Tag Archive: Bank of Japan

Are Central Banks Setting Each Other Up?

Authored by Mark St.Cyr,

There are times you try to connect the dots. There are others where those connections warrant adorning your trusted tin-foiled cap of choice; for you just can’t get there unless you do. This I believe is one of those time...

Read More »

Read More »

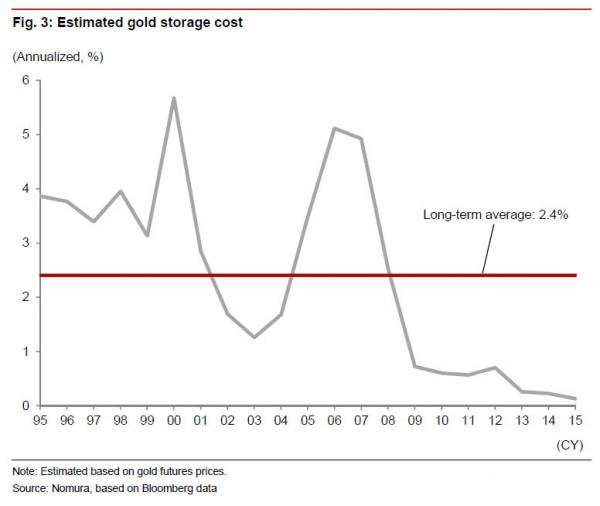

How Low Can The Bank Of Japan Cut Rates? Ask Gold

As we noted last night, in what was the second clear example of sheer desperation by the Bank of Japan, the central banker formerly known as Peter Pan for his on the record belief that "he should fly", and as of this morning better known as Peter Pan...

Read More »

Read More »

BoJ Adopts Negative Interest Rates, Fails To Increase QE

Well that did not last long. After initial exuberance over The BoJ's wishy-washy decision to adopt a 3-tiered rate policy including NIRP, markets have realized that without further asset purchases (which were maintained at the current pace), there is...

Read More »

Read More »

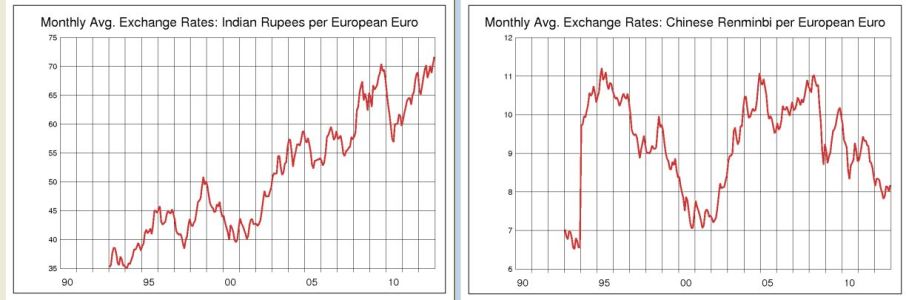

(1.2) Explaining price movements in FX rates

We indicate the main factors that influence FX rates in the longer term. We explain the movements of currencies based on these factors.

Read More »

Read More »

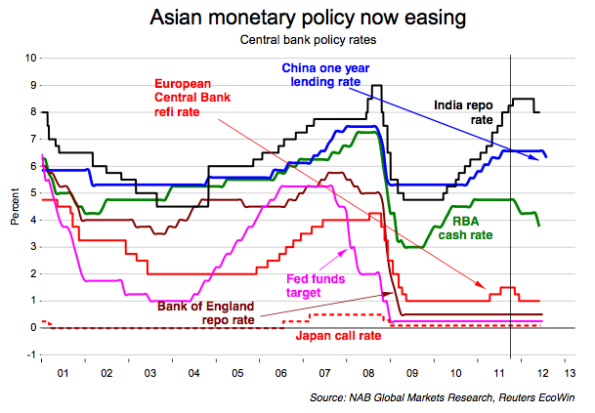

(3) Inflation, Central Banks and Interest Rates

In this chapter we connect three related concepts: inflation, central banks and interest rates.

Read More »

Read More »

