. Bank of Israel’s MPC had a split vote last month for the first time in three years. South Africa President Ramaphosa said the ANC wants Julius Malema of the opposition EFF to rejoin the party. Former South Africa President Zuma will face trial on 16 criminal charges.

Read More »

Read More »

China’s Questionable Start to 2018

The Chinese government reported estimates for Industrial Production, Retail Sales, and Fixed Asset Investment (FAI) for both January and February 2018. The National Bureau of Statistics prepares and calculates China’s major economic statistics in this manner at the beginning of each year due to the difficulties created by calendar effects (New Year Golden Week).

Read More »

Read More »

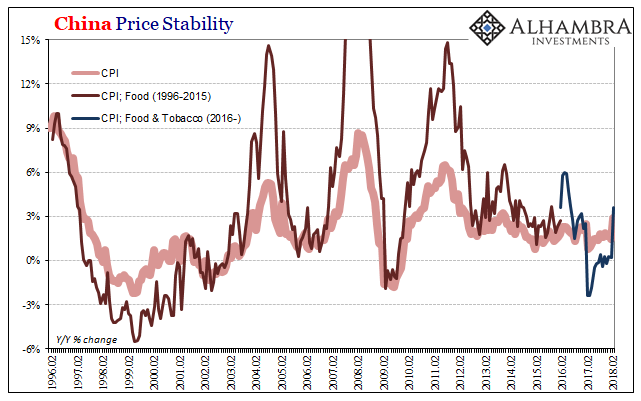

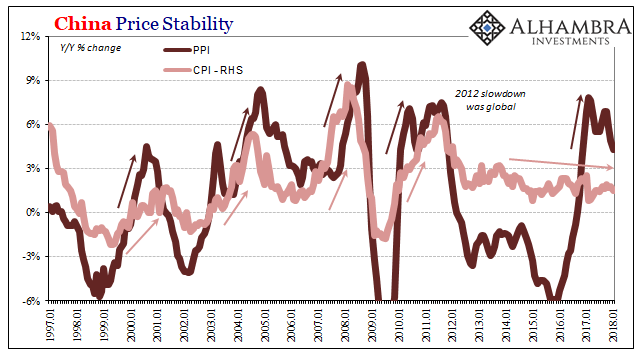

China Prices Include Lots of Base Effect, Still Undershoots

By far, the easiest to answer for today’s inflation/boom trifecta is China’s CPI. At 2.9% in February 2018, that’s the closest it has come to the government’s definition of price stability (3%) since October 2013. That, in the mainstream, demands the description “hot” if not “sizzling” even though it still undershoots. The primary reason behind the seeming acceleration was a more intense move in food prices.

Read More »

Read More »

Emerging Markets: Preview Week Ahead

EM FX ended Friday on a firm note and capped off a mostly firmer week. MXN, KRW, and ZAR were the best performers last week, while CLP, CZK, and PLN were the worst. US jobs data was mixed, with markets focusing on weak average hourly earnings rather than on the strong NFP number. Still, the data did nothing to change market expectations for a 25 bp by the FOMC this month.

Read More »

Read More »

