Tag Archive: China

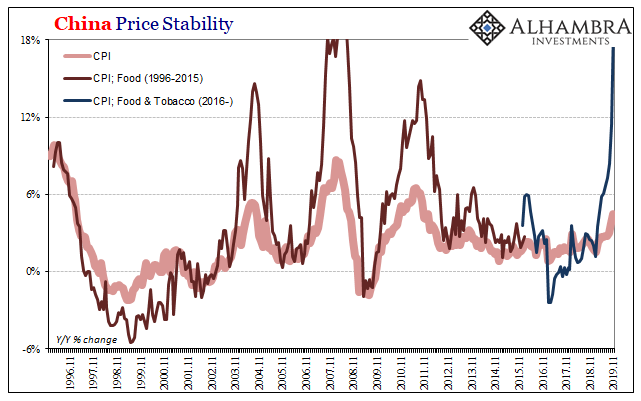

If Trade Wars Couldn’t, Might Pig Wars Change Xi’s Mind?

Forget about trade wars, or even the eurodollar’s ever-present squeeze on China’s monetary system. For the Communist Chinese government, its first priority has been changed by unforeseen circumstances. At the worst possible time, food prices are skyrocketing. A country’s population will sit still for a great many injustices. From economic decay to corruption and rising authoritarianism, the line between back alley grumbling and open rebellion is...

Read More »

Read More »

FX Daily, December 09: China’s Steps-Up Import Substitution Strategy while USMCA Comes Down to the Wire

The important week is off to a slow start. While the MSCI Asia Pacific benchmark extended its gains for a third session, European and US shares are struggling. The Dow Jones Stoxx 600 is consolidating its pre-weekend 1%+ rally, while US shares are trading heavier after rallying for the last three sessions.

Read More »

Read More »

FX Weekly Preview: An Eventful Week Ahead

The US employment report on the first Friday of December usually marks the unofficial end of the year. The desks are often lighter and dealers are loath to jeopardize the year’s bonuses in thin and often erratic markets. This year is an exception. Next week features the first ECB meeting with Lagarde at the helm and the final FOMC meeting of the year.

Read More »

Read More »

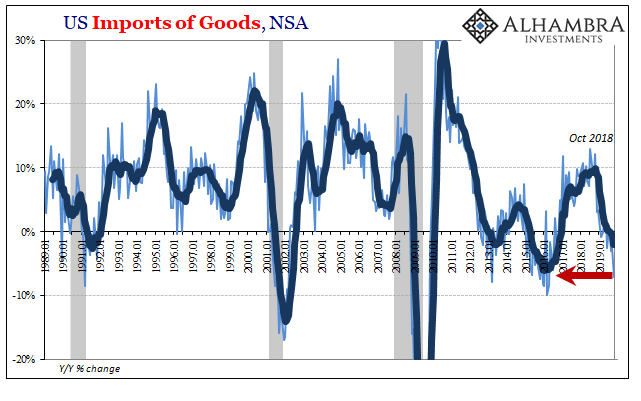

More Signals Of The Downturn, Globally Synchronized

For US importers, October is their month. And it makes perfect sense how it would be. With the Christmas season about to kick into full swing each and every November, the time for retailers to stock up in hearty anticipation is in the weeks beforehand. The goods, a good many future Christmas presents, find themselves in transit from all over the world during the month of October.

Read More »

Read More »

FX Daily, December 4: Hope Springs Eternal

Overview: The prospect of not just the failure of the US and China to resolve its trade dispute but a new escalation has sapped the confidence that had lifted equity benchmarks and the greenback. Led by more than a 1% decline in Tokyo (Nikkei), Hong Kong, and Australia, all the major markets in the Asia Pacific region fell. European shares, perhaps encouraged by an upward revision to the flash composite PMI, are snapping a four-day 2.75% slide.

