Tag Archive: Bonds

Global Asset Allocation Update

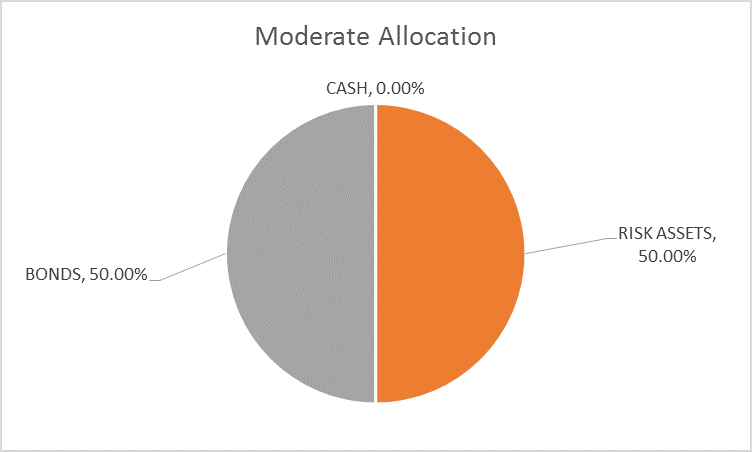

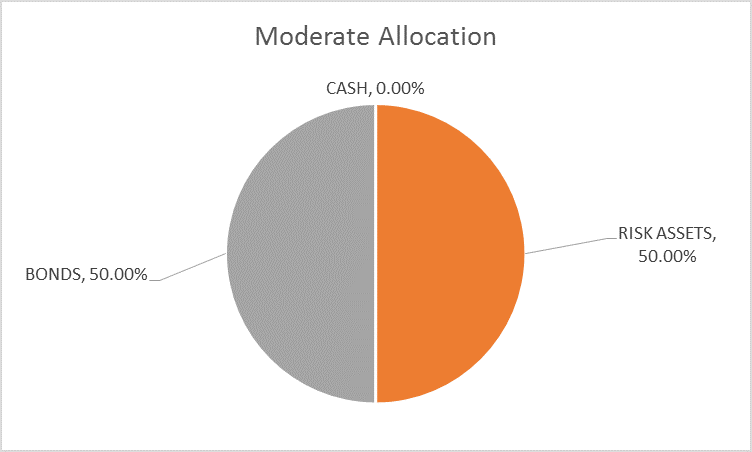

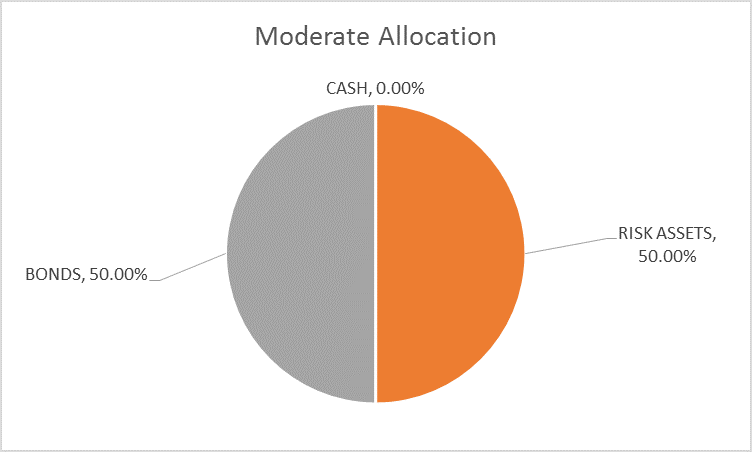

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are, however, changes within the asset classes. We are reducing the equity allocation and raising the allocation to REITs.

Read More »

Read More »

Bi-Weekly Economic Review

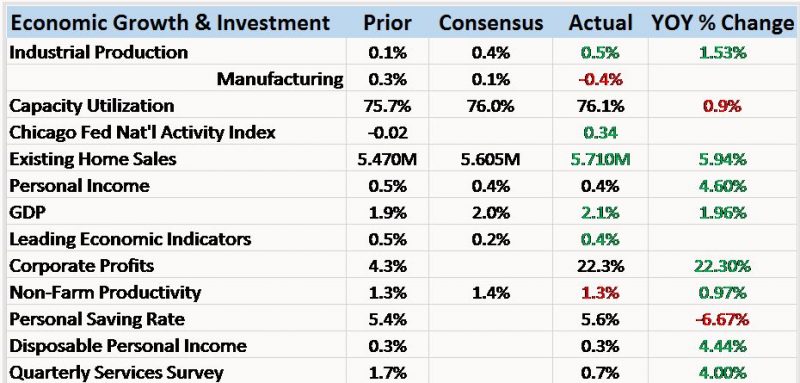

The economic data releases since the last update were generally upbeat but markets are forward looking and the future apparently isn’t to their liking. Of course, it is hard to tell sometimes whether bonds, the dollar and stocks are responding to the real economy or the one people hope Donald Trump can deliver when he isn’t busy contradicting his communications staff.

