Tag Archive: Bank of Japan

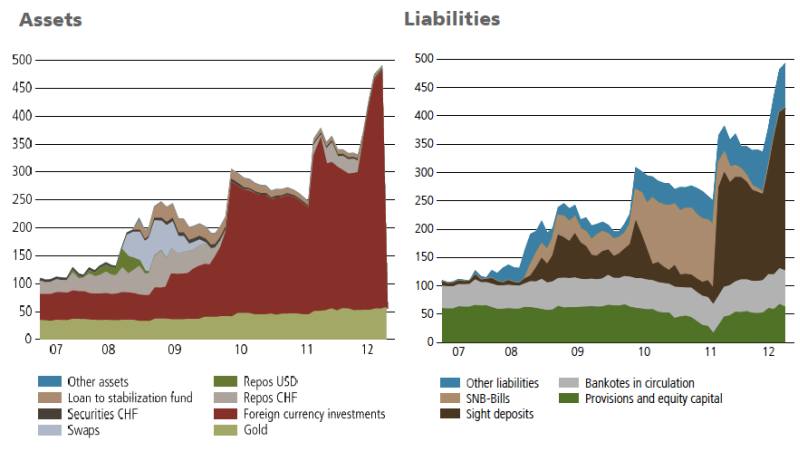

SNB Balance Sheet Expansion

Since 2008 the balance sheet of the Swiss National Bank is 280% higher, this is the equivalent of 60% of Swiss GDP. So did most other central banks, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

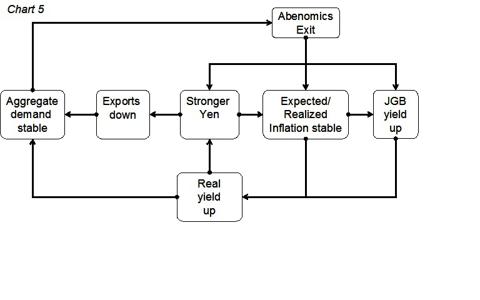

Abenomics: Japanese Economy Would Have Recovered Even Without it

Response to Prof. Nick Rowe, Carleton University, Canada and Lars Christensen, the leading “Market Monetarist“. Nick Rowe: Is the Bank of Japan trying to push down bond yields? Well, yes and no. Yes, it is fighting a battle to push down bond yields, but that battle is part of a wider war for economic recovery. And …

Read More »

Read More »

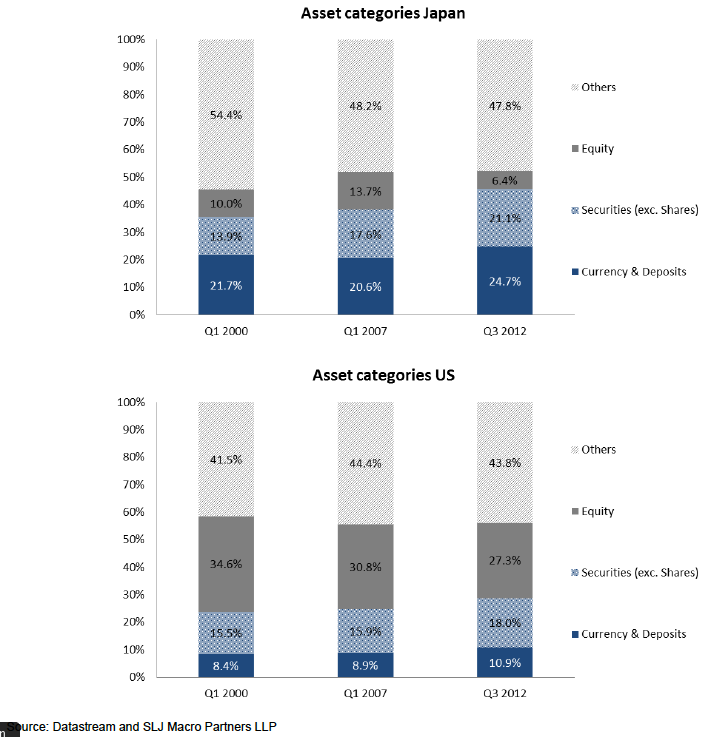

Japanese Investors Will Determine Fate of USD/JPY not U.S. Hedge Funds

By Stephen Jen (via Itau Global Connections). Bottom line Now that the Bank of Japan will be led by a team of super-doves, the mechanism through which a more aggressive BOJ could influence the yen is through capital flows. We have used the analogy of a two-stage rocket to describe how USDJPY could be propelled. … Continue reading »

Read More »

Read More »

