Tag Archive: China Producer Price Index

A Producer Price Index (PPI) is a price index that measures the average changes in prices received by domestic producers for their output. Its importance is being undermined by the steady decline in manufactured goods as a share of spending.

FX Daily, May 10: Markets Adjust to North Korean Threat, Fifth Fall in US Oil Inventories and Trump Drama

Investors absorbed a few developments that might have been disruptive for the markets with little fanfare. North Korea's ambassador to the UK warned that his country would go ahead with its sixth nuclear test, as South Korea elected a new president who wants to reduce tensions on the peninsula.

Read More »

Read More »

FX Daily, April 12: Investors Catch Breath, Markets Stabilize

Markets are calmer today. The significant movers yesterday have stabilized. The dollar has been unable to resurface above JPY110, but after plumbing to new lows near JPY109.35 in Asia, the dollar has recovered back levels since in North America late yesterday. The decline in the US 10-year yield was also initially extended in Asia before stabilizing and returning to levels seen in the US afternoon.

Read More »

Read More »

FX Daily, March 09: Pre-ECB Squaring Lifts Euro in a Strong USD Context

The euro tested the lower of its range near $1.05 in Asia before short covering in Europe lifted back toward yesterday's highs near $1.0575. However, buoyed by the upside surprise in the ADP estimate of private sector jobs growth, the dollar is firmer against most other currencies today. The US 10-year yield is up 20 bp this week.

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

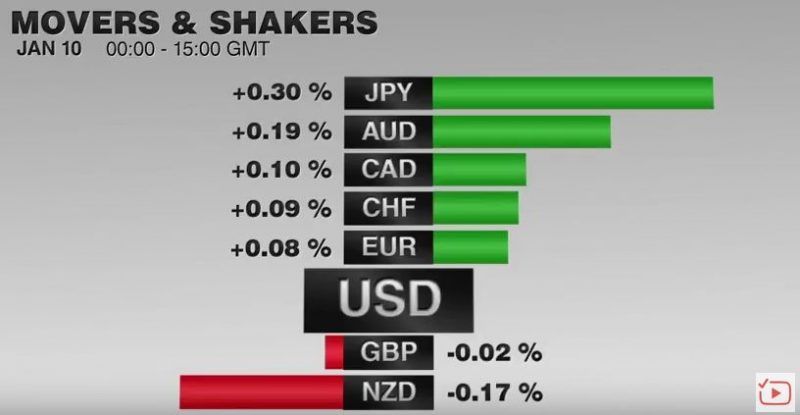

FX Daily, January 10: Positioning more than Fundamentals Give Traders Pause

After strong moves to start the year, the capital markets continue to consolidate. Many observers are suggesting a fundamental narrative behind the loss of momentum, but in discussions with clients and other market participants, it seems as if the main source of caution is coming from an understanding of market positioning rather than a reevaluation of the macro drivers.

Read More »

Read More »