Read More »

Read More »

Bi-Weekly Economic Review

The economic reports since the last economic update were generally less than expected and disappointing. The weak growth of the last few years had been supported by autos and housing while energy has been a wildcard. When oil prices fell, starting in mid-2014 and bottoming in early 2016, economic growth suffered as the shale industry retrenched.

Read More »

Read More »

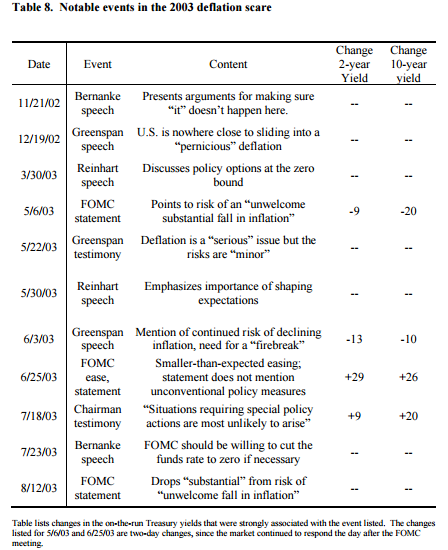

Clickbait: Bernanke Terrifies Stock Investors, Again

If you are a stock investor, you should be terrified. The most disconcerting words have been uttered by the one person capable of changing the whole dynamic. After spending so many years trying to recreate the magic of the “maestro”, Ben Bernanke in retirement is still at it.

Read More »

Read More »

Bi-Weekly Economic Review

It wasn’t a very good two weeks for economic data with the majority of reports disappointing. Most notable I think is that the so called “soft data” is starting to reflect reality rather than some fantasy land where President Trump enacts his entire agenda in the first 100 days of being in office. Politics is about the art of the possible and that is proving a short list for now.

Read More »

Read More »

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50.

The performance of markets in the first quarter of the year was a bit schizophrenic. Stocks performed well which one might interpret as a reflection of improving economic growth prospects. Certainly President Trump and his proxies were quick to take credit but unfortunately for the new...

Read More »

Read More »

The Global Burden

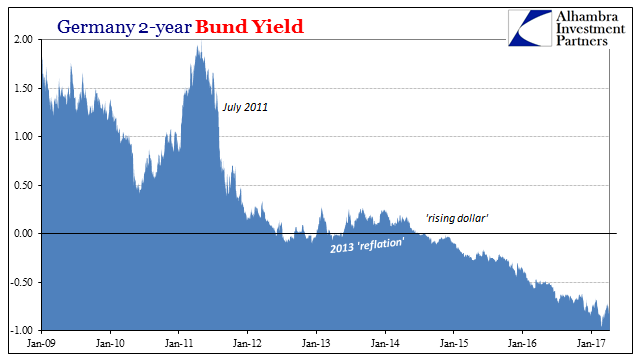

Bundesrepublik Deutscheland Finanzagentur GmbH (German Finance Agency) was created on September 19, 2000, in order to manage the German government’s short run liquidity needs. GFA took over the task after three separate agencies (Federal Ministry of Finance, Federal Securities Administration, and Deutsche Bundesbank) had previously shared responsibility for it.

