Switzerland has established itself as a global leader in the custody of digital assets, a position the country has gained thanks to a conducive regulatory framework that’s encouraging innovation and diversity, a new report by industry trade group Home of Blockchain.swiss says.

The Swiss Digital Asset Custody Report 2023, released in June, provides an overview of the digital asset custody landscape in Switzerland, focusing on the services offered by various providers, their licensing status, and the types of storage they use.

In particular, the report highlights the innovation and diversity of the Swiss digital asset custody ecosystem, which includes various business models and providers ranging from technology companies to universal banks.

According to the report, Switzerland is currently home to 57 companies that provide such services. An industry survey which polled 34 of these companies found that 44.1% of the respondents were banks or institutions with an equivalent license. These institutions range from retail and online banks such as Swissquote to private banks such as Maerki Baumann, to universal banks such as Credit Suisse, crypto banks such as Sygnum and regional banks such as Hypothekarbank Lenzburg.

The rest of the providers are typically established cryptocurrency companies, such as Bitcoin Suisse and Crypto Finance. According to the study, crypto-specialized providers often have a larger offering than traditional financial institutions and can support dozens of tokens. In contrast, banking incumbents have a narrower offering, sometimes supporting only bitcoin and ether, the study found. However, several regional banks indicated that they are working on a future digital asset solution.

Another indication of the diversity of the Swiss digital asset custody ecosystem is the client base and business models. 20.6% of the respondents indicated exclusively servicing business-to-consumer (B2C) clients such as wallet providers or private banks, whereas 26.5% service only business-to-business (B2B) clients and 50.0% service both.

The report also notes that Switzerland has become an attractive jurisdiction for foreign companies with many international providers now offering digital asset services in the country. These providers include Spain’s BBVA bank, Fidelity from the US and Arab Bank from Bahrain. Dedicated international service providers such as UK’s Copper and Israel’s Fireblocks also have representatives in Switzerland, servicing the growing Swiss market.

A favorable regulatory landscape

The diversity of the Swiss digital custody landscape is the result of the country’s progressive and pioneering regulatory landscape, the report says. In 2018, the Swiss Financial Market Supervisory Authority (FINMA) issued its ICO guidelines, clarifying the regulatory framework for initial coin offerings (ICOs) in Switzerland. The guidelines aimed to address the growing interest in ICOs and the associated risks related to investor protection and anti-money laundering.

The FINMA ICO guidelines were followed by the pioneering DLT Act. The legislation, which came into effect on February 01, 2021, provides a clear legal framework for the use and application of blockchain technology and distributed ledger technology (DLT) in various industries. The primary objectives of the DLT Act are to enhance legal certainty, promote innovation, and strengthen investor protection in the blockchain sector.

About eight in ten digital asset custody services providers in Switzerland are licensed in some form, findings of the study show, whether that’s through an asset management license, security firm license, banking license, or through an self-regulatory organization.

Despite the seemingly breadth and depth of the Swiss digital asset custody ecosystem, the report states that some products and services are still lacking. In particular, it notes that most providers currently in operation offer custody services solely for cryptocurrencies such as bitcoin and ether, with only few started offering custody for non-fungible tokens (NFTs). In fact, only 20.6% of the providers polled said they offer custody services for security or asset tokens such as NFTs, a result that’s reflective of the nascent state of these types of digital assets.

The rise of asset tokenization

Asset tokenization, a process that involves converting rights to a real-world asset into a digital token and recording that said asset on a blockchain, is becoming a critical part of the financial market infrastructure.

Financial institutions and central banks from around the world are ramping up asset tokenization efforts to keep up pace with technological advancements and tap into the benefits the technology brings to the table, including improved speed, efficiency and liquidity, as well as enabling asset fractionalization.

In January, Switzerland’s Cite Gestion became the first private bank to issue shares as ledger-based securities under Swiss law. The bank partnered with digital assets firm Taurus to issue its tokenized shares, manage the smart contract that creates the shares, and perform asset servicing of its securities, it said in a press release.

Earlier this year, the Swiss National Bank (SNB) shared how it intended to “future-proof” the domestic payment ecosystem, outlining its ambition to leverage technologies and processes including tokenization and DLT.

SNB governing board member Andréa Maechler said during an event in March that the central bank was conducting a study on how central bank money can be made available in a regulated token environment. The project focuses on examining different models for token settlement, and is being undertaken in collaboration with regulated financial market infrastructures and other market participants.

