Tag Archive: China New Loans

This release measures the change in the total value of outstanding bank loans issued to consumers and businesses. Borrowing and spending are closely correlated with consumer confidence. A higher than expected reading should be taken as positive/bullish for the CNY , while a lower than expected reading should be taken as negative/bearish for the CNY.

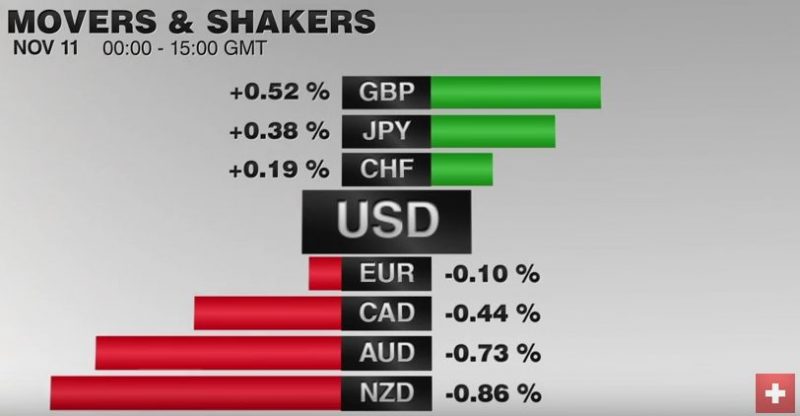

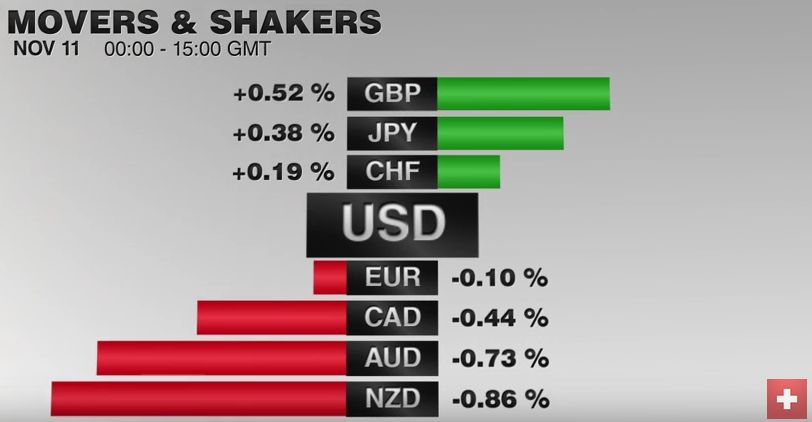

FX Daily, November 11: Reduced Risk of Negative Policy Rates Lifts Sterling and the Kiwi

Overview: Investors are trying to figure out the impact of the likelihood of a vaccine. One thing that has happened is that the market perceives less chance that the UK or New Zealand will adopt negative rates, and their respective currencies are adjusting higher. Meanwhile, the equity rally is continuing in Asia and Europe.

Read More »

Read More »

FX Daily, June 10: Corrective Forces Still Seem in Control Ahead of the FOMC Outcome

The pullback ins US shares yesterday has not derailed the global advance. Japanese and Chinese markets were mixed, the Hang Seng slipped, and Indonesia was hit with profit-taking, but the MSCI Asia Pacific Index eked out a small gain. It has fallen once past two and a half weeks. The Dow Jones Stoxx 600 opened higher but is falling for the third consecutive session.

Read More »

Read More »

FX Daily, May 11: Quiet Start to New Week

Overview: The new week begins slowly in the capital markets. Many markets in the Asia Pacific region, including Japan, Hong Kong, and Australia, gained over 1%, but European and US shares are heavier. Benchmarks off all three regions rallied by 3.4%-3.5% over the past two weeks. Bond markets are also little changed, with the US 10-year benchmark just below 70 bp ahead of this week's record refunding.

Read More »

Read More »

FX Daily, May 09: De-Risking as US-China Trade Talks Resume

The end of the tariff truce between the US and China continues to dominate investment considerations. The truce was often cited in narratives explaining the recovery of equities from the Q4 18 slide. Ahead of the midnight US tariff hike, global equities are being smashed. Korea's Kospi was off 3%, and Hong Kong's Hang Seng was shed 2.4%. Shanghai lost 1.5%.

Read More »

Read More »

FX Daily, March 09: Today is about Jobs, but Not Really

The US Administration has softened its initial hardline position of no exemptions for the new steel and aluminum tariffs. There is little doubt that the actions will be challenged at the World Trade Organization and the idea that national security includes the protection of jobs for trade purposes will be tested. At the same time, US President Trump has agreed to meet North Korea's Kim Jong Un.