Read More »

Read More »

Bi-Weekly Economic Review

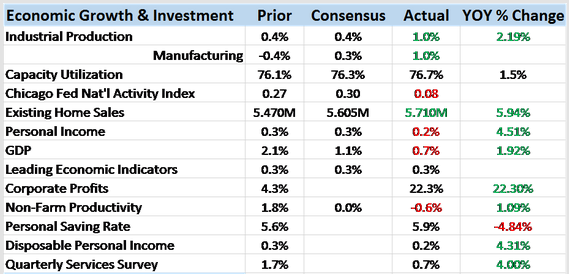

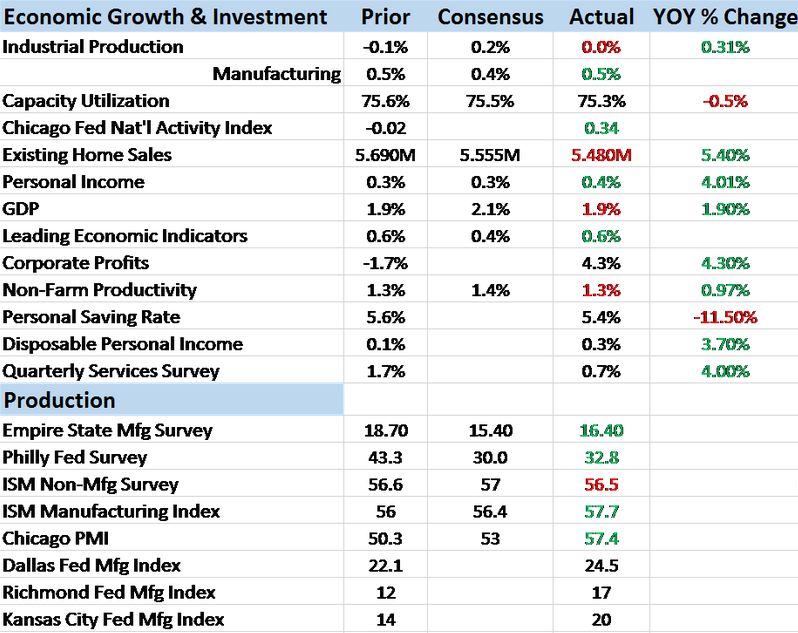

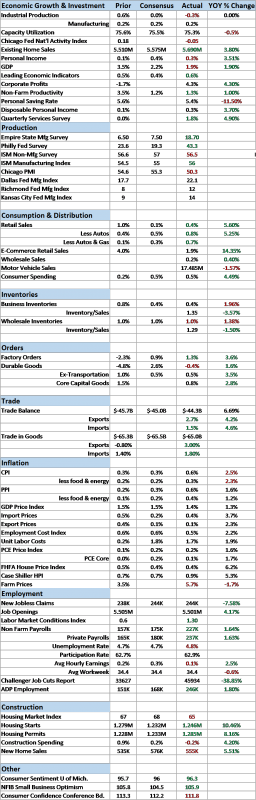

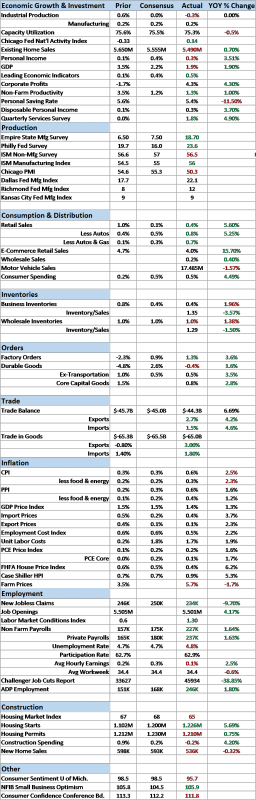

It is hard not to notice that the chart above has a lot less red in it than it has in some time. That is true of the month to month data as well as the year over year changes. There has been a widely reported gap between so called soft data – surveys and polls – and the hard data – actual economic activity reports. Bulls say the gap is there because the soft data always leads the hard data.

Read More »

Read More »

Bi-Weekly Economic Review

The Fed did, as expected, hike rates at their last meeting. And interestingly, interest rates have done nothing but fall since that day. As I predicted in the last BWER, Greenspan’s conundrum is making a comeback. The Fed can do whatever it wants with Fed funds – heck, barely anyone is using it anyway – but they can’t control what the market does with long term rates.

Read More »

Read More »

All In The Curves

If the mainstream is confused about exactly what rate hikes mean, then they are not alone. We know very well what they are supposed to, but the theoretical standards and assumptions of orthodox understanding haven’t worked out too well and for a very long time now. The benchmark 10-year US Treasury is today yielding less than it did when the FOMC announced their second rate hike in December.

Read More »

Read More »

Global Asset Allocation Update

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. The Fed spent the last month forward guiding the market to the rate hike they implemented today. Interest rates, real and nominal, moved up in anticipation of a more aggressive Fed rate hiking cycle.

