Tag Archive: China

FX Daily, June 15: Unwind Continues

Overview: The swing in the pendulum of market sentiment toward fear from greed began last week and has carried over into today's activity. Global equities are getting mauled. In the Asia Pacific region, no market was spared as the Nikkei's 3.5% drop, and South Korea's 4.7% fall led the way. In Europe, the Dow Jones Stoxx 600 is recovering from a more than two percent early loss, as it drops for the fifth time in the past six sessions.

Read More »

Read More »

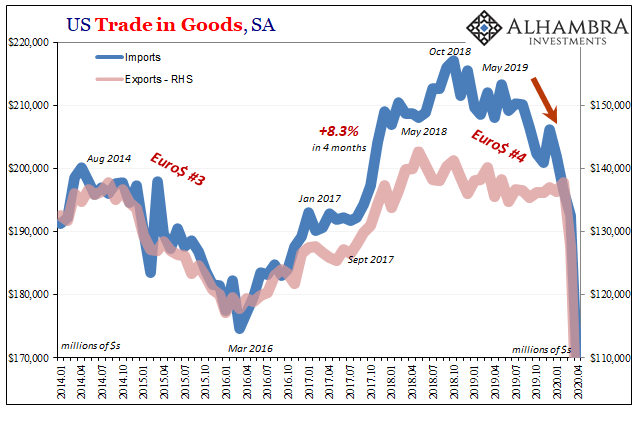

Someone’s Giving Us The (Trade) Business

The NBER has made its formal declaration. Surprising no one, as usual this group of mainstream academic Economists wishes to tell us what we already know. At least this time their determination of recession is noticeably closer to the beginning of the actual event. The Great “Recession”, you might recall, wasn’t even classified as an “official” contraction until December 2008 – a full year after the NBER figured the thing had begun.

Read More »

Read More »

FX Daily, June 8: Monday Blues: Consolidation Threatened

Overview: The MSCI Asia Pacific Index rose for a sixth consecutive session. Japan, Taiwan, Singapore, and Indonesian markets advanced more than 1%. European bourses are mixed, with the peripheral shares doing better than the core, leaving the Dow Jones Stoxx 600 about 0.5% lower near midday after surging 2.5% ahead the weekend. US shares are firm, as is the 10-year yields, hovering near 92 bp.

Read More »

Read More »

FX Daily, May 27: China and Hong Kong Pressures are Having Limited Knock-on Effects

Overview: The S&P 500 gapped higher yesterday, above the recent ceiling and above the 200-day moving average for the first time since early March. The momentum faltered, and it finished below the opening level and near session lows. The spill-over into today's activity has been minor. The heightened tensions weighed on China and Hong Kong markets, but Japan, South Korea, Taiwan, and Indian equity markets rose.

Read More »

Read More »

FX Daily, May 21: Markets Pull Back after Flirting with Breakouts

Overview: New two and a half month highs in the S&P 500 yesterday failed to have much sway in the Asia Pacific region and Europe today as US-China tensions escalate and profit-taking set in. Perhaps it is a bit of "buy the rumor sell the fact" type of activity on the back of upticks in the preliminary PMI reading and hesitancy about pushing for what appeared to be breakouts.

Read More »

Read More »

FX Daily, May 20: Fed Funds Futures No Longer Imply Negative Rates

Overview: Another late sell-off of US equities, ostensibly on questions over Moderna's progress on a vaccine, failed to deter equity gains in the Asia Pacific region. China was a notable exception, but the MSCI Asia Pacific Index rose for the fourth consecutive session. European shares are little changed, but reflects a split.

Read More »

Read More »

FX Daily, May 19: Optimism Burns Eternal

Overview: Hopes for a vaccine and a German-French proposal to break the logjam at the EU for a joint recovery effort helped propel equities higher yesterday. There was strong follow-through in the Asia Pacific region, where most markets advanced by more than 1% today. However, the bloom came off the rose, so to speak, in Europe. After a higher opening, markets reversed lower, and the Dow Jones Stoxx 600 is off about 0.75% in late morning turnover.

Read More »

Read More »

FX Daily, May 12: Markets Tread Water, Looking for New Focus

Overview: Investors seem to be in want of new drivers, leaving the capital markets with little fresh direction. While Japanese and China equities were little changed, several markets in the region, including Australia, Hong Kong, Taiwan, and India, were off more than 1%. European bourses are mostly higher after the Dow Jones Stoxx 600 slipped 0.4% yesterday.

Read More »

Read More »

FX Daily, May 11: Quiet Start to New Week

Overview: The new week begins slowly in the capital markets. Many markets in the Asia Pacific region, including Japan, Hong Kong, and Australia, gained over 1%, but European and US shares are heavier. Benchmarks off all three regions rallied by 3.4%-3.5% over the past two weeks. Bond markets are also little changed, with the US 10-year benchmark just below 70 bp ahead of this week's record refunding.

