Tag Archive: central-banks

The Donald Saves the Dollar

The world is full of bad ideas. Just look around. One can hardly blink without a multitude of bad ideas coming into view. What’s more, the worse an idea is, the more popular it becomes. Take Mickey’s Fine Malt Liquor. It’s nearly as destructive as prescription pain killers. Yet people chug it down with reckless abandon.

Read More »

Read More »

The FOMC Meeting Strategy: Why It May Be Particularly Promising Right Now

As readers know, investment and trading decisions can be optimized with the help of statistics. One way of doing so is offered by the FOMC meeting strategy. A study published by the Federal Reserve Bank of New York in 2011 examined the effect of FOMC meetings on stock prices. The study concluded that these meetings have a substantial impact on stock prices – and contrary to what most investors would probably tend to expect, before rather than after...

Read More »

Read More »

As the Controlled Inflation Scheme Rolls On

American consumers are not only feeling good. They are feeling great. They are borrowing money – and spending it – like tomorrow will never come. On Monday the Federal Reserve released its latest report of consumer credit outstanding. According to the Fed’s bean counters, U.S. consumers racked up $28 billion in new credit card debt and in new student, auto, and other non-mortgage loans in November.

Read More »

Read More »

Why Monetary Policy Will Cancel Out Fiscal Policy

Good cheer has arrived at precisely the perfect moment. You can really see it. Record stock prices, stout economic growth, and a GOP tax reform bill to boot. Has there ever been a more flawless week leading up to Christmas?

Read More »

Read More »

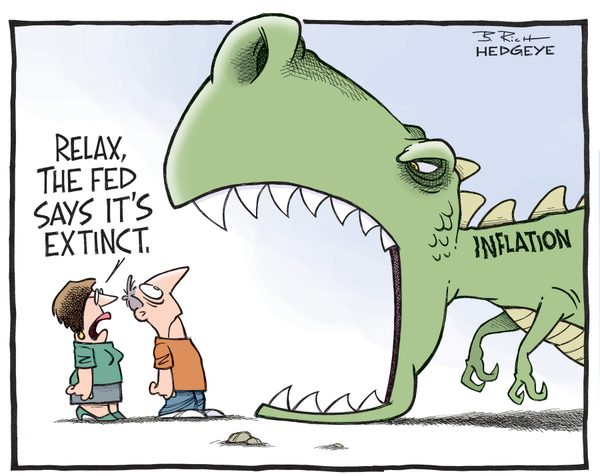

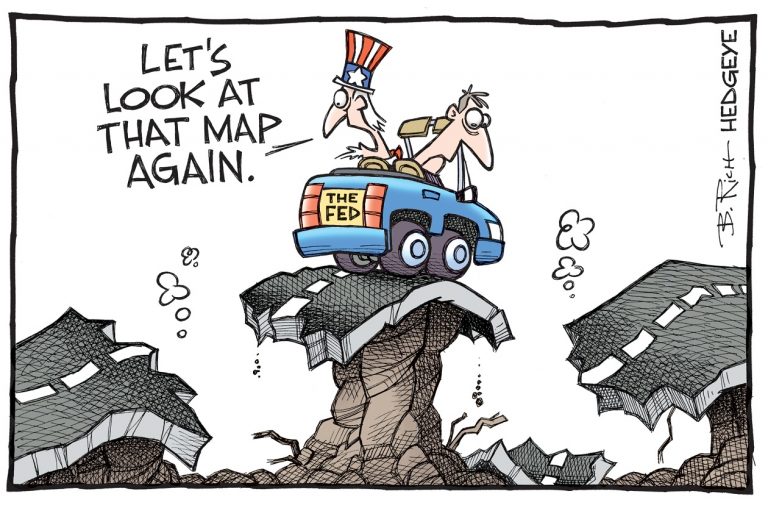

How Uncle Sam Inflates Away Your Life

“Inflation is always and everywhere a monetary phenomenon,” economist and Nobel Prize recipient Milton Friedman once remarked. He likely meant that inflation is the more rapid increase in the supply of money relative to the output of goods and services which money is traded for.