(7) FX Theory: The Asset Market Model

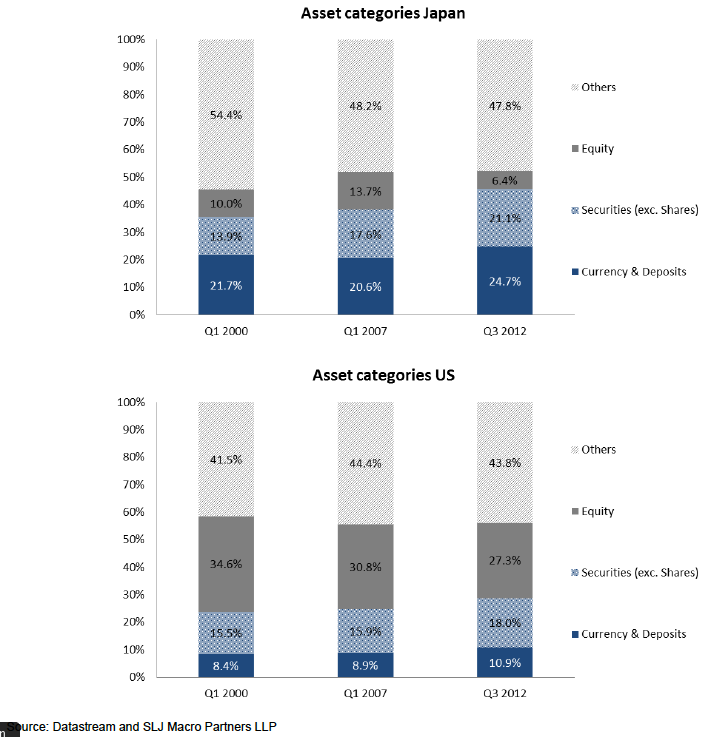

The Asset Market Model implies that a currency will be in higher demand and should appreciate in value, if the flow of funds into financial market of the country such as equity and bonds markets increase.

Read More »

Read More »

(8) Currency Wars: How to Push and Talk Down Your Currency?

Direct or indirect intervention is credible only in countries where domestic asset prices are undervalued and CPI/asset price inflation are no issues. Otherwise they create medium-term risks.

Read More »

Read More »

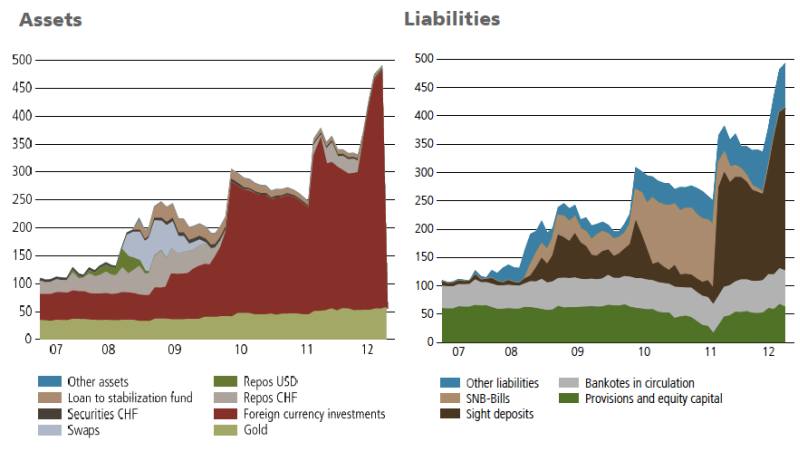

SNB Balance Sheet Expansion

Since 2008 the balance sheet of the Swiss National Bank is 280% higher, this is the equivalent of 60% of Swiss GDP. So did most other central banks, too. But there is one big difference: The risk for the SNB is far higher, the SNB nearly exclusively possesses assets denominated in volatile foreign currency.

Read More »

Read More »

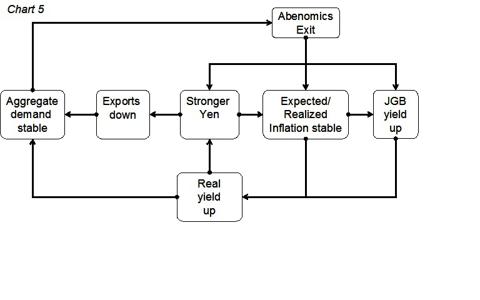

Abenomics: Japanese Economy Would Have Recovered Even Without it

Response to Prof. Nick Rowe, Carleton University, Canada and Lars Christensen, the leading “Market Monetarist“. Nick Rowe: Is the Bank of Japan trying to push down bond yields? Well, yes and no. Yes, it is fighting a battle to push down bond yields, but that battle is part of a wider war for economic recovery. And …

Read More »

Read More »

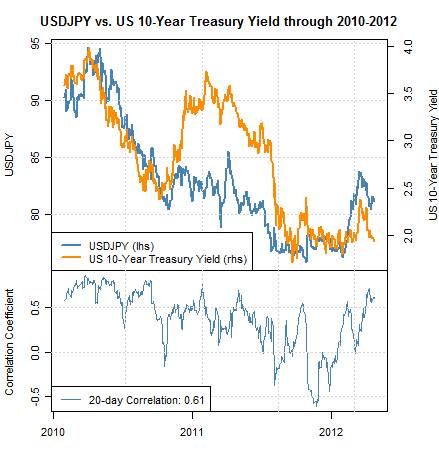

Japanese Investors Will Determine Fate of USD/JPY not U.S. Hedge Funds

By Stephen Jen (via Itau Global Connections). Bottom line Now that the Bank of Japan will be led by a team of super-doves, the mechanism through which a more aggressive BOJ could influence the yen is through capital flows. We have used the analogy of a two-stage rocket to describe how USDJPY could be propelled. … Continue reading »

