Tag Archive: Blockchain/Bitcoin

Swiss National Bank Launches Pilot Project With CBDC for Financial Institutions

On 1 December 2023, the Swiss National Bank – together with six commercial banks – will start a pilot project with central bank digital currency for financial institutions (wholesale CBDC) on the regulated platform of SIX Digital Exchange (SDX).

With this pilot, called Helvetia Phase III, the SNB will for the first time issue real wholesale CBDC in Swiss francs on a financial market infrastructure based on distributed ledger technology (DLT). The...

Read More »

Read More »

Postfinance E-Commerce setzt auf Worldline’s Crypto Payment Lösung

Worldline hat in der Schweiz mit Postfinance einen wichtigen Schweizer Kunden gewonnen. Die Zahllösung Worldline Crypto Payments wird ab sofort in der E-Commerce Lösung von Postfinance angeboten.

Read More »

Read More »

Eurex Expands Its Crypto Derivatives Suite With Options on FTSE Bitcoin Index Futures

Eurex was the first exchange in Europe to offer Bitcoin index futures in April 2023. After this successful implementation, Eurex now expands the trusted path to crypto with the launch of Options on FTSE Bitcoin Index Futures. This is another major milestone in Eurex’s ambition to offer secure access to cryptocurrencies in a regulated market environment.

Regulated access to cryptocurrencies

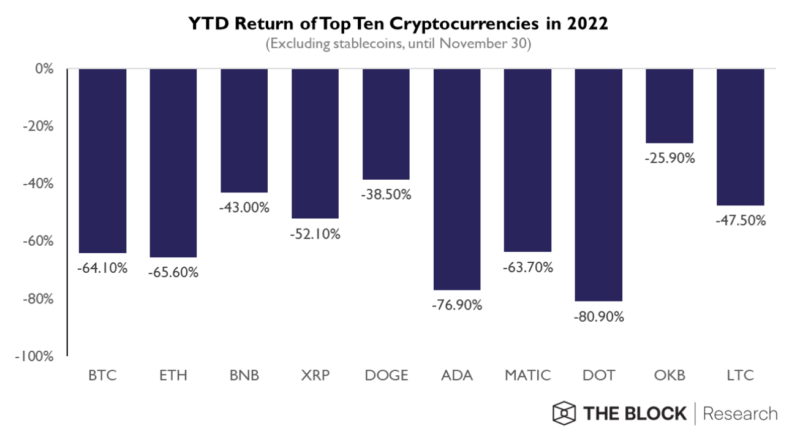

The cryptocurrency market has undergone a volatile period...

Read More »

Read More »

Zuger Kantonalbank Launches Crypto Asset Trading and Storage

The first cantonal bank to offer clients straightforward trading and secure storage of the most common cryptocurrencies. The offering complements its existing investment services and is delivered within a fully regulated banking environment.

As of today, Zuger Kantonalbank clients are able to invest in cryptocurrencies such as Bitcoin, Ethereum, XRP, Litecoin, Polygon and Uniswap. The digital assets can be bought, traded and stored simply and...

Read More »

Read More »

UBS Asset Management Launches First Blockchain-Native Tokenized VCC Fund Pilot in Singapore

UBS Asset Management has launched its first live pilot of a tokenized Variable Capital Company (VCC) fund. The fund is part of a wider VCC umbrella designed to bring various “real world assets” on-chain as part of Project Guardian, a collaborative industry initiative led by the Monetary Authority of Singapore (MAS).

Thomas Kaegi

Thomas Kaegi, Head UBS Asset Management, Singapore & Southeast Asia, said:

“This is a key milestone in understanding...

Read More »

Read More »

New Study Sheds Light on Crypto’s Super-Rich

Over the past decade, the rise of cryptocurrency has created a new class of millionaires and billionaires. The early adopters, investors, business founders, and more broadly, those who bought in early and held onto their investments, became extremely rich, accumulating massive wealth as prices soared.

