Tag Archive: China Imports

An import is any good or service brought into one country from another country in a legitimate fashion, typically for use in trade. Import goods or services are provided to domestic consumers by foreign producers.

FX Daily, February 08: Dollar Firms, While Equities Search for Stability

The swings in the equity markets are subsiding, bond yields are firm and the US dollar is extending its recovery. Although US equities closed lower, the MSCI Asia Pacific Index snapped a four-day drop by posting a 0.25% gain. However, the MSCI Emerging Markets Index is off nearly as much, though the range was modest. European markets are also lower, and the range for the Dow Jones Stoxx 600 is the smallest in more than a week.

Read More »

Read More »

The Dea(r)th of Economic Momentum

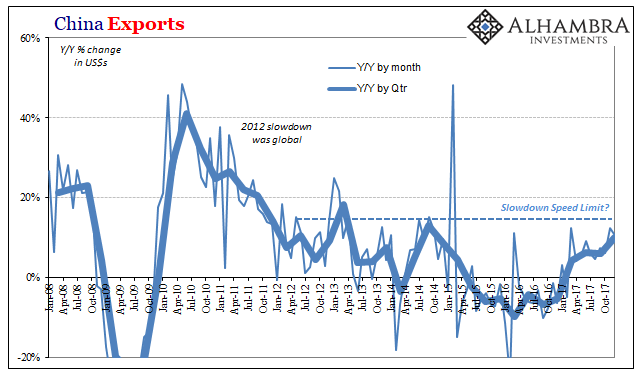

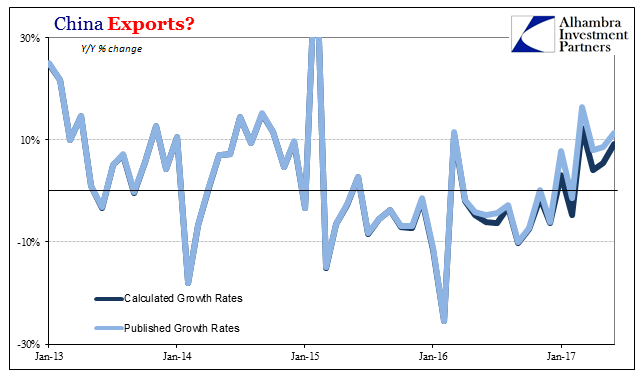

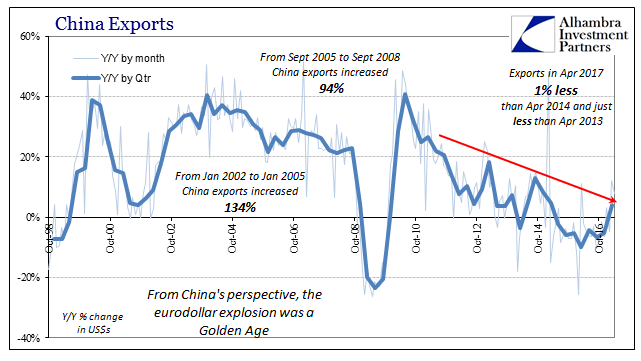

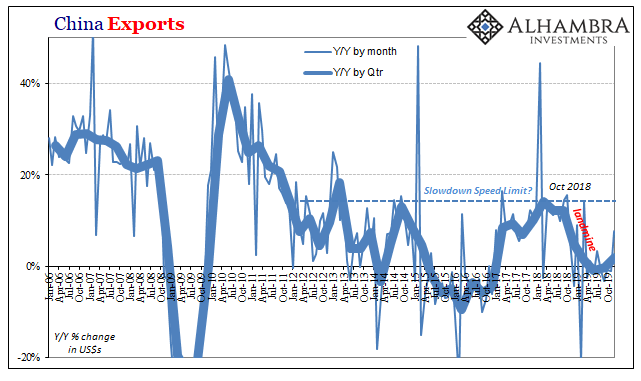

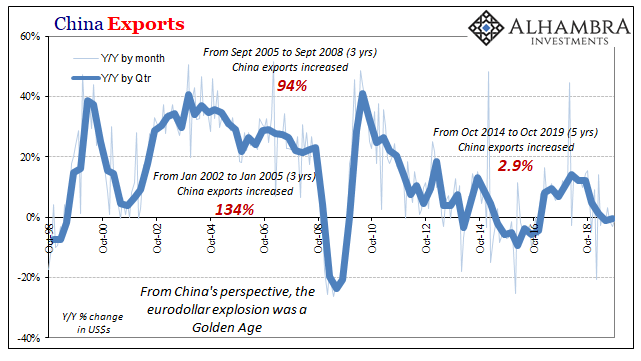

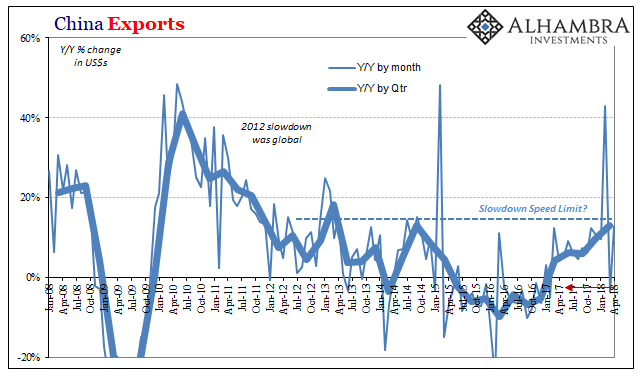

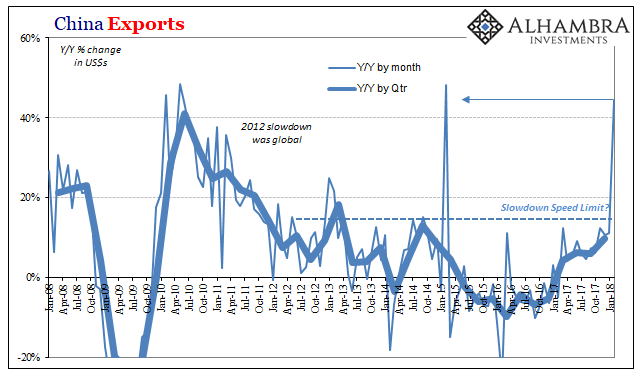

For the fourth quarter as a whole, Chinese exports rose by just less than 10% year-over-year. That’s the highest quarterly rate in more than three years, up from 6.3% and 6.0% in Q2 2017 and Q3, respectively. That acceleration is, predictably, being celebrated as a meaningful leap in global economic fortunes. Instead, it highlights China’s grand predicament, one that country just cannot seem to escape.

Read More »

Read More »

FX Daily, January 12: Euro Jumps Higher

There is one main story today and it is the euro's surge. The euro began the week consolidating it recent gains a heavier bias, but the record of last month's ECB meeting surprised the market with its seeming willingness to change the forward guidance early this year in a more hawkish direction. This spurred a 0.7% gain in the euro back above $1.20. The euro stayed bid in Asia, but took another leg up (~0.75%) in response to reports that a...

Read More »

Read More »

China Exports and Industrial Production: Revisiting Once More The True Worst Case

As weird as it may seem at first, the primary economic problem right now is that the global economy looks like it is growing again. There is no doubt that it continues on an upturn, but the mere fact that whatever economic statistic has a positive sign in front of it ends up being classified as some variant of strong. That’s how this works in mainstream analysis, this absence of any sort of gradation where if it’s negative it’s bad (though in 2015...