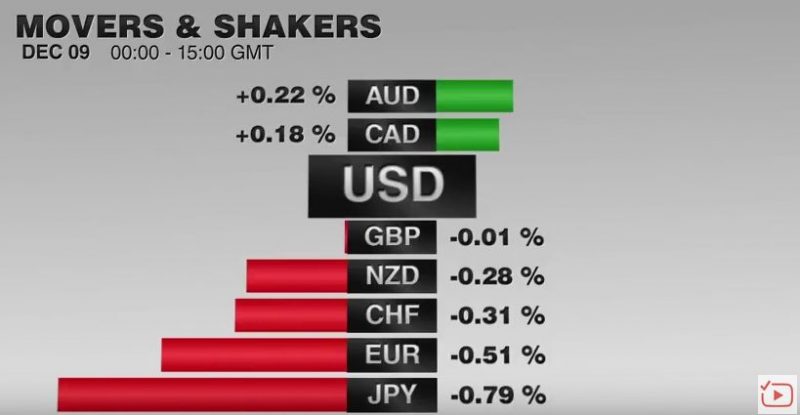

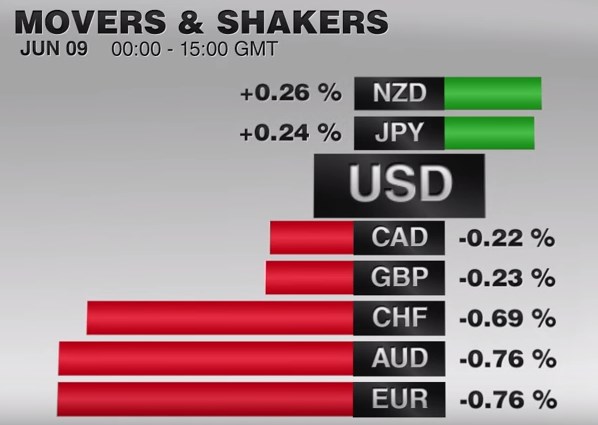

FX Daily, December 09: Euro Chopped Lower before Stabilizing

The euro has stabilized after extending yesterday's ECB-driven losses. The euro's drop yesterday was the largest since the UK referendum to leave the EU. Ahead of the weekend, there may be some room for additional corrective upticks, but they will likely be limited, with the $1.0650 area offering initial resistance. In the larger picture, this week's range, roughly $1.05 to $1.0850 likely will confine the price action for the remainder of the...

Read More »

Read More »

FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

The US dollar is firm against most of the major currencies, but within yesterday's ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain.

Read More »

Read More »

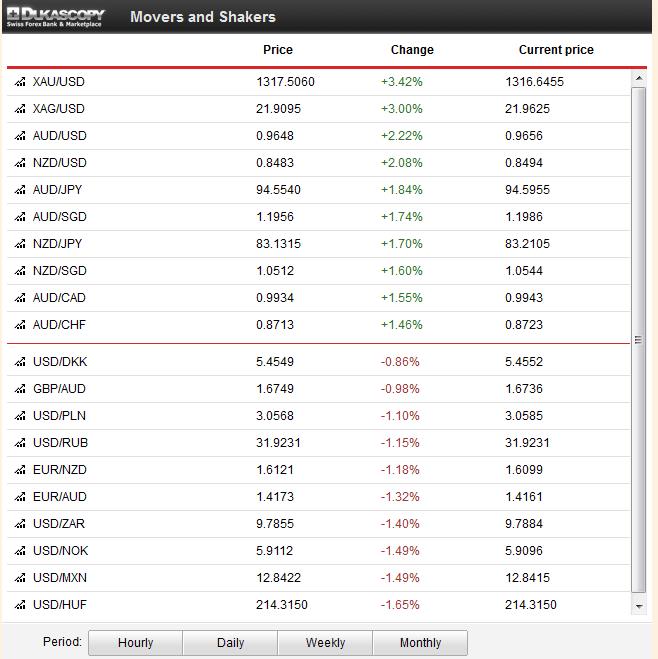

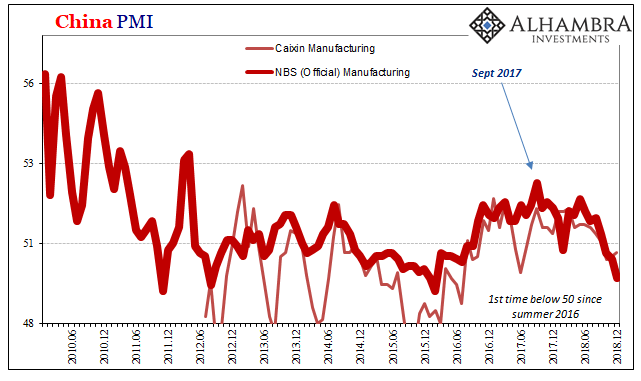

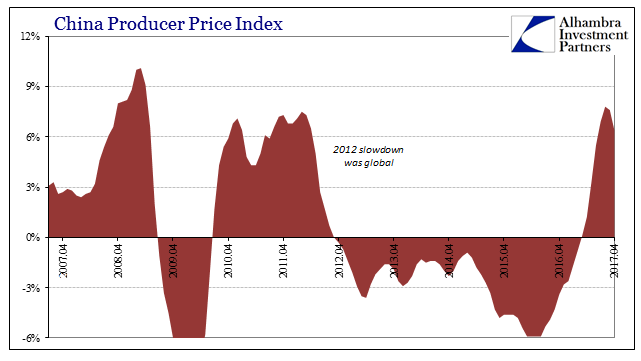

Great Graphic: China’s PPI and Commodities

China's PPI rose for the first time in four years. It is related to the rise in commodities. Yet there are good reasons there is not a perfect fit between China's PPI and commodity prices. US and UK CPI to be reported next week, risk is on the upside.