Read More »

Read More »

FX Daily, May 8: Jobs and Negative Fed Funds Futures

Overview: The S&P 500 closed near its session lows for the third day running yesterday but failed to deter the bulls in Asia-Pacific, where most markets rose by more than 1%. Taiwan, Korea, and Australia lagged a bit though closed higher. Europe's Dow Jones Stoxx 600 is firm, and the modest gains (~0.5%) would be enough to ensure a higher weekly close if it can be maintained.

Read More »

Read More »

FX Daily, May 7: China Reports an Unexpected Jump in Exports, While Norway Surprises with a Rate Cut

Overview: There is a sense of indecision in the air today. There have been several developments, but investors seem mostly reluctant to extend positions. China reported a surge in exports in April and an increase in the value of reserves. Australia reported a rise in exports in March. The Bank of England left policy steady, but clearly signaled it was prepared to boost its asset purchases.

Read More »

Read More »

FX Daily, May 4: Monday Blues

Overview: The constructive mood among investors in April has given way to new concerns as May gets underway. Japan and China are still on holiday, but most of the other markets in Asia fell, led by 4.5%-5.5% declines in Hong Kong and India, and more than 2% in most other local markets. Australia bucked the trend a gained 1.4% after shedding 5% before the weekend.

Read More »

Read More »

FX Daily, April 30: ECB Takes Center Stage

Overview: Equities continue to recover even as deep economic contractions are reported. Yesterday, the US said Q1 GDP contracted at an annualized pace of 4.8%, while the eurozone reported today that output fell 3.8% quarter-over-quarter in Q1. Hong Kong and South Korea were closed, but the rest of the Asia Pacific bourses rallied strongly with several, including Australia and India, rising more than 2%.

Read More »

Read More »

An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »

FX Daily, April 15: Dollar Rises as Equities Slump

Overview: The recovery in equities stalled, and the risk-off mood has helped lift the US dollar, which had been trending lower. Taiwan and Malaysia were notable exceptions in the Asia Pacific regions to the heavier equity tone. The Nikkei gave back almost 0.5% after surging more than 3% on Tuesday. Europe's Dow Jones Stoxx 600 is ending a five-day rally.

Read More »

Read More »

FX Daily, April 14: Equities are Firm but New Developments Needed or Risk Appetites may Become Satiated

Overview: Risk appetites have returned today after taking yesterday off. The MSCI Asia Pacific Index advanced every day last week, slipped yesterday, and jumped back today. Most of the national benchmark advanced at least 1.5%, and the Nikkei led the way with a 3% rally to reach its best level since mid-March.

Read More »

Read More »

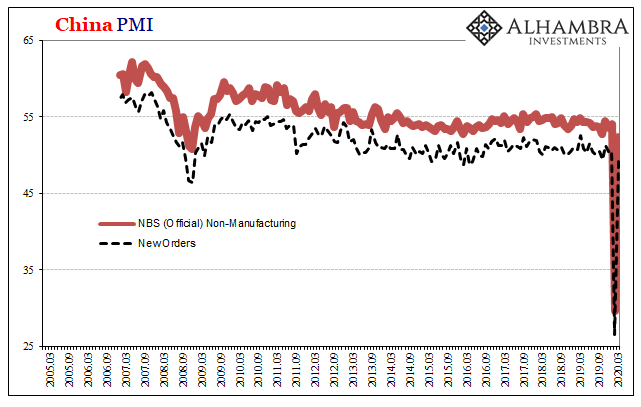

China’s Back!

The Washington Post began this week by noting how the US economy seems to have lost its purported zip just when it needed that vitality the most. Never missing a chance to take a partisan swipe, of course, still there’s quite a lot of truth behind the charge. An actual economic boom produces cushion, enough of one that President Trump and his administration may have been counting on it when opting for full-blown shutdown.

Read More »

Read More »

FX Daily, March 31: March Ends like a Lion, No Lamb in Sight

Overview: The coronavirus plague upended the world in March. Equities are finishing the month on a firm note. Strong gains in the US yesterday and an unexpectedly strong Chinese PMI (yes, to be taken with the proverbial grain of salt) helped lift most Asia Pacific and European markets today. Japan and Australia are exceptions to the generalization.

Read More »

Read More »

FX Daily, February 26: Dramatic Investor Adjustment Continues

Overview: The warning by the US Center for Disease Control and Prevention that Americans should prepare for an outbreak of Covid-19 sent the S&P 500 tumbling to an 11-week low and the 10-year Treasury yield to a record low near 1.30%. The volatility of the S&P (VIX) jumped to its highest level since 2018. The sell-off in global equities continues unabated.

Read More »

Read More »

FX Daily, February 25: Capital Markets Remain Fragile after Yesterday’s Bloodletting

Overview: Yesterday's bloodletting in global equities has calmed, but investors remain on edge. Despite all the concerns that the markets were under-appreciating the implications of the new coronavirus, there is a sense that yesterday's moves were in excess. Japanese markets, which were closed on Monday, played catch-up today, and the Nikkei shed 3.3%.

Read More »

Read More »