Read More »

Read More »

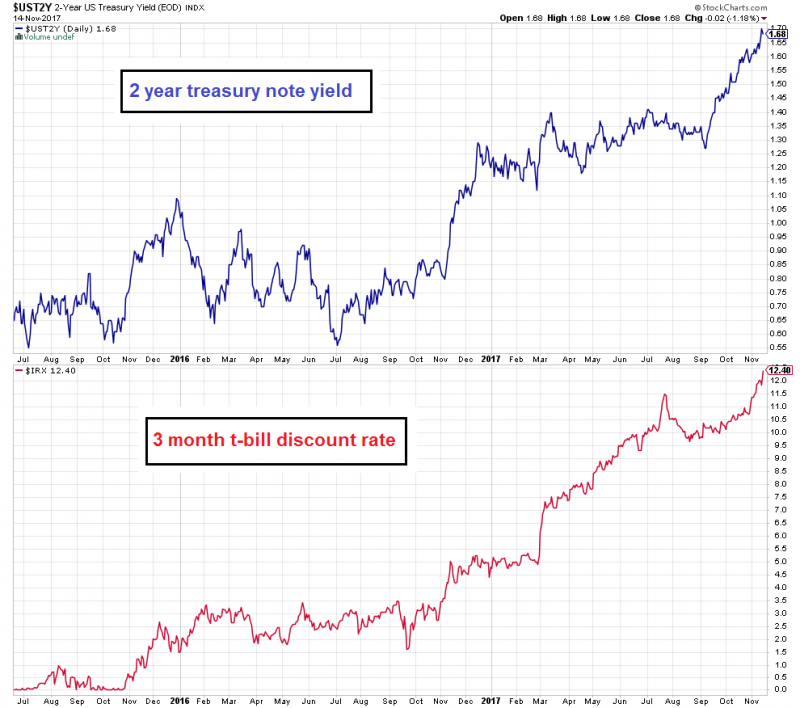

Business Cycles and Inflation, Part II

We recently received the following charts via email with a query whether they should worry stock market investors. They show two short term interest rates, namely the 2-year t-note yield and 3 month t-bill discount rate. Evidently the moves in short term rates over the past ~18 – 24 months were quite large, even if their absolute levels remain historically low.

Read More »

Read More »

Business Cycles and Inflation – Part I

Incrementum Advisory Board Meeting Q4 2017 – Special Guest Ben Hunt, Author and Editor of Epsilon Theory. The quarterly meeting of the Incrementum Fund’s Advisory Board took place on October 10 and we had the great pleasure to be joined by special guest Ben Hunt this time, who is probably known to many of our readers as the main author and editor of Epsilon Theory.

Read More »

Read More »

Heat Death of the Economic Universe

Physicists say that the universe is expanding. However, they hotly debate (OK, pun intended as a foreshadowing device) if the rate of expansion is sufficient to overcome gravity—called escape velocity. It may seem like an arcane topic, but the consequences are dire either way.

Read More »

Read More »

Federal Reserve President Kashkari’s Masterful Distractions

The True Believer.How is it that seemingly intelligent people, of apparent sound mind and rational thought, can stray so far off the beam? How come there are certain professions that reward their practitioners for their failures? The central banking and monetary policy vocation rings the bell on both accounts. Today we offer a brief case study in this regard.

Read More »

Read More »

Fed Quack Treatments are Causing the Stagnation

Bleeding the Patient to Health. There’s something alluring about cure-alls and quick fixes. Who doesn’t want a magic panacea to make every illness or discomfort disappear? Such a yearning once compelled the best and the brightest minds to believe the impossible for over two thousand years.

Read More »

Read More »