Read More »

Read More »

China’s NPC Ends with New Initiatives

China will make its mainland bond market more accessible. As China's portfolio of patents grows it will likely become more protective of others' intellectual property rights. PRC President Xi will likely visit US President Trump early next month.

Read More »

Read More »

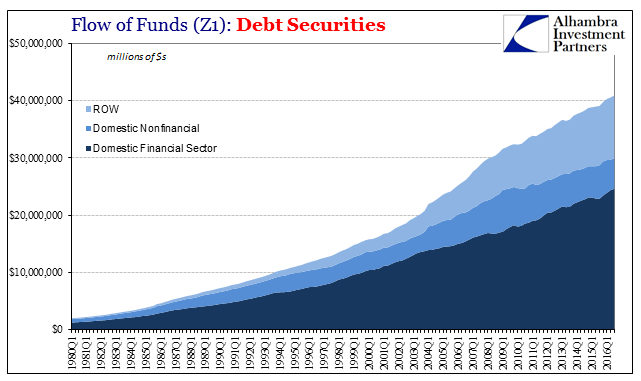

Do Record Debt And Loan Balances Matter? Not Even Slightly

We live in a non-linear world that is almost always described in linear terms. Though Einstein supposedly said compound interest is the most powerful force in the universe, it rarely is appreciated for what the statement really means. And so the idea of record highs or even just positive numbers have been equated with positive outcomes, even though record highs and positive growth rates can be at times still associated with some of the worst. It...

Read More »

Read More »

No Paradox, Economy to Debt to Assets

It is surely one of the primary reasons why many if not most people have so much trouble accepting the trouble the economy is in. With record high stock prices leading to record levels of household net worth, it seems utterly inconsistent to claim those facts against a US economic depression.

Read More »

Read More »

Bi-Weekly Economic Review

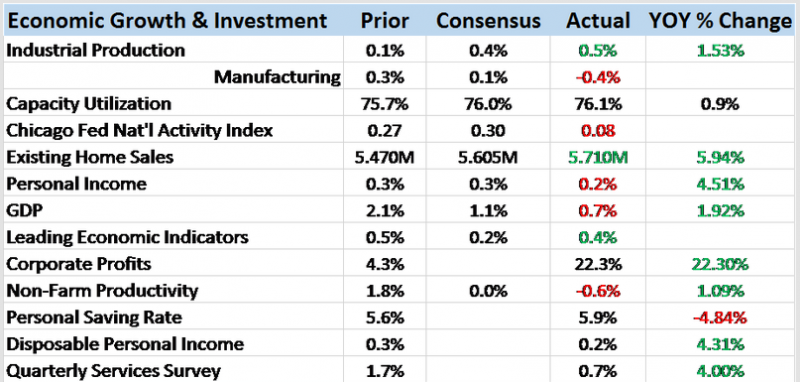

Economic Reports Scorecard. The economic data released since my last update has been fairly positive but future growth and inflation expectations, as measured by our market indicators, have waned considerably. There is now a distinct divergence between the current data, stocks and bonds. Bond yields, both real and nominal, have fallen recently even as stocks continue their relentless march higher.

Read More »

Read More »

Bi-Weekly Economic Review

The economic data since my last update has improved somewhat. It isn’t across the board and it isn’t huge but it must be acknowledged. As usual though there are positives and negatives, just with a slight emphasis on positive right now. Interestingly, the bond market has not responded to these slightly more positive readings with nominal and real yields almost exactly where they were in the last update 3 weeks ago. In other words, there’s no reason...

Read More »

Read More »

Italian Euro Exit: Why it Might Come in some Years and Why it Will Help the Euro Zone and Italy

Italy has three options: 1. exit the euro zone and devalue the currency; 2. remain in the euro zone and devalue salaries. 3. go for Japan-like decades-long slow growth with stagnating wages, but also with falling inflation and (positive news!) falling bond yields.

Read More »

Read More »

FX Daily, November 10: US Dollar, Equities, and Commodities Firmer as Reflation Trade Takes Hold

GBP/CHF rates spiked by almost two cents during Wednesday’s trading, providing those clients holding Sterling with some of the best rates they’ve seen in the past few weeks. This move came following confirmation that Donald Trump had won the race for the White House, news which sent shockwaves through the market. How the outcome will affect the global markets is difficult to analyse at this point but could yesterday’s positive spike indicate better...

Read More »

Read More »

Jim Grant Puzzled by the actions of the SNB

James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold.

Read More »

Read More »