Tag Archive: central-banks

Fed Quack Treatments are Causing the Stagnation

Bleeding the Patient to Health. There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years.

Read More »

Read More »

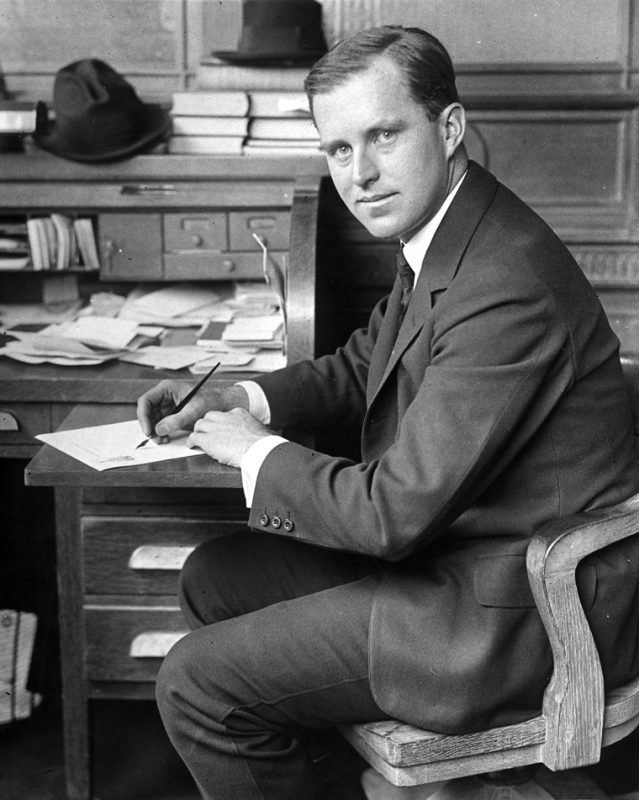

21st Century Shoe-Shine Boys

Anecdotal Flags are Waved. “If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.”

– Joseph Kennedy

It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning, and the shoe-shine boy, one Pat...

Read More »

Read More »

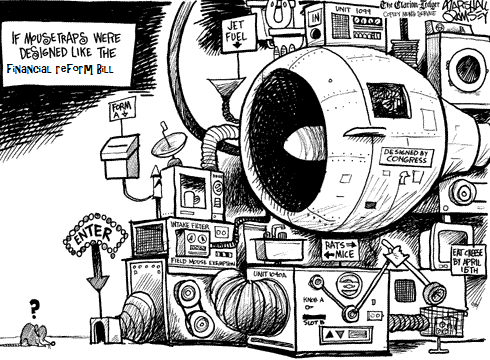

The Government Debt Paradox: Pick Your Poison

“Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted.

Read More »

Read More »

How to Make the Financial System Radically Safer

Clear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism.

Read More »

Read More »

FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Following strong Q2 GDP figures, risk is that Bank of Canada's rate hike anticipated for October is brought forward. ECB's guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley's comments are the most important.

Read More »

Read More »

Yanking the Bank of Japan’s Chain

Based on the simple reflection that arithmetic is more than just an abstraction, we offer a modest observation. The social safety nets of industrialized economies, including the United States, have frayed at the edges. Soon the safety net’s fabric will snap. This recognition is not an opinion. Rather, it’s a matter of basic arithmetic. The economy cannot sustain the government obligations that have been piled up upon it over the last 70 years.

Read More »

Read More »

Adventures in Quantitative Tightening

All remaining doubts concerning the place the U.S. economy and its tangled web of international credits and debts is headed were clarified this week. On Monday, Mark Yusko, CIO of Morgan Creek Capital Management, told CNBC that:

Read More »

Read More »

How Dumb Is the Fed?

Bent and Distorted. POITOU, FRANCE – This morning, we are wondering: How dumb is the Fed? The question was prompted by this comment by former Fed insider Chris Whalen at The Institutional Risk Analyst blog.

Read More »

Read More »

No “Trump Bump” for the Economy

POITOU, FRANCE – “Nothing really changes.” Sitting next to us at breakfast, a companion was reading an article written by the No. 2 man in France, Édouard Philippe, in Le Monde. The headline promised to tell us how the country was going to “deblock” itself.

Read More »

Read More »

