We give an overview of opinions of leading economists that want to help Japan out of deflation. Paul Krugman, Richard Koo, Adam Posen and Kyle Bass. We show that FX traders and some hedge funds might have weakened the yen solely on the opinion of the unholy alliance of Kyle Bass and Shinzo Abe.

Paul Krugman and premier Shinzo Abe think that the liquidity trap and deflation are big issues and must be fought with monetary and fiscal stimulus, so-called “Helicopter money”.

Nomura’s leading economist Richard Koo and the leaving head of the Bank of Japan, Shirikawa tend to say that these issues are not big enough to risk financial stability. Richard Koo thinks that fiscal spending must replace private spending during the liquidity trap and that deflation is not an issue because consumers will not delay spending forever. But both think that Japanese inflation will arrive soon anyway, see the following inflation break even graph.

We give an overview of opinions of leading economists that want to help Japan out of deflation. Paul Krugman, Richard Koo, Adam Posen and Kyle Bass. - Click to enlarge

Adam Posen, the president of the Peterson institute, reckons that the strong yen is the basis of the problem and wants solely monetary actions, but an end of fiscal stimulus that crowds out private investments.

He states: “Japan was able to get away with such unremittingly high deficits without an overt crisis for four reasons. First, Japan’s banks were induced to buy huge amounts of government bonds on a recurrent basis. Second, Japan’s households accepted the persistently low returns on their savings caused by such bank purchases. Third, market pressures were limited by the combination of few foreign holders of JGBs (less than 8 per cent of the total) and the threat that the Bank of Japan could purchase unwanted bonds. Fourth, the share of taxation and government spending in total Japanese income was low.” source FT

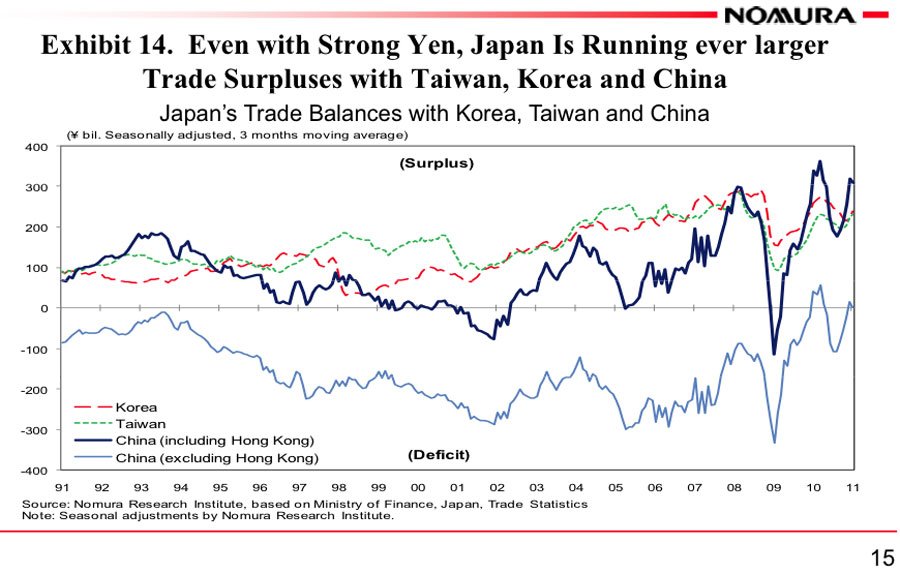

Still, in 2011 before the Tsunami that weakened the Japanese trade balance, Richard Koo emphasized that Japan was able to live with a strong yen.

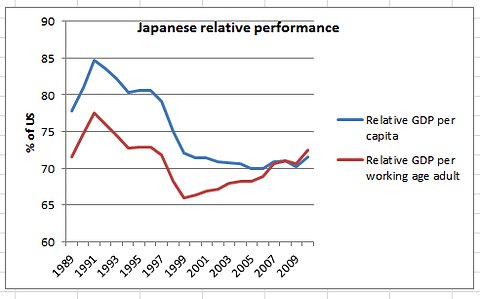

We showed that a strong currency and deflation reflect strong fundamentals and productivity, despite Japanese zombie companies in the 1990s and early 2000s. Both Posen and Krugman have indicated that Japan only lived through one lost decade, but GDP growth per working person between 2000 and 2007 was actually higher than in the U.S., this despite a liquidity trap.