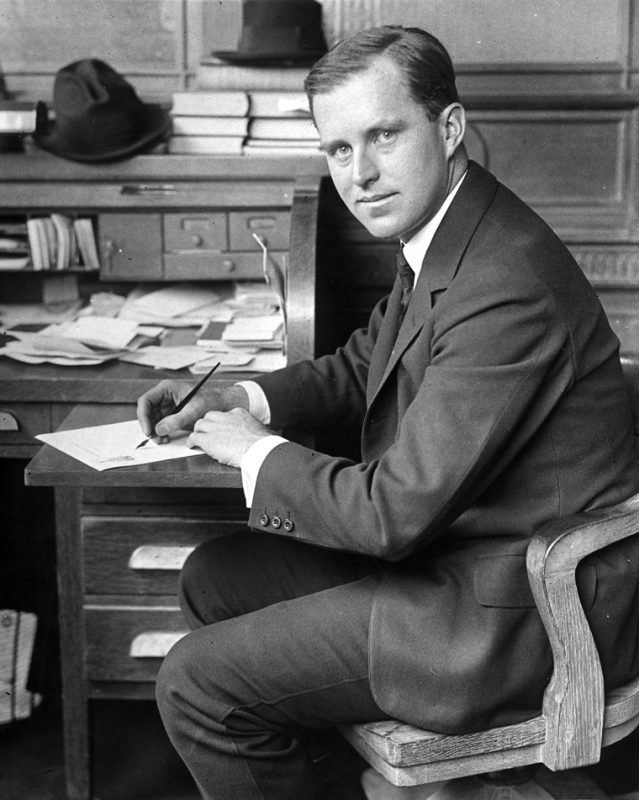

21st Century Shoe-Shine Boys

Anecdotal Flags are Waved. “If a shoeshine boy can predict where this market is going to go, then it’s no place for a man with a lot of money to lose.”

– Joseph Kennedy

It is actually a true story as far as we know – Joseph Kennedy, by all accounts an extremely shrewd businessman and investor (despite the fact that he had graduated in economics*), really did get his shoes shined on Wall Street one fine morning, and the shoe-shine boy, one Pat...

Read More »

Read More »

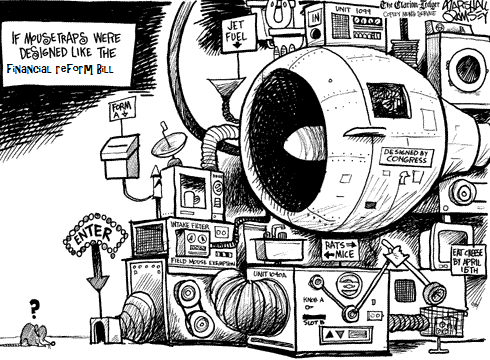

The Government Debt Paradox: Pick Your Poison

“Rule one: Never allow a crisis to go to waste,” said President Obama’s Chief of Staff Rahm Emanuel in November of 2008. “They are opportunities to do big things.” At the time of his remark, Emanuel was eager to exploit the 2008 financial crisis to raid the public treasury. With the passage of the American Recovery and Reinvestment Act in February 2009, Emanuel’s wish was granted.

Read More »

Read More »

How to Make the Financial System Radically Safer

Clear thinking and discerning rigor when it comes to the twisted state of present economic policy matters brings with it many physical ailments. A permanent state of disbelief, for instance, manifests in dry eyes and droopy shoulders. So, too, a curious skepticism produces etched forehead lines and nighttime bruxism.

Read More »

Read More »

FX Weekly Preview: Three Central Banks Dominate the Week Ahead

Following strong Q2 GDP figures, risk is that Bank of Canada's rate hike anticipated for October is brought forward. ECB's guidance to that it will have to extend its purchases into next year will continue to evolve. Among Fed officials speaking ahead of the blackout period, Brainard and Dudley's comments are the most important.

Read More »

Read More »

Yanking the Bank of Japan’s Chain

Based on the simple reflection that arithmetic is more than just an abstraction, we offer a modest observation. The social safety nets of industrialized economies, including the United States, have frayed at the edges. Soon the safety net’s fabric will snap. This recognition is not an opinion. Rather, it’s a matter of basic arithmetic. The economy cannot sustain the government obligations that have been piled up upon it over the last 70 years.

Read More »

Read More »

Adventures in Quantitative Tightening

All remaining doubts concerning the place the U.S. economy and its tangled web of international credits and debts is headed were clarified this week. On Monday, Mark Yusko, CIO of Morgan Creek Capital Management, told CNBC that:

Read More »

Read More »

How Dumb Is the Fed?

Bent and Distorted. POITOU, FRANCE – This morning, we are wondering: How dumb is the Fed? The question was prompted by this comment by former Fed insider Chris Whalen at The Institutional Risk Analyst blog.

Read More »

Read More »

No “Trump Bump” for the Economy

POITOU, FRANCE – “Nothing really changes.” Sitting next to us at breakfast, a companion was reading an article written by the No. 2 man in France, Édouard Philippe, in Le Monde. The headline promised to tell us how the country was going to “deblock” itself.

Read More »

Read More »

Tales from the FOMC Underground

Many of today’s economic troubles are due to a fantastic guess. That the wealth effect of inflated asset prices would stimulate demand in the economy. The premise, as we understand it, was that as stock portfolios bubbled up investors would feel better about their lot in life.

Read More »

Read More »