A new report by wealth and investment migration specialists Henley and Partners, released on September 05, 2023, shares insights into the state of...

Read More »

Read More »

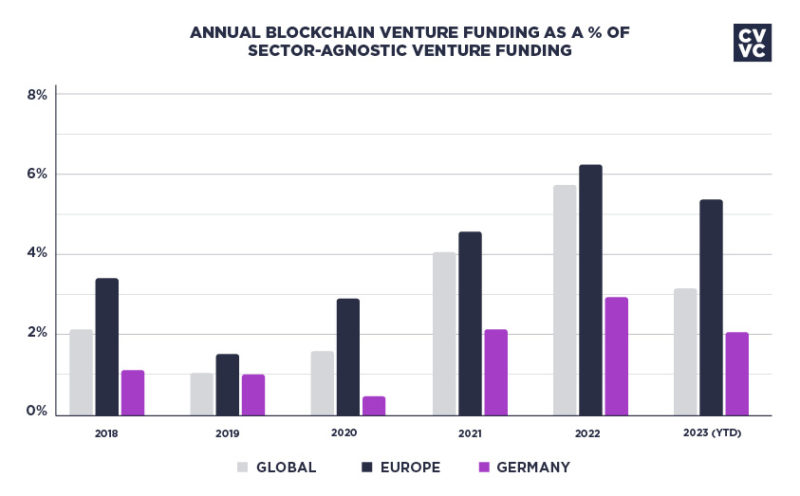

Funding Overview Blockchain Germany 2023

The CV VC German Blockchain Report 2023 highlights Germany’s remarkable achievements in the blockchain sector, unveiling a 3% increase in blockchain funding and an all-time high share of global funding.

Covering data from Q3 2022 to Q2 2023, the report reveals that the German blockchain sector experienced an impressive 3% year-over-year increase in funding, totaling $355 million across 34 deals. In contrast, all continents saw YoY funding declines,...

Read More »

Read More »

33% Coupon on Helveteq’s First Multi Barrier Reverse Convertible on Crypto

Helveteq launched in Switzerland the their first Multi Barrier Reverse Convertible with three crypto currencies as underlying.

The product is admitted for broad distribution in Switzerland and offers investors to benefit from elevated volatility in the crypto currencies Bitcoin, Ripple and Solana.

Multi Barrier Reverse Convertibles are popular on baskets of equities. The products pay a fixed coupon while the redemption of the nominal value is...

Read More »

Read More »

Switzerland Sees Blossoming Digital Asset Custody Ecosystem: Study

Switzerland has established itself as a global leader in the custody of digital assets, a position the country has gained thanks to a conducive regulatory framework that’s encouraging innovation and diversity, a new report by industry trade group Home of Blockchain.swiss says.

The Swiss Digital Asset Custody Report 2023, released in June, provides an overview of the digital asset custody landscape in Switzerland, focusing on the services offered by...

Read More »

Read More »

Bitcoin Crosses US$30K Mark Following Slew of Spot ETF Announcements

The price of bitcoin crossed the US$30,000 mark last week, driven by investors’ excitement about the prospects of high-profile investment firms jumping deeper into digital assets by launching spot crypto exchange-traded funds (ETFs).

Bitcoin, the world’s largest cryptocurrency by market capitalization, rose 15% following news that big name issuers were looking to launch spot bitcoin ETFs. Bitcoin surpassed the US$31,000/BTC mark on June 23, 2023,...

Read More »

Read More »

Mastercard Accelerates Go-To-Market Opportunities for Blockchain Innovation

Expanded Mastercard Engage partner network will help scale digital assets and blockchain technology, and meet continued ecosystem demand

As Mastercard’s continues to embrace new and emerging payments technology such as crypto, Mastercard is introducing a new track as part of its global Engage partner network to allow businesses to quickly launch and scale products that power the Web3 economy.