Read More »

Read More »

FX Daily, February 12: Equity Markets Find Firmer Footing, Dollar Softens

The most important development today has been the stability in the equity markets after last week's meltdown. The recovery from new lows in the US before the weekend set the tone for today's moves. Tokyo markets were on holiday, and the MSCI Asia Pacific Index excluding Japan snapped a seven-day slide with a nearly 0.6% gain.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

FX Daily, November 13: Sterling Trounced by Growing Political Challenges

The US dollar has begun the new week on firm footing, without the help of either higher interest rates or increased confidence that Congress will agree on a tax plan. Indeed, over the weekend the Chair of the House Ways and Means Committee was explicit that the Senate plan to repeal the federal tax break for state and local taxes will not find support in the House of Representative.

Read More »

Read More »

FX Daily, October 10: Dollar Pullback Extended

The US dollar's advance faltered before the weekend after rise average hourly earnings and a new cyclical low in unemployment and underemployment initially fueled greenback buying. There is no doubt the data was skewed by the storms, though the upward revision to the August hourly early cannot be attributed to the weather distortions. The reversal in the dollar before the weekend has carried over into the early trading this week. Even the Turkish...

Read More »

Read More »

FX Daily, September 15: Short Note Ahead of the Weekend

Sporadic updates continue as the first of two-week business trip winds down. North Korea missile launch failed to have much impact in the capital markets. The missile apparently flew the furthest yet, demonstrating its ability to hit Guam. However, there was not an immediate response from the US. South Korea said it had simultaneously conducted its own drill which included firing a missile into the Sea of Japan (East Sea).

Read More »

Read More »

FX Daily, August 15: Greenback Firms, Encouraged by Dudley and Ebbing of Tensions

NY Fed President Dudley appears to have stolen any potential thunder in the July FOMC minutes that will be released tomorrow. While we put more emphasis on today's US retail sales data and the August Fed surveys, many others argued that the minutes were the key report this week.

Read More »

Read More »

FX Daily, July 12: Currencies Stabilize, but Yen Strengthens

The US dollar and sterling have stabilized after being sold off yesterday. The yen, which had begun recovering from a four-month low, is the strongest of the major currencies today, gaining around 0.5% against the dollar (@~JPY113.40).

Read More »

Read More »

FX Daily, February 14: Markets Showing Little Love on Valentines

Corrective pressures are gripping the major capital markets today.The Dollar Index's nine-day advancing streak is being threatened by the position adjustment ahead of Yellen's testimony later today. Despite record high closes in the main US equity markets yesterday, Asia could not follow suit. It tried to initially, and recorded new highs since July 2015, but sellers emerged and the MSCI Asia Pacific Index closed marginally lower on the lows of the...

Read More »

Read More »

FX Daily, January 12: Dollar and Yields Ease Further, but Look for Recovery

After a choppy North American session yesterday, the dollar and US yields remain under pressure. The dollar is lower against all the major currencies and most emerging market currencies, including the recently shellacked Turkish lira and Mexican peso.

Read More »

Read More »

FX Daily, December 14: Markets Quietly Edge into FOMC Meeting

The Pound is entering mid-December in the same fashion it begun the month after having a very strong November as well. After being buoyed by Donald Trump’s victory and the High Courts ruling that parliamentary approval is needed before invoking Article 50, the Pound has been boosted further after economic data has also impressed, with yesterday being a good example of this.

Read More »

Read More »

FX Daily, November 11: Ramifications of Trump’s Election Continue to Drive Markets

The forces unleashed by the US election results continue to drive the capitals markets. The combination of nationalism, reflation and deregulation are seen as good for US equities and the US dollar. It has not been so kind to US Treasuries, where the 10- and 30-year yield has risen about 32 bp this week coming into today's federal holiday that closes the bond market, while the stock market is open.

Read More »

Read More »