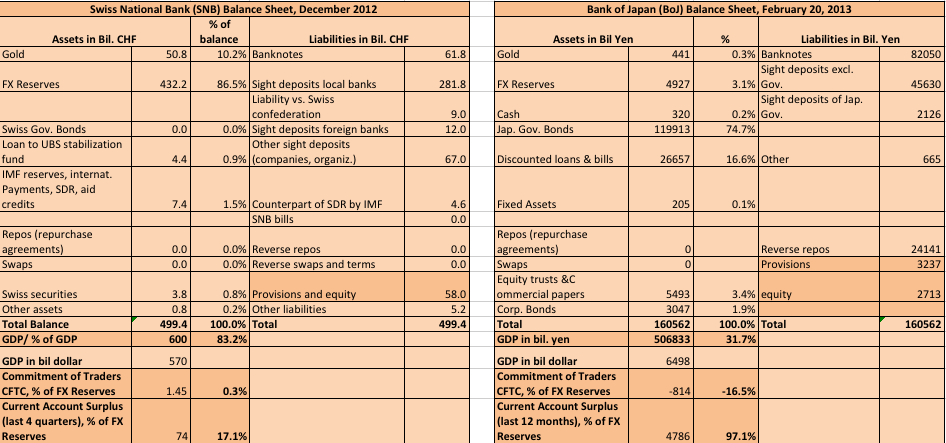

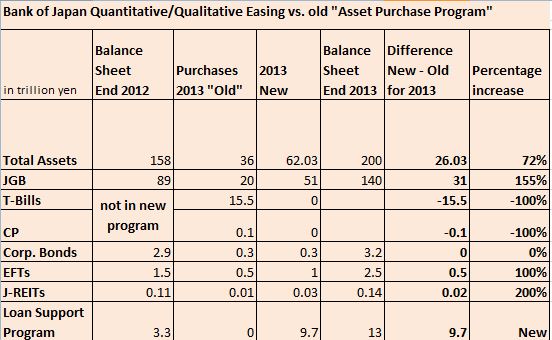

BoJ: Despite Quantitative and Qualitative Easing No Sign of FX Purchases

The Bank of Japan has introduced the expected “massive” quantitative and qualitative easing programme. “Quantitative” means increase of quantities of JGBs bought, “qualitative” the purchase of more ETFs, REIT and the loan support program.

Read More »

Read More »

Why the Yen Is Now Fairly Valued, USD back as Preferred Funding Currency

Producer prices and “real mean reversion” for currencies show that the yen is currently fairly valued. Many momentum factors could, however, speak for some further weakening, while seasonality favours an appreciation. For us, the US dollar is back as the preferred funding currency. The real mean reversion for currencies Some economists, like Goldman’s O’Neill, in the case …

Read More »

Read More »

When Will Hedge Funds and FX Traders Close their Short Yen Positions?

Hedge Funds have lost their power. This year has shown that their only remaining possibility to gain easy money is a concerted action with some of their friends manipulating currency markets, calling it “currency wars” and creating an unholy alliance with the dovish prime minister Abe. Some of the biggest U.S. hedge-fund investors have made …

Read More »

Read More »

SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk

Central Bank data show that the Swiss National Bank (SNB) remains the only central bank that strongly participated in currency wars with FX intervention, while the Japan was just verbal intervention.

Read More »

Read More »

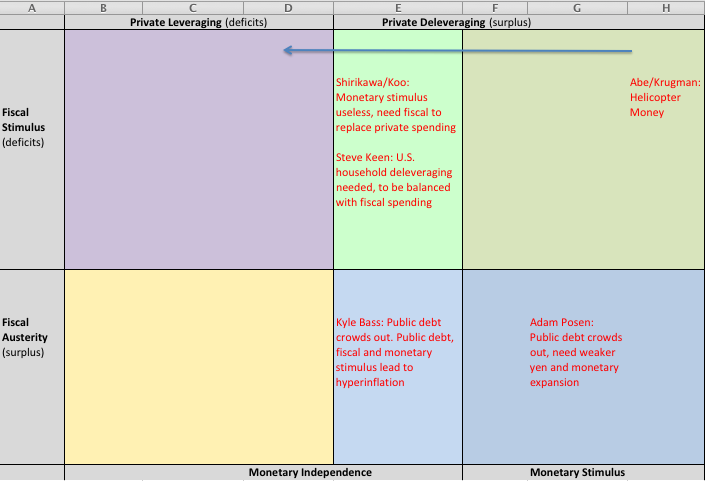

Opinions of Leading Economists on Japan and the Unholy Alliance of Kyle Bass and Shinzo Abe

We give an overview of opinions of leading economists that want to help Japan out of deflation. Paul Krugman, Richard Koo, Adam Posen and Kyle Bass.