We give an overview of opinions of leading economists that want to help Japan out of deflation. Paul Krugman, Richard Koo, Adam Posen and Kyle Bass. - Click to enlarge

Kyle Bass of Hayman Capital represent the ones that think that the huge public debt will lead to financial instability:

- Japan persists with one of the largest structural fiscal deficits in the world.

- The aging population has strangled tax revenues and inflates expenditure on a growing basis.

- We are of the opinion that the fragility of the Asian economy as a whole, and more specifically that of Japan, will subvert Japan’s ability to implement their newly‐passed consumption tax rate hike. Simply put, we believe it cannot and will not happen.

- The flow of new domestic buyers is drying up so fast that the BOJ is on track to buy a majority of new issuance this year.

- .. the trade balance is in such structural decline that the entire current account threatens to turn negative next year.

Posen, however, affirms that Japanese public debt stands only at 130% instead of 220% when all government and BoJ holdings are excluded.

Posen states, “Japanese public debt has ballooned for 20 years, rising from 60 per cent to 220 per cent of gross domestic product (though the true figure net of government holdings may be 130 per cent).” Source FT

Kyle Bass’ understanding, however, is that public JGB holdings, so-called “monetization of debt”, will quickly lead to hyper-inflation and a weak yen. Even if we share Austrian and free-market opinions with Bass, we think that he oversimplifies because a sudden increases of government bond yields mostly happen in cases with:

- a high percentage of foreign bond holders (currently JGBs have only 8% foreign holders),

- a weak international investment position (but the Japanese position is positive with +51%),

- high inflation (which can be excluded thanks to Japanese demographic factors and immigration policy and good productivity)

- and a tradition of high wage increases to counter inflation and a history of defaults or high yields (e.g. Argentina and Venezuela).

Strangely, the combination of the arguments of Kyle Bass and Shinzo Abe, a potentially “unholy alliance”, has caused that FX traders made the yen overshoot.

Overview of opinions

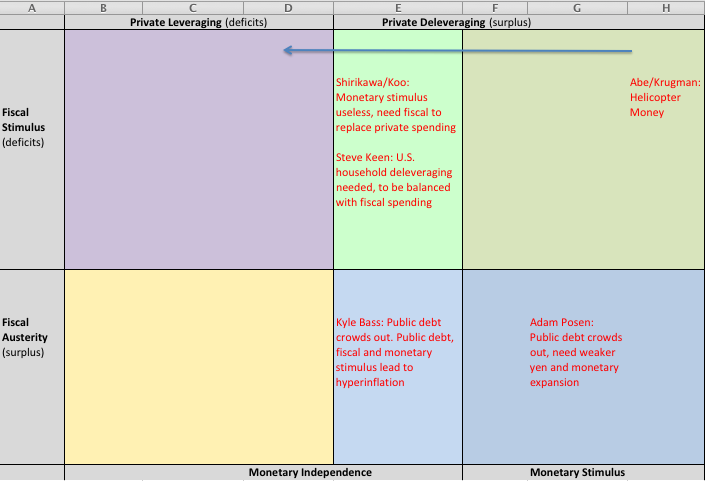

The following graph gives an overview of the cited opinions based on Poszar/Mc Culley’s quadrants. For all the aim is to achieve private leveraging from the current status of private deleveraging. In particular, firms need to invest more than they pay down debt, i.e. they leverage; the left side of the following graph (pink and yellow quadrants) actually represents the “normal” state of an economy.

(Remark: Poszar/Mc Culley identify “private” as a combination of households and firms.)

Poszar/Mc Culley with an additional column containing Richard Koo’s private deleveraging combined with monetary independence

We added an additional column E with “monetary independence”, but “private deleveraging”. It does not represent Poszar/Mc Culley’s views, but rather the one of Richard Koo, who thought that monetary easing does not help the Japanese to come into the private leveraging area.

See more for