Mastercard Engage makes it simple for partners to...

Read More »

Read More »

Bank of China and UBS Issue First Fully Digital Tokenized Structured Notes in Hong Kong

BOCI (Bank of China) has successfully issued CNH 200 million fully digital structured notes, making it the first Chinese financial institution to issue a tokenized security in Hong Kong. The product was originated by UBS and placed to its clients in Asia Pacific, marking a long-term collaboration between BOCI and UBS in the space of digital structured notes.

UBS had issued a USD 50 million tokenized fixed rate note in December 2022 under English...

Read More »

Read More »

Blockchain Zug Initiative sichert sich vom Kanton 40 Millionen CHF

Der Zuger Regierungsrat will sich während fünf Jahren mit total 39,35 Millionen an den Aufbaukosten der «Blockchain Zug – Joint Research Initiative», einem gemeinsamen innovativen Projekt der Universität Luzern und der Hochschule Luzern, beteiligen. Dadurch wird das Crypto-Valley international zum Zentrum für die Blockchain-Forschung.

Der Regierungsrat beantragt dem Kantonsrat die Gründung eines Zuger Instituts an der Universität Luzern mit neun...

Read More »

Read More »

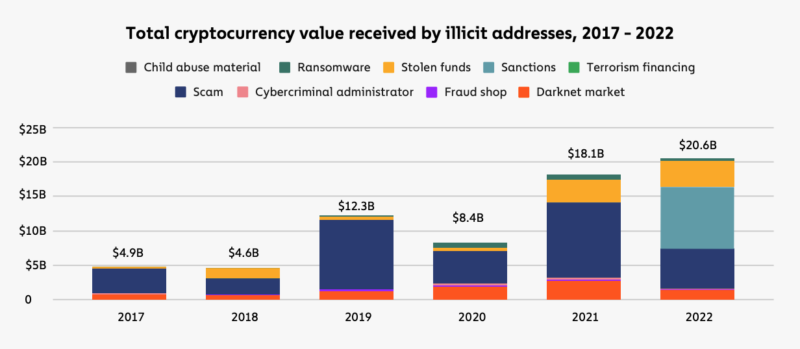

Illicit Crypto Volume Reaches All-Time High Despite Markets Slump

In spite of a market downturn and a prolonged “crypto winter”, the volume of illicit cryptocurrency transactions continued to rise in 2022, reaching an all-time high of US$20.6 billion, new data released by blockchain analysis firm Chainalysis show.

Total cryptocurrency value received by illicit addresses, 2017-2022, Source: The 2023 Crypto Crime Report, Chainalysis

The sum represents a 13.8% increase from the previous all-time high of US$18.1...

Read More »

Read More »

Formula 1 Sponsorship Deals with Blockchain Companies Shrink Amid Crypto Scandals and Bear Market

After a buoyant year 2022, sponsorship deals with blockchain and cryptocurrency companies for the Formula One (F1) race are shrinking this year on the back of high-profile collapses and turbulent markets.

A Bloomberg analysis found that while all teams had at least one crypto-native sponsors in 2022, that proportion declined to 70% this year, as of June. The trend suggests that F1 may be re-evaluating its ties with the crypto industry amid the FTX...

Read More »

Read More »

Swiss Banks Unlikely to Migrate to Blockchain, DLT Systems, Says SNB Advisor

While some banks have started experimenting with blockchain and distributed ledger technology (DLT), widespread migration to these systems are unlikely to occur due to a number of roadblocks, including regulatory and compliance challenges, the high costs of the endeavor, as well as uncertainties about the long-term benefits and potential disruption of the technology on existing business models, Benjamin Müller, an advisor on banking operations for...

Read More »

Read More »

Kanton Zug Increases Maximum Tax Payment Amount With Cryptos to CHF 1.5 Million

The Canton of Zug is increasing the transaction limit for tax payments with the cryptocurrencies Bitcoin and Ether from CHF 100,000 to CHF 1.5 million with immediate effect. This measure will facilitate access to digital means of payment and meet the increasing needs of Zug’s population and companies.