Read More »

Read More »

FX Daily, December 08: Brexit Talks Move to Stage II, While Greenback Remains Firm

Sufficient progress will be judged to have been made, and negotiations of the separation between the UK and EU will be allowed to enter the second stage. The formal decision will be made at next week's EU summit. To be sure, "sufficient progress," which the diplomatic-speak that does not mean that any agreement has really been reached, but rather that the UK has made a few concessionary signals.

Read More »

Read More »

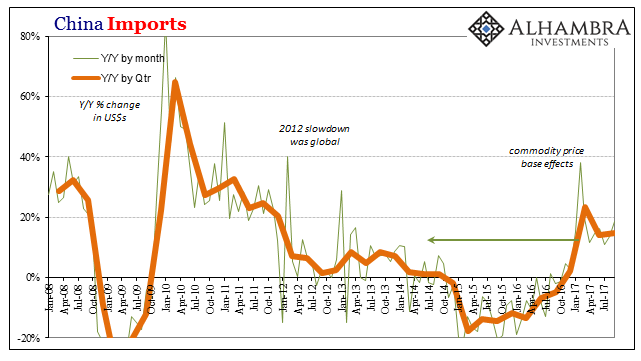

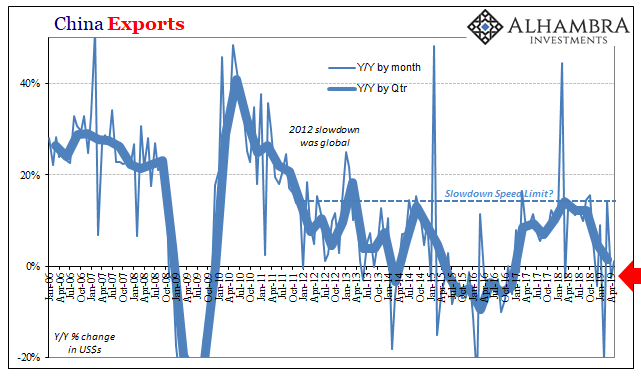

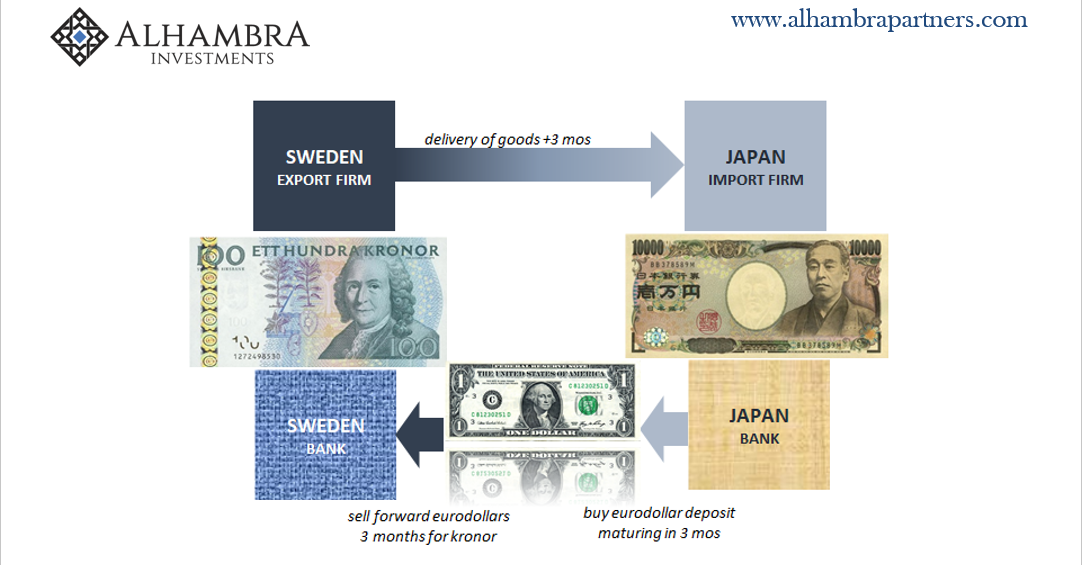

China Exports/Imports: Enforcing A Global Speed Limit

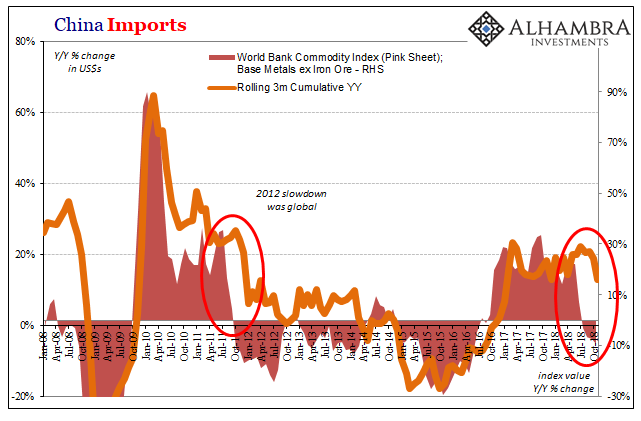

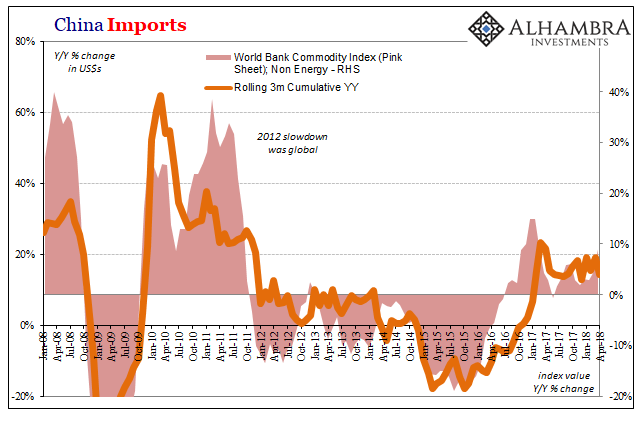

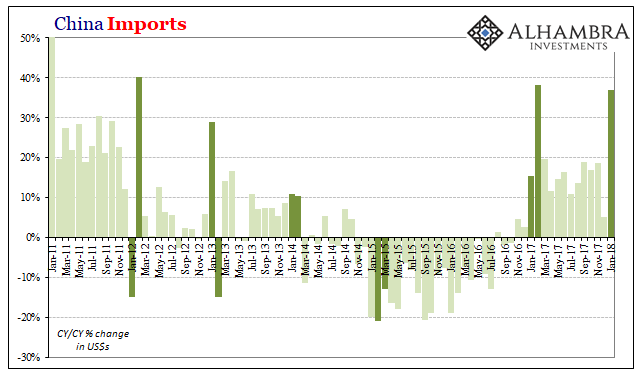

Chinese imports rose 18.7% in September 2017 year-over-year. That’s up from 13.5% growth in August. While near-20% expansion sounds good if not exhilarating, it isn’t materially different from 13.5% or 8% for that matter. In addition, Chinese trade statistics tend to vary month to month.

Read More »

Read More »

FX Daily, October 13: Sterling Extends Yesterday’s Recovery; US Data Awaited

The EU's leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The willingness to discuss a two-year transition period spurred sterling's recovery. After trading on both sides of Wednesdays, it closed on its highs was a bullish technical signal and there has been follow-through buying...

Read More »

Read More »

FX Daily, September 08: US Dollar Tracks Yields Lower

The US dollar has been unable to find any traction as US yields continue to move lower. The US 10-year year is slipping below 2.03% in European turnover, the lowest level in ten months. The risk, as we have noted, is that without prospects of stronger growth and inflation impulses, the yield returns to where was before the US election (~1.85%). The two-year note yield, anchored more by Fed policy than the long-end, is also soft. It yielded 1.25%...