Read More »

Read More »

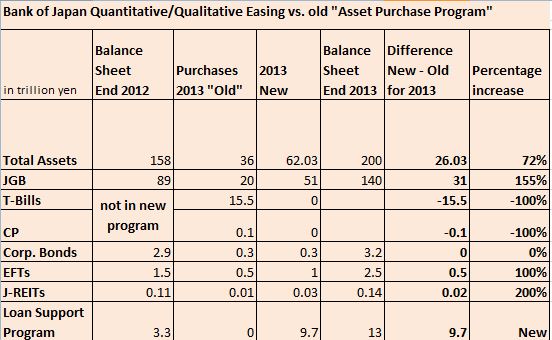

BoJ: Despite Quantitative and Qualitative Easing No Sign of FX Purchases

The Bank of Japan has introduced the expected “massive” quantitative and qualitative easing programme. “Quantitative” means increase of quantities of JGBs bought, “qualitative” the purchase of more ETFs, REIT and the loan support program.

Read More »

Read More »

Why the Yen Is Now Fairly Valued, USD back as Preferred Funding Currency

Producer prices and “real mean reversion” for currencies show that the yen is currently fairly valued. Many momentum factors could, however, speak for some further weakening, while seasonality favours an appreciation. For us, the US dollar is back as the preferred funding currency. The real mean reversion for currencies Some economists, like Goldman’s O’Neill, in the case …

Read More »

Read More »

When Will Hedge Funds and FX Traders Close their Short Yen Positions?

Hedge Funds have lost their power. This year has shown that their only remaining possibility to gain easy money is a concerted action with some of their friends manipulating currency markets, calling it “currency wars” and creating an unholy alliance with the dovish prime minister Abe. Some of the biggest U.S. hedge-fund investors have made …

Read More »

Read More »

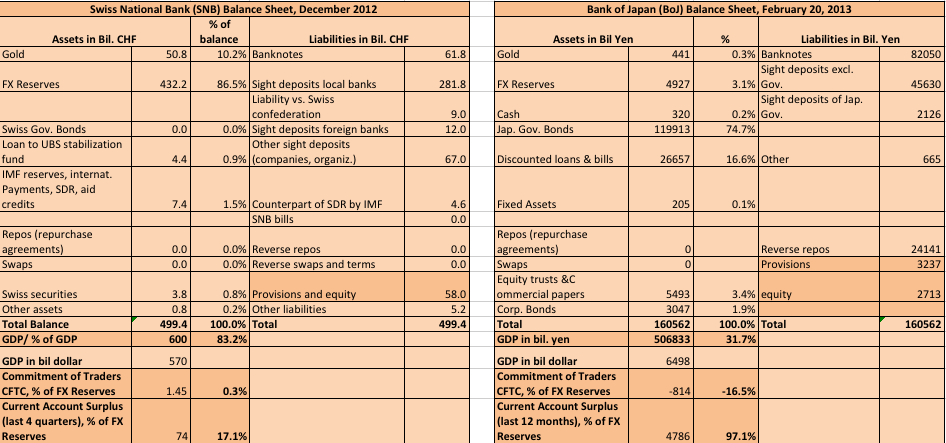

SNB Remains the Only Central Bank Currency Warrior: The Japanese do not Fight, they Talk

Central Bank data show that the Swiss National Bank (SNB) remains the only central bank that strongly participated in currency wars with FX intervention, while the Japan was just verbal intervention.

Read More »

Read More »

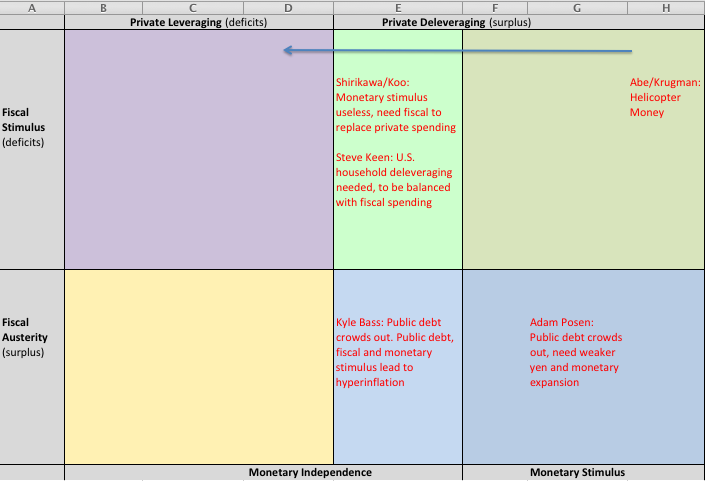

Opinions of Leading Economists on Japan and the Unholy Alliance of Kyle Bass and Shinzo Abe

We give an overview of opinions of leading economists that want to help Japan out of deflation. Paul Krugman, Richard Koo, Adam Posen and Kyle Bass.

Read More »

Read More »