Heinz Tännler

“We are proud that the Canton of Zug has been a pioneer in the use of cryptocurrencies for years. With the increase in the transaction...

Read More »

Read More »

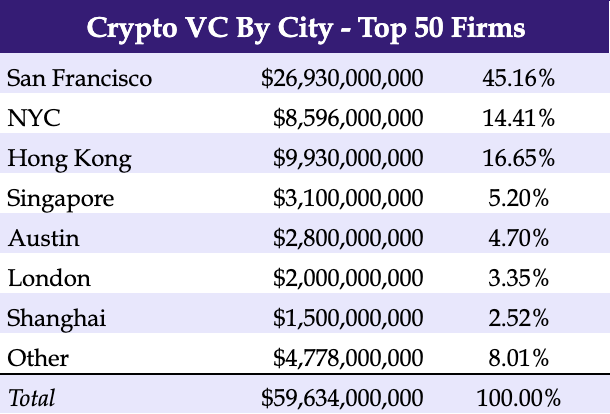

The Top 50 Crypto VC’s in 2023

The USA is dominant in the cryptocurrency venture capital (VC) game, representing more than 71% of the total amount of capital under management from the top 50 crypto-focused VC funds, a new report by Coinstack Partners, a boutique investment bank for crypto and Web 3.0 companies, shows.

Global crypto VC by city – Top 50 firms, Source: The Crypto VC List 2023, Coinstack, March 2023

The report, which looks at VC funding activity in the crypto space,...

Read More »

Read More »

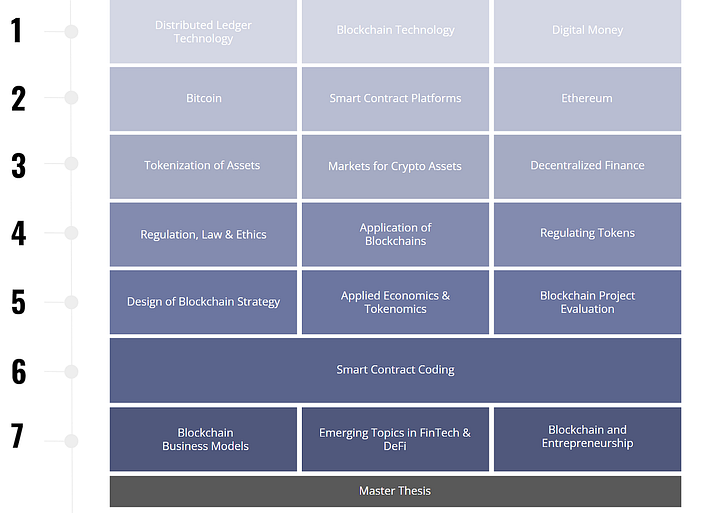

Frankfurt University Forms Master in Blockchain & Digital Assets

Frankfurt School of Finance Center and its Blockchain center designed a new four semester long post-experience master program (MSc) last year. The Frankfurt School’s goal is to provide the expert knowledge necessary to students looking to shape and lead blockchain innovation around the globe and in all industries.

Technical and economical understanding on the topics of blockchain, digital assets (including Bitcoin and Ethereum), DeFi, Web3,...

Read More »

Read More »

SweePay and SMART VALOR Brings Crypto to Masses at National Railways, Retailers

The Swiss crypto exchange SMART VALOR and the financial intermediary SweePay has partnered to ensure that the purchase of cryptocurrencies at Swiss Federal Railways (SBB) ticket machines is simple, smooth and secure.

Since 2016, it has been possible to buy crypto at the 1,500 (expected number of ticket machines as of 2023) ticket machines of the SBB.

At the SBB ticket machines, users will receive their Bitcoin in a secure paper wallet when they buy...

Read More »

Read More »