Read More »

Read More »

China Exports, China Imports: Textbook

China’s export growth disappointed in July, only we don’t really know by how much. According to that country’s Customs Bureau, exports last month were 7.2% above (in US$ terms) exports in July 2016. That’s down from 11.3% growth in June, which as usual had been taken in the mainstream as evidence of “strong” or “robust” global demand.

Read More »

Read More »

FX Daily, August 08: Trade Featured as Dollar Drifts Lower

The US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended their pre-weekend losses yesterday, and are trading within yesterday's range today.

Read More »

Read More »

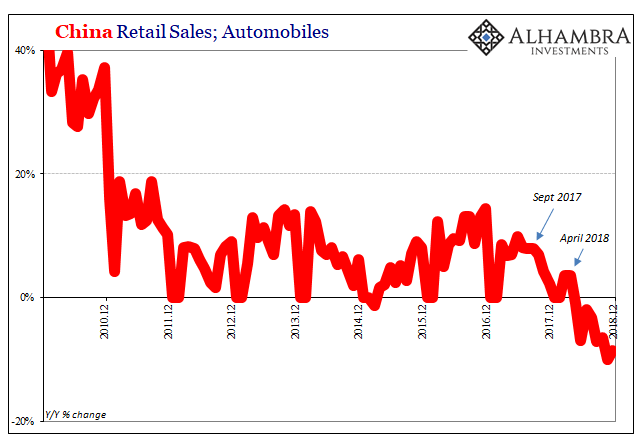

China Imports and Exports: The Ghost Recovery

To the naked eye, it represents progress. China has still an enormous rural population doing subsistence level farming. As the nation grows economically, such a way of life is an inherent drag, an anchor on aggregate efficiency Chinese officials would rather not put up with.

Read More »

Read More »

FX Daily, July 13: Sterling and Antipodeans Trade Higher

The US dollar is mostly consolidating yesterday's move. Sterling is pushing back through $1.29 as the hawks on the MPC may not have been dissuaded by disappointing PMI readings and the softer earnings growth. The table is being set for another 5-3 vote at next month's MPC meeting.

Read More »

Read More »

Questions Persist About China Trade

Chinese trade statistics were for May 2017 better than expected by economists, but on the export side questions remain as to their accuracy. Earlier this year discrepancies between estimates first published by the General Administration of Customs (GAC), those you find reported in the media, and what is captured by the National Bureau of Statistics (NBS), backed up by data from the Ministry of Commerce, became noticeable.

Read More »

Read More »

FX Daily, June 08: Thursday’s Show

Today has an anti-climactic feel to it. Yesterday's leak of what is purported to be the ECB staff forecasts point to small downward revisions to inflation forecasts and an ever small upward tweak to growth. This would be in line with only mild changes in the forward guidance language. The clear indication is that inflation is still not the conditions of a self-sustaining path toward the target.

Read More »

Read More »

