Tag Archive: China

FX Daily, September 27: Markets Limp into the Weekend with the Euro Languishing at New Lows and Sterling under Pressure

Overview: Equities remain under pressures. The MSCI Asia Pacific Index lower today, though Chinese and Australian shares were firmer. It is the second consecutive week the benchmark has fallen. European equities are firmer, but not enough to offset the losses earlier this week and are set to snap a five-week advance.

Read More »

Read More »

FX Daily, September 25: Risk Appetite Stymied: Dollar Recovers while Stocks Slide

Overview: Global equities and fixed income reacted to the large moves yesterday in the US when the 10-year note yield fell eight basis points, and the S&P 500 fell by 0.85%. Investors have focused on three separate developments and two of which came from President Trump's speech at the UN. He dismissed the likelihood of a short-term trade deal with China and was critical of the large social media platforms.

Read More »

Read More »

FX Daily, September 24: UK Supreme Court Deals another Defeat to Johnson

Overview: A fragile calm hangs over the capital markets today. Equities in Asia Pacific were narrowly mixed. Japan, China, and HK advanced. India saw some profit-taking after a two-day surge in response to the unexpected corporate tax cuts but recovered in late dealings. European shares are recovering after posting its largest loss in a month yesterday (-0.8%). US shares are trading firmer in Europe.

Read More »

Read More »

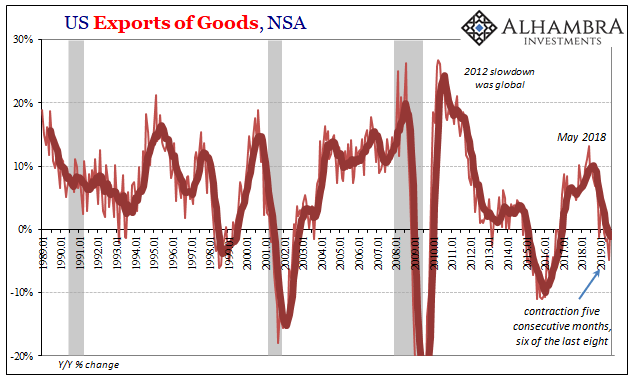

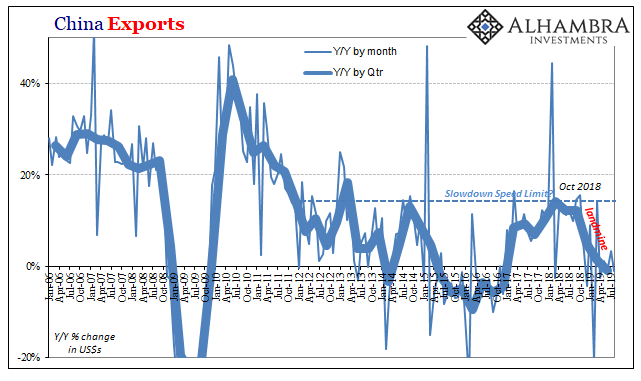

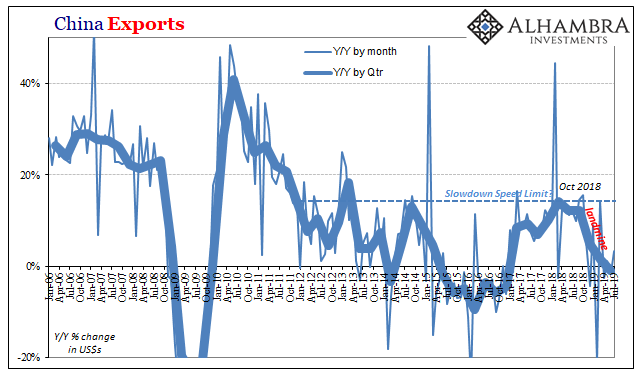

Where The Global Squeeze Is Unmasked

Trade between Asia and Europe has dimmed considerably. We know that from the fact Germany and China are the two countries out of the majors struggling the most right now. As a consequence of the slowing, shipping companies have had to make adjustments to their fleet schedules over and above normal seasonal variances.

Read More »

Read More »

Dollar (In) Demand

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness.

Read More »

Read More »

FX Daily, September 11: Dollar is Firm as ECB is Awaited

Overview: Global equities are extending their recent gains while bonds remain on the defensive. The dollar is firm. There is a degree of optimism that is prevailing. There are some more overtures in terms of US-Chinese trade. In Hong Kong, developers and banks led an equity rally on ideas that the political tensions may ease. South Korea reported better trade data for the first ten days of September.

Read More »

Read More »

FX Daily, September 10: Turn Around Tuesday

Overview: The momentum from the end of last week carried into yesterday's activity, but the momentum began fading. Today, equities were mixed in Asia Pacific and weaker in Europe. The Dow Jones Stoxx 600 reversed lower yesterday and is slipped further today. The S&P 500 may gap lower at the open.

Read More »

Read More »

Is The Negativity Overdone?

Give stimulus a chance, that’s the theme being set up for this week. After relentless buying across global bond markets distorting curves, upsetting politicians and the public alike, central bankers have responded en masse. There were more rate cuts around the world in August than there had been at any point since 2009.

Read More »

Read More »

FX Daily, September 9: Market Sentiment Still Constructive

Overview: The improvement of investor sentiment seen last week is carrying over into the start of the new weeks. Global equities are firm as are benchmark yields. Asia Pacific equities advanced, except in Hong Kong, where Chief Executive Lam's promise to formally withdraw the controversial extradition bill failed to deter protests.