Read More »

Read More »

Is a Liquidity Trap Really a Problem? Yen Debasement Part3 by Noah Smith

Thoughts on the Japanese Currency Debasement (part 3) In previous posts we looked on the following aspects of the recent Japanese currency debasement: Overview: What different leading economists – Paul Krugman, Richard Koo, Adam Posen, Kyle Bass – think about the Japanese currency debasement and the way to more private spending and investing instead of …

Read More »

Read More »

Net Speculative Positions, Week January 21

Submitted by Mark Chandler, from marctomarkets.com The technical tone of the major foreign currencies deteriorated in recent days. It appears to be a cascading effect. Favorite risk-on currencies, like the dollar-bloc, failed to participate in the move against the greenback. The Swiss franc took the dubious honor of being the weakest currency last week, losing 2.2% …

Read More »

Read More »

Helicopter Money against Animal Spirits and our Critique

The newest paper by McCulley and Poszar "Helicopter Money: or how I stopped worrying and love fiscal-monetary cooperation" presents fiscal policy and monetary policy along these two criteria

Read More »

Read More »

Epic Shift in Monetary Policy: Japan goes SNB, Nuclear Option

According to Bloomberg, at least prime minister Abe is taking the nuclear option and is following the SNB in buying foreign assets. This is a huge change in global monetary policy.

Read More »

Read More »

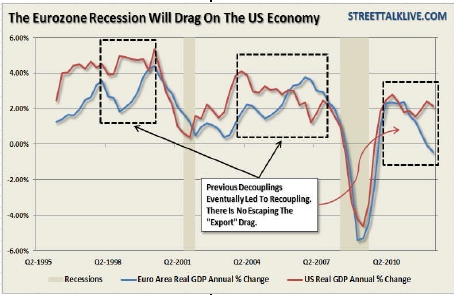

Same Procedure as Every Year: Analysts Shouting “The Great Recession is Over!” But It Is Not!

Or why we do not believe in the American economy. Like every year in Q4, analysts proudly present the end of the great recession: 2009: The big picture: The Great Recession is Over! Long Live the Ordinary Recession …. 2010: Mish Global Trend Analysis: The Great Recession is Over; Bad News: It Doesn’t Feel Like … Continue...

Read More »

Read More »

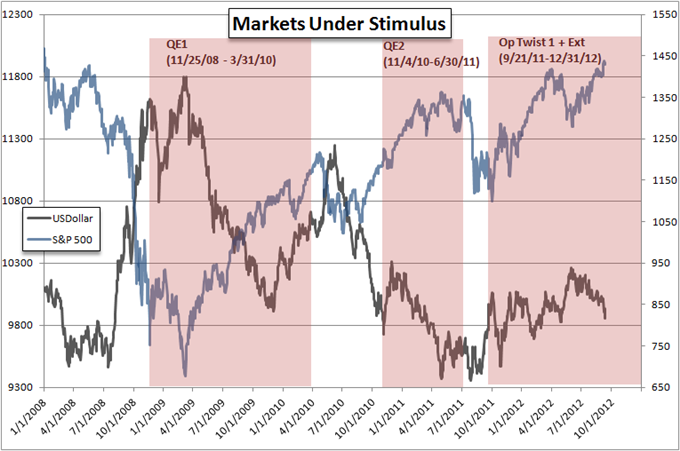

Net Speculative Positions, Week November 19

Submitted by Mark Chandler, from marctomarkets.com The US Dollar Index bottomed on September 14, the day after QE3+ was announced. It reached a 2-month high before the weekend. It has now retraced half of the ground lost from ECB President Draghi’s pledge to “to do whatever it takes” through hints, and then delivery, of …

Read More »

Read More »

Who Has Got the Problem? Europe or Japan?

A couple of months ago the euro traded close to EUR/USD 1.20 and the whole world was betting on its breakdown. Once the euro downtrend ended thanks to QE3, OMT and euro zone current account surpluses, the common currency did not stop to appreciate against the yen and reached levels of EUR/JPY 104 and above. … Continue reading...

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week of October 1

Submitted by Mark Chandler, from marctomarkets.com If the third quarter was about the reduction of tail-risk by official actions, then Q4 will be about the limitations of the policy response. It will pose a challenging investment climate after what turned out to be a favorable performance in Q3. Equities generally did well. The US …

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 24

Submitted by Mark Chandler, from marctomarkets.com The days ahead will help clarify whether the US dollar’s somewhat firmer tone last week was simply corrective in nature, before a new leg lower, or the carving out of a bottom of a downtrend that began in June against most of the major currencies and July for the …

Read More »

Read More »

Net Speculative Positions, FX Outlook, Global Stock Markets, Week September 17

Submitted by Mark Chandler, from marctomarkets.com Nearly every development in recent days has been embraced by the foreign exchange market as a reason to continue to do what it has been doing since late July, and that is to sell the dollar. The German Constitutional Court ruling, allowing the European Stability Mechanism to …

Read More »

Read More »

It’s not simply QE3

Submitted by Mark Chandler, from marctomarkets.com The outcome of the FOMC meeting is not just a new round of quantitative easing, some might call it QE3. What the Fed announced represents a new chapter in its policy response. The first distinguishing aspect of its decision is the open-ended nature of it. While it has not indicated … Continue reading...

Read More »

Read More »