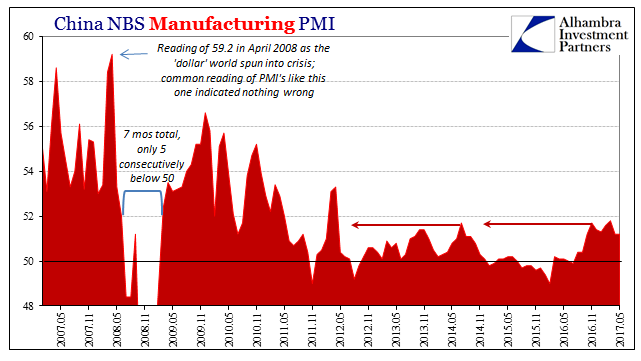

Pay No Attention To 50

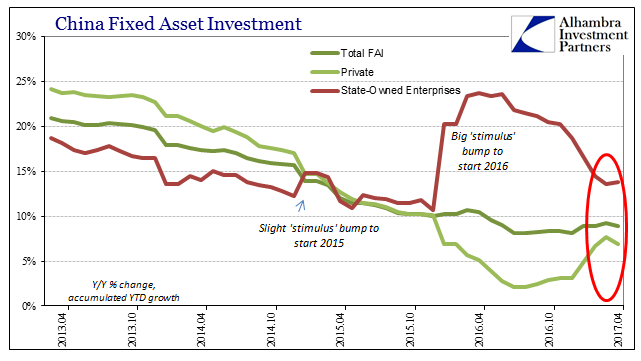

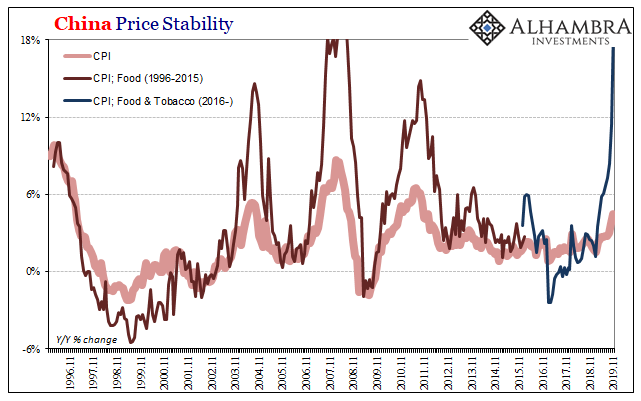

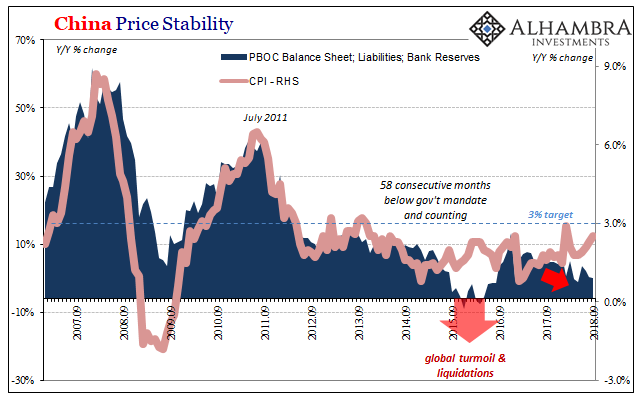

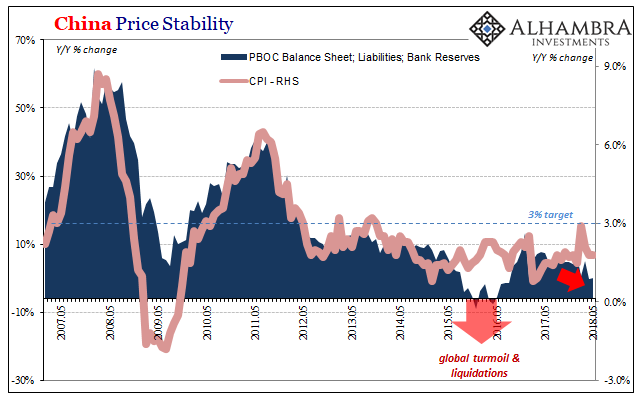

China’s PMI’s were uniformly disappointing with respect to what Moody’s was on about last week. Chinese authorities expended great effort and resources to get the economy moving forward again after several years of “dollar”-driven deceleration. here was a massive “stimulus” spending program where State-owned FAI expenditures of about 2% of GDP were elicited to make up for Private FAI that at one point last year was actually contracting.