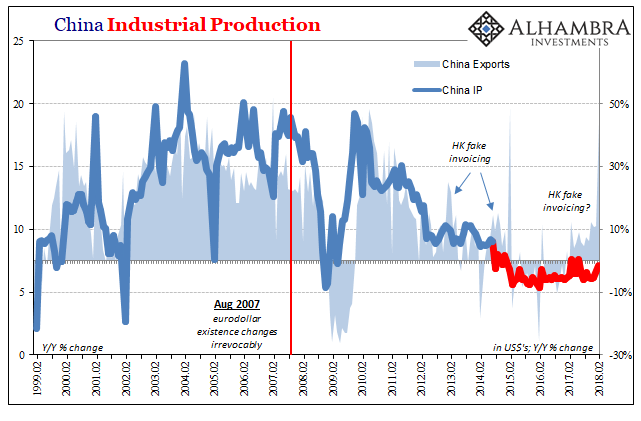

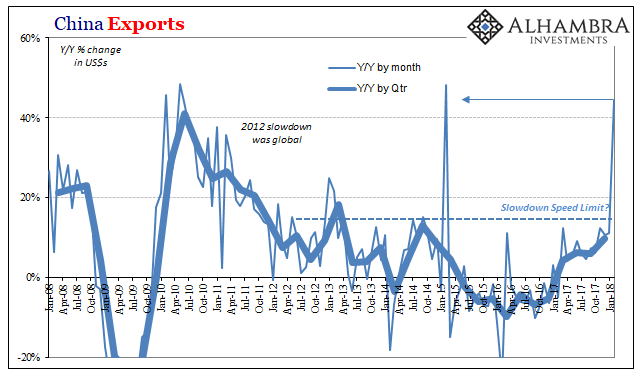

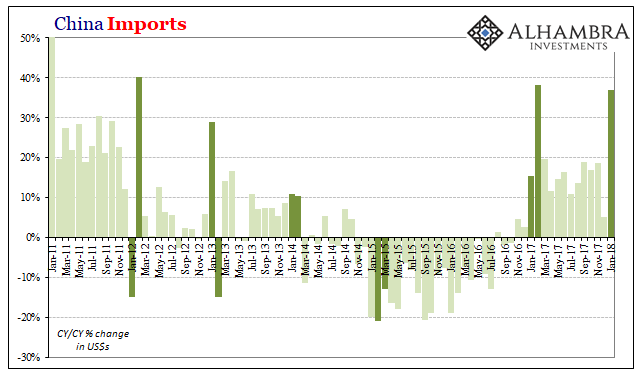

China Exports: Trump Tariffs, Booming Growth, or Tainted Trade?

China’s General Administration of Customs reported that Chinese exports to all other countries were in February 2018 an incredible 44.5% more than they were in February 2017. Such a massive growth rate coming now has served to intensify the economic boom narrative.

Read More »

Read More »

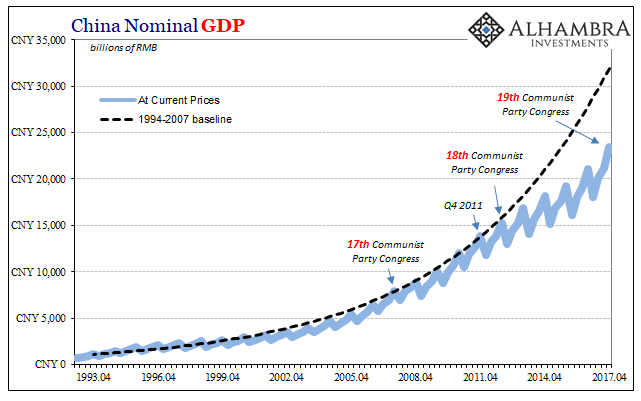

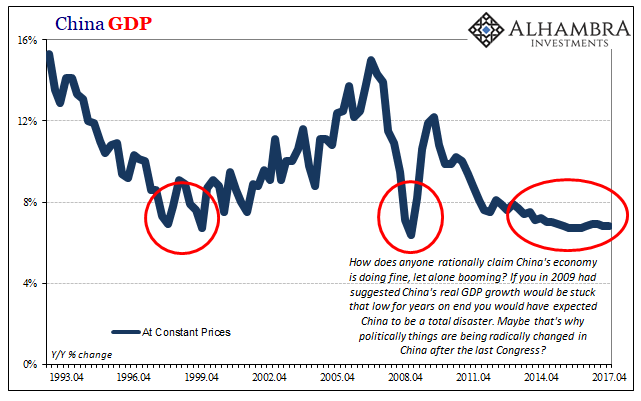

China Going Boom

For a very long time, they tried it “our” way. It isn’t working out so well for them any longer, so in one sense you can’t blame them for seeking answers elsewhere. It was a good run while it lasted. The big problem is that what “it” was wasn’t ever our way. Not really. The Chinese for decades followed not a free market paradigm but an orthodox Economics one. This is no trivial difference, as the latter is far more easily accomplished in a place...

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note, capping off a largely softer week. Best performers last week for MYR and TWD while the worst were ZAR and ARS. US stocks clawed back early losses and ended the week on a firmer note but we think further market turbulence is likely.

Read More »

Read More »

Data Distortions One Way Or Another

Back in October, we noted the likely coming of two important distortions in global economic data. The first was here at home in the form of Mother Nature. The other was over in China where Communist officials were gathering as they always do in their five-year intervals. That meant, potentially. In the US our economic data for a few months at least will be on shaky ground due to the lingering economic impacts of severe hurricanes.

Read More »

Read More »

Emerging Markets: Week Ahead Preview

EM FX ended Friday on a mixed note and capped off a soft week overall. Best performers last week were ZAR, CLP, and PHP while the worst were TRY, ARS, and IDR. Fed Chief Powell’s testimony to Congress will likely draw market attention back to Fed policy.