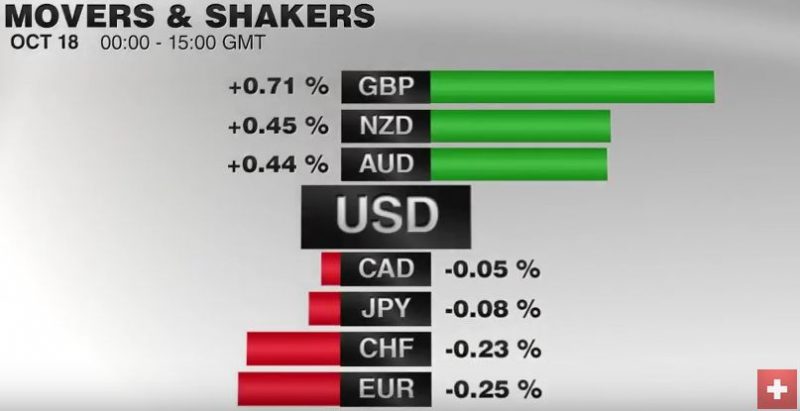

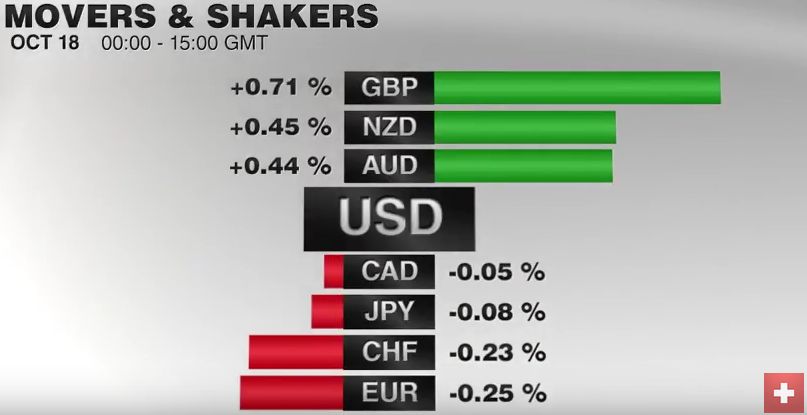

FX Daily, October 18: Dollar Slips Broadly but not Deeply

According to Bank of England deputy governor Ben Broadbent the drop in the value of Sterling has helped to stop the UK economy from falling further since the shock of the Brexit vote. He went on to say ‘in the shape of the referendum, we’ve had exactly one of those shocks’ and added that the Bank of England would not interfere with monetary policy to boost the Pound’s value.

Read More »

Read More »

FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

The US dollar is firm against most of the major currencies, but within yesterday's ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the only majors to gain.

Read More »

Read More »

FX Daily, September 14: Precarious Stabilization

Swiss ZEW expectations came in better than expected. The value was +2.7 instead of expected negative value. The US dollar advanced yesterday and is in narrow ranges with a mostly softer bias today. The exception is the Japanese yen. Japanese press have reported that more negative rates are under consideration may have contributed to the weakness of the yen.

Read More »

Read More »

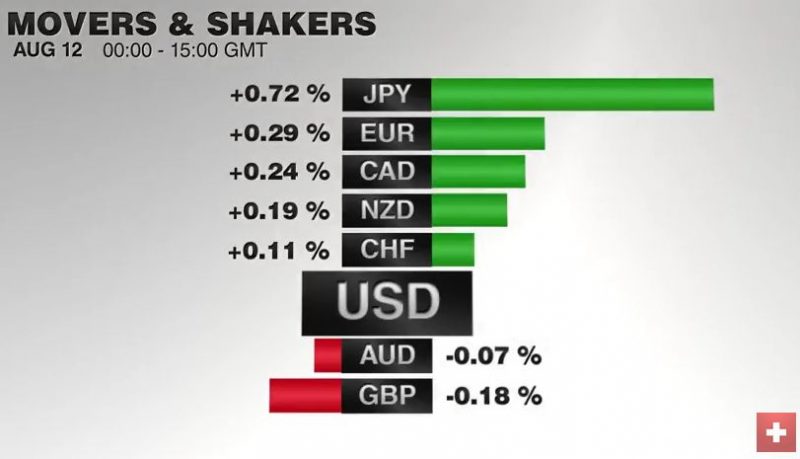

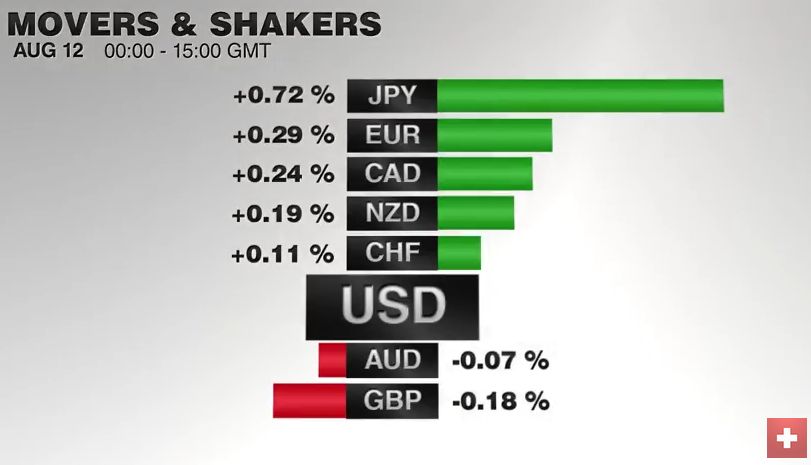

FX Daily, August 12: Summer Markets Grind into the Weekend

There is a general consolidative tone in the capital markets as the week draws to a close. The US retail sales report may offer a brief distraction, but it is unlikely to significantly shift expectations about the trajectory of Fed policy. Indeed, it might not really change investors' information set.

Read More »

Read More »