Read More »

Read More »

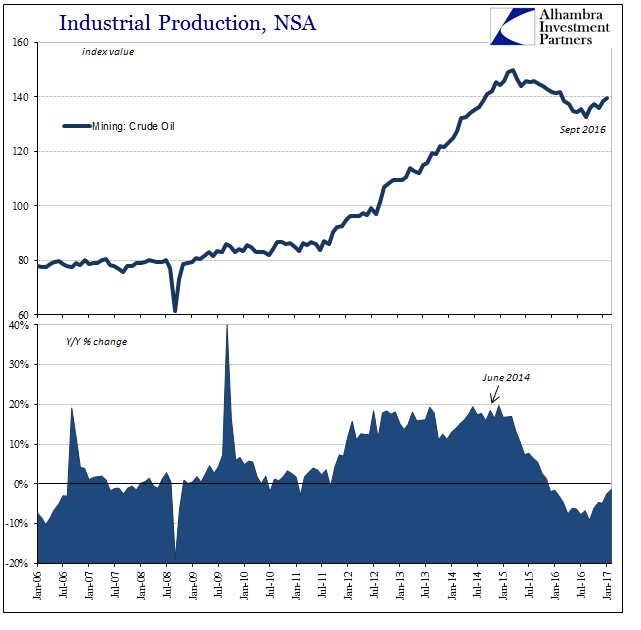

Commodity and Oil Prices: Staying Suck

The rebound in commodity prices is not difficult to understand, perhaps even sympathize with. With everything so depressed early last year, if it turned out to be no big deal in the end then there was a killing to be made. That’s what markets are supposed to do, entice those with liquidity to buy when there is blood in the streets. And if those speculators turn out to be wrong, then we are all much the wiser for their pain.

Read More »

Read More »

Trying To Reconcile Accounts; China

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern.

Read More »

Read More »

Lackluster Trade, China April Edition

China’s trade statistics for April 2017 uniformly disappointed. They only did so, however, because expectations are being calibrated as if the current economy is actually different. It is instead merely swinging between bouts of contraction and low-grade growth, but so low-grade it really doesn’t qualify as growth.

Read More »

Read More »

FX Daily, May 08: Euro Bought on Rumor, Sold on Fact

The euro initially opened higher in Asia following confirmation that Macron was elected the next president of France, but quickly fell below $1.0960 before bouncing back toward $1.10 only to be sold again in early Europe below the pre-weekend low near $1.0950. A break now of $1.0930 could signal a return to the lower end of the range seen since the first round of the French election near $1.0850-$1.0870.

Read More »

Read More »

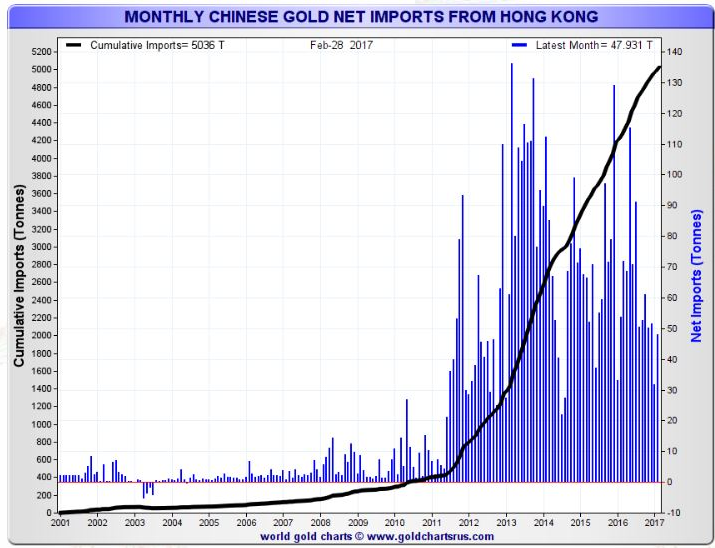

Gold Bullion Imports Into China via Hong Kong More Than Doubles in March

Gold bullion imports into China via main conduit Hong Kong more than doubled month-on-month in March, data showed on Tuesday as reported by Reuters. Net-gold imports by the world’s top gold consumer through the port of Hong Kong rose to 111.647 tonnes in March from 47.931 tonnes in February, according to data emailed to Reuters by the Hong Kong Census and Statistics Department.

Read More »

Read More »