Tag Archive: China

China’s Big Money Gamble

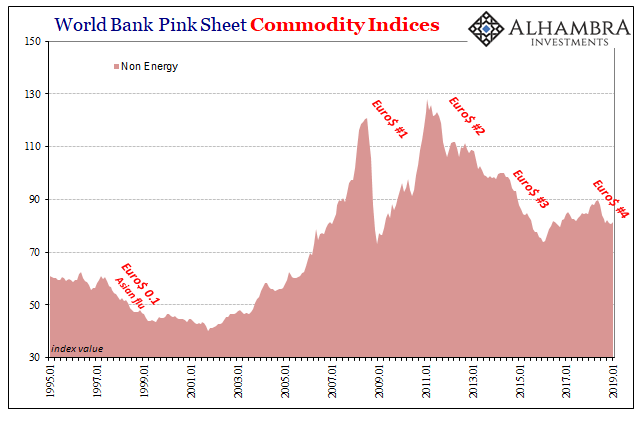

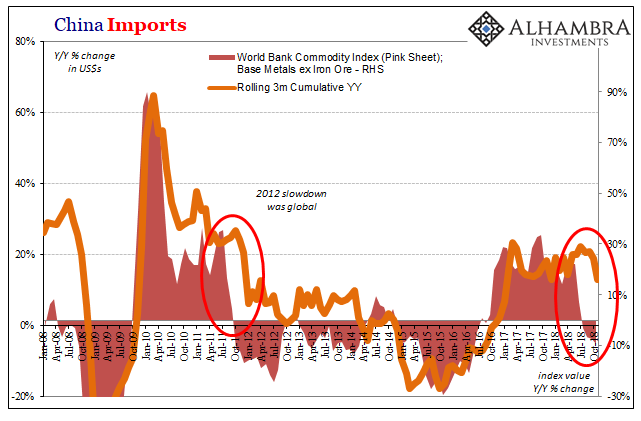

While oil prices rebounded in January 2019 around the world, outside of crude commodities continued to struggle. According to the World Bank’s Pink Sheet, base metal prices fell another 1.8% on average from December. On an annual basis, these commodities as a group are about 16% below where they were in January 2018.

Read More »

Read More »

FX Weekly Preview: Drivers, While Marking Time

The main issues for investors have not changed. There are three dominant ones: Trade, growth, and Brexit. Unfortunately, there won’t be any closure in the week ahead, and that may make short-term participants reluctant to turn more aggressive.

Read More »

Read More »

FX Weekly Preview: Little Resolution in the Week Ahead

According to legend, the person who unraveled the Gordian Knot would rule the world. No one succeeded until Alexandar the Great took his mighty sword and sliced the knot in half. A young boy saw him afterward, crying on the steps of the Temple of Apollo. "Why are you crying?" the boy asked, "you just conquered the world. "Yes'" Alexander wept, " now there is nothing else for me to do."

Read More »

Read More »

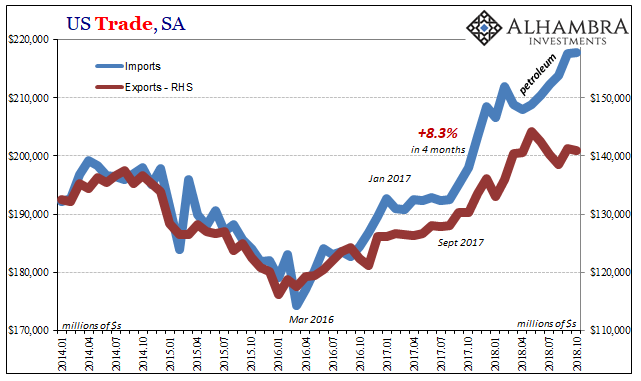

More Of What Was Behind December, And Not Just December

As more and more data rolls in even in this delayed fashion, the more what happened to end last year makes sense. The Census Bureau updated today its statistics for US trade in November 2018. Heading into the crucial month of December, these new figures suggest a big setback in the global economy that is almost certainly the reason markets became so chaotic.

Read More »

Read More »

Fear Or Reflation Gold?