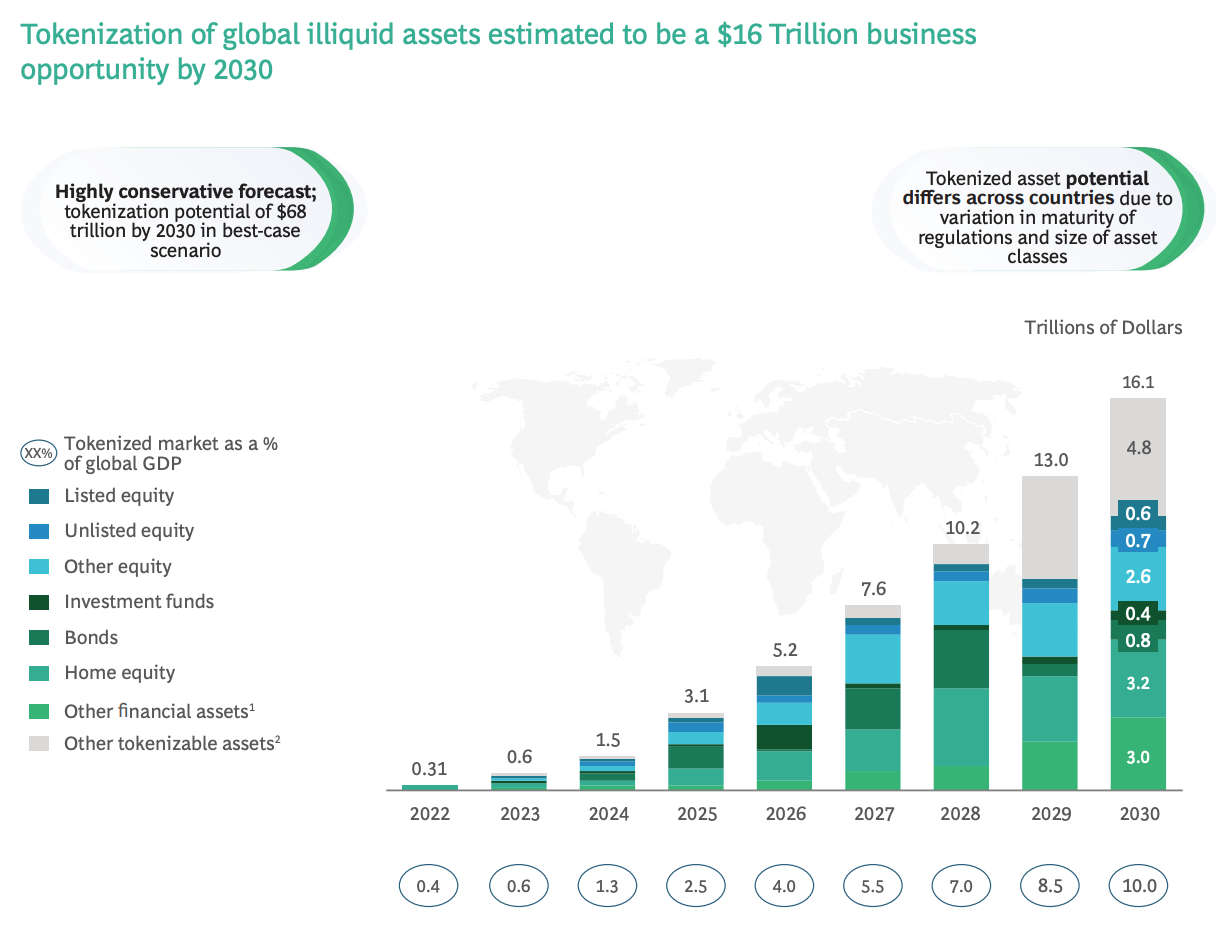

Boston Consulting Group estimates that asset tokenization and blockchain technology could generate savings of US$20 billion annually in global clearing and settlement and unlock a US$16 trillion market for tokenized illiquid assets by 2030.

Tokenization of global illiquid assets estimated to be a US$16 Trillion business opportunity by 2030, Source: Boston Consulting Group, 2022

Featured image credit: Edited from Freepik

The post Switzerland Sees Blossoming Digital Asset Custody Ecosystem: Study appeared first on Fintech Schweiz Digital Finance News - FintechNewsCH.

Full story here Are you the author? Previous post See more for Next postTags: Blockchain/Bitcoin,Featured,newsletter