Read More »

Read More »

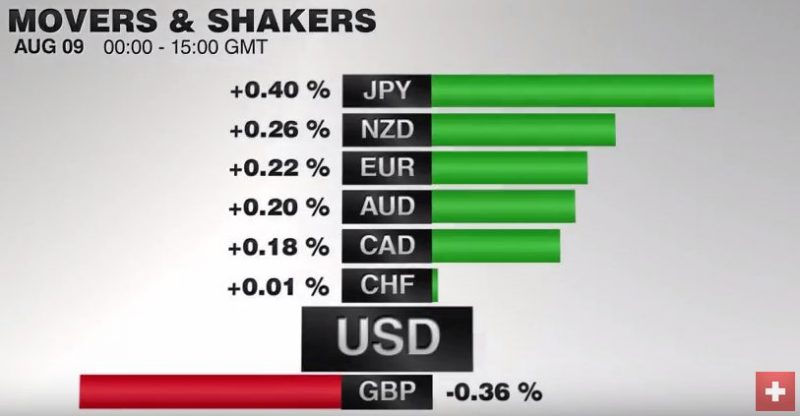

FX Daily, August 09: Sterling Slips to a Four-Week Low, EUR/CHF still trending up

In an otherwise uneventful foreign exchange market, sterling's slide for its fifth consecutive session is the highlight. It was pushed below $1.30 for the first time since July 12. Initial resistance for the North American session is seen near $1.3020, while the $1.2960 area corresponds to a minor retracement objective.

Read More »

Read More »

FX Daily, June 9: Greenback is Mostly Firmer, but Yen is Firmer Still

The euro continues to weaken against the franc at 1.0922. But the speed of the descent has slowed. The dollar is stronger, in particular against EUR, CHF and AUD.

The US dollar is posting modest upticks against most of the

European currencies and the Canadian and Australian dollars. However, it has fallen against the yen and taken out the

recent low, leaving little between it and the May 3 l...

Read More »

Read More »

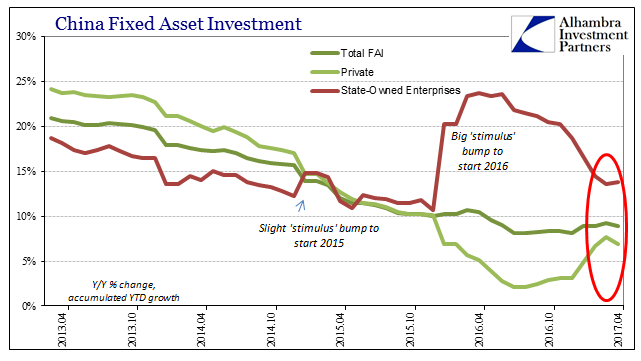

Week October 14 to 18, A Close Look at China’s Fundamental Data

Weekly Overview of FX Rates Movements The week was driven by the following factors: Solid Chinese economic data including a 7.8% rise in GDP. The end of the debt ceiling debate, at least for now. The expectation by the Fed member Evans that the government shutdown has delayed Fed tapering. San Francisco Fed’s Williams …

Read More »

Read More »

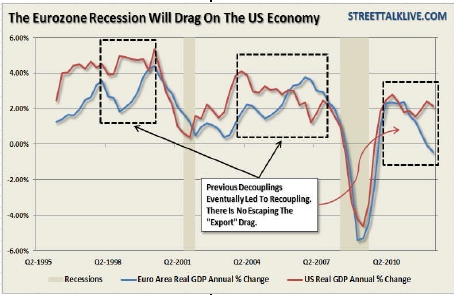

Same Procedure as Every Year: Analysts Shouting “The Great Recession is Over!” But It Is Not!

Or why we do not believe in the American economy. Like every year in Q4, analysts proudly present the end of the great recession: 2009: The big picture: The Great Recession is Over! Long Live the Ordinary Recession …. 2010: Mish Global Trend Analysis: The Great Recession is Over; Bad News: It Doesn’t Feel Like … Continue...

Read More »

Read More »