Read More »

Read More »

China: Inflation? Not Even Reflation

The conventional interpretation of “reflation” in the second half of 2016 was that it was simply the opening act, the first step in the long-awaiting global recovery. That is what reflation technically means as distinct from recovery; something falls off, and to get back on track first there has to be acceleration to make up that lost difference.

Read More »

Read More »

Emerging Markets: The Week Ahead, February 12

EM FX ended Friday on a mixed note, as risk assets recovered a bit from broad-based selling pressures. Best EM performers on the week were ZAR, PHP, and CNY while the worst were COP, RUB, and ARS. Besides the risk-off impulses still reverberating through global markets, we think lower commodity prices are another headwind on EM.

Read More »

Read More »

China: CNY, Not Imports

In February 2013, the Chinese Golden Week fell late in the calendar. The year before, 2012, New Year was January 23rd, meaning that the entire Spring festival holiday was taken with the month of January. The following year, China’s New Year was placed on February 10, with the Golden Week taking up the entire middle month of February.

Read More »

Read More »

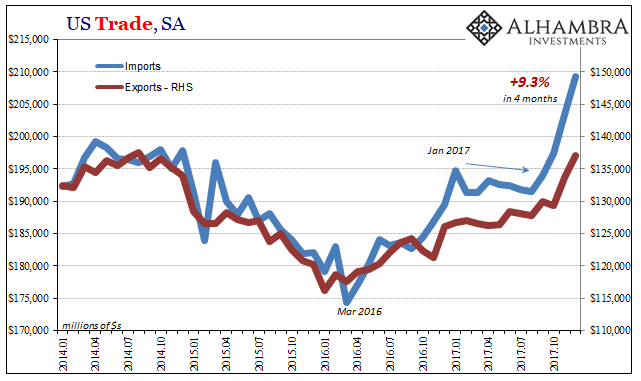

US Imports: A Little Inflation For Yellen, A Little More Bastiat

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower.

Read More »

Read More »

FX Weekly Preview: Changing Fortunes in the Capital Markets or Long Overdue Correction?

The chief development in the capital markets has been the sharp drop in equities after a significant rally since late last year and the rise in yields. The dollar had fallen alongside the exuberant appetite for risk assets. Anecdotal evidence supports the idea that the greenback was used as a funding currency to purchase those risk assets.

Read More »

Read More »

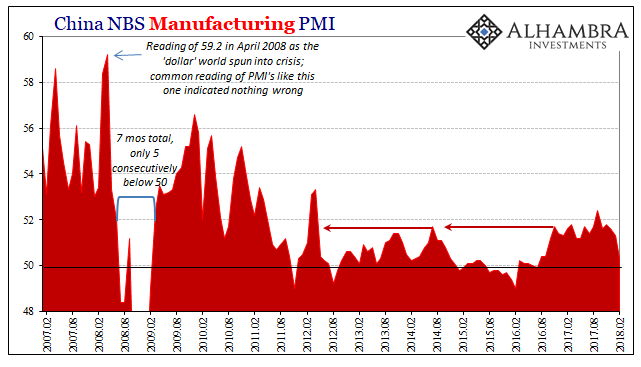

How Global And Synchronized Is A Boom Without China?

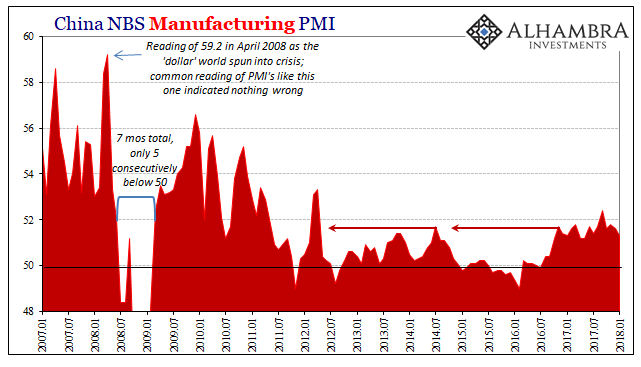

According to China’s official PMI’s, those looking for a boom to begin worldwide in 2018 after it failed to materialize in 2017 are still to be disappointed. If there is going to be globally synchronized growth, it will have to happen without China’s participation in it. Of course, things could change next month or the month after, but this idea has been around for a year and a half already.

Read More »

Read More »

Central Bank Transparency, Or Doing Deliberate Dollar Deals With The Devil

The advent of open and transparent central banks is a relatively new one. For most of their history, these quasi-government institutions operated in secret and they liked it that way. As late as October 1993, for example, Alan Greenspan was testifying before Congress intentionally trying to cloud the issue as to whether verbatim transcripts of FOMC meetings actually existed.

Read More »

Read More »