Read More »

Read More »

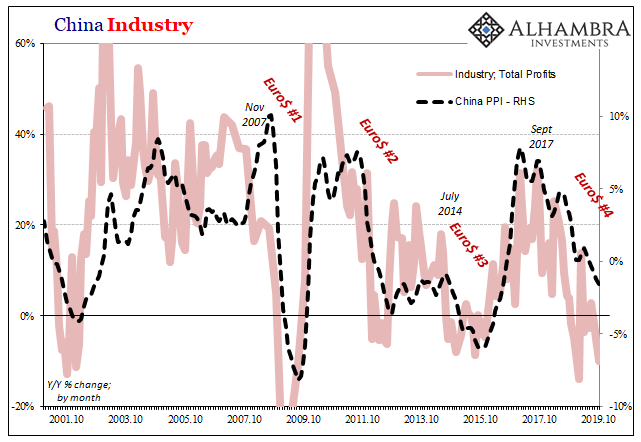

Nothing Good From A Chinese Industrial Recession

October 2017 continues to show up as the most crucial month across a wide range of global economic data. In the mainstream telling, it should have been a very good thing, a hugely positive inflection. That was the time of true inflation hysteria around the globe, though it was always presented as a rationally-determined base case rather than the unsupported madness it really was.

Read More »

Read More »

FX Daily, November 27: In Search of New Incentives

Overview: The global capital markets are subdued. There have been few developments to induce activity. Even President Trump's claims that the talks with China are in the "final throes" failed to excite. Equities are extending their advance. Bonds are little changed, and the dollar is mostly firmer. The MSCI Asia Pacific Index and Europe's Dow Jones Stoxx 600 advanced for the fourth consecutive session.

Read More »

Read More »

China’s Financial Stability: A Squeeze and a Strangle

I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled.

Read More »

Read More »

FX Daily, November 26: Some Are More Equal Than Others

Overview: Neither optimistic comments from Federal Reserve Chairman, that the economic glass is more than half full, nor a seemingly positive spin on the weekend fall calendar between Chinese and US officials have succeeded in deterring some profit-taking today.

Read More »

Read More »

FX Daily, November 25: Hong Kong, China, and UK Election Hopes Fan Modest Risk-Taking

Overview: The combination of the victory of the pro-democracy movement in Hong Kong and an apparent concession by China on intellectual property rights is helping bolster risk appetites to start the week. Equities are higher. Hong Kong's Hang Seng led Asia Pacific equities with a 1.5% gain, the second biggest this month. Korea and India's bourses also gained more than 1%.

Read More »

Read More »

FX Weekly Preview: Is Conventional Wisdom Too Optimistic?

There have been three general issues that the macro-fundamental picture has revolved around this year: trade, growth, and Brexit. On all three counts, conventional wisdom seems unduly optimistic, and this may have helped dampen volatility. A series of signals suggest that the US and China remain far apart in trade negotiations.

Read More »

Read More »

FX Daily, November 22: Europe’s Flash PMI Disappoints and Hong Kong Shares Advance Ahead of Sunday’s Election

Overview: Equities in the Asia Pacific managed to mostly shrug off the drag of the losses in US equities yesterday. China and India could not escape the pull, but most other bourses were higher, led by Singapore and Hong Kong. It was the second consecutive week that the MSCI Asia Pacific Index fell. The US and European benchmarks are paring this week's small losses.

Read More »

Read More »

FX Daily, November 21: Markets Hear What it Wants from China’s Chief Negotiator, but HK maybe New Obstacle

Overview: The strongest signs to date that even phase one of a US-China trade deal is proving elusive helped spur the risk-off mood that had already been emerging. The S&P 500 fell by the most in a month (~-0.40%) yesterday, closing the gap from last week we had noted was the risk, and follow-through selling was seen in Asia Pacific and Europe.

Read More »

Read More »

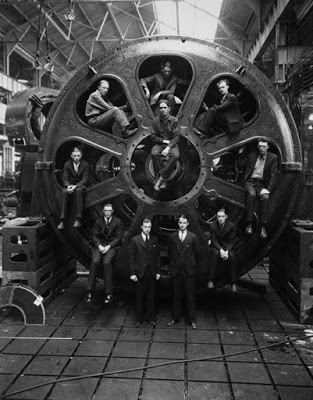

The Real Boom Potential

For the last five years Larry Summers has called it secular stagnation. It’s the right general idea as far as the result, if totally wrong as to its cause. Alvin Hansen, who first coined the term and thought up the thesis in the thirties, was thoroughly disproved by the fifties. Some, perhaps many Economists today believe it was WWII which actually did the disproving.