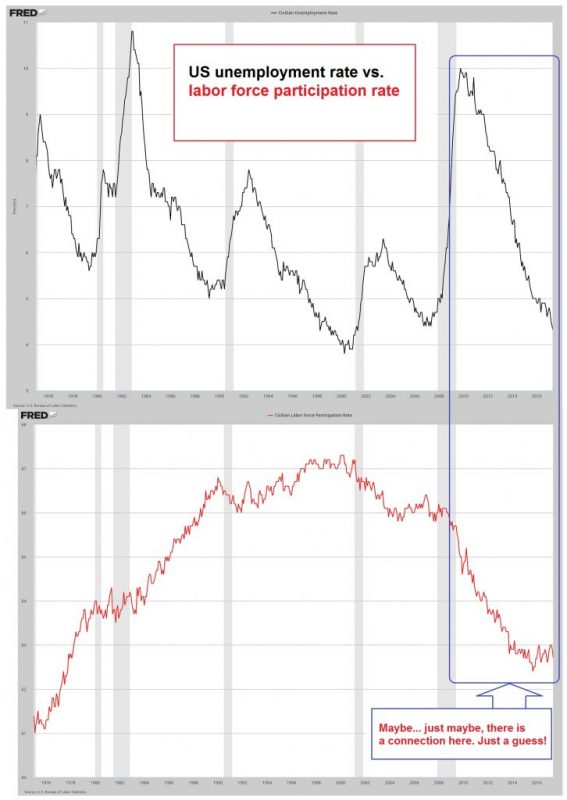

Tales from the FOMC Underground

Many of today’s economic troubles are due to a fantastic guess. That the wealth effect of inflated asset prices would stimulate demand in the economy. The premise, as we understand it, was that as stock portfolios bubbled up investors would feel better about their lot in life.

Read More »

Read More »

Dudley in a Good Place

Dear Mr. Dudley, Your recent remarks in the wake of last week’s FOMC statement were notably unhelpful. In particular, your explanation that further rate hikes are needed to prevent crashing unemployment and rising inflation stunk of rotten eggs.

Read More »

Read More »

Great Graphic: Fed, ECB, and BOJ Balance Sheets

This Great Graphic composed on Bloomberg shows the balance sheets of the Federal Reserve, the European Central Bank, and the Bank of Japan as a proportion of GDP.

Read More »

Read More »

Quantitative Easing Explained

We have noticed that lately, numerous attempts have been made to explain the mechanics of quantitative easing. They range from the truly funny as in this by now ‘viral’ You Tube video with two robotic teddy-bears discussing the Fed chairman’s qualifications (‘my plumber has a beard too’), to outright obfuscation such as the propagation of this ‘Bernanke explains he’s not printing money, it’s just an asset swap‘ notion.

Read More »

Read More »

The Three Headed Debt Monster That’s Going to Ravage the Economy

Mass Infusions of New Credit. “The bank is something more than men, I tell you. It’s the monster. Men made it, but they can’t control it.” – John Steinbeck, The Grapes of Wrath. Something strange and somewhat senseless happened this week. On Tuesday, the price of gold jumped over $13 per ounce. This, in itself, is nothing too remarkable. However, at precisely the same time gold was jumping, the yield on the 10-Year Treasury note was slip sliding...

Read More »

Read More »

Necessity is the Mother of Invention – Retirees Desperate Reach for Yield

Ben Bernanke’s creativity inspired a generation of economists and central bankers. QE, ZIRP and NIRP established a new class of economics that is mathematically sound but practically disastrous. Billions of dollars were transferred from savers to investors to boost the economy, but the wizards of quant forgot that something has to give. In this case, it was the formation of a pension crisis that threatens the golden years of millions of retirees...

Read More »

Read More »

The Triumph of Hope over Experience

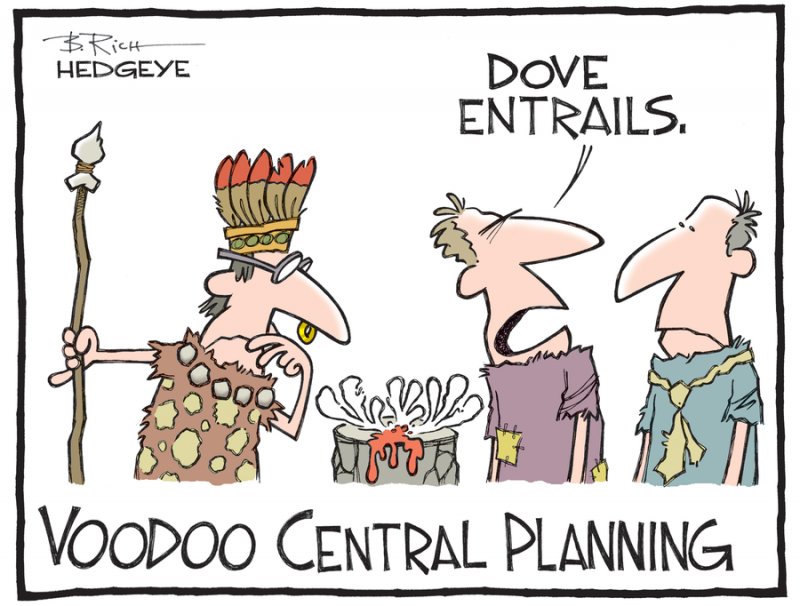

On Wednesday the socialist central planning agency that has bedeviled the market economy for more than a century held one of its regular meetings. Thereafter it informed us about its reading of the bird entrails via statement (one could call this a verbose form of groping in the dark).

Read More »

Read More »

Central Banks’ Obsession with Price Stability Leads to Economic Instability

For most economists the key factor that sets the foundation for healthy economic fundamentals is a stable price level as depicted by the consumer price index. According to this way of thinking, a stable price level doesn’t obscure the visibility of the relative changes in the prices of goods and services, and enables businesses to see clearly market signals that are conveyed by the relative changes in the prices of goods and services.

Read More »

Read More »