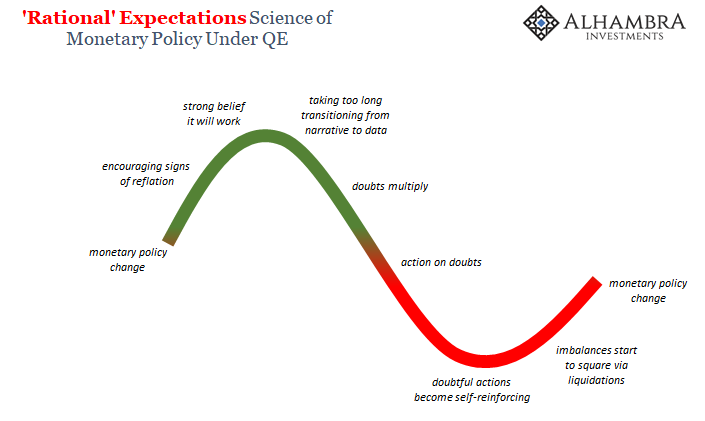

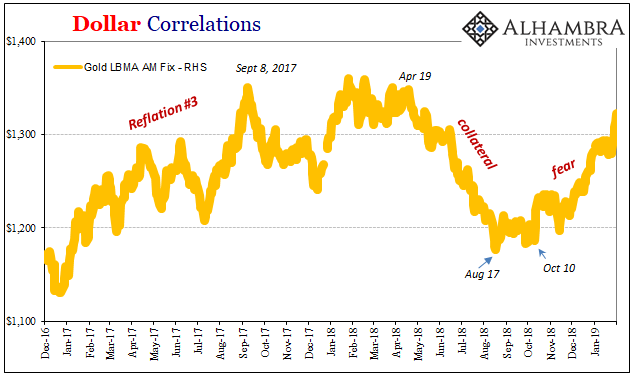

Gold is on fire, but why is it on fire? When the precious metals’ price falls, Stage 2, we have a pretty good idea what that means (collateral). But when it goes the other way, reflation or fear of deflation? Stage 1 or Stage 3? If it is Stage 1 reflation based on something like the Fed’s turnaround, then we would expect to find US$ markets trading in exactly the same way.

Read More »

Read More »

China’s Eurodollar Story Reaches Its Final Chapters

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream.

Read More »

Read More »

Spreading Sour Not Soar

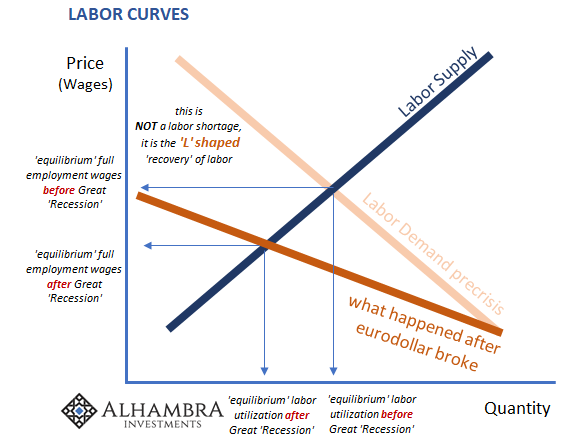

We are starting to get a better sense of what happened to turn everything so drastically in December. Not that we hadn’t suspected while it was all taking place, but more and more in January the economic data for the last couple months of 2018 backs up the market action. These were no speculators looking to break Jay Powell, probing for weakness in Mario Draghi’s resolve.

Read More »

Read More »

Rate of Change

We’ve got to change our ornithological nomenclature. Hawks become doves because they are chickens underneath. Doves became hawks for reasons they don’t really understand. A fingers-crossed policy isn’t a robust one, so there really was no reason to expect the economy to be that way.

Read More »

Read More »

FX Weekly Preview: For the Millionth Time, Markets Exaggerate

The S&P 500 fell more than 12% in a few weeks. The 10-year Treasury yield fell nearly 40 bp. There were cries that the sky was falling. A recession is imminent, we are warned by prognosticators. The Fed went ahead and raised interest rates on March 21, 2018, and the S&P 500 proceeded to gap lower the next day and continued to sell-off the following day. Investors did not like the unanimous decision.

Read More »

Read More »

More Unmixed Signals

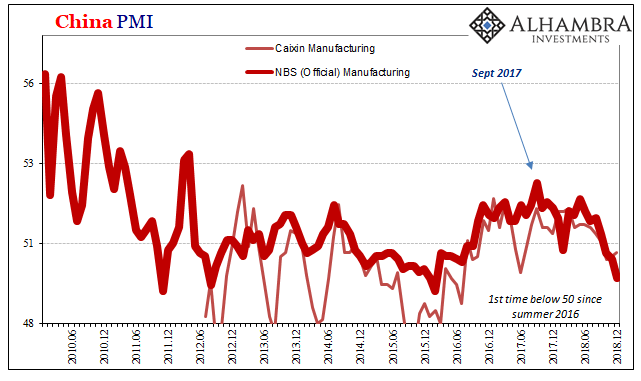

China’s National Bureau of Statistics (NBS) reports that the country’s official manufacturing PMI in December 2018 dropped below 50 for the first time since the summer of 2016. Many if not most associate a number in the 40’s with contraction. While that may or not be the case, what’s more important is the quite well-established direction.

Read More »

Read More »

Xi Jinping’s Pretty Consistent Message

It seems many were disappointed by the speech delivered by Xi Jinping. China’s supreme leader spoke at the Great Hall of the People in Beijing today on the 40th anniversary of his country’s first embrace of economic reform. Commentators had been expecting Xi to use the occasion to recommit to liberalization, further opening China to free market forces.

Read More »

Read More »

The Relevant Word Is ‘Decline’

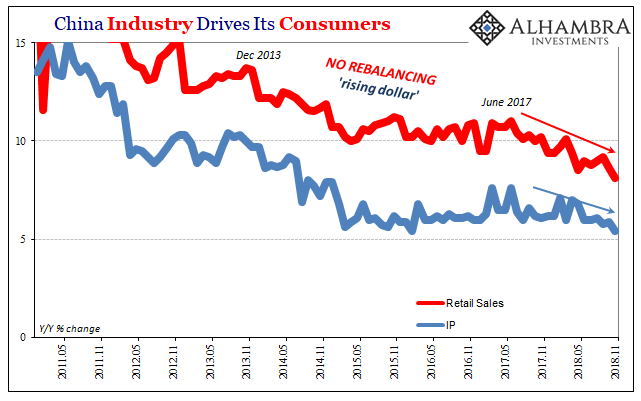

The English language headline for China’s National Bureau of Statistics’ press release on November 2018’s Big 3 was, National Economy Maintained Stable and Sound Momentum of Development in November. For those who, as noted yesterday, are wishing China’s economy bad news so as to lead to the supposed good news of a coordinated “stimulus” response this was itself a bad news/good news situation.

Read More »

Read More »

FX Weekly Preview: FOMC Dominates Week Ahead Calendar

The last FOMC meeting of 2018 is at hand. After hiking rates three times in 2017, the Fed signaled that four hikes were likely this year and with a widely expected move on December 20, it would have fully delivered, though many steps along the way, skeptical investors had to be led by the nose, as it were, to minimize the element of surprise.

Read More »

Read More »

Sometimes Bad News Is Just Right

There is some hope among those viewing bad news as good news. In China, where alarms are currently sounding the loudest, next week begins the plenary session for the State Council and its working groups. For several days, Communist authorities will weigh all the relevant factors, as they see them, and will then come up with the broad strokes for economic policy in the coming year (2019).

Read More »

Read More »

