Tag Archive: Blockchain/Bitcoin

Nassim Taleb Now Calls Bitcoin Worthless, Too Volatile to be a Useful Currency or Store of Value

Not only does bitcoin fail to satisfy the notion of being a currency without a government, but the cryptocurrency is also not a reliable inflation hedge nor a safe haven investment, Nassim Nicholas Taleb, a probability researcher and former quantitative trader, says in a recent paper.

Read More »

Read More »

Visa Customers Spent More Than US$1 Billion on Crypto-Linked Cards in 2021

Visa revealed that its customers had spent more than US$1 billion on its crypto-linked cards in the first half of 2021. The payments giant reported that it had partnered with 50 leading crypto platforms on card programmes that make it easy to convert and spend digital currency at 70 million merchants worldwide.

Read More »

Read More »

AntChain Inks Deal With UEFA EURO to Be Its Official Global Blockchain Partner

UEFA and AntChain, the blockchain business of Ant Group, announced a five-year global partnership around blockchain technologies and to jointly explore how blockchain technology can be used to further the digital transformation of football industry and improve the experiences of fans around the world.

Read More »

Read More »

9 Top-Ranked Crypto Blockchain Project Coins You’ve Probably Never Heard of Before

Cryptocurrencies have been all the rage this year with total market capitalization surging 132% since the beginning of the year. Given this crypto frenzy, it is quite remarkable how some of the top marketcap ranking firms have eluded mainstream attention.

Read More »

Read More »

ETC Group Lists Physically Backed Ethereum and Litecoin Crypto ETCs on SIX

ETC Group, a specialist provider of digital asset-backed securities, has announced that it will list its physically backed Ethereum and Litecoin cryptocurrency ETCs on the Swiss Stock Exchange SIX.

Read More »

Read More »

Swissquote Adds 9 Additional Cryptocurrencies for Retail Trading

Swiss banking group Swissquote announced that it is expanding its cryptocurrency offering with nine additional ones.

Read More »

Read More »

Societe Generale Issues Structured Products as Security Token on Public Blockchain

Societe Generale announced that it has issued its first structured product as a security token directly registered on the Tezos’ blockchain network.

Read More »

Read More »

Delta Exchange Closes US$5 Million Raise From Blockchain Valley Ventures Among Others

Delta Exchange, a UK-based institutional-grade crypto derivatives exchange, announced that it has closed a US$ 5 million token raise from existing and new investors where Swiss venture firm Blockchain Valley Ventures (BVV) backed and advised the former on their token raise.

Read More »

Read More »

PayPal Allows American Customers to Use Cryptocurrencies for Purchases

PayPal announced the launch of Checkout with Crypto, where US customers will be able to choose to check out with crypto seamlessly. Building on the ability to buy, hold and sell cryptocurrency with PayPal, customers using Checkout with Crypto can check out safely and easily, converting cryptocurrency holdings to fiat currency, with certainty of value and no additional transaction fees.

Read More »

Read More »

Digital Asset Adoption Gains Momentum With US$26 Billion in Bitcoin Transactions

Bitcoin’s recent price surge has accelerated institutional adoption of cryptocurrencies leading to institutional investor pouring an estimated US$26 billion into bitcoin over the past eight months, an analysis by SNGLR Group shows.

Read More »

Read More »

Switzerland and Estonia Among Europe’s Most Advanced Blockchain Ecosystems

In Europe, Switzerland, Estonia, Malta and Cyprus have the most advanced and mature blockchain ecosystems with well-developed startup scenes and high levels of regulatory maturity, a paper by the EU Blockchain Observatory and Forum says.

Read More »

Read More »

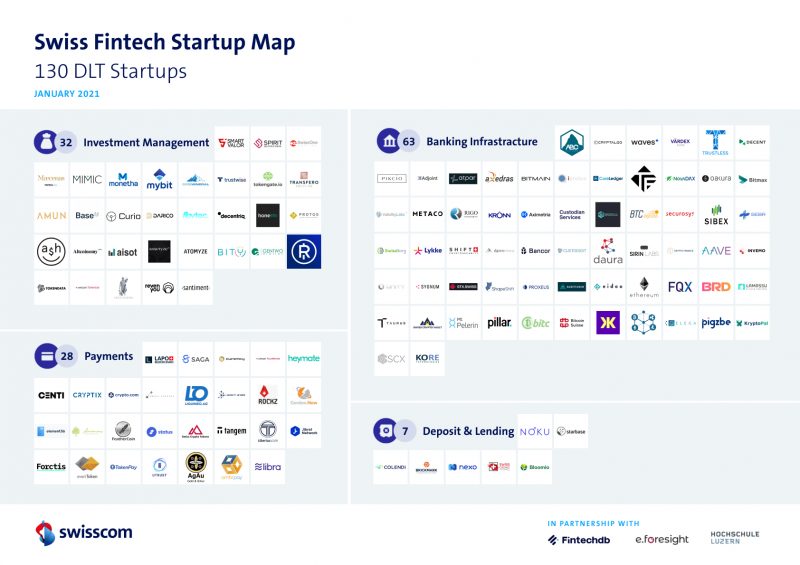

Switzerland’s Blockchain Fintech Industry in 2021

Switzerland is home to 130 startups that are applying blockchain and distributed ledger technology (DLT) to finance use cases, new data from Swisscom show. Most of these companies (48%) operate in the banking infrastructure vertical, followed by investment management (24%), and payments (21%).

Read More »

Read More »