Read More »

Read More »

FX Daily, September 06: Focus Shifts to North American Jobs Before Turning Back to Europe next Week

Investors hope that the world took a step away from the abyss in recent days. Developments in Hong Kong, US-China talking, a political and economic crisis in Italy appears to have been averted, and a risk of a no-deal Brexit has lessened. Asia Pacific equities closed the week on a firm note and extended the rally the third week.

Read More »

Read More »

“The Eurozone faces the worst combination of economic and systemic risk”

The past few months have been an exciting time for gold investors, as the precious metal has seen a spike in demand after serious economic concerns and geopolitical tensions unsettled the markets. Many mainstream analysts have pointed to a number of recent events, from the US-China trade war escalations to the inverted yield curve, to explain the recent gold rally.

Read More »

Read More »

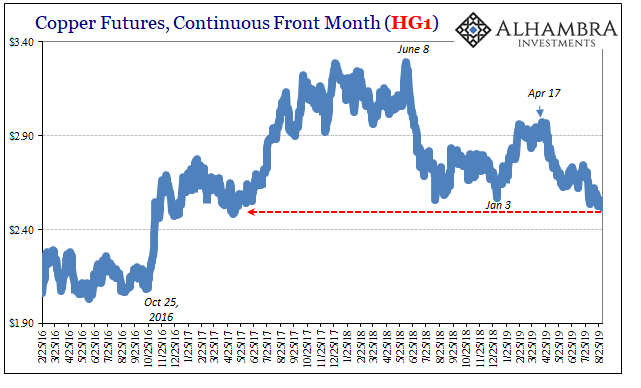

Copper Confirmed

Copper prices behave more deliberately than perhaps prices in other commodity markets. Like gold, it is still set by a mix of economic (meaning physical) and financial (meaning collateral and financing). Unlike gold, there doesn’t seem to be any rush to get to wherever the commodity market is going. Over the last several years, it has been more long periods of sideways.

Read More »

Read More »

What Happened Monday

Markets in the US and Canada were closed on Monday for national Labor Day holidays. Here is a succinct summary of key developments that will set the backdrop for Tuesday. On September 1, the new round of tariffs in the US-China fight took effect. The US placed a 15% tariff on around 3000 Chinese goods that thus far had escaped action.

Read More »

Read More »

FX Weekly Preview: Talking and Fighting in the Week Ahead

Equity markets and the US dollar closed last week and August on a firm note. Ahead of the weekend, the dollar rose to new highs for the year against the euro, Swedish krona, Norwegian krone, and the New Zealand dollar. While the next set of US and Chinese tariffs start September 1, the market is making the most of the lull.

Read More »

Read More »

FX Daily, August 26: Trump’s “Call from China” helps Markets Recover

Overview: The anticipated growth implications of the heightened tensions between the world's two largest economies is dominating activity at the start of the new week. These considerations that drove the 2.6% drop in the S&P 500 before the weekend is carrying over into today's activity.

Read More »

Read More »

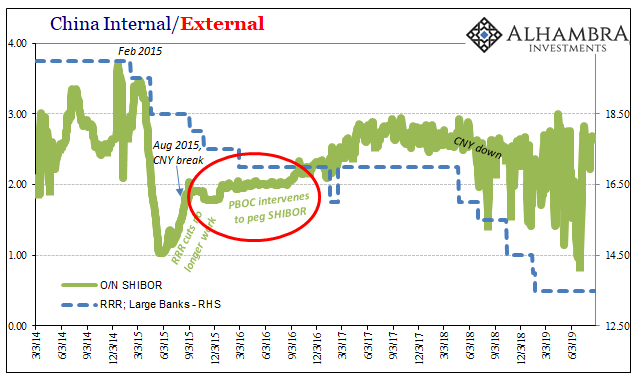

That Can’t Be Good: China Unveils Another ‘Market Reform’

The Chinese have been reforming their monetary and credit system for decades. Liberalization has been an overriding goal, seen as necessary to accompany the processes which would keep the country’s economic “miracle” on track. Or get it back on track, as the case may be. Authorities had traditionally controlled interest rates through various limits and levers.

Read More »

Read More »

FX Daily, August 19: China’s Rate Reform Helps Markets Extend End of Last Week Recovery

Overview: China announced some changes in its interest rate framework that is expected to lead to lower rates. This helped lift equity markets, which were already recovering at the end of last week from the earlier drubbing. Chinese and Hong Kong shares led the regional rally with 2-3% gains. The Nikkei gapped higher for the third time in six sessions, and the first two were followed by lower gaps.

Read More »

Read More »

FX Weekly Preview: A Vicious Cycle Grips Markets

The capital markets are in their own doom loop. Poor data from Germany and China, coupled with the escalation of the US-China trade dispute and rising tensions in Hong Kong spur concerns about the risks of a global recession. Interest rates are driven lower, and curves flatten or go inverted, spurring more concern about the outlook. The problem is that it is not clear how this vicious cycle ends.

Read More »

Read More »

FX Weekly Preview: Macro Deterioration

The US-China tensions remain the dominant driver of investor risk appetites. President Trump has repeatedly accused China of manipulating its currency on twitter, and finally Treasury Secretary Mnuchiin acquiesced after China failed to prevent the dollar from rising above CNY7.0.

Read More »

Read More »

The Myth of CNY DOWN = STIMULUS Won’t Die

On the one hand, it’s a small silver lining in how many even in the mainstream are beginning to realize that there really is something wrong. Then again, they are using “trade wars” to make sense of how that could be. For the one, at least they’ve stopped saying China’s economy is strong and always looks resilient no matter what data comes out.

Read More »

Read More »