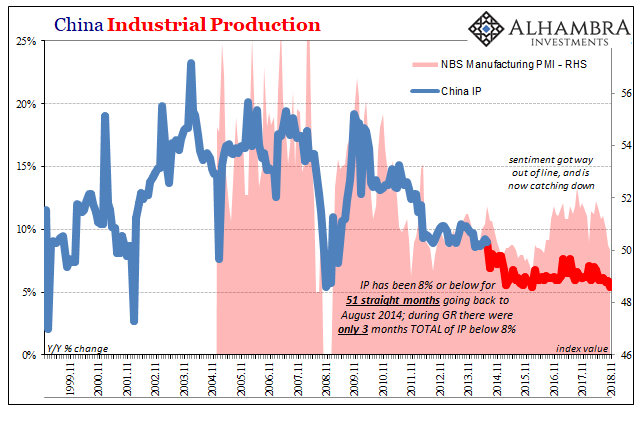

China Going Back To 2011

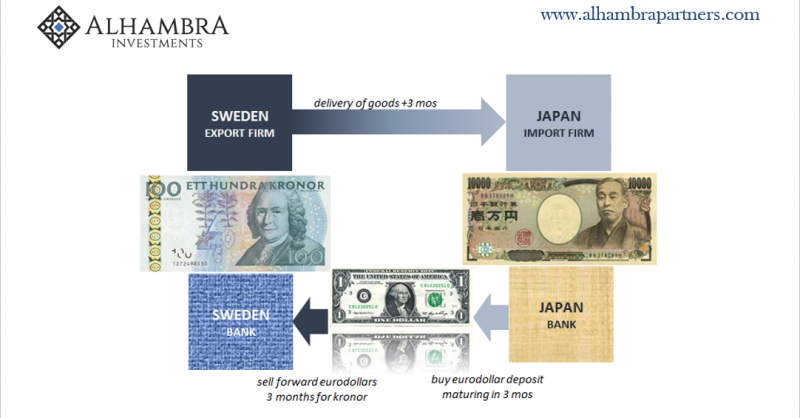

The enormous setback hadn’t yet been fully appreciated in March 2012 when China’s Premiere Wen Jiabao spoke to and on behalf of the country’s Communist governing State Council. Despite it having been four years since Bear Stearns had grabbed the whole world’s attention (for reasons the whole world wouldn’t fully comprehend, specifically as to why the whole world would need to care about the shadow “dollar” business of one US investment “bank”) the...

Read More »

Read More »

Converging Views Only Starts With Fed ‘Pause’

There’s no sign of inflation, markets are unsettled, and now new economic data keeps confirming that dark side. Forget each month, every day there is something else suggesting a slowdown. That much had been evident across much of the global economy, but this is now different. The US has apparently been infected, too, not that that is any surprise.

Read More »

Read More »

China’s Global Slump Draws Closer

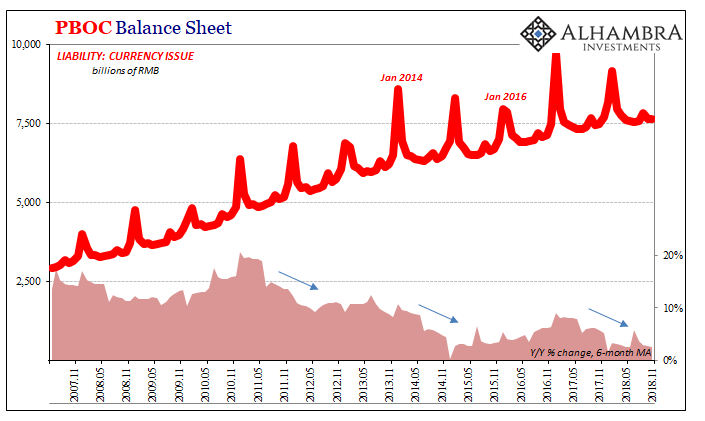

By the time things got really bad, China’s economy had already been slowing for a long time. The currency spun out of control in August 2015, and then by November the Chinese central bank was in desperation mode. The PBOC had begun to peg SHIBOR because despite so much monetary “stimulus” in rate cuts and a lower RRR banks were hoarding RMB liquidity.

Read More »

Read More »

Cool Video: Santa Claus Rally and Trade

I was on Fox Business today. Stuart Varney introduced me by asking me about my forecast for a Santa Claus rally--a year-end recovery in equities. From a technical perspective, I liked the fact that the S&P 500 successfully retested last month's lows last week. I liked that the price action made last Friday's price action into an island bottom, with a gap lower opening followed by Monday's gap higher opening.

Read More »

Read More »

FX Weekly Preview: Powell and Draghi, Xi and Trump

The investment climate will be shaped by three events next week. ECB President Draghi's testimony before the European Parliament to kick-off the week. Fed Chairman Powell speaks to the NY Economic Club in the middle of the week. Presidents Trump and Xi are to meet at the G20 meeting to end the week in hopes of dialing back the escalating trade conflict. Also at the G20 summit, the NAFTA2.0 is expected to be signed, and the steel and aluminum...

Read More »

Read More »

FX Weekly Preview: Unfinished Business

Often, and apparently wrongly attributed to Mark Twain is the observation that it is not what we know that gets into trouble, but "what we know that just ain't so." Now though, investors suffer from a different problem. Several processes are in motion, and there is little confidence in their outcomes. Among these are Brexit, US-China trade, the trajectory of Fed policy, and the EC's efforts to enforce the agreed-upon budget rules.

Read More »

Read More »