Read More »

Read More »

FX Daily, November 11: Dollar Consolidates and Equities Follow Asia Lower

Overview: Escalating violence in Hong Kong and the continued fall in Chinese producer prices weighed on equities in Asia Pacific trading. The MSCI Asia Pacific Index has risen nearly 7% during the five-week rally and is off to a weak start this week. Hong Kong's Hang Seng fell around 2.6%, its biggest loss in three months, and China's CSI 300 was off 1.75%. Nearly all the local markets fell but Australia.

Read More »

Read More »

The Sudden Need For A Trade Deal

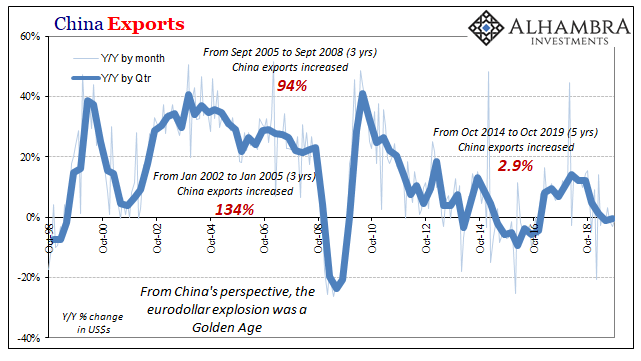

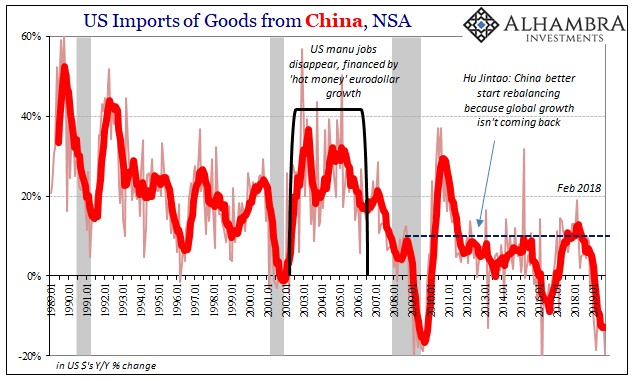

Talk of trade deals is everywhere. Markets can’t get enough of it, even the here-to-fore pessimistic bond complex. Rates have backed up as a few whispers of BOND ROUT!!! reappear from their one-year slumber. If Trump broke the global economy, then his trade deal fixes it. There’s another way of looking at it, though. Why did the President go spoiling for trouble with China in 2018?

Read More »

Read More »

FX Daily, November 8: Risk Appetites Satiated Ahead of the Weekend

The capital markets are consolidating the recent moves ahead of the weekend. Equities are paring this week's gains, though the Nikkei, which was closed on Monday, extended its advance for the fourth consecutive session. Despite the profit-taking today, the MSCI Asia Pacific Index rose for the fifth week. Europe's Dow Jones Stoxx 600 is snapping a five-day rally, but it is closing in on the fifth consecutive weekly advance.

Read More »

Read More »

FX Daily, November 5: Animal Spirits Remain Animated

The prospects that the US-China deal could include some rolling back of existing US tariffs helped underpin risk appetites. After new record highs in the US S&P 500 and NASDAQ, Asia Pacific markets marched higher, and the MSCI Asia Pacific reached its highest level since August 2018. A small rate cut by China and catch-up by Tokyo, which was on holiday on Monday, helped extended the regional rally for the 14th session in the past 17.

Read More »

Read More »

More Synchronized, More Downturn, Still Global

China was the world economy’s best hope in 2017. Like it was the only realistic chance to push out of the post-2008 doldrums, a malaise that has grown increasingly spasmatic and dangerous the longer it goes on. Communist authorities, some of them, anyway, reacted to Euro$ #3’s fallout early on in 2016 by dusting off their Keynes. A stimulus panic that turned out to be more panic than stimulus.

Read More »

Read More »

FX Daily, November 1: Dollar Remains on the Defensive Ahead of Jobs Report

Overview: An unexpected increase in China's Caixin manufacturing PMI helped lift Asia Pacific equities after the S&P 500 stumbled yesterday amid concerns that there will not be a phase 2 in US-China trade negotiations. The MSCI Asia Pacific Index rose 4.3% in October, and with the help of gains in China, Hong Kong, Korea, and Taiwan began November with